The Ultimate DeFi Wallets For 2023

Decentralized Finance (DeFi) is one of the biggest trends in the blockchain industry, revolutionizing global finance. DeFi protocols aim to provide equal access to all financial services worldwide. DeFi uses DApps and distributed ledger technology (DLT) to allow permissionless financial operations within a peer-to-peer network. In this article we are going to explore the top DeFi wallets on the market.

DeFi allows millions of people who don’t have access to traditional financial systems to be in control of their finances, promoting financial freedom and unprecedented economic growth.

The services range from DeFi products like efficient stablecoin trading, decentralized lending or Yield Farming, DEX (Decentralized exchanges), DeFi insurance, liquidity mining, prediction market, NFTs, etc.

All one needs to access these services is an internet connection and a DeFi wallet that securely stores all your digital assets. DeFi wallets are among the safest solutions on the market. The safety and security of your digital assets are paramount because if your crypto assets are lost due to some error or stolen by some hacker, it’s nearly impossible to track down and recover those funds. This is one of the reasons why centralized exchanges also store the majority of their funds in a cold storage wallet.

DeFi wallets provide access to DeFi financial products, thereby providing freedom, transparency, and ownership of users’ assets. With the fast pace of innovation in the crypto world and the decentralized finance ecosystem, the number of DeFi wallets continues to increase, making it more difficult for users to determine which one is best.

Read on for CoinStats ultimate guide to learn everything you need to know about decentralized finance(DeFi), a DeFi wallet, the best DeFi wallets available in the market, and download our CoinStats wallet that lets you coordinate all your DeFi activity from one place.

Let’s dive in!

What Is DeFi

Decentralized Finance (DeFi) is an umbrella term for peer-to-peer financial services and one of the most important innovations of blockchain technology. It operates according to a protocol that runs on a blockchain-powered decentralized network. DeFi disrupts the role of intermediaries such as banks and financial institutions that act as middlemen and charge high fees for their services.

DeFi is permissionless, decentralized, and borderless. DeFi transactions such as trades, lending, borrowings, etc., are conducted within a peer-to-peer network. They are governed by smart contracts, which are one of the most valuable features in DeFi, upholding transparency and visibility on the blockchain. A smart contract works by creating an automatic and self-executing agreement whereby each party inputs predetermined conditions that must be completed for the contract to be executed without a central authority or third party. The replacement of intermediaries by smart contracts enables almost instantaneous peer-to-peer transactions and payments. The instantaneous and low-cost DeFi transactions also play a significant role in scalability.

The DeFi ecosystem started on the Ethereum blockchain, still the backbone for DeFi. However, other blockchains such as Solana, BSC (Binance smart chain), etc., are coming up with their own DeFi protocols, products, and services that provide multiple new opportunities to users.

To get started with DeFi, you first need a DeFi wallet to store your assets securely. DeFi wallets are compatible with DApps and eliminate the need for a third party by providing users with a key-based solution requiring users to retain responsibility for the safekeeping of their private key.

You can choose between a cold wallet (hardware wallets) and a hot wallet (software wallets).

Hardware wallets are preferable if you intend on keeping your digital assets for an extended period, as they give the maximum level of protection. These are secure offline storage alternatives, and your keys are stored on a physical device. Hardware wallets function similar to a flash drive, allowing you to connect to a PC or laptop to transfer money into a secure wallet.

A software wallet uses private keys to secure the tokens stored in them. It’s available as an app in the form of a mobile wallet or web browser extension. Assets stored in a software wallet are connected to the internet, increasing the risk of these tokens being lost or stolen by cyber attacks or hacks.

To sum up, a DeFi wallet is a crypto wallet used to store tokens within the DeFi ecosystem. It gives people complete control over their assets. The main features of DeFi wallets are as follows:

Non-Custodial Wallets

DeFi wallets also operate with a non-custodial background, ensuring only the wallet owner can access the funds. A non-custodial wallet is secured by a private key that is supposed to be stored offline (i.e., by writing it down). Without the private key, no one can access the wallet.

Key-Based

The private key in a DeFi wallet is usually a 12-word seed phrase that the user needs to remember and store to use their wallets and their assets. This is different from centralized wallets, as users are responsible for the safekeeping of their private keys, often introduced through a 12-word seed phrase.

