This Week in Crypto: DADDY Meme Coin Dives, Donald Trump’s DJT Sage, and Altcoin Risks

0

0

This week’s developments in the crypto ecosystem continue to capture the community’s attention. From meme coins capturing the public’s imagination and then facing abrupt corrections to Bitcoin’s (BTC) role as a safe haven in global finance, the crypto market remains a complex and exciting arena.

Adding to the allure of the crypto market, mainstream personalities such as Andrew Tate have joined the meme coin bandwagon. Moreover, there are claims that former US President Donald Trump has released his own meme coin. Meanwhile, the experts highlight the risks with altcoin investment, as they lag despite the Bitcoin rally.

Andrew Tate’s DADDY Meme Coin Plummets 60%

This week, Andrew Tate’s venture into the meme coin market, Daddy Tate (DADDY), witnessed a steep 65% decline. Despite Tate’s ambitious strategies to increase its utility—including transforming it into a non-fungible token (NFT) and integrating it with his Real World University—the coin failed to inspire investor confidence.

“I want to reduce the supply of the DADDY coin, so even if you hold one DADDY coin, you get karmic benefits from the universe. I will do that by buying the coin with my own money and burning it at certain market caps. It will have such a limited supply that it becomes a badge of honor to own any at all,” Tate stated.

Even with Tate’s commitment to purchasing and burning coins to boost market value, the meme coin struggles amid controversies and a volatile market. It has dropped over 70% from its peak.

Read more: Crypto Scam Projects: How To Spot Fake Tokens

Daddy Tate (DADDY) Price Performance. Source: DEX Screener

Daddy Tate (DADDY) Price Performance. Source: DEX Screener

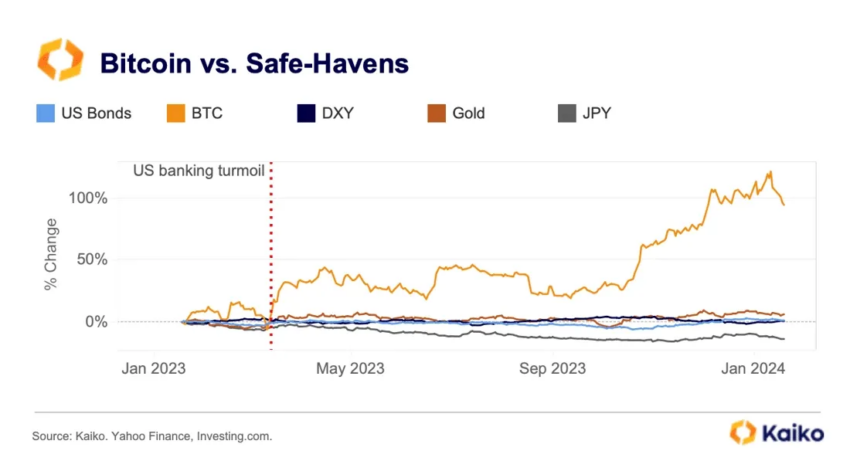

Bitcoin as Safe Haven: BlackRock CEO Highlights Economic Shift

At a recent G7 summit, BlackRock CEO Larry Fink emphasized the pivotal change in global financial systems. Capital markets have overtaken banks as the main sources of private-sector financing.

Consequently, Bitcoin has emerged as a potential safe haven. Analysts note its low correlation with equities and significant institutional interest as factors boosting its safe-haven status. With the US launching spot Bitcoin ETFs attracting $15 billion since January, Bitcoin continues to draw attention as a reliable asset during economic uncertainties.

“I believe the role of Bitcoin and the digital assets space will become increasingly significant each year,” Matteo Greco, Research Analyst at Fineqia, told BeInCrypto.

Read more: Who Owns the Most Bitcoin in 2024?

Bitcoin’s Performance Against Safe Havens. Source: Kaiko

Bitcoin’s Performance Against Safe Havens. Source: Kaiko

Donald Trump’s DJT Meme Coin Saga Unfolds

This week, the DJT meme coin, allegedly linked to Donald Trump and his son Barron, captured the crypto community’s attention after soaring 1,450% due to speculative posts. However, the coin later plummeted nearly 75% amid the unfolding drama.

