London IPOs Hit a 30-Year Low: Is the US Crypto Boom the Reason?

0

0

London’s once-prized IPO market has slumped to its weakest level in three decades, even as the US enjoys a resurgence powered by crypto and AI listings.

The contrast reflects a structural realignment in global capital flows, with new-economy sectors choosing New York over London as their preferred launch pad.

London IPO Market Stumbles to a Historic Low

According to data reported by Barchart, London IPO fundraising in the first half (H1) of 2025 plunged to just £160 million (around $215 million) across five deals, marking the lowest since 1995.

The post highlights the city’s diminished standing in global finance, with deal volumes and valuations collapsing to near zero. This is far below peaks such as 2007 or the post-COVID boom of 2021.

Analysts point to post-Brexit capital flight, tighter regulatory hurdles, and reduced liquidity as driving forces behind the downturn.

Many companies that might have listed on the London Stock Exchange (LSE) are now turning to New York or Hong Kong for deeper capital pools and stronger investor appetites.

More closely, the US IPO market is telling a very different story. American exchanges raised around $28.3 billion across 156 listings in H1 of 2025, effectively dwarfing London’s numbers.

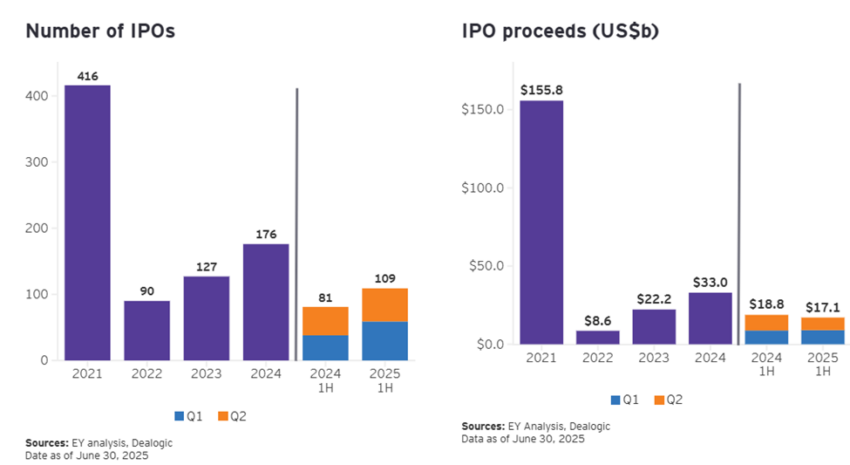

A report by EY Americas shows that the number of US IPOs in Q2 2025 rose by 16% compared to Q2 2024 despite weaker gross proceeds.

Number of US IPOs and Related Proceeds. Source: EY Americas

Number of US IPOs and Related Proceeds. Source: EY Americas

In June alone, nine IPOs raised more than $50 million each, including the quarter’s two largest offerings. Aftermarket performance is equally strong, with median first-day trading gains of over 20%.

Much of the momentum has been driven by crypto and AI firms, which have electrified investors with promises of innovation and scarcity value.

Bloomberg reports that companies like Circle Internet Group, stablecoin issuer Bullish, and blockchain lender Figure Technology are among the biggest beneficiaries.

Similarly, Circle’s $1.21 billion listing in June has surged more than 336% since going public.

“Circle’s stock price has quadrupled its initial offer, an extraordinary moment that puts it on the heels of Coinbase’s historic $86 billion debut. This is a loud and clear signal that investor confidence in crypto is charging forward with unstoppable momentum,” Anil Oncu, CEO of Bitpace, said in a statement to BeInCrypto.

Crypto exchange Bullish (BLSH) raised more than $1 billion in its August IPO, with shares nearly tripling on opening day. This gave it a $10 billion market cap, almost double its IPO valuation.

They reportedly doubled or tripled in value on debut, aligning with BeInCrypto’s report that Circle’s IPO proved Wall Street wins.

“We are seeing technology and crypto-sector companies accelerate their IPO timelines after triple-digit first-day pops became a regular feature in this summer’s market,” Bloomberg reported, citing Will Connolly, Goldman Sachs Group Inc.’s co-head of equity capital markets in the Americas.

Global Capital Flows Realign Amid Crypto’s Growing Role in Equity Markets

The divergence between London’s stagnation and America’s IPO boom reflects deeper structural changes.

Since Brexit, London has struggled to maintain its role as a financial hub, while US markets have positioned themselves as the home for growth industries like blockchain, fintech, and AI.

“Half of the top 10 IPOs in Q2 took place in June, highlighting a strong finish to the quarter,” EY’s Rachel Gerring noted, pointing to the resilience of US equity markets despite tariffs and geopolitical tensions.

Meanwhile, global IPO proceeds rose in H1 of 2025, with the US, China, and India accounting for 60% of listings.

Yet London remains conspicuously absent from the growth story, increasingly sidelined as companies seek more dynamic markets.

For crypto, the IPO boom represents more than just liquidity. It signals the mainstreaming of digital asset companies like Tron into traditional equity markets.

Other firms include Grayscale, BitGo, and, more recently, Gemini, which seeks a public debut with $18 billion in assets.

Investors hungry for exposure to crypto infrastructure, stablecoins, and blockchain services are piling into listings, often at valuations that rival traditional tech firms.

Recently, BeInCrypto reported that Asian crypto firms are also eyeing US IPOs amid pursuits such as capital, legitimacy, and global expansion opportunities. According to Deutsche Bank’s Nick Williams, demand is fueled by scarcity value.

“Equity investors’ limited ways to get exposure to crypto assets, and insatiable retail demand for the theme, are driving many of the moves,” said Williams.

The rise of crypto-fueled IPOs in the US compounds London’s challenges. With crypto exchanges, stablecoin issuers, and blockchain firms racing to New York, the LSE risks being left behind in the industries defining the next decade of finance.

Even as Wall Street bankers prepare for a busy autumn IPO window, with names like Kraken, Figure, Klarna, and StubHub in the pipeline, London’s conduit appears thin.

“Crypto’s institutional era enters a new phase as IPO activity accelerates…With Circle’s high-profile NYSE debut, Gemini’s IPO filing…the playing field for regulated crypto exposure is fundamentally reshaped. Capital markets are reopening to digital asset firms with credible models,” Tracy Jin, COO of MEXC, told BeInCrypto.

Without bold reforms, analysts warn, the city risks losing its competitive edge entirely.

“The realignment of the IPO market across regions and sectors reflects a deeper shift in global capital flows and investor sentiment,” EY Global IPO Leader George Chan said.

Overall, London’s IPO drought marks a structural decline. But the US rides a wave of investor euphoria driven by crypto and AI-fueled listings.

Unless London adapts, its place in the global IPO race may have already passed into history.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.