Community Update 2024

2

0

Welcome to the first update of 2024.

The Connect Financial team hopes that you had an enjoyable holiday season with your loved ones, and, as the kids are saying these days, you touched some grass.

As is typical for an end/start of year update, I want to recap on 2023, but I will do so only briefly. The main thrust of this update will be to focus on 2024 — loosely categorized into immediate focus and how we envision 2024 to play out.

As we’ve seen, the fintech and crypto markets are constantly moving. We’ve made many adjustments to the plan over the last few years, some small and some large, and we fully expect that there will be events that will require us to respond with agility. However, as we enter the final stretch of this part of the journey, every decision and action carries significant weight and impact. This pivotal point is where our focus becomes the most valuable asset we have at our disposal.

2023 Recap

When building something within the scope of Connect Financial, it becomes apparent that the customer-facing technology platform is just the visible part. The majority of the work, about 95%, remains hidden beneath the surface and, if executed correctly, remains invisible to the end user.

As mentioned before, we have successfully established a partnership with Mastercard and participated in their startup acceleration program, which proved to be highly valuable. This program enabled us to thoroughly analyze every aspect of our card program alongside their teams.

Our collaboration with Mastercard is ongoing, and we have started integrating several of their supplementary security, fraud prevention, and rewards technologies.

On the product front, we underwent a significant redesign of the core platform, including a fresh user interface. Additionally, we rebuilt several core backend services to enhance their resilience, performance, and compliance with upcoming regulatory and accreditation requirements.

By the end of 2023, we had successfully secured all of our main technology and financial partnerships, which is a significant achievement.

In summary, throughout 2023, we continued to make progress despite a challenging market, strengthening the foundational layers of our technology and partnerships.

Launching is a one-time opportunity, and we have dedicated significant effort to ensure that we are truly prepared.

2024 — Initial focus

The MVP product has been specifically developed to test four core technology systems in the market and provide a basis for iteration and continuous improvement.

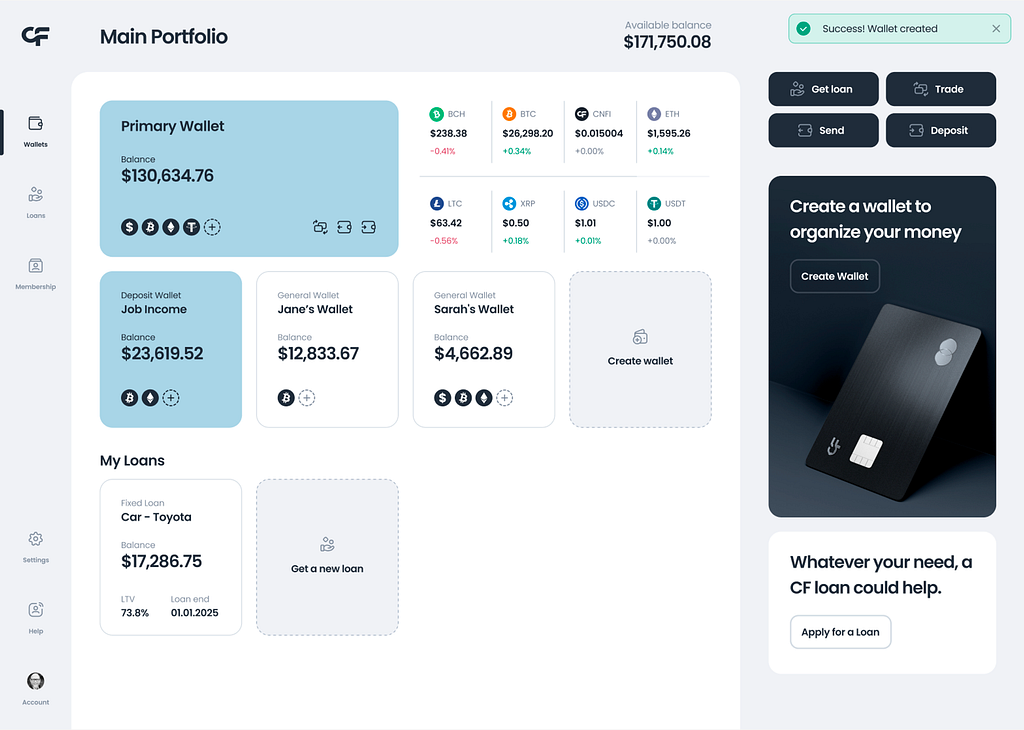

Wallet Dashboard

Our system design prioritizes flexibility and a clean, modern, and intuitive user interface.

