Ethereum Name Service (ENS) Price Unlikely to Hit Another 2024 High: Here’s Why

0

0

Ethereum Name Service (ENS) price nearly broke through the 2024 highs, but broader market cues pulled it down before it could.

However, investors did not support the altcoin much either, as they, too, are looking to sell.

Ethereum Name Service Sees Gains

ENS price surged and, along with it, increased the probability of selling at the hands of investors. The unexpected rally was fuelled by broader market cues and the spot Ethereum ETF approval. ENS benefited from it, given the token is an Ethereum namesake.

However, this also resulted in the asset being overvalued, as exhibited by the Market Value to Realized Value (MVRV) ratio. Ethereum Name Service’s 30-day MVRV is 25.7%, signaling profits and potentially prompting selling.

Historically, ENS corrections occur within the 7% to 21% MVRV range, labeling it a danger zone.

ENS MVRV Ratio. Source: Santiment

ENS MVRV Ratio. Source: Santiment

Thus, ENS holders are likely to sell their holdings for profits.

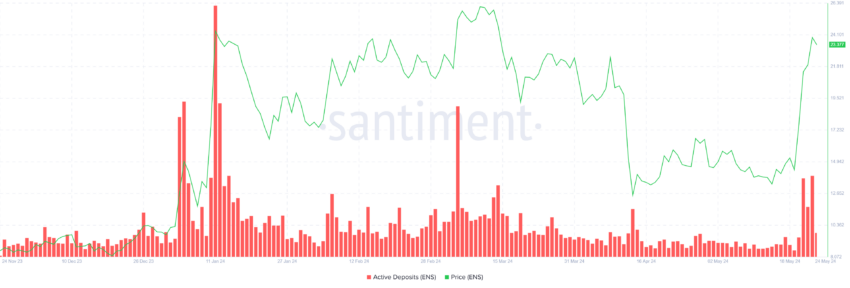

This theory is substantiated by the rise in active deposits on the network. Active deposits measure the unique addresses of users who have been moving their holdings from their wallets to the exchange’s wallets.

Read More: Ethereum Name Service (ENS): Everything You Need To Know

ENS Active Deposits. Source: Santiment

ENS Active Deposits. Source: Santiment

Over the last few days, as the ENS price shot up, investors began moving their holdings in large volumes. This signals that ENS holders are prepared to sell for profit, which could prove to be bearish for the price action.

ENS Price Prediction: Further Rise Unlikely

ENS price, trading at $23.4 at the time of writing, breached the resistance at $23.15, but if it does not sustain this rise, it may not test this level as support. This is crucial for noting a rise to establishing new 2024 highs above $26.

However, considering the investors are heavily bearish on growth, the altcoin will mostly fail to secure $23.15 as support. Consequently, ENS could pursue a drawdown to $20.91.

Read More: Ethereum Name Service (ENS) Price Prediction 2024/2025/2030

ENS Price Analysis. Source: TradingView

ENS Price Analysis. Source: TradingView

However, should the investors refrain from selling, ENS could test the crucial level of support. This would reignite optimism among ENS holders, triggering a potential recovery that could lead to a new 2024 high, invalidating the bearish outcome.

0

0