Circle to Launch Arc with USDC Gas to Power EVM-Compatible Stablecoin Network

0

0

Highlights:

- Circle to launch Arc, an EVM-compatible blockchain using USDC as its native gas token.

- Arc will target stablecoin payments, FX, and tokenized assets with sub-second settlement.

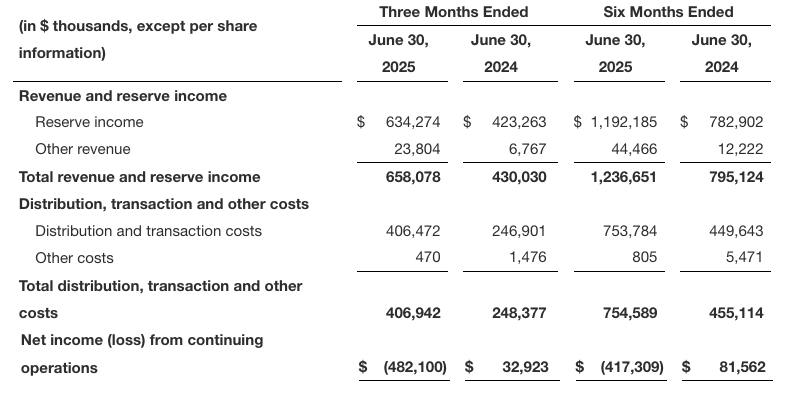

- Circle reported $658M Q2 revenue and 90% USDC supply growth to $61.3B.

Stablecoin issuer Circle has announced the release of Arc, an enterprise-grade Layer-1 blockchain. The platform will run on the Ethereum Virtual Machine, according to the company’s second-quarter earnings report. USDC will be used as a native gas token in all transactions. Furthermore, Arc will integrate with Circle services and will be able to be interoperable with partner blockchains.

The network seeks to facilitate stablecoin payments, foreign currencies, and capital markets applications. Its litepaper describes performance plans for 3,000 transactions per second and sub-350 millisecond settlement using 20 validators. Under smaller sets of validators, speeds might be larger than 10,000 transactions per second with near-instant settlement.

Additionally, Arc will feature a stablecoin FX engine, allowing currency swaps at minimal friction. Amounts used in confidential transfers will be hidden while revealing the addresses. Selective disclosure to authorized parties will be possible by the use of view keys.

Introducing Arc, the home for stablecoin finance.@Arc is an open Layer-1 blockchain purpose-built to drive the next chapter of financial innovation powered by stablecoins.

Designed to provide an enterprise-grade foundation for payments, FX, and capital markets, Arc delivers… pic.twitter.com/Z8FHUls1xY

— Circle (@circle) August 12, 2025

Product Integration and Institutional Features

Circle’s launch of Arc will lead to the integration with its Payments Network, which was introduced in May. The network already has more than 100 financial institutions in the onboarding pipeline. Arc will also connect with CCTP and the Gateway of Circle for quick transactions across the chains. The platform will host USYC, which is an interest-bearing stablecoin pegged to short-term US Treasury securities. Equities, bonds, and private credit are some of the tokenized RWAs that will be hosted on Arc. These assets will consequently be fully collateralized and will be issued by authorized partners.

Moreover, Circle to launch Arc will incorporate market integrity mitigation mechanisms that include encrypted mempools and batch processing as ways of reducing MEV. The governance model at the start will be permissioned proof-of-stake and later will expand the number of validators. The Arc structure is oriented toward regulated finance and bridges the traditional institutions and blockchain infrastructure. It will provide compatible tools to the asset issuer, custodian, and fund administrator. Arc is scheduled for public testnet release between September and December 2025.

Financial Results and Regulatory Developments

The Q2 2025 earnings indicate that total revenue and reserve earnings increased by 53% year-over-year to $658 million. By the end of the quarter, the circulation of USDC increased by 90% to $61.3 billion. Furthermore, circulation rose once more to $65.2 billion in early August. The firm, however, posted a $482 million net loss, attributable largely to the $591 million in non-cash charges related to the IPO. This consisted of $424 million on stock-based compensation and an addition of convertible debt of $167 million.

Furthermore, Circle completed its $1.2 billion IPO in June, raising net proceeds of $583 million. USDC issued by the company currently has a market share of 28%, comprising fiat-backed stablecoins. Moreover, the amount of USDC minted in the quarter exceeded $42 billion, with $40.8 billion redeemed.

Jeremy Allaire, chief executive officer and chairman of Circle, noted:

“The company going public was regarded as a breakthrough moment for both Circle and the stablecoin market as a whole. There was robust growth in various use cases and partnerships registered in the quarter. Our platform gained increased use in key industries.”

In addition, Circle highlighted the passing of the GENIUS Act into law as a significant step in the U.S. crypto industry. The law was termed to establish a federal regulatory regime of stablecoins that enhances consumer protection and facilitates innovation.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.