Users will be able to create unlimited general wallets for account organization, and create additional deposit vaults depending on their membership level.

Membership

In the first iteration of the membership program users will be able to purchase and/or transfer their Connect Financial Tokens to the platform and commit them towards a membership. Your membership level will control prices across the platform and grant access to certain products as they are released.

After launch, we will be adding in additional functionality to memberships, including the ability to rebase your CNFI commitment, redeemable reward points and access to the various perks and rewards that will be made available to all of our members.

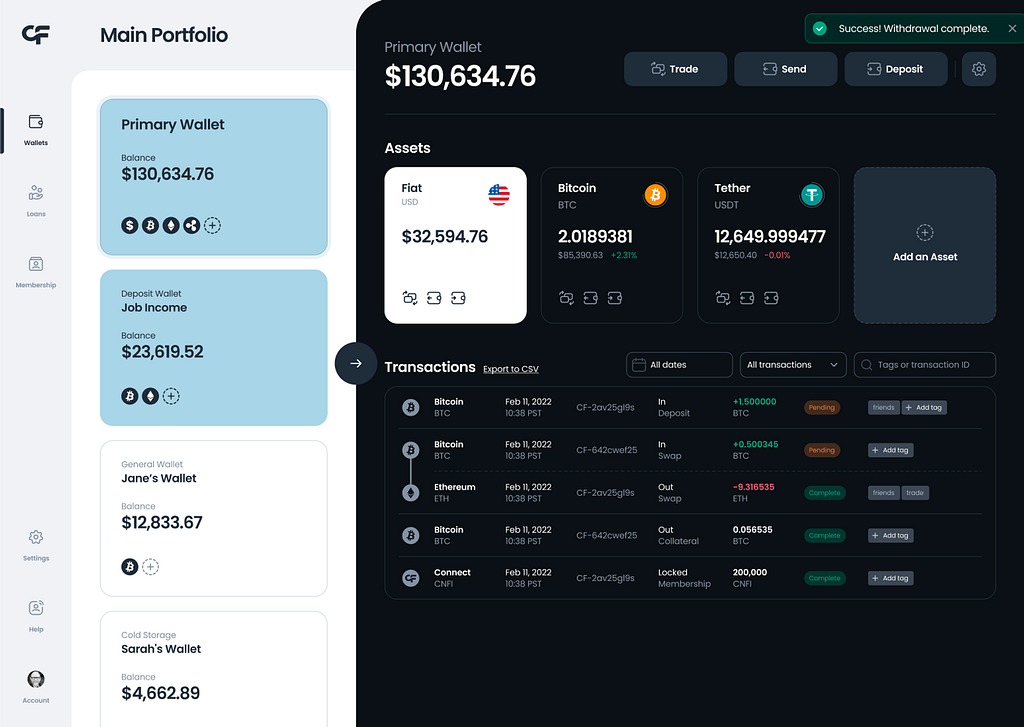

Custody engine

The custody engine, flow of funds and business systems are amongst the most challenging to get right (but more from a licensing/regulation perspective vs. technology).

At launch, users will be able to onboard fiat via wire transfer and ACH. After launch we will be adding in multiple other payment rails including SEPA, FedNow, Interac, RTP and push-to-card.

Crypto custody will be provided by our trust partners and will involve cold storage as standard for all balances held on platform, with support from on-demand hot-wallets to reduce friction around some of our products.

This has all been built to use MPC technology with strict security rulesets and anti-fraud processes.

