Giving projects the ability to build on its distributed ledger network, Ethereum formed the bedrock for what we know today as decentralized finance or DeFi.

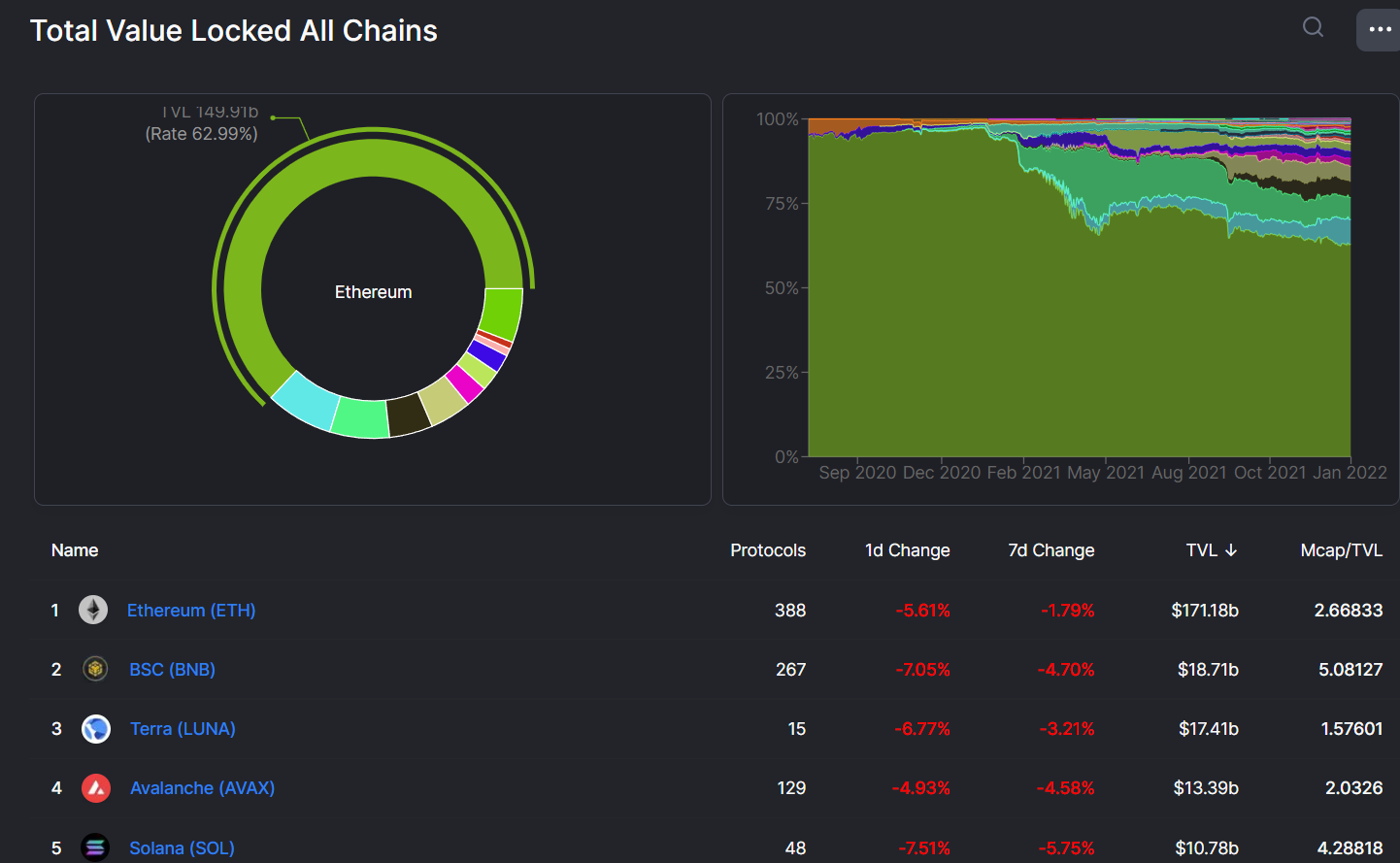

As the first DeFi chain, Ethereum enjoys unrivaled popularity and dominance in the DeFi industry – contributing nearly two-thirds of the value locked in the DeFi ecosystem.

Ethereum contributes $171.1 billion of the $269 billion locked in 87 DeFi chains. While this dominance and imminent ETH 2.0 migration has caused many to believe that Ethereum could only grow even further, JPMorgan believes it could lose this dominance.

Ethereum Could Lose its DeFi Dominance

According to analysts at JPMorgan, Ethereum’s dominance could wane even further as competitors push deeper into decentralized finance. Ethereum once dominated as much as 97% of the DeFi industry.

In addition, Ethereum’s late launch of sharding – an essential feature for Ethereum’s improved scalability – could mean the pioneer of DeFi play catchup in an industry where projects are offering greater scalability.