Bitcoin and Ethereum Options Expiry Looms as Crypto Market Faces $700 Million Liquidation

0

0

- The crypto market is bracing for significant changes as a substantial number of Bitcoin and Ethereum options are set to expire.

- This event could trigger further volatility, especially given the recent downward pressure on major cryptocurrencies.

- An on-chain analyst has indicated that the real crypto market selloff is yet to begin, despite significant liquidations already occurring.

As major crypto options near their expiration, an upcoming wave of volatility threatens to shake the market, with experts predicting the real panic hasn’t even started.

Bitcoin and Ethereum Options Set to Expire

Bitcoin and Ethereum are at the forefront of a potential market upheaval as their options near expiration. Specifically, more than 18,300 Bitcoin options and 163,170 Ethereum options are set to expire soon. Market participants are closely watching these events, as they could push the already tumultuous crypto market into further disarray.

Impact of Upcoming Expirations

The expiration of these options signifies a notable movement in the crypto market. On Deribit alone, Bitcoin’s notional value for the expiring options is around $1 billion, with a put-call ratio standing at 0.65. This ratio represents a higher inclination toward call options compared to put options, potentially indicating a bearish market sentiment. Moreover, the maximum pain price for Bitcoin options has dropped from $63,500 to $61,500, reflecting the downward price movement. On the other hand, Ethereum’s notional value for its expiring options is approximately $472 million, with a significant put-call ratio of 0.35, further signaling a bearish outlook as its price remains below key support levels.

On-Chain Data Insights: Selloff Looms

Despite a staggering $700 million in crypto liquidations, an on-chain analyst at CryptoQuant suggests that the panic selloff is yet to truly hit the market. The analyst points to the BTC Daily Realized Profit Loss Ratio 30DMA metric, which has not yet indicated the onset of panic. As more traders liquidate their holdings in response to price volatility, the potential for a more dire selloff looms over the market.

Market Reaction and Future Outlook

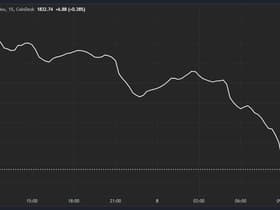

The market reaction to these expiring options has already been severe. Bitcoin bears have evidently taken control, driving its price down to $53,400, a level last seen in February. Investors are jittery amid significant moves by entities like Mt. Gox, the US government, and the German government, further exacerbating selling pressure. Similarly, Ethereum has witnessed increased put volume, underscoring trader worries as its price fell below $2,890.

The Path Forward

Looking ahead, traders and investors must stay vigilant. The substantial number of options expirations could trigger heightened volatility in an already stressed market. Not only are these expirations affecting major cryptocurrencies like Bitcoin and Ethereum, but they also have a ripple effect on altcoins. Recent data shows significant liquidations in various tokens, hinting at broader market instability.

Conclusion

The expiration of Bitcoin and Ethereum options marks a critical juncture for the crypto market. As significant expirations approach, the market could see further downward pressure, exacerbated by existing bearish sentiment and liquidation events. Traders should brace for increased volatility and prepare for potential market upheavals while keeping a close watch on on-chain data indicators for signs of real panic selloff.

0

0