Crypto ETF Momentum Builds: Solana, XRP, and Litecoin ETF Approval Odds Surge to 95%

0

0

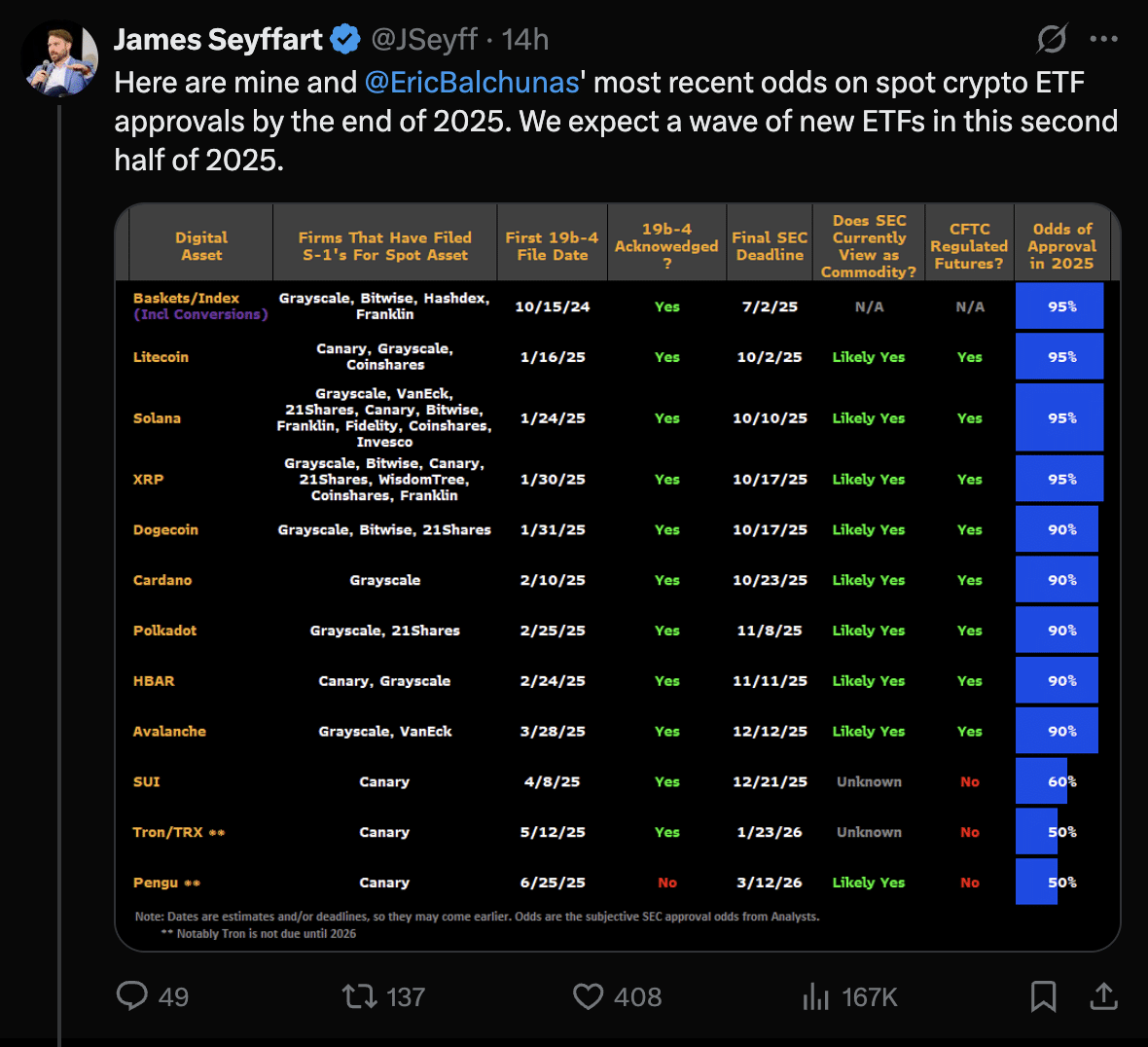

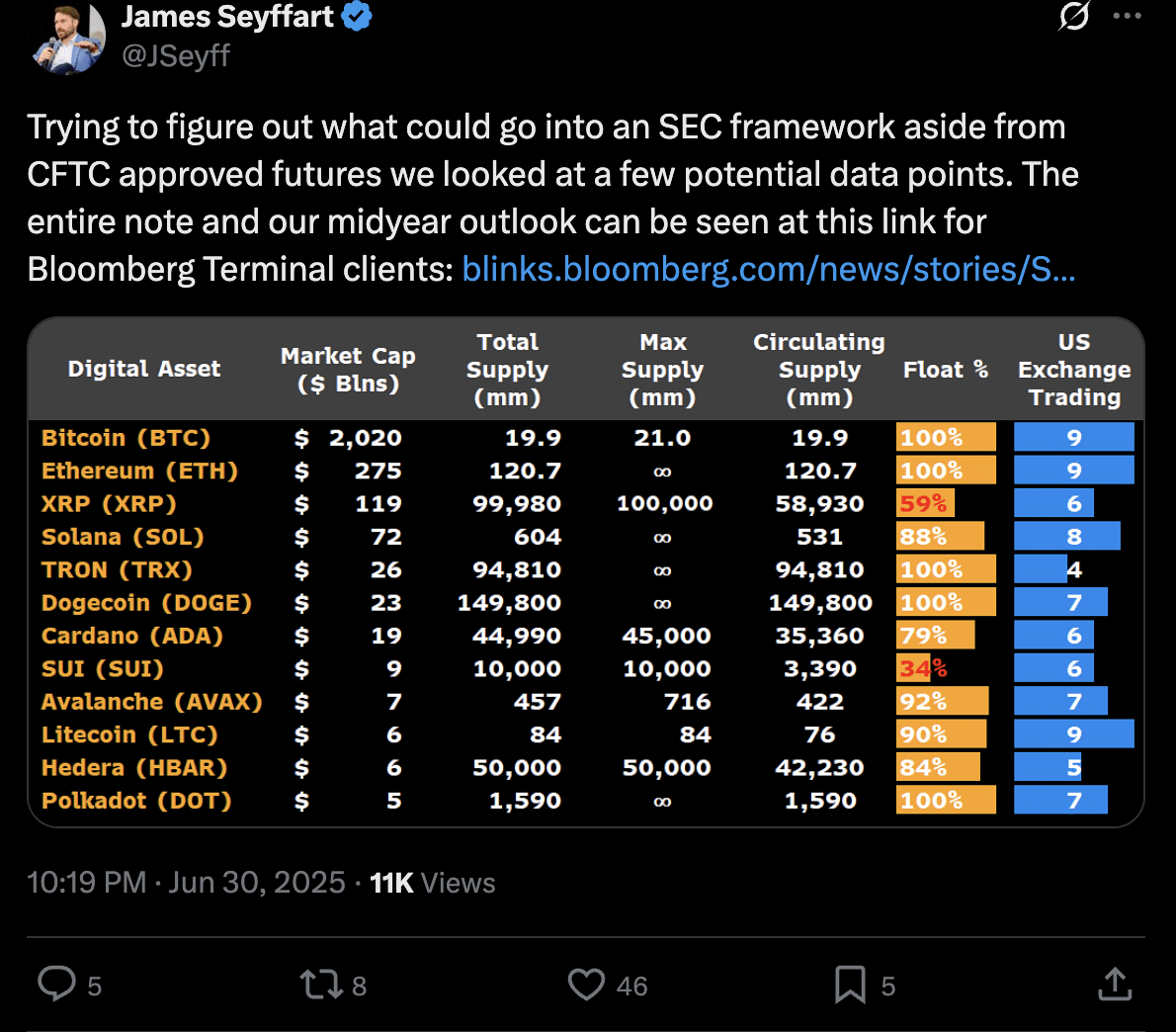

The race to launch spot crypto exchange-traded funds (ETFs) has taken a decisive turn. According to Bloomberg ETF analysts Eric Balchunas and James Seyffart, the odds of Solana XRP Litecoin ETF approval have climbed to 95%, up from their prior 90% forecast. This surge in confidence suggests that U.S. regulators are poised to open the door wider to altcoin-based investment vehicles in 2025.

In a June 1 update, Balchunas and Seyffart emphasized that a wave of ETF approvals could land in the second half of the year, potentially reshaping access to digital assets. The Securities and Exchange Commission (SEC) has yet to announce final decisions, but the signals from Bloomberg analysts reflect growing alignment between issuers and regulators.

This momentum isn’t limited to just three altcoins. Approval odds are also high for a crypto index ETF, with a potential green light expected as soon as this week.

Solana Staking ETF Launches Ahead of Broader Approvals

Even before final approval for spot ETFs tied to individual tokens, the REX Osprey Solana Staking ETF has made history. Launching this Wednesday, it becomes the first U.S.-listed fund to incorporate crypto staking, specifically tied to Solana, one of the tokens now expected to receive SEC backing for a broader spot ETF.

This staking ETF passed regulatory review after issuers agreed to allocate at least 40% of fund assets to other exchange-traded products, many of which are listed outside the U.S. This workaround helped address the SEC’s concerns over the fund’s classification under U.S. investment laws.

While the Solana XRP Litecoin ETF approval trajectory remains on an upward slope, Ethereum staking ETFs continue to face delays. The SEC recently postponed decisions on Bitwise’s proposed Ether staking ETF and the Osprey Bitcoin Trust, signaling ongoing scrutiny around staking mechanisms within ETFs.

Beyond the Big Three: What’s Next in Line?

Balchunas and Seyffart aren’t just bullish on Solana, XRP, and Litecoin. Their forecast places Dogecoin, Cardano, Polkadot, Hedera, and Avalanche at 90% odds for ETF approval by year-end. These tokens represent the next batch of contenders likely to enter regulated ETF markets, pending final decisions from the SEC.