Accessible

The DeFi wallets allow a host of tokens to be stored together and accessed easily. Ethereum-specific DeFi wallets enable users to deposit ETH in pairs with stablecoins like Dai, ERC20 tokens like KNC, and ERC721 tokens like Axies.

Compatible

Mobile wallets have begun to integrate DApps browsers to make it easy to connect with decentralized applications without having to leave the app.

Top DeFi Wallets

The number of DeFi wallets continues to increase; therefore, users need to carefully consider all the wallets’ features before making a selection.

The most essential consideration is to check if the wallet supports the asset a user is looking to hold. The other comes down to the wallet’s reputation for security and to see if the provider ensures the safety of its users. Users will also need to consider the types of products they would like access to, i.e., staking, yield farming, etc. Finally, user-friendliness and ease of use must also be considered.

Let’s look into our list of the best DeFi wallets available in the market.

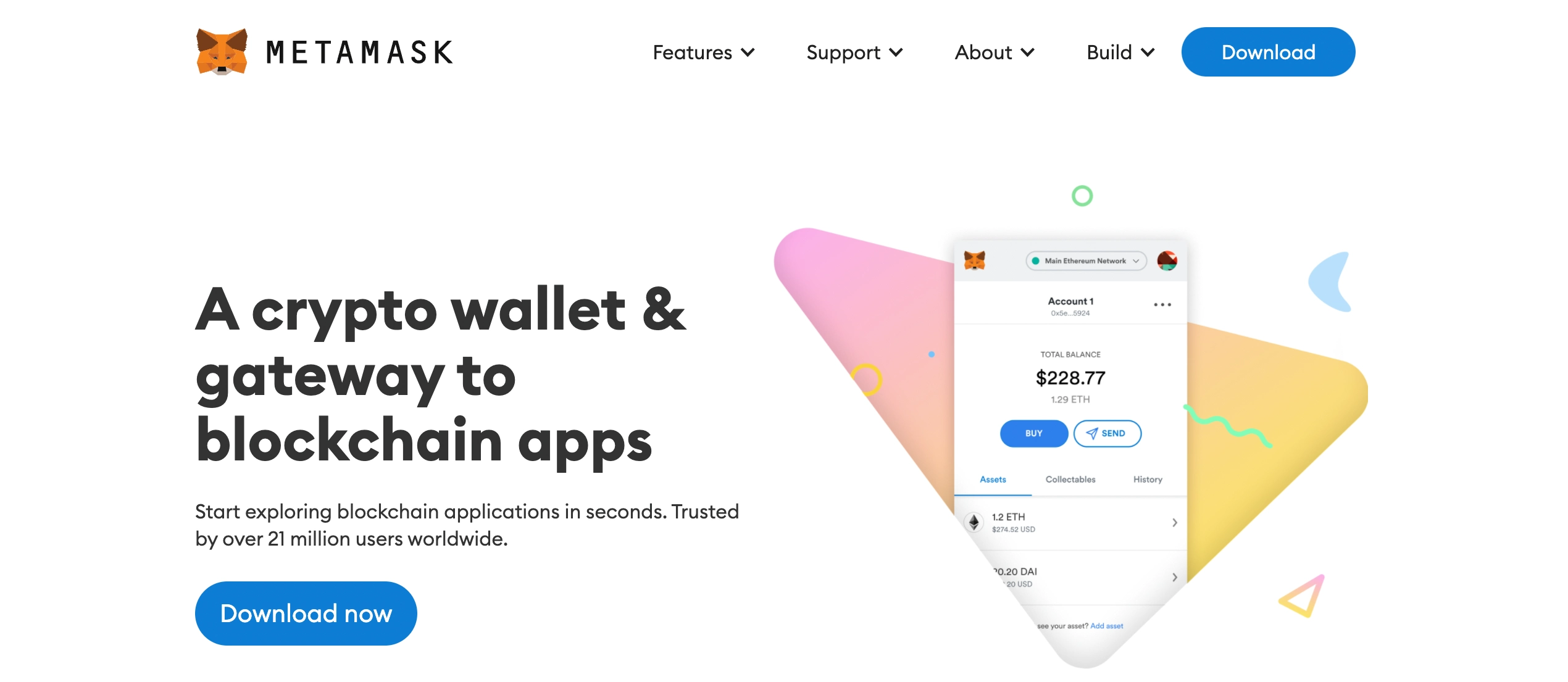

Metamask

It’s the most used and one of the best DeFi wallets globally. Metamask is primarily available as a web browser extension, and its mobile app is not a popular mobile wallet.

