Long-term holders capitulating to the tune of 100k Bitcoin after SVB collapse could mark a stronger market rebound

1y ago•

bullish:

7

bearish:

7

Share

Quick Take

- Bitcoin is hovering around $28,500 and has proven significant resistance in the past few weeks.

- However, we can analyze that capitulation with long-term holders occurred meaningfully in the past few weeks.

- CryptoSlate analyzed how long-term holders defined the end of bear markets in the past.

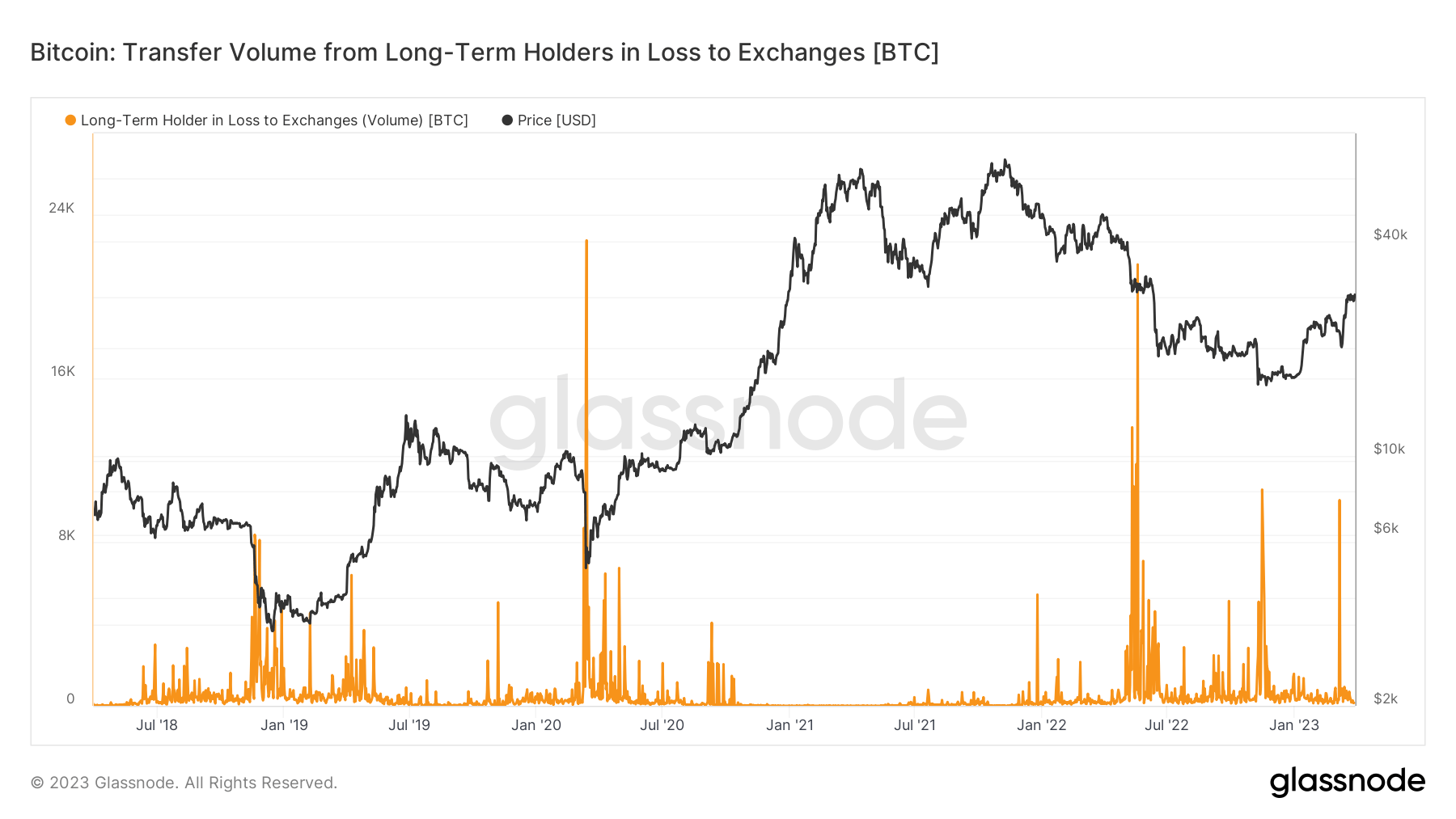

- We define long-term holders as an investor who has held Bitcoin for longer than six months, and during the SVB collapse, they capitulated to similar levels to the FTX collapse.

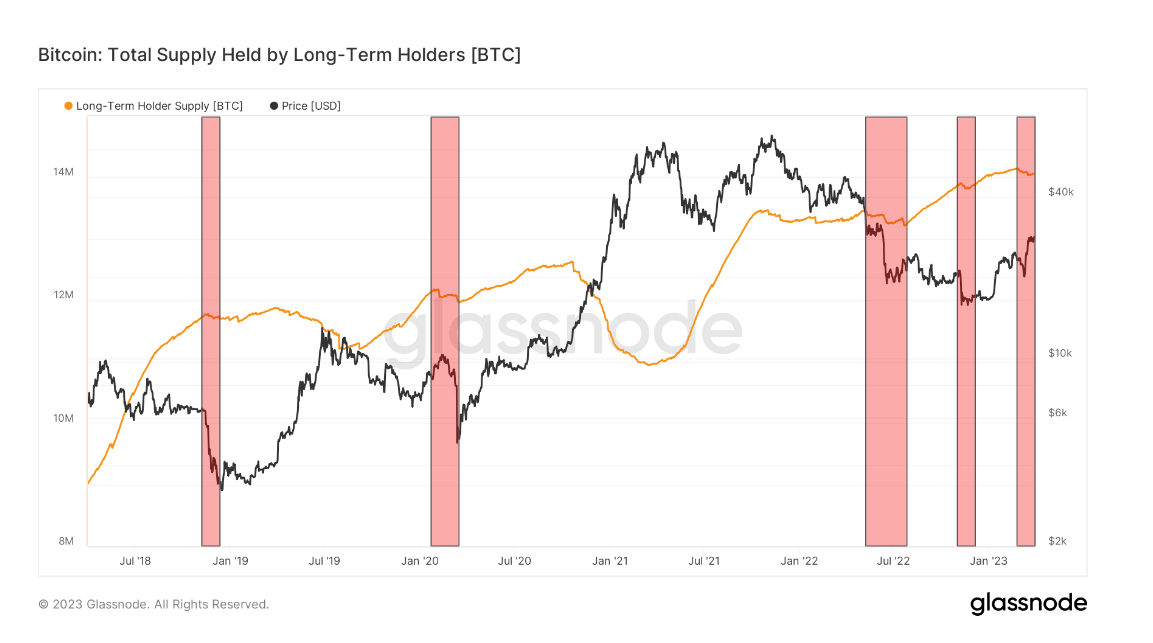

The times LTHs have capitulated in the past five years are highlighted in red. However, LTHs do also sell in the lead-up to bull runs.

- November 2018: Capitulation before the market bottom

- January 2020: Capitulation before the covid bottom

- June 2022: Luna collapse

- November 2022: FTX collapse

- March 2023: SVB collapse

- In mid-march, roughly 10,000 BTC were distributed at a loss by LTHs, similar to the FTX collapse. While the overall supply of LTHs decreased by 100,000 BTC.

- As history suggests, these capitulation events are needed for the next leg up.

The post Long-term holders capitulating to the tune of 100k Bitcoin after SVB collapse could mark a stronger market rebound appeared first on CryptoSlate.

1y ago•

bullish:

7

bearish:

7

Share