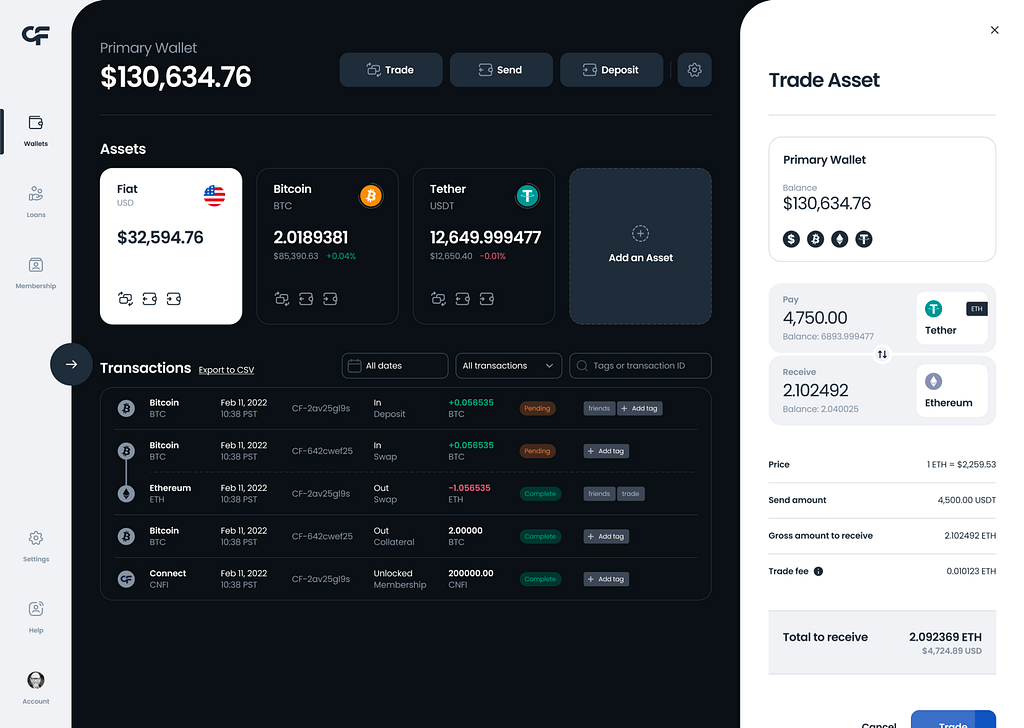

Trade

On day one, users will be able to trade between cash and a basket of digital assets through our trade product. The trade protocol works as an automated OTC desk and provides very competitive prices.

While buying and selling digital assets on demand is a core feature, the Trade product also powers a number of other lending products, so we will be carefully iterating on the functionality to ensure that settlement and liquidity meets the specifications of the Loans and Credit Card products.

