Crypto: BTC Holders Decline While ETH Gains Momentum

0

0

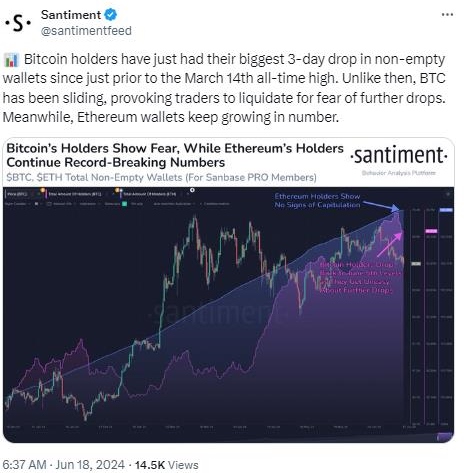

In recent weeks, the cryptocurrency market has experienced contrasting movements. Bitcoin, the flagship crypto, faces a significant decrease in its holders. Ethereum, on the other hand, continues to grow and set records. Let’s explore these trends and what they mean for the future of these digital assets.

Why are Bitcoin Holders Leaving the Network?

According to data from the on-chain analysis company Santiment, the total number of Bitcoin crypto wallets has recorded its sharpest drop since March. More specifically, this metric tracks the number of crypto wallets that have a non-zero balance. It shows that many investors have emptied their wallets, suggesting a loss of confidence. Indeed, a 3% drop in the price of Bitcoin last week has accentuated this trend.

The main cause of this exodus seems to be the fear of a further price drop. Crypto investors have started liquidating their positions, hoping to avoid larger losses.

Ethereum Continues to Attract Crypto Investors

Unlike Bitcoin, Ethereum continues to see its number of holders increase. The data shows growing adoption of the crypto network, with new investors joining every day. Cryptography experts attribute this positive dynamic to:

- the robustness of Ethereum’s technology,

- its reputation as a reliable network for dApps.

Ethereum has managed to maintain a constant adoption flow, even in the face of crypto market fluctuations. This indicates sustained confidence in its long-term potential.

What Impact on the Cryptocurrency Market?

The current trend highlights an interesting market dynamic. It could even influence investors’ perception of crypto assets in general.

An exodus from Bitcoin could signal a shift towards more innovative or secure digital assets. In the long term, this situation could redefine the power dynamics within the crypto market.

The current divergence could shape the future of the crypto market. Hence the importance of closely following it to understand upcoming trends.

“””

0

0