Racing Against Time: 24 Crypto Exchanges Flock to Hong Kong for Regulatory Approval

0

0

24 crypto firms have sought licenses from Hong Kong’s Securities and Futures Commission (SFC). This list includes prominent names such as OKX, Bybit, and Crypto.com. They aim to offer retail trading services, aligning with Hong Kong’s vision as a crypto hub.

The SFC’s deadline on February 29 spurred these applications, signaling a pivotal moment for the sector.

Hong Kong Aims for Crypto Regulation Amidst Rising Revenue

Hong Kong’s licensing initiative is a bold step toward regulating the volatile crypto market. It showcases the city’s dedication to safeguarding virtual asset investors. To date, only HashKey and OSL have secured their licenses. Thus, the pressure mounts for the others, as non-applicants must halt operations by March’s end.

The SFC’s stringent licensing criteria aim to bolster investor protection. Platforms awaiting license approval are differentiated from those fully licensed, ensuring transparency and security.

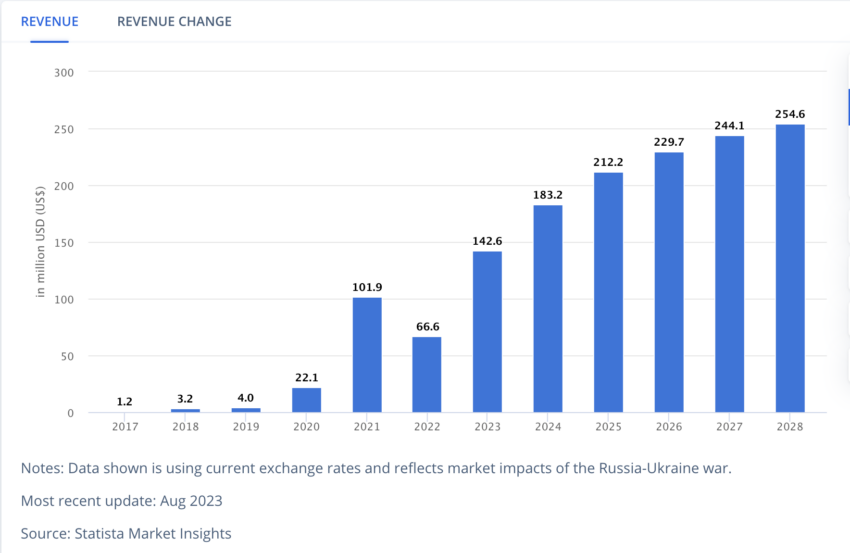

This approach is critical, especially with the city’s crypto market revenue hitting $142.6 million in August 2023. Furthermore, projections suggest a growth towards the $254.6 million mark by 2028, highlighting the sector’s economic significance.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Crypto Market Revenue in Hong Kong. Source: Statista

Crypto Market Revenue in Hong Kong. Source: Statista

Matrixport HK, under Flying Hippo Technologies Limited, also joined the fray, submitting its application just in time. Yet, the journey to licensing has its setbacks.

For example, Huobi HK retracted its application shortly after submission, illustrating the challenges of meeting the SFC’s high standards. This and other withdrawals emphasize the rigorous vetting process to ensure platform reliability and compliance.

Read more: A Guide to the Best Stablecoins in 2024

Beyond crypto trading, Hong Kong is expanding its regulatory scope to include stablecoin issuance. Announcements about a regulatory sandbox for stablecoin issuers and the e-CNY pilot project expansion signal a comprehensive approach to digital asset oversight.

We will expand the scope of e-CNY pilot testing in Hong Kong. Members of the public may set up e-CNY wallets easily for use and for topping up funds by the Faster Payment System, thereby further enhancing the efficiency and user experience of cross-boundary payment services,” Hong Kong Financail Secretary Paul Chan said.

0

0