Marketing

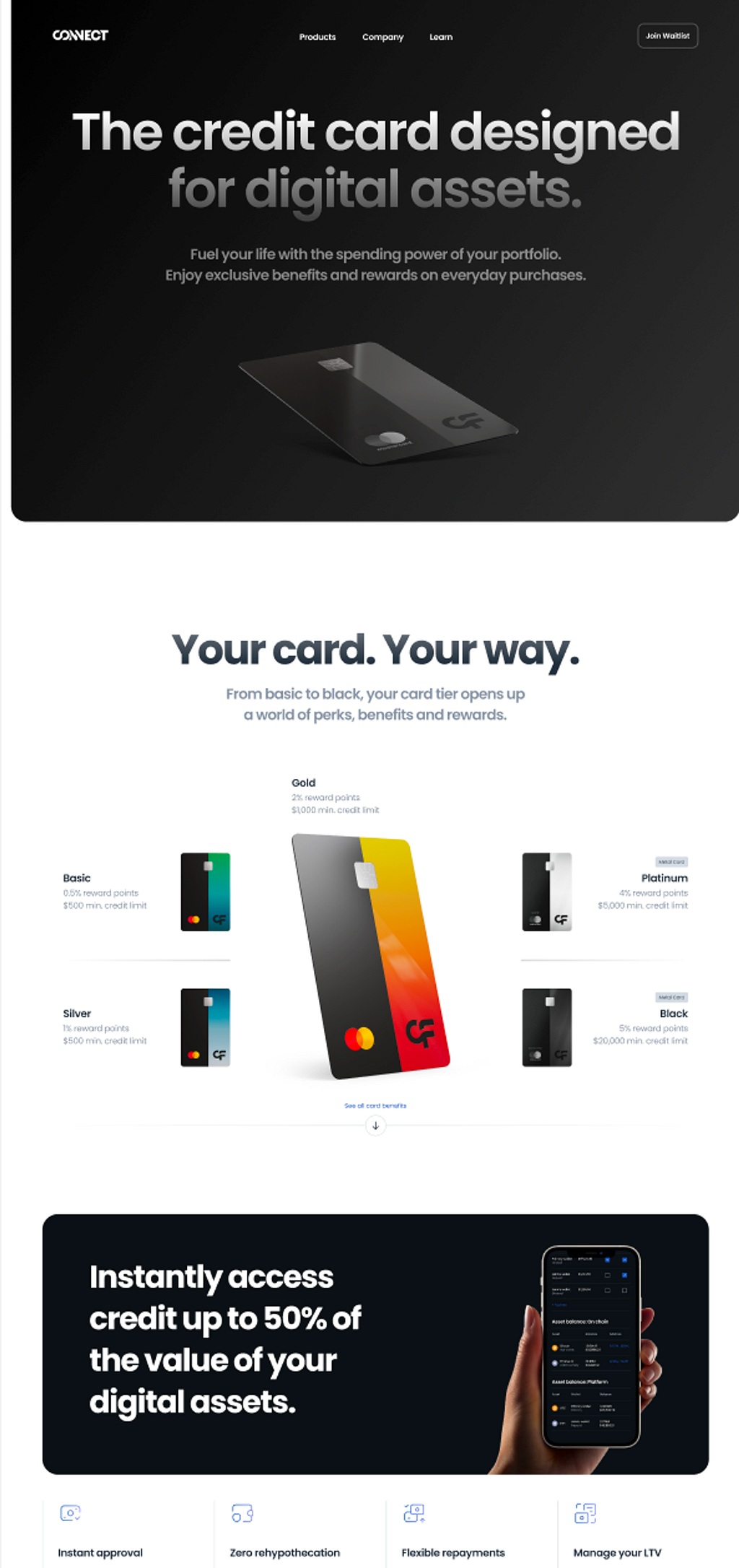

We have been working on redesigning the main landing page website to showcase our product lineups. Additionally, we are incorporating design sensibilities from the client platform to create a fresh and cohesive look.

2024 Vision

Core product releases

Following the rollout of the MVP platform, we will begin deploying the full suite of Connect Financial retail products to the platform. Of note (but not necessarily in this order):

- Credit Cards: Our Mastercard credit card, collateralized with digital assets continues to be our flagship product. Of course, there are a number of moving parts to consider, both in terms of technology and partnerships, and this core feature will be rolled out in several stages.

The product scope remains largely the same as we have described before, but rates, fees and terms will be reviewed to ensure that they still make sense in the market.

One of the things that I am personally most excited about is finally packing black and platinum cards in our gorgeous swag boxes. They’ve been sitting in storage for too long!

- Loans: The ability to access the liquidity in a digital asset will, in our opinion, be a driving use case over the next market cycle. We’ll be starting with a basket of digital assets to form the basis of collateral, and we will look to slowly add in other asset classes over time as confidence and regulatory clarity increases.

One of the key features about our loan feature is their flexibility. Essentially, you will choose your own loan terms and have control over your collateral type, amount, repayments and interest rate.

- Rewards: We are focused on building a premier membership program, including some of the most attractive rewards and perks available in the market today.

You will access rewards through a number of ways, including partner-specific rewards through the MasterCard network, reward points based on purchases (redeemable for cash, digital assets and marketplace purchases), and discounts and benefits for transactions made on the platform.

Smart Metals

Smart Metals (Connect Financial’s sister tokenized precious metals platform) will be rolled out in stages once the focus can be shifted slightly away from core product releases mentioned above.

The full potential aspiration for Smart Metals is as a protocol to tokenize a range of novel asset classes, including collectibles, spirits, NFTs and more. Over time, we will add functionality for users to sell their tokens on the secondary market and access the liquidity of their digital assets.

B2B2C

Without getting into the technical specifics too much, every part of Connect Financial’s infrastructure has been designed to function as a compartmentalized service, accessible via API and SDK.

Along with our partnerships, this will allow Connect Financial to provide access to the product suite, issue cards and provide custody for fintechs and other players in the market.

At full scale, this will see Connect Financial as a major service provider for modern fintechs working in the neobank/digital asset space.

I am incredibly excited to see this vision come to life and we’re looking forward to getting your thoughts and feedback as the first users of the platform.

I’d also like to take a moment to offer my heartfelt appreciation to the Connect Financial community. Your continued support, forthrightness and good humor are very important to me and the Connect Financial team.

Be kind to one another.

2

0