Metamask’s popularity is primarily due to its support of ERC20 tokens and tokens on the Binance Smart Chain, Polygon, etc., meaning you can store all your DeFi assets in one place. Metamask is also compatible with almost all DeFi applications available in the DeFi ecosystem. It’s also really easy to use, making it our first pick for the best DeFi wallet in the market.

CoinStats Wallet

The CoinStats Wallet is among the best centralized wallets globally due to the rich suite of features it offers. It allows users to swap between BSC, Ethereum, or Polygon without having to switch between different exchanges. Additionally, the CoinStats wallet lets users buy cryptocurrencies directly through credit/debit cards and a bank transfer. The wallet comes with biometric security and the 12-word seed phrase, offering an extra layer of security for the users’ assets. Moreover, the user can access a large number of DApps using the CoinStats Wallet.

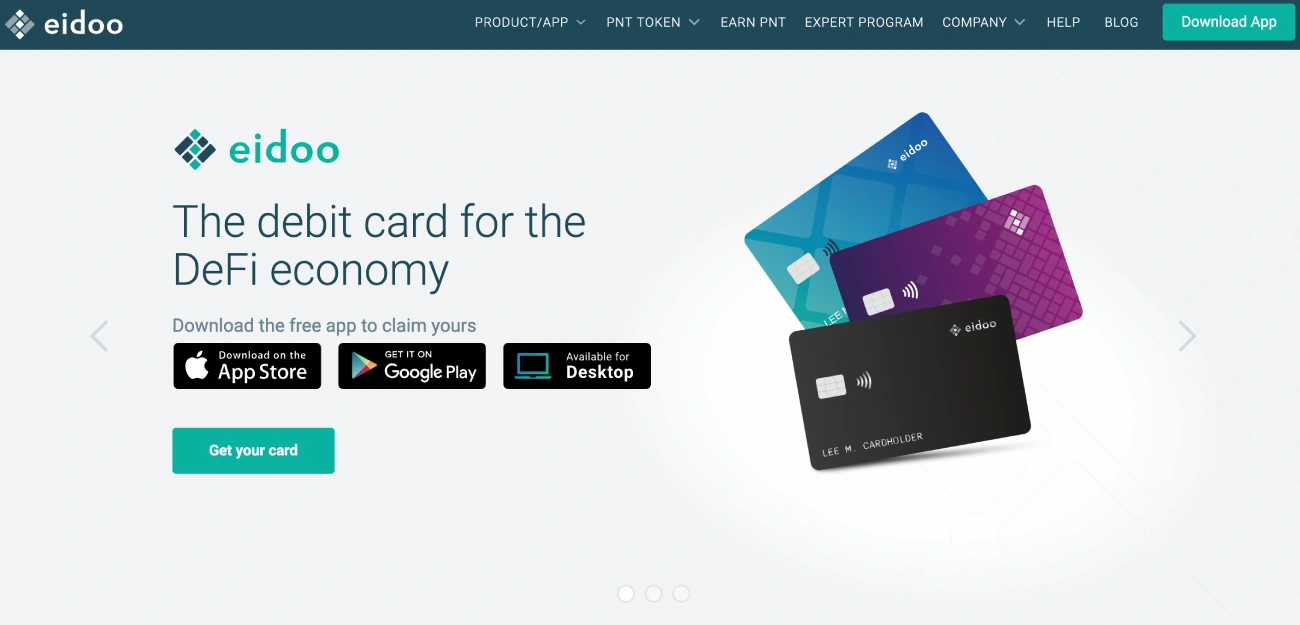

Eidoo Wallet

It’s one of the best non-custodial DeFi wallets available in the market, with support for more than 1000 cryptocurrencies. The Eidoo wallet supports liquidity mining and yield farming, among its most significant features. The wallet also supports buying, storing, trading NFTs, and lets users participate in or launch token sales. The Eidoo wallet enables users to act as their own bank and navigate almost all DApps.

