Five Spot Ethereum ETFs to Launch on Cboe July 23, Including Franklin Templeton and VanEck

0

0

Several spot Ethereum exchange-traded funds (ETFs) are set to begin trading on July 23, according to the Chicago Board Options Exchange (Cboe).

This announcement marks a pivotal moment in the evolution of Ethereum (ETH) as a mainstream investment asset.

Fidelity and VanEck Among Five New Ethereum ETFs Launching on Cboe

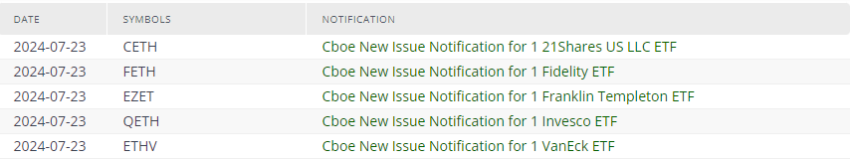

The Cboe has confirmed that several high-profile funds will start trading next week. These include the Fidelity Ethereum Fund, Franklin Ethereum ETF, Invesco Galaxy Ethereum ETF, VanEck Ethereum ETF, and 21Shares Core Ethereum ETF.

This development came after the US Securities and Exchange Commission (SEC) approved Grayscale Ethereum Mini Trust and ProShares Ethereum ETF for listing on the New York Stock Exchange’s (NYSE) Arca platform earlier this week.

Read more: Ethereum ETF Explained: What It Is and How It Works

Cboe Issue Notification for Several Spot Ethereum ETFs. Source: Cboe

Cboe Issue Notification for Several Spot Ethereum ETFs. Source: Cboe

The journey to this launch date began in May when the SEC approved the 19b-4 forms for these ETFs. However, the firms still needed their registration statements to become effective before they could officially launch.

Bloomberg Senior ETF Analyst Eric Balchunas had previously noted that firms would “request effectiveness” on Monday. He anticipated that the ETFs would start trading on July 23.

In preparation for the launch, the potential issuers have updated their fee structures and plan to waive their fees for a limited time. For instance, Fidelity announced waiving its 0.25% fee through the end of 2024.

VanEck also offers a one-year fee waiver for the first $1.5 billion in assets. Similarly, 21Shares will not charge its 0.21% fee for the first six months or until the fund reaches $500 million in assets, whichever comes first.

Industry experts believe the success of the Ethereum ETFs’ debut week could set the tone for future market developments. Danny Chong, co-founder of Tranchess, shared his perspective on the potential market impact with BeInCrypto. He believes that the spot ETF inflows could substantially impact ETH more than Bitcoin due to Ethereum’s fast-expanding ecosystem and additional utility.

“The ETH/BTC price ratio has already seen positive movement as investors anticipate Ethereum ETFs to go live soon. […],” he pointed out.

Despite the optimism, Chong noted that spot Ethereum ETFs did not meet industry expectations when launched in Hong Kong. However, with a larger investor base in the US, these upcoming ETFs are expected to perform better.

Read more: How to Invest in Ethereum ETFs?

Optimism surrounding the imminent launch of these Ethereum ETFs also extends beyond market impact. Experts believe these funds could influence the future of crypto regulation in the US.

Furthermore, many in the crypto community already shifted their attention to what might come next. There is speculation about the potential approval of a Solana (SOL) ETF and other cryptocurrency-based ETFs.

0

0