Here’s Why Zilliqa (ZIL) May Find It Difficult to Escape Consolidation

0

0

Zilliqa (ZIL) notes sideways momentum that has continued for the past few weeks, which may not be easy to break.

While investors exhibit one sentiment, the market sends a much different signal, which might not favor a breakout.

Zilliqa Investors Want a Rise

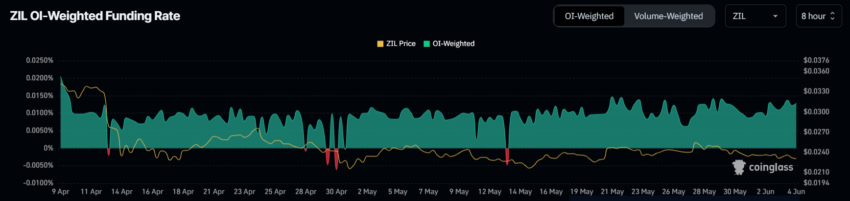

Zilliqa’s price is finding bullish support from ZIL holders, who have been waiting for a price rise for some time now. Traders have predominantly placed bullish bets in the Futures market, evident in the Funding Rate.

The funding rate is a periodic payment exchanged between traders in perpetual futures contracts to keep the contract price close to the spot price. It reflects the market sentiment, where a positive rate indicates bullishness and a negative rate indicates bearishness.

Positive rates signify long contracts dominating the market, while negative funding rates suggest short contracts’ dominance. The latter hints at investors expecting a price drawdown, which is not true with ZIL.

Zilliqa Funding Rate. Source: Coinglass

Zilliqa Funding Rate. Source: Coinglass

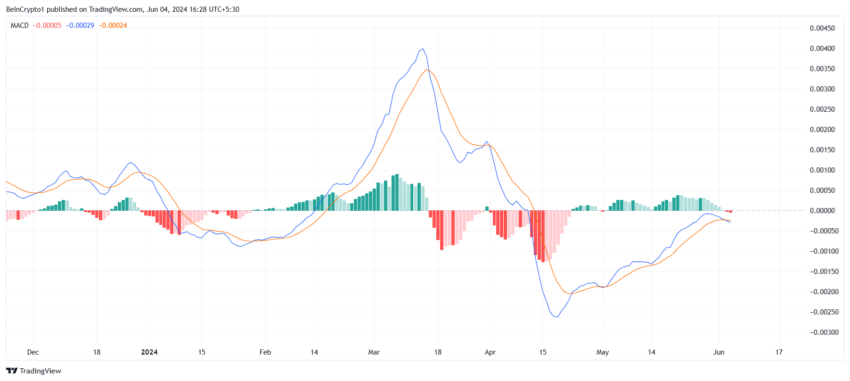

However, the broader market does not seem to agree with the investors, as indicated by the Moving Average Convergence Divergence (MACD). The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of an asset’s price, helping to identify potential buy and sell signals.

In the case of Zilliqa, the MACD has formed a bearish crossover with the histogram noting the presence of red bars. This means that bearishness dominates the market and could cause a price dip.

Read More: Zilliqa (ZIL) Staking: A Step-by-Step Guide for Beginners

Zilliqa MACD. Source: TradingView

Zilliqa MACD. Source: TradingView

Together, the signals suggest consolidation.

ZIL Price Prediction: The Waiting Game Continues

Zilliqa’s price, trading at $0.023, failed to breach the resistance of $0.025 for the third time in the past month. This level, along with $0.022, has consolidated ZIL for nearly two months.

In a few instances, the altcoin broke both the limits, once rising to $0.027 and once dropping to $0.021. This is the highest ZIL has managed to escape, which makes a breakout difficult.

Read More: Zilliqa (ZIL) Price Prediction 2024/2025/2030

Zilliqa Price Analysis. Source: TradingView

Zilliqa Price Analysis. Source: TradingView

However, if Zilliqa’s price manages to break out or break down, the neutral-bearish thesis could be invalidated. Should ZIL cross the resistance at $0.027, the altcoin could climb to $0.030.

0

0