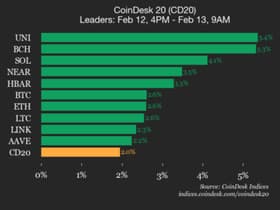

What Is Uniswap

Uniswap is a decentralized finance protocol and one of the largest decentralized cryptocurrency exchanges (DEX) by transaction volume. It consists of a set of smart contracts running on the Ethereum blockchain and enables peer-to-peer (P2P) trades without a centralized intermediary.

Uniswap allows users to swap Ethereum-based tokens with each other almost instantly with the use of liquidity pools. Deposits in liquidity pools are essential to Uniswap’s operations, and liquidity providers are rewarded with a portion of the trading fees alongside UNI cryptocurrency that has been minted for providing necessary liquidity.

Anyone can swap tokens; contribute tokens to a pool; earn fees; or list a token on Uniswap, as long as there is a liquidity pool for traders. Furthermore, there are no listing fees for a token to be available for trade on Uniswap. Since Uniswap is built on Ethereum, almost any ERC-20 token is exchangeable using Uniswap.

UNI Token

The governance token UNI was created in 2020 to facilitates greater community involvement and oversight. UNI holders can vote on Uniswap project developments and changes to the platform, including distributing minted tokens to the community and developers. They can also use the token to fund liquidity mining pools, grants, partnerships, and other initiatives that expand Uniswap's usability.

Uniswap executed an airdrop of 400 UNI tokens for anyone who had used the platform.

While UNI is primarily a governance token on the Uniswap platform, investors can also trade it on exchanges and use it as an investment.

Who Are the Founders of Uniswap

Uniswap was originally released in 2018, and Uniswpa V2 in 2020 by Hayden Adams.

Adams is known for transforming an idea proposed in 2016 by Vitalik Buterin for a decentralized exchange (DEX) that would employ an on-chain automated market maker with certain unique characteristics into a functional product. The protocol quickly gained liquidity and became a leading decentralized exchange that runs on the Ethereum blockchain.

Adams graduated from Stony Brook University with a Bachelor’s degree in Engineering, Mechanical Engineering in 2016. As a Siemens Engineer, he performed engineering simulations, design exploration, wrote Java macros, and learned the UNIX operating system.

CoinDesk writes that Hayden Adams took two decisions that would eventually lead him to success with Uniswap: First, he purchased Ethereum in March 2017; second, he started to learn to code.

What Is UNI Used For

Uniswap is a network specifically designed to address the liquidity problem prevailing in controlled exchanges. As a DEX, decentralized exchange, Uniswap provided liquidity for quick trading by using smart contracts developed on the Ethereum Blockchain network.

Users can deposit crypto assets that can be programmatically accessed by traders; users who trade against assets in the pool pay a fee that is then distributed to all liquidity providers proportionally, based on their contribution to the pool.

The key innovation that makes the Uniswap protocol work is automated market maker (AMM) technology. An automated market maker is a smart contract that manages the Uniswap pools to effectuate a trade. Uniswap’s AMM algorithm determines the token’s effective price based on the supply and demand dynamics between the involved tokens in these liquidity pools when a trade is made. It works by increasing and decreasing the price of a coin depending on the ratio of how many coins there are in the respective pool.

The equation for working out the price of each token is x*y=k, where the amount of token A is x, and the amount of token B is y. K is a constant value, the total contract price of the pool. Uniswap depends on this “constant product” principle to govern trading — that is, the product of the two liquidity pools should be the same after and before the trade (excluding fees). The Uniswap price is given by the ratio of the two liquidity pools. The constant product is therefore price-independent.

In newly created liquidity pools, the first provider sets the initial price of the assets in the pool by supplying an equal value to both tokens. Buyers can then swap tokens within the pool based on the formula. Smart contracts that run the protocol use this formula to keep the total pool constant stable (k).

UNI, the Uniswap governance token, plays a key role in maintaining and operating the decentralized exchange. The UNI tokens were created with the intention of allowing the Uniswap network to be owned and operated by stakeholders involved in protocol decision-making. 60% of UNI tokens are distributed to existing Uniswap community members, and the other 40% will be made available to team members, investors, and advisors.

Built upon the principle of community self-sufficiency, the platform serves as a successful model of self-sustainable decentralized finance.

Where Can You Buy UNI

Uniswap has an available supply of 519,857,388 and a total supply of 1 Billion coins.

If you want to buy, sell or trade Uni, you can do so on exchanges such as Binance, HitBTC, Uniswap V2, SushiSwap, and Bkex. Our step-by-step guide on how to Buy Uniswap will help you get started!