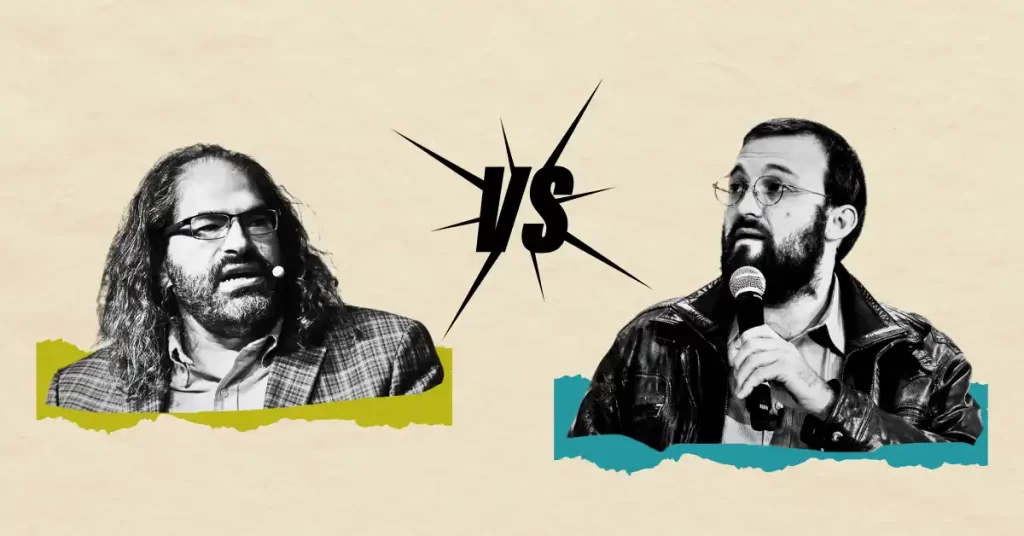

Ripple’s Schwartz & Cardano’s Hoskinson Clash Over ETH Gate Theory: What’s the Truth?

0

0

The post Ripple’s Schwartz & Cardano’s Hoskinson Clash Over ETH Gate Theory: What’s the Truth? appeared first on Coinpedia Fintech News

What initially seemed to be a sarcastically heated but harmless debate between Ripple CTO David Schwartz and Cardano Founder Charles Hoskinson recently turned into a fiery debate on X. Their replies revealed many key revelations, shedding light on various aspects amidst SEC Chair Gary Gensler’s scrutiny, particularly regarding Ethereum’s classification.

What really went down? Read on to find out everything we know!

Schwartz’s (Shocking!) Admission

In the midst of their exchange, David Schwartz dropped a surprising revelation, admitting to holding a significant amount of XRP. He disclosed,

“I had about 26 million XRP. I sold BTC to buy XRP and ETH.”

This revelation countered rumors within the crypto community suggesting Schwartz sold off billions of XRP to invest in ETH and other cryptocurrencies, allegedly prompted by SEC statements.

Schwartz clarified that he never liquidated XRP to acquire other cryptocurrencies, except for some “unusual purposes.” He also explained his risk minimization strategy over the years: selling specific assets when they reached their new all-time highs.

Clarifying Ethereum’s SEC Status

While this heated debate was occurring, lawyer Bill Morgan posted on X his thoughts on correcting misleading statements suggesting the SEC classified Ethereum as a security.

He noted that the SEC is currently investigating whether certain offers or sales of Ethereum can fall into the umbrella term “securities,” highlighting the fact that the token itself isn’t necessarily a security.

Morgan’s clarification, although not part of the debate, helped frame the debate and reminded readers of the importance of understanding the difference between a token and its sale context.

The ETH Gate Controversy

Coming back to the same fiery debate, Schwartz and Hoskinson also engaged in a contentious discussion about the ongoing hot topic—the ETH Gate, a theory that tends to suggest the SEC has always had a regulatory bias towards Ethereum.

Hoskinson also openly rejected and dismissed the XRP community’s claims that Ethereum insiders bribed the SEC to target Ripple’s XRP. He says that XRP supporters had unfairly targeted him, leading to significant online harassment.

However, Schwartz questioned back Hoskinson’s statements about the lack of evidence for the ETH Gate theory, pointing out discrepancies in the SEC’s treatment of Ethereum and Ripple.

“So, was Hinman not intimately involved? Did he not have a financial interest in Ethereum? Did he recuse himself? Or is that not evidence for some reason?”

David Schwartz

Hoskinson clarified his stance, denying allegations of a grand conspiracy against Ripple by the SEC.

The Community Grows Tense

The debate between Schwartz and Hoskinson reflects underlying tensions within the crypto community regarding SEC practices. As the SEC v. Ripple case nears its conclusion, the debate underscores the need for transparency, fairness, and a clear regulatory framework from SEC Chair Gary Gensler. Such measures are crucial for maintaining stability in the crypto market and fostering innovation.

Phew! That was intense for sure. What do you think – Is the “ETH Gate” theory a conspiracy, or is there something to it?

0

0