Meanwhile, Sui and Tron appear less certain. The analysts assign 60% and 50% approval odds respectively, citing regulatory ambiguity and lower demand from institutional issuers. Despite these lower probabilities, the mere inclusion in discussions highlights a maturing ETF ecosystem eager to move beyond Bitcoin and Ethereum.

With over 70 crypto ETFs currently pending before the SEC, 2025 may usher in the broadest expansion of digital asset investment tools since the approval of Bitcoin ETFs.

Capital Inflows Reflect Growing Market Appetite

Recent market data further supports institutional interest in these developments. According to Bloomberg, digital asset investment products attracted $2.7 billion in inflows last week alone, the 11th consecutive week of net gains, totaling $16.9 billion in just under three months.

The U.S. continues to dominate global flows, accounting for $2.65 billion of last week’s inflows. While Bitcoin pulled in $2.2 billion, capturing 83% of the total, Ethereum followed with $429 million, raising its YTD total to $2.9 billion.

By contrast, Solana, despite its rising prominence in ETF talks, has only seen $91 million in inflows this year, signaling that an ETF approval could catalyze substantial new interest and help close the adoption gap.

Why Solana XRP Litecoin ETF Approval Is a Game Changer

The significance of these ETF developments goes beyond price action or token exposure. If Solana XRP Litecoin ETF approval becomes official, it will:

Enhance accessibility: ETFs eliminate the technical barriers of self-custody, making altcoin exposure viable for retail and institutional investors alike.

Build regulatory trust: SEC recognition would add legitimacy to assets that have long operated in legal gray zones.

Widen adoption: Broader ETF listings could prompt traditional financial advisors and asset managers to consider altcoins as part of diversified portfolios.

It also reflects a deeper maturation of the crypto industry, with traditional finance (TradFi) slowly weaving digital assets into regulated frameworks.

Expert Perspective: ETF Market Expansion Underway

ETF analysts from Bloomberg aren’t alone in their optimism. BlackRock CEO Larry Fink has recently reiterated that the future of ETFs includes multi-asset crypto funds, stating,

“We’re not done with crypto ETFs. There’s room for more, especially across non-Bitcoin tokens.”

Veteran crypto lawyer Jake Chervinsky adds that Solana’s recent legal wins, especially around the SEC’s prior allegations, may have eased regulatory pressure enough to facilitate approval. He notes,

“If the SEC gives Solana the green light, it’s effectively validating its non-security status, something the market has waited years to hear.”

Conclusion: Solana XRP Litecoin ETF Approval Signals a New Era

The jump to 95% approval odds for Solana, XRP, and Litecoin ETFs is a notable inflection point. A crypto index ETF may debut within days, the first Solana staking ETF is now live, and over 70 ETF applications await decision, most tied to altcoins.

If the current pace continues, 2025 could see an ETF expansion wave that rivals the impact of the original Bitcoin ETF approvals. The era of altcoin accessibility via mainstream platforms may be closer than ever.

Summary

Bloomberg analysts have raised the approval odds for Solana, XRP, and Litecoin ETFs to 95%, citing strong regulatory engagement and growing institutional demand. The launch of the first U.S. Solana staking ETF further cements momentum, while a broader crypto index ETF could be approved this week. Over 70 crypto ETFs await SEC review, with Dogecoin, Cardano, and others also in line. Despite Bitcoin dominating current inflows, altcoins are catching up, especially as ETF pathways open.

FAQs

What is the current status of Solana, XRP, and Litecoin ETF approval?

Bloomberg analysts now place the odds of approval at 95%, with decisions expected by October 2025.

When will the crypto index ETF be approved?

It could be approved as early as this week, according to Bloomberg forecasts.

What makes the Solana staking ETF significant?

It’s the first U.S.-listed crypto ETF to incorporate staking, signaling regulatory comfort with newer asset models.

Are Ethereum staking ETFs also expected soon?

No. The SEC recently delayed decisions on Ethereum staking ETFs due to ongoing concerns.

Which other altcoins may get ETF approval soon?

Dogecoin, Cardano, Hedera, Polkadot, and Avalanche are at 90% approval odds, with decisions expected by year-end.

Glossary

ETF (Exchange-Traded Fund): A security that tracks an asset or group of assets and is traded on stock exchanges.

Staking: Participating in a blockchain network’s operations by locking up tokens to support security and consensus.

Spot ETF: An ETF that holds the underlying asset directly, rather than derivatives or futures.

SEC (Securities and Exchange Commission): U.S. regulatory body overseeing securities markets and investment products.

Altcoin: Any cryptocurrency other than Bitcoin.

Sources

Read More: Crypto ETF Momentum Builds: Solana, XRP, and Litecoin ETF Approval Odds Surge to 95%">Crypto ETF Momentum Builds: Solana, XRP, and Litecoin ETF Approval Odds Surge to 95%

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.