Circle’s IPO Proves Wall Street Wins, Retail Gets Left Behind

0

0

Circle’s initial public offering (IPO) highlighted the exclusivity of early-stage investments. The rise of tokenized real-world assets opens up these opportunities to a broader audience, with institutional investors increasingly adopting this shift.

Kingsley Advani, CEO of tokenized stock exchange Allo, emphasizes that the future of tokenization lies in a hybrid model combining traditional finance and blockchain. This model enhances access, transparency, and efficiency to create a more inclusive financial system.

Exclusion of Early-Stage Investments

Circle’s debut IPO on the New York Stock Exchange demonstrated the wealth investors can gain from such listings.

Pre-IPO, Circle was priced at $31 per share. It opened at $69 and closed its first trading day at $83.23, marking a 168% gain. While impressive, this success also exposed the exclusive nature of accessing early-stage investments.

For decades, institutions have controlled access to primary investment instruments, limiting opportunities for retail investors. Few non-institutional players can afford private equity without significant capital.

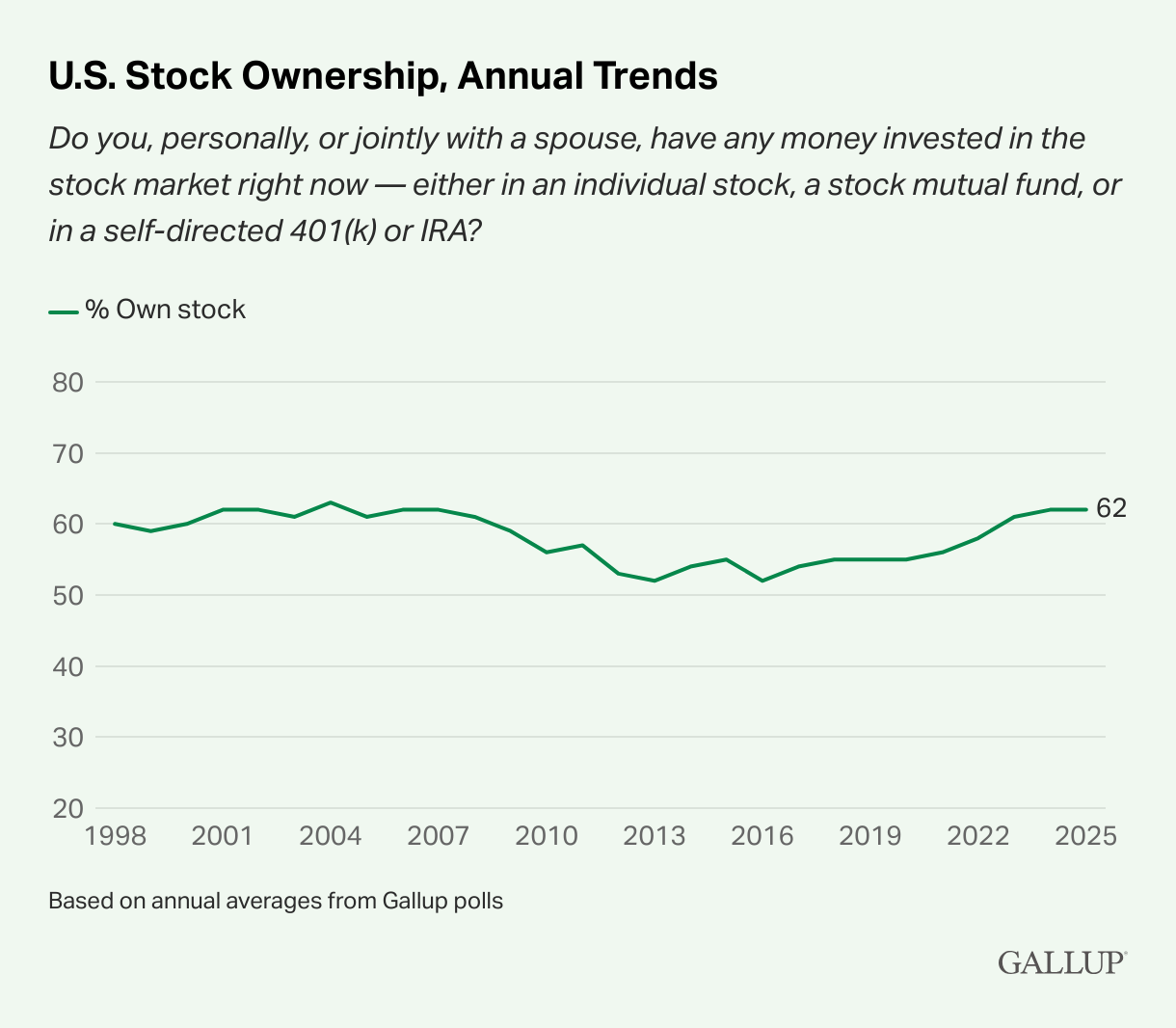

Only 62% of Americans owned stock in 2025. Source: Gallup.

Only 62% of Americans owned stock in 2025. Source: Gallup.

According to a recent Gallup poll, only 62% of US adults own stocks, while minimum investment requirements for Treasuries or private equity often reach $100,000.

Slowly, blockchain technology is changing this reality.