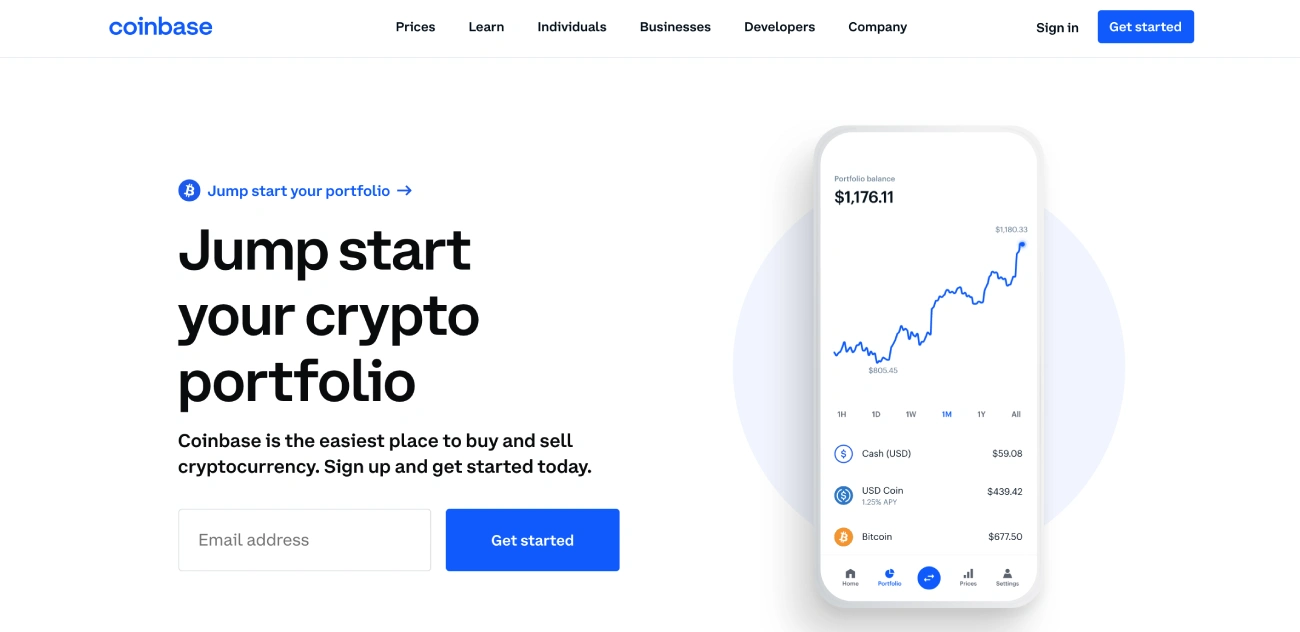

Coinbase Wallet

Coinbase is a leading cryptocurrency exchange, and its wallet makes no exception. The Coinbase wallet lets users store a large number of cryptocurrency tokens and interact with a large number of DApps and decentralized exchanges. One of the most salient features of the wallet is that it lets users transfer their crypto assets from their Coinbase account directly to the Coinbase wallet. The wallet also provides additional security measures such as biometric security or a 6-digit security PIN, making it one of the most secure DeFi wallets on the list.

Trezor

Trezor is one of the most secure DeFi wallets as it’s a cold storage wallet and stores assets offline. It’s available in 2 different models and can be used to store more than 1000 cryptocurrency tokens. The Trezor wallet has a very user-friendly client-side interface.

Argent

The Argent wallet is designed to enhance the users’ experience when navigating the DeFi space on a mobile phone. Transactions performed using the Argent wallet are free from any transaction fee, and therefore users aren’t required to deposit any Ethereum into their wallets to use them. Another feature that distinguishes the wallet from others is that it doesn’t have any seed phrase for accessing it.

Conclusion

As more and more people migrate from centralized exchanges towards decentralized exchanges and use DeFi finance services, DeFi wallets are becoming a mainstay in the crypto space.

All the wallets mentioned above are amongst the best in their class, and picking any of these as your go-to wallet would be a wise decision.