How to Buy Terra Luna | Where, How and Why

The Terra Protocol is a blockchain protocol that uses algorithmic stablecoins to power price-stable global payments systems. The Terra blockchain supports an ecosystem for users to mint, manage, exchange, and trade Terra stablecoins that can be tied to any fiat.

Terra seeks to stabilize the global payments systems by combining the price stability of fiat currencies with the control-free and censorship-resistant blockchain technology.

The Terra protocol consists of two cryptocurrencies: Terra and LUNA.

Read on for our deep dive into the Terra blockchain network and Terra’s native token, Luna, and learn how to buy Terra Luna cryptocurrency in a few simple steps.

Now let’s get started!

What Is Terra Luna

Terra is an open-source blockchain platform for algorithmic stablecoins that are pegged against traditional fiat. The algorithmic stablecoins created on the Terra protocol consistently track the price of any fiat currency. While most stablecoins are pegged to the US dollar, Terra also has stablecoins pegged to many other currencies, including the Euro and the TerraKRW (KRT) pegged to the South Korean won, along with the TerraUSD (UST) pegged to the US dollar.

The Terra blockchain enables users to trade Terra stablecoins instantly on its platform and offers support for stablecoin developers to build Terra DeFi projects.

The project consists of two cryptocurrencies: Terra and LUNA. TERRA is the stablecoin that tracks the price of fiat currencies and is named after them, i.e., TerraKRW (KRT), TerraUSD (UST), etc. Users mint Terra by burning LUNA. LUNA is the network’s native token, its staking and governance token, used to stabilize the price of the protocol’s stablecoins.

Unlike most DeFi protocols that run on the Ethereum Network, Terra runs on the Cosmos Blockchain. This gives a huge advantage to Terra over other DeFi projects as the transaction time and gas fees are pretty negligible for it compared to the ones running on the Ethereum Network. However, the drawback is that since Terra is not on Ethereum, its user base still has to grow. The Terra stablecoin platform uses the Proof of Stake (PoS) mechanism.

Terraform Labs is the company behind Terra, founded in January 2018 by Daniel Shin and Do Kwon.

How Does Terra Luna Work

The Terra ecosystem is built with Tendermint, and the Proof-of-Stake mechanism keeps the Terra network secured.

The native Terra network token is Luna with the ticker LUNA. The Luna token is used to issue Terra stablecoins (TerraSDRs). It works as a price stability mechanism on the platform and can also be used for staking and earning rewards. The Terra Luna token holders are granted governance rights and voting power for the protocol.

The network offers Terra stablecoins pegged to U.S. Dollar, South Korean Won, Mongolian Tugrik, and the currency basket in the International Monetary Fund’s Special Drawing Rights(SDRs), with plans to include more fiat currency pegged stablecoins in the future. The Terra stablecoin aims to balance stability by creating a cryptocurrency with a flexible monetary policy managed by a Treasury. To keep the value of Terra stable, the Terra algorithm automatically adjusts the supply of stablecoins based on their demand. This is done by incentivizing the Luna holders to swap Luna and stablecoins depending on whether the supply of stablecoins is increased or decreased. The U.S. dollar stablecoin for Terra is UST and is mutual to Luna. The excess tokens are burned when the demand for UST stablecoin rises. As the demand for UST grows, the Luna price increases, and if the demand for UST decreases, the Luna price will also decrease.

Luna Tokenomics

There are currently 1 Billion Luna tokens in supply, and new Luna tokens are burnt or minted depending on the demand. The token is used to stabilize the price of the protocol’s stablecoins.

Terra raised $32 million in seed funding. Of the 385,245,974 LUNA minted for sale, 10% was reserved for Terraform Labs, 20% for employees and project contributors, 20% for the Terra Alliance, 20% for price stability reserves, 26% for project backers, and 4% for genesis liquidity.

