XRP Forecast Turns Bearish After Ripple Permissioned DEX Launch

0

0

This article was first published on The Bit Journal. XRP price action remained subdued as markets digested a major network upgrade from Ripple. The token was trading sideways around $1.4860 despite the introduction of a new Permissioned decentralized exchange (DEX) feature on the XRP Ledger, remaining well within the narrow stage of the past few days. The dampened reaction has prompted investors to use a subdued XRP forecast in the short-term.

The price level is significantly lower than the year-to-date high of XRP of $2.4160, highlighting the larger consolidation period of the crypto market.

XRP Forecast Shifts After Permissioned DEX Launch

Ripple achieved a significant milestone this week by turning on the Permissioned DEX, which is specifically supported by regulated financial institutions. In contrast to open exchanges that are decentralized like Uniswap and Raydium, the Permissioned DEX presents controlled access, where only approved parties take part in it.

This form is supposed to follow the institutional compliance needs and allow engaging in decentralized finance. Ripple reports that institutional trading, cross-border payments, and foreign exchange settlements are some of the use cases supported by the solution. Collaborating partners are allowed to trade assets such as XRP and Ripple USD without being subjected to unverified counterparties.

Permissioned Domains Power New DEX Access

The Permissioned DEX launch is a continuation of previous launches of permissioned domains and token credentials on the XRP Ledger. Permissioned domains are on-ledger allowlists, which determine who is allowed to interact with a particular feature and serve as the main gating mechanism of the DEX.

Ripple is confident that such improvements will make XRP more useful in the real world in the long term and will lead to increased tokens burning. Although these fundamentals have the potential to justify an improved XRP forecast in the long term, the short-run market reaction has been moderate.

XRP Forecast Tied to Regulatory Progress

The upgrade follows the wider efforts by Ripple to be in line with regulatory frameworks across the world. The company has enhanced its compliance, gained a temporary banking charter in the United States as well as regulatory licenses in major jurisdictions such as the United Kingdom and the European Union.

Such developments are broadly considered putting Ripple in a better place to pursue additional institutional collaborations, which may ultimately impact the outlook of the XRP in the medium- to long-term.

Gravestone Doji Suggests Potential XRP Reversal

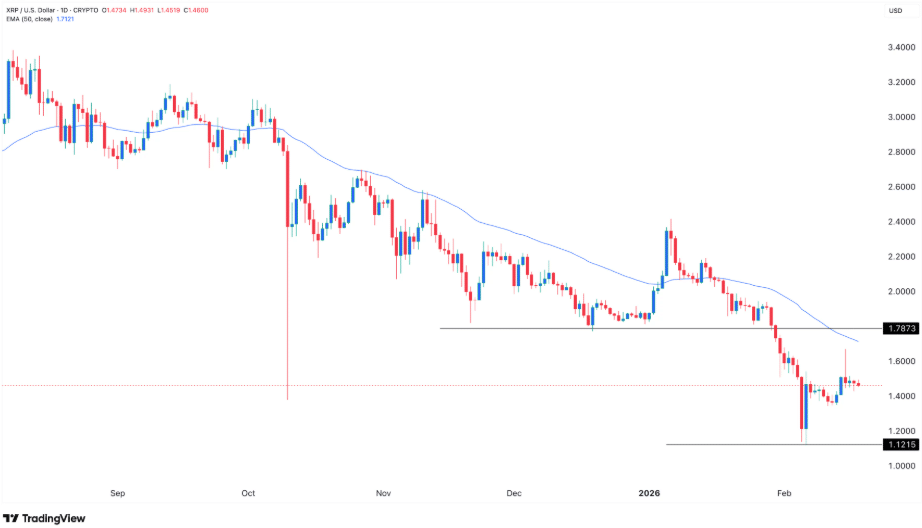

Technically, XRP is still trading within a small range which is a sign of concern as the crypto sector is still uncertain. Based on the daily chart, it is observed that the token has a gravestone doji candlestick at the beginning of the week, which is typically linked to bearish reversals.

XRP has moved below the 50-day and 100-day exponential moving average and is below the Ichimoku cloud. It has also not regained the $1.7873 resistance point, which is an important point since the end of 2024.

With such indicators, the short-term XRP forecast will be bearish. Analysts indicate the year-to-date minimum of around $1.1215 is a starting point of a downside target. A decisive decline below this point may open the door to further declines possibly driving the XRP into the psychological level of $1.00.

Conclusion

XRP traded sideways near $1.4860 following Ripple’s Permissioned DEX launch, reflecting ongoing consolidation in the crypto market. Despite increased institutional adoption and network upgrades, technical indicators point to a bearish short-term XRP forecast, with potential downside targets at $1.1215 and the psychological $1.00 level.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

Summary

- XRP moves sideways close to $1.4860 as Ripple releases Permissioned DEX.

- Institutional adoption grows with controlled DEX access and compliance features.

- XRP is bearish with target at $1.1215 and may hit $1.00.

Glossary of Key Terms

Permissioned DEX: Decentralized exchange with restricted, approved access.

Decentralized Exchange (DEX): Platform for direct crypto trading without intermediaries.

Permissioned Domains: Allowlist controlling who can access network features.

Gravestone Doji: Candlestick indicating potential bearish reversal.

Psychological Level: Round number seen as key support/resistance.

Token Burn: Permanently removing tokens to reduce supply.

Frequently Asked Questions about XRP Forecast

1. What is the XRP forecast now?

The XRP short-term forecast is bearish, the price targets are $1.1215 and $1.00.

2. What is a Permissioned DEX?

A Permissioned DEX allows only approved institutions to trade XRP securely.

3. How do technical indicators affect XRP?

XRP is below key averages and shows a bearish gravestone doji.

4. How do Ripple’s regulations impact XRP?

Compliance and licenses may support medium- to long-term XRP forecast.

References

Disclaimer

The article is purely informational, and it is not a financial investment or trading advice. Cryptocurrencies are extremely risky and volatile. Before investing, the readers are to conduct personal research and seek the advice of a qualified financial expert.

Read More: XRP Forecast Turns Bearish After Ripple Permissioned DEX Launch">XRP Forecast Turns Bearish After Ripple Permissioned DEX Launch

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.