Ethereum Poised for Gains, Coinbase Predicts

0

0

Coinbase projects that Ethereum (ETH) might outshine other cryptocurrencies shortly.

The company’s recent report suggests that the second-largest cryptocurrency has the potential to surprise its holders positively.

Key Factors Supporting Ethereum’s Potential

This year, Ethereum has lagged behind the broader crypto market. Despite this underperformance, Coinbase remains optimistic about its long-term prospects. The report highlights ETH’s 29% year-to-date rise, positioning it well due to a lack of significant supply-side pressures like token unlocks or miner sell-offs.

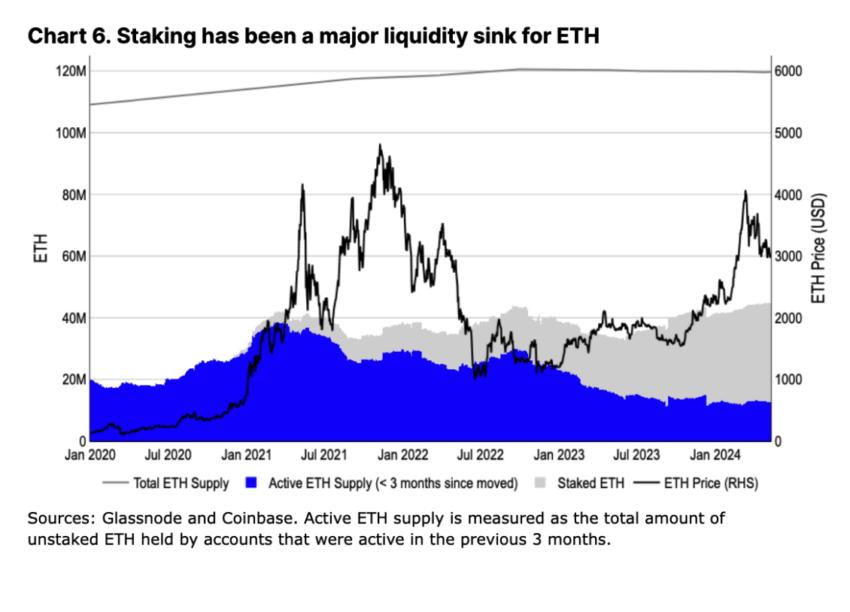

Coinbase analyst David Han highlights that ETH benefits from substantial and growing liquidity sinks. Staking, where investors lock up tokens to support the network and earn rewards, has been a major factor. Additionally, Layer 2 solutions, which scale the Ethereum by processing transactions off the main blockchain, have grown considerably.

Read more: 9 Best Places To Stake Ethereum in 2024

Active ETH supply. Source: Coinbase

Active ETH supply. Source: Coinbase

The expert also notes the increasing institutional interest. As more financial institutions explore blockchain technology and decentralized finance (DeFi), Ethereum, the backbone of most DeFi applications, benefits significantly. The platform’s versatility and infrastructure make it a preferred choice for developers and investors alike.

The Impact of Potential Spot ETFs Launch

The potential launch of spot Ethereum exchange-traded funds (ETFs) in the US could significantly impact the asset’s market position, boost liquidity and potentially driving up its price. Although the SEC recently hinted at a possible denial, the mere prospect has already stirred market excitement.

Scott Johnsson from Davis Polk and Wardwell highlighted the SEC’s call for public input on classifying BlackRock’s proposed spot Ethereum ETF as a commodity-based trust. Johnsson suggested that denying the ETFs could be strategic, as they might be misfiled as commodity-based trust shares.

“We think the market may be underestimating the timing and odds of a potential approval, which leaves room for surprises to the upside,” Han said.

Read more: How to Invest in Ethereum ETFs?

No matter how the US ETF story ends, Coinbase’s report suggests that Ethereum will outperform in the coming months. Strong demand drivers and technological innovations help ETH remain a key asset to watch.

0

0