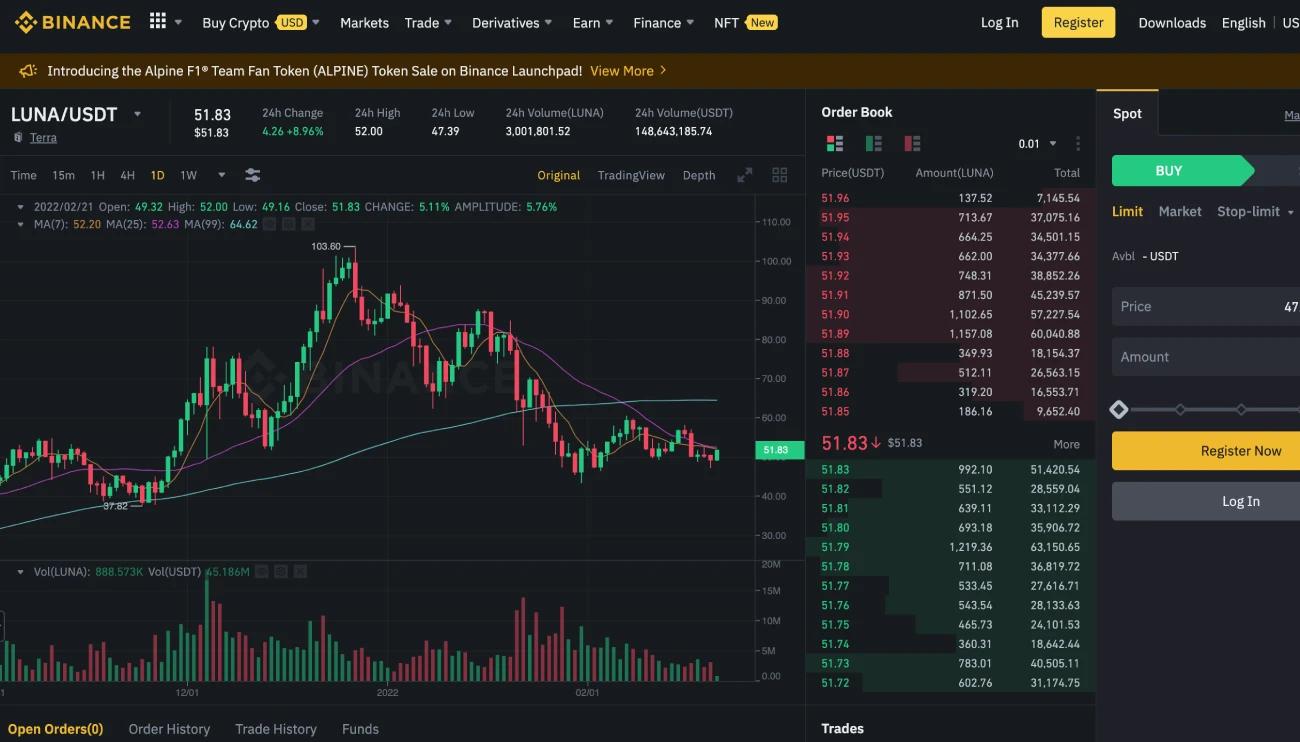

The token’s price hit an all-time high of USD 103.33 on December 27th, 2021. Since the price has dropped by nearly 50 percent in the last couple of months, this presents an excellent opportunity to buy Terra.

The most popular cryptocurrency exchanges for trading Luna tokens are Binance, Kucoin, Huobi Global, Bitfinex, etc., and the most popular buying pair is LUNA/USDT. You can also trade Luna on almost all major centralized and decentralized crypto exchanges worldwide.

The present market capitalization of the Terra Luna token is USD 22,349,147,751. You can check the current price of LUNA Terra and more on CoinStats crypto portfolio tracker, one of the best crypto platforms around.

You can also learn more about the Terra network and the Terra Alliance using Coinmarketcap’s online educational resource.

Buy Terra on Binance

Since Binance is the world’s largest cryptocurrency exchange in trading volume, many users prefer to purchase Terra(LUNA) on it. However, Binance does not allow US investors, so we recommend you sign up on other exchanges listed below if you are from the U.S.

To buy Luna on Binance, you need to create a retail investor account and undergo KYC verification by uploading identity proof documents. Once the account is verified, you can buy Luna or any other coins of your choice either through fiat currency deposits using a credit or debit card and bank transfer or through another crypto.

Once you have successfully added funds to your wallet, the next step is to pick the trading pair against which you wish to buy Terra(LUNA). Major trading pairs are LUNA/USDT, LUNA/BTC, LUNA/BUSD, LUNA/EUR, etc. To compare prices across different trading pairs, use the comparison service of CoinStats.

Let’s say you select the LUNA/BTC pair; then, you will need to purchase Bitcoin worth the amount you want to purchase Terra for. Once you’ve added the required BTC to your Spot Wallet, you can trade Bitcoin for Terra using the Binance exchange. The transaction occurs within seconds, and the tokens should reflect in your Spot Wallet.

Buy Terra on Kucoin

Kucoin ranks among the top cryptocurrency exchanges in the world by trading volume. It allows users to buy and trade cryptocurrency tokens with fiat currencies and other stablecoins. The Kucoin cryptocurrency exchange offers a rich suite of trading options and crypto tokens and is the second-best preference for buying LUNA tokens.

The process of buying Terra on Kucoin is pretty similar to that on Binance. You need to create an account on the exchange, complete the identity verification, and select the asset you wish to trade for Terra.

Suppose you wish to buy and sell LUNA/USDT, then you will need to buy USDT worth the amount you want to invest in LUNA. You can do so by purchasing USDT through fiat deposits with your debit/credit card or third-party transfers. Once you have the desired amount of USDT in your wallet, place the order for the price you wish to buy the token for. The transaction will go through within a few seconds, and the tokens will reflect in your wallet in no time.

Storing Your Terra Luna

While crypto exchanges have their own exchange wallets, the risk of cyber-attacks and hacks is still high when using them. So, it’s highly recommended to store your cryptocurrency tokens in your private wallet securely. We distinguish between Software Wallets (Hot Wallets) and Hardware Wallets (Cold Wallets).

Software Wallets: Software wallets, also known as Hot wallets, are connected to the internet at all times. They store your keys online and are therefore less secure. Software wallets are free to use, and their ease of use makes them an ideal choice for newbies with a few tokens. One of the most popular and widely used software wallets is the CoinStats Wallet. It’s available for free download on Google Playstore and App store and will provide you access to the full potential of DeFi and cryptocurrencies.

Hardware Wallets: Hardware wallets, also known as Cold Wallets, like Trezor or Ledger, are the most reliable options, as they come with safe offline storage and backup features. These are more suitable for experienced users who own large amounts of tokens.

Conclusion

Trading cryptocurrencies has proved profitable to millions of people globally and resulted in making the fastest billionaires and millionaires in the world. With the power of DeFi protocols such as Terra, the financial world is on the cusp of a revolution that aims to eliminate the need for banking and financial institutions and break their monopoly over the financial market.

Investment Advice Disclaimer: The information contained on this website is provided to you solely for informational purposes and does not constitute a recommendation by CoinStats to buy, sell, or hold any security, financial product, or instrument mentioned in the content, nor does it constitute investment advice, financial advice, trading advice, or any other type of advice.

Cryptocurrency is a highly volatile market, do your independent research and only invest what you can afford to lose. Performance is unpredictable, and the past performance of Terra Luna is no guarantee of its future performance.

There are significant risks involved in trading CFDs, stocks, and cryptocurrencies. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider your own circumstances and take the time to explore all your options before making any investment.