Bitcoin ETF: The tornado shaking up gold as a safe-haven asset

0

0

The resurgence of Bitcoin, which has recently regained the symbolic market capitalization threshold of 1 trillion dollars, is stirring up greed and reviving competition with gold. Driven by massive inflows of capital into Bitcoin spot ETFs, the king of cryptos could outpace gold faster than expected.

Unprecedented Enthusiasm for Bitcoin ETFs

Fueled by a massive influx of capital into American Bitcoin Spot ETFs, Bitcoin’s market capitalization surpassed the symbolic milestone of 1 trillion dollars for the first time since November 2021 on February 14, 2023.

Riding this bullish wave, the queen of cryptos now threatens the dominance of gold in the safe-haven market, risking to push the yellow metal below the $1,200 mark.

In just four days, no less than 2.2 billion dollars have poured into Bitcoin spot ETFs in the United States, according to Thomas Fahrer, co-founder of the tracking platform Apollo. This rate of accumulation is significantly higher than that observed in the four weeks following their launch in January 2023.

When interviewed by CNBC about the ability of these index funds to accurately track Bitcoin’s price, David LaValle, global head of ETFs at Grayscale Investments, was reassuring.

“The tracking has been really remarkable. We’ve seen the Bitcoin ETFs do an excellent job of holding very firmly along the net asset value and we’ve observed a liquidity profile indicative of what we had anticipated,” said the executive.

A Growing Threat to Gold’s Supremacy

While the arrival of spot ETFs has been accompanied by capital outflows from Grayscale Bitcoin Trust (GBTC), its historic rival, David LaValle remains confident. With 461,983 BTC under management, GBTC still dominates the market and now displays a positive premium over Bitcoin’s price.

But beyond the rivalry between Bitcoin ETFs, their combined growth could eventually threaten the preeminence of gold in the safe-haven market. According to Checkmate Research, Bitcoin’s market capitalization now accounts for 15% of that of all sound monetary assets.

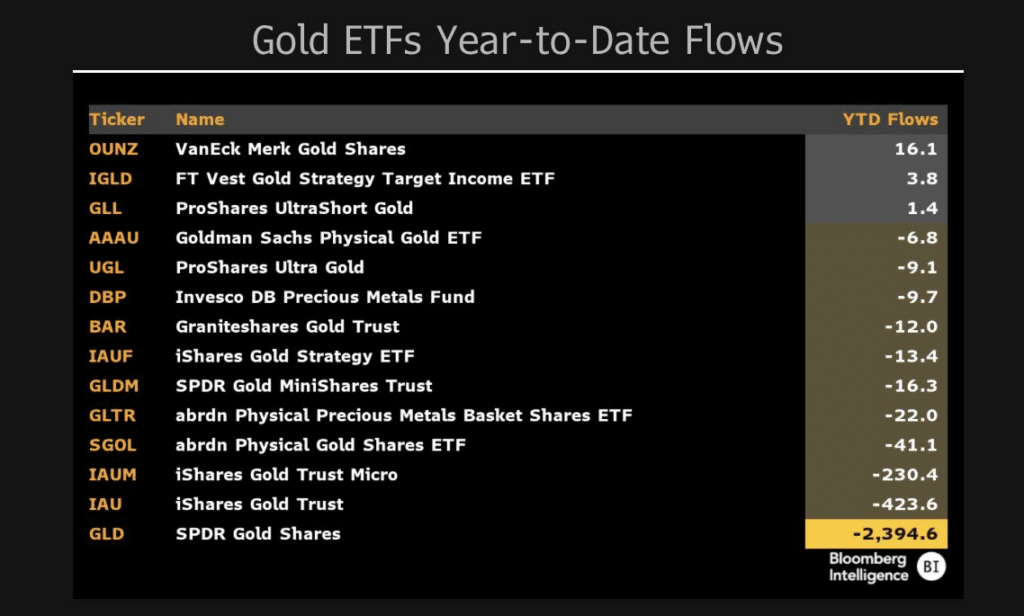

This trend is confirmed by recent investor movements. Since the start of 2024 alone, gold-backed Exchange Traded Funds (ETFs) have registered net outflows of 2.39 billion dollars, according to Bloomberg. In contrast, within just one month, Bitcoin ETFs have attracted over 4 billion dollars.

Bitcoin: Future Benchmark Safe-Haven Asset?

Although not all inflows into Bitcoin ETFs necessarily come from gold funds, this divergence reflects a profound shift. As its market capitalization swells, Bitcoin is establishing itself as a credible store of value in the eyes of investors, to the point of directly threatening the millennia-old dominance of gold.

This transition may occur faster than expected, according to Adam Back, CEO of Blockstream. In this emerging new monetary order, the “barbarous relic” often criticized could even see its price dive below 1,200 dollars, according to Robert Kiyosaki, the famous author of “Rich Dad Poor Dad.”

At the time of writing, the gold futures contract is trading at 2,005.90 dollars while Bitcoin has just exceeded 52,000 dollars for the first time since mid-January. Indeed, at 52,000 dollars, the flagship crypto is still far from its all-time high of 69,000 dollars. However, the appetite of investors seems unabated. Even among institutional players, as evidenced by the massive inflows into ETFs.

Further proof of its growing status as a safe-haven asset, Bitcoin is now outperforming gold. Over the past 30 days, it has gained 35% compared to just 2% for the precious metal. But just how high is the king of cryptos capable of soaring? The wild race to the moon may only be beginning.

0

0