Rise of Tokenized Real-World Assets and Blockchain Promise

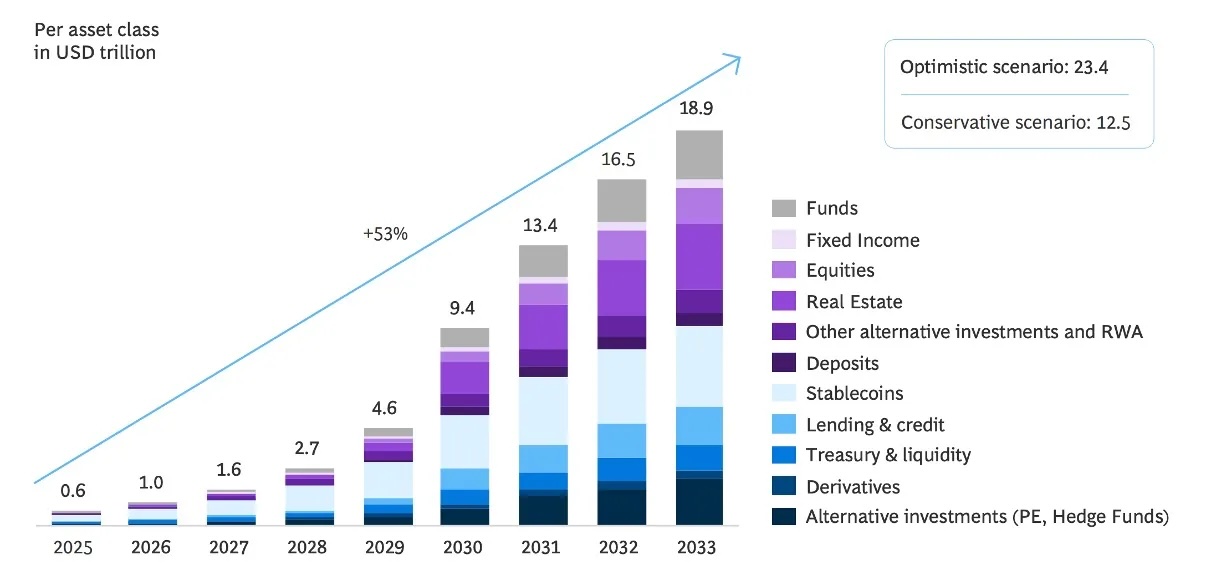

The tokenized real-world asset (RWA) market has gained momentum over several crypto cycles, now projected to be valued at $2.08 trillion, with forecasts reaching $18.9 trillion by 2033. What makes this market particularly appealing is its ability to fractionalize ownership, enabling smaller investors to access various asset classes.

RWA Tokenization projected to reach $18.9 trillion by 2033. Source: Boston Consulting Group.

RWA Tokenization projected to reach $18.9 trillion by 2033. Source: Boston Consulting Group.

“This shift goes beyond a technical upgrade, suggesting a meaningful redistribution of access and control. By distributing ownership, tokenization levels the playing field and moves to a future where its gatekeeping model no longer holds,” Advani told BeInCrypto.

The tokenization of assets such as stocks is a key example of this trend. It lowers barriers to investment by reducing minimum amounts and making these assets more accessible to retail investors. Major players are taking note of this technology.

Broadening Tokenized Investments

Tokenized stocks represent an important development in the broader market. Institutions increasingly leverage blockchain technology to offer more accessible versions of traditionally exclusive assets. Kraken’s recent launch of tokenized stocks exemplified this shift.

Besides equities, other tokenized assets like bonds and yield-bearing instruments –including tokenized Treasuries valued at over $7.3 billion– contribute to this expansion.

“The arrival of tokenized equities, bonds, and yield-bearing instruments is quickly balancing the appetite of institutional and retail investors,” Advani noted.

Meanwhile, as tokenized markets grow, decentralized finance (DeFi) lending platforms like Euler now allow using BUIDL as collateral, enabling users to borrow stablecoins while displaying real-time risk data on the blockchain. These platforms operate without intermediaries, offering open access without requiring broker approval or accredited investor status.

Several jurisdictions, such as the United Arab Emirates, Singapore, and Hong Kong, have already established regulatory frameworks for digital assets that ensure that tokenized securities can be issued, traded, and settled securely on blockchain technology.

Regulatory efforts promote transparency and accountability, strengthening the credibility and stability of the tokenized market. These developments, in turn, provide a solid foundation for future growth.

Stability Through Broader Participation

One key benefit of broader participation in tokenized markets is the potential to reduce volatility. Increased holder diversity dilutes the impact of large market-moving transactions, often driven by whales, leading to more stable markets.

“Wider participation strengthens markets, especially in driving away short-term speculators. The presence of diverse holders dilutes whale-driven price swings, on-chain proof-of-reserves eliminates opaque practices like rehypothecation, and transparent collateral dashboards make trades visible 24/7,” Advani told BeInCrypto.

As tokenized markets grow more stable, they will open the door to a future with more inclusive and accessible financial systems.

Transforming Wealth Creation Using a Hybrid Model

Advani emphasized that tokenization isn’t just about expanding financial access– it fundamentally transforms wealth creation.

“Tokenization isn’t about adding risk or overthrowing legacy infrastructure. It’s about allowing anyone to own yield-bearing assets outright and creating a wealth creation market that’s open and fairer.”

Looking ahead, he envisions a hybrid model where traditional finance (TradFi) and blockchain coexist and complement each other. Tokenized assets won’t replace traditional systems but will enhance them, offering greater accessibility, transparency, and efficiency.

Ultimately, this hybrid approach could help balance the benefits of both financial structures, supporting the development of a more transparent and accessible financial system for a wider range of participants.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.