Martin Shkreli, a controversial figure, claimed to have helped develop DJT, asserting involvement from the Trump family, though this remains unverified.

“Barron told me his dad was in on it. His dad liked it,” Shkreli stated.

However, Trump advisor Roger Stone has categorically denied any Trump family involvement. Meanwhile, other political personalities like New York legislator Ben Geller have contrasted Stone’s claims.

“I believe from reputable sources that Barron was [involved], then backed away once things were absolutely destroyed by the developer. This was a PR disaster,” Geller said.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

DJT Price Performance. Source: DEX Screener

DJT Price Performance. Source: DEX Screener

Analyst Warns Against Altcoin Investments

Crypto analysts are increasingly skeptical about altcoins’ prospects. Quinn Thompson of Lekker Capital points to market instability and high leverage as indicators of potential risks. The significant capital inflows into Bitcoin ETFs contrast sharply with the struggling altcoin market.

New altcoins face intense selling pressure due to oversupply and diminished demand. Experts suggest that altcoins are facing a tougher environment, potentially reducing their investment appeal.

“Altcoins have a constant stream of sell pressure. As we enter an already low-volume summer period, the combination of significant token supply unlocks and venture capitalists’ sell pressure will likely be too strong of an uphill battle for most tokens,” Thompson said.

Since March, the total crypto market capitalization, excluding Bitcoin and Ethereum (ETH), has decreased by 22.42%. This means that all the other crypto, except Bitcoin and Ethereum, are struggling.

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

Crypto Total Market Cap Excluding Bitcoin and Ethereum. Source: TradingView

Crypto Total Market Cap Excluding Bitcoin and Ethereum. Source: TradingView

Financial Advisors Remain Cautious on Bitcoin ETFs

Despite the growing popularity of Bitcoin ETFs among self-directed investors, financial advisors are treading carefully. BlackRock’s Chief Investment Officer of ETF, Samara Cohen, highlighted that advisors are meticulously analyzing the risks associated with Bitcoin’s price volatility.

With a cautious approach, advisors prioritize their fiduciary duties over the high-risk, high-reward allure of Bitcoin investments. Despite optimistic forecasts about Bitcoin’s potential, the careful stance of professional advisors highlights the challenges of integrating cryptocurrencies into traditional investment portfolios.

Meanwhile, this week, the spot Bitcoin ETFs are struggling. So far, they have recorded an outflow of over $438 million.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

| Date | IBIT | FBTC | BITB | ARKB | BTCO | EZBC | BRRR | HODL | BTCW | GBTC | DEFI | Total |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| June 17, 2024 | 0.0 | (92.0) | 2.9 | (50.0) | 0.0 | 0.0 | 0.0 | (3.8) | 0.0 | (3.0) | 0.0 | (145.9) |

| June 18, 2024 | 0.0 | (83.1) | (7.0) | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | (62.3) | 0.0 | (152.4) |

| June 19, 2024 | – | – | – | – | – | – | – | – | – | – | – | 0.0 |

| June 20, 2024 | 1.5 | (51.1) | (31.5) | 0.0 | (2.0) | 0.0 | 0.0 | (3.7) | 0.0 | (53.1) | 0.0 | (139.9) |

This Week’s Crypto Top 10

The crypto market continues its downward trend this week, with the total market capitalization dipping to $2.35 trillion. Notably, Bitcoin and Ethereum saw declines of 3.48% and 0.15%, respectively.

Top 10 Crypto Assets by Market Capitalization. Source: CoinMarketCap

Top 10 Crypto Assets by Market Capitalization. Source: CoinMarketCap

Dogecoin (DOGE) and Solana (SOL) faced the steepest drops among the top ten cryptocurrencies. However, XRP bucked the trend with a 2.67% increase, showcasing its resilience amidst market volatility.

0

0