Frax Shares is part of a two-token system in the Frax Protocol, an open-source, permissionless, and entirely on-chain protocol built on Ethereum. Frax Protocol is the first fractional-algorithmic stablecoin system.

The Frax Finance protocol is partially backed by collateral and partially stabilized algorithmically. FXS is the governance token for generating fees, revenue, and excess collateral value.

The other half, FRAX stablecoin (FRAX), maintains a peg to the U.S. dollar by being partly collateralized by the USD coin (USDC). Frax Shares are also periodically bought and sold to maintain the market capitalization of FRAX.

Holders of FXS are incentivized to invest in the token because FRAX’s minting mechanism creates demand for FXS. As FRAX tokens are minted, a proportional number of FXS tokens are burned, further driving the price of FXS higher.

Social Media: Website | Twitter | GitHub | Discord | Telegram | Audit

Recent Developments and Future Events

Frax’s strong product lineup, especially its liquid staking derivatives (LSD) has been one of its most talked-about features. While FRAX-USDC generates an Annual Percentage Rate of 10%, holding FRAX-FXS can earn you an APR of 49% on Optimism.

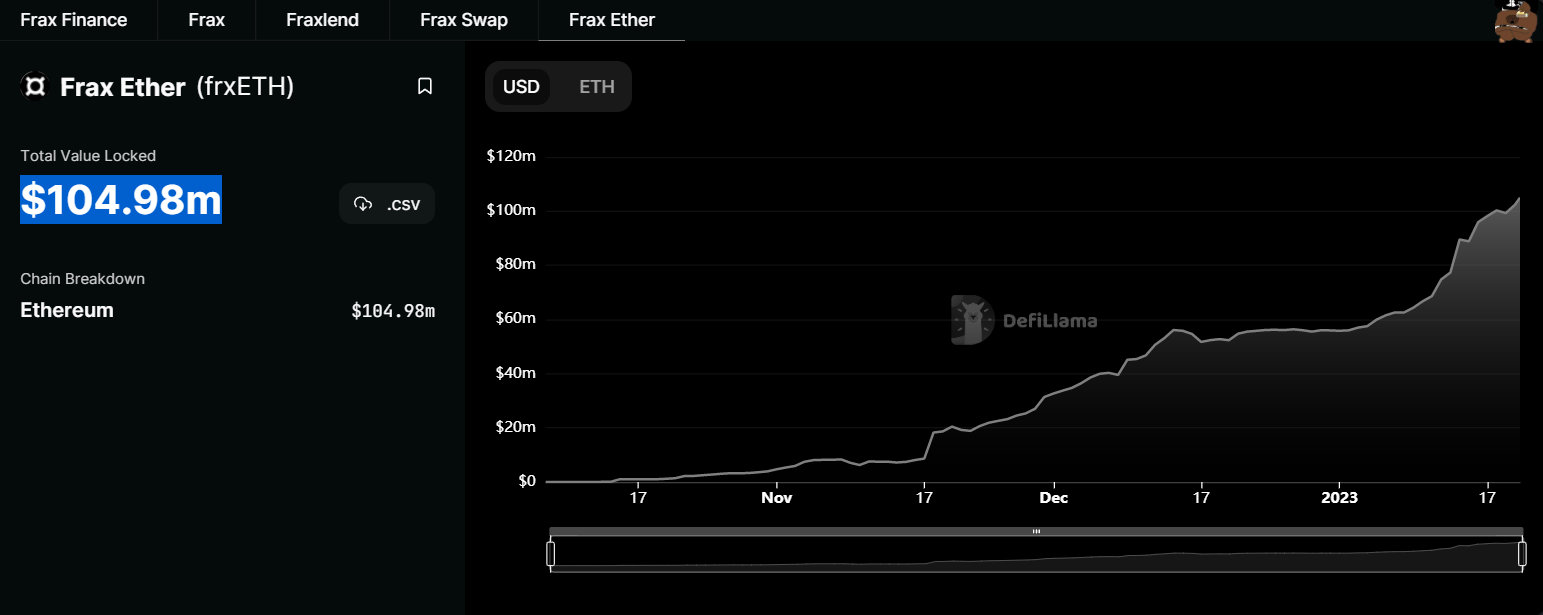

Frax’s staked ether (frxETH) product, which was launched in October, has begun amassing capital for its 10% APR. At the time of this writing, frxETH holds $104.98 million from just $50 million at the start of January.

The massive growth of the frxETH product is because of the edge it has over its competitors. While it offers staking APR of up to 10%, the closest ETH staking competitor of Frax Finance offers 5%.

On January 20th, leading crypto exchange Bybit announced the upcoming listing of $FXS on its Spot trading platform. While $FXS deposits were opened on the same day, withdrawals will be available from January 21st, 2023.

This comes just a day after Binance Futures announced the launch of an FXS perpetual contract with up to 20x leverage. The rapid growth of Frax has attracted more users to the project, helping its price grow.

Frax Shares (FXS) is crypto’s top gainer over the last week, with the price of the token jumping by 55.3%. In the last month, FXS has doubled its price, making it one of the best-performing crypto assets.

The 7-day price chart of Frax Shares (FXS). Source: CoinMarketCap

In the last 24 hours, FXS has also been pumping, gaining 11%. As a result of the recent gains, the price of FXS has crossed the $10 mark for the first time since May 2022, when the Terra ecosystem collapsed.

The 24-hour price chart of Frax Shares (FXS). Source: CoinMarketCap

FXS now trades at $10.12 and is ranked as the 58th largest cryptocurrency with a market cap of $728 million.

Frax Shares is growing into one of the largest communities in the DeFi space, thanks to its market-leading liquid staking derivatives programs.

Remarking on its products, crypto market builder @ShaharAbrams writes:

Blockchain and DeFi researcher Thor Hartvigsen in a thread shared reasons why the Frax community should be excited about 2023.

Crypto trader @CryptoDefiLord is bullish about FXS, writing:

The remarkable staking product of Frax Finance continues to give it a competitive advantage. As the unlocking of staked ETH draws closer, the volume of frxETH is expected to increase even further. These advantages could make Frax Finance a major player in the DeFi sector as it gains more popularity.

,

, ) (@ShaharAbrams)

) (@ShaharAbrams)

1/19

1/19

(@CryptoDefiLord)

(@CryptoDefiLord)