DeFi, short for decentralized finance, is a growing trend in the cryptocurrency world. DeFi apps aim to provide financial services that are accessible to anyone with an internet connection, without the need for intermediaries such as banks or financial institutions. As the cryptocurrency market continues to evolve, more and more people are turning to DeFi apps to manage their digital assets.

In recent years, the popularity of DeFi apps has skyrocketed, with a wide range of platforms available to users. However, with so many options to choose from, it can be difficult to know where to start. In this article, we’ll explore some of the top DeFi apps on the market today, highlighting their features, benefits, and drawbacks to help you make an informed decision about which one to use.

One Place For All Your

Crypto, DeFi & NFTs

What Are DeFi Apps?

DeFi apps are blockchain-based financial applications that allow users to access financial services without intermediaries such as banks or other financial institutions. These apps run on decentralized networks, meaning that they are not controlled by a single entity and operate independently of traditional financial systems.

DeFi apps use smart contracts, which are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code. These contracts enable the automation of financial services, such as lending, borrowing, and trading, without the need for intermediaries.

The advantages of DeFi apps over traditional financial systems are numerous. First and foremost, DeFi apps provide users with more control over their finances, as they are not reliant on centralized institutions to manage their assets. Additionally, DeFi apps are typically more accessible than traditional financial services, as they are available to anyone with an internet connection. They also tend to have lower fees and faster processing times compared to traditional financial services. Finally, DeFi apps are often more transparent, as all transactions are recorded on a public blockchain, providing users with a greater degree of visibility and accountability.

Top DeFi Apps

There are many DeFi apps on the market today, each with its own unique features and benefits. Here are some of the top DeFi apps to consider:

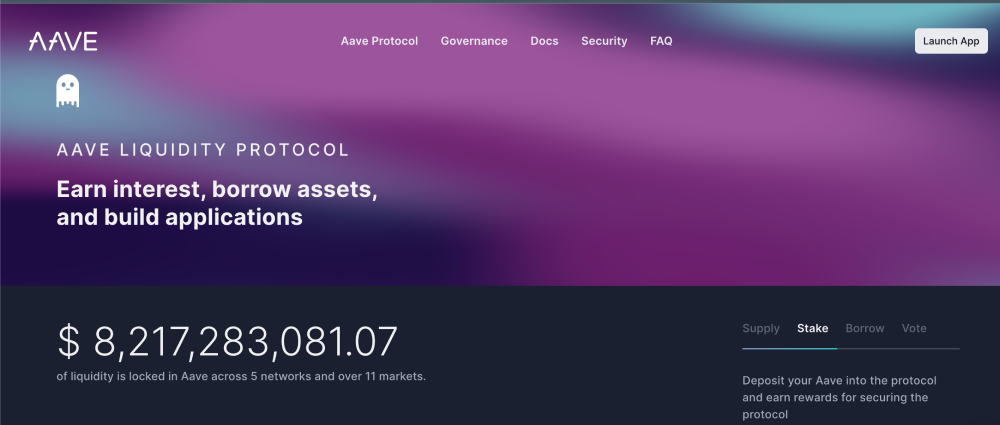

AAVE

Aave is a decentralized lending and borrowing platform that allows users to earn interest on their cryptocurrency holdings. Aave is known for its user-friendly interface, wide range of supported cryptocurrencies, and competitive interest rates. However, the platform’s fees can be high, and there is a risk of loss in the event of a smart contract failure.

General Information:

· Stani Kulechov is the founder of Aave.

· The DApp was created in 2017.

· It was formerly named ETHLend.

· Aave runs on the Ethereum blockchain.

· Aave Twitter community consists of 408,000 followers.

Key Features:

· Collateralized infinite loans with zero borrow interest rates.

· Flash loans or non-collateralized loans with a fixed interest rate of 0.09%.

· Access loans in different virtual currencies.

· Flexible interest rate for borrowers.

Why We Recommend: Aave is a fantastic protocol for experienced users with unique features and functionality. It’s an excellent choice for individuals interested in crypto-based borrowing and lending due to its rapid and straightforward lending process.

Uniswap

Uniswap is a decentralized exchange that enables users to trade cryptocurrencies without intermediaries. The platform uses an automated market maker (AMM) system, which allows for more efficient price discovery and liquidity provision. Uniswap is known for its ease of use, low fees, and transparency. However, the platform can be susceptible to front-running attacks, and some users may find the AMM system confusing.

Pros

- Swapping a wide range of ERC-20 tokens is possible.

- Straightforward and user-friendly.

- Full transparency and an open-source code.

- You can earn rewards by staking your digital currencies.

- Your crypto wallet is all you need to get started.

- KYC registration and other personal details are not required to set up an account.

Cons

- You can’t use fiat currency to make transactions on Uniswap.

- Ethereum fees. Uniswap operates on Ethereum, which as of May 2021, is plagued with high gas (transaction) fees.

- Investors often experience impermanent losses when staking on Uniswap.

General Information:

· Hayden Adams is the founder of Uniswap.

· Uniswap serves as a decentralized exchange platform (DEX).

· Uniswap was launched in 2018.

· The Twitter community of Uniswap includes 718,000 followers.

Key Features:

· UNI, Uniswaps’ original coin, is a governance token, so owners can participate in decisions on how the platform is run.

· Customers may make money by supplying liquidity using Uniswap’s Pool.

Why We Recommend: Uniswap provides a wide range of services and features and allows you to trade via the DEX to exchange tokens. You can also earn interest on your crypto holdings through Uniswap’s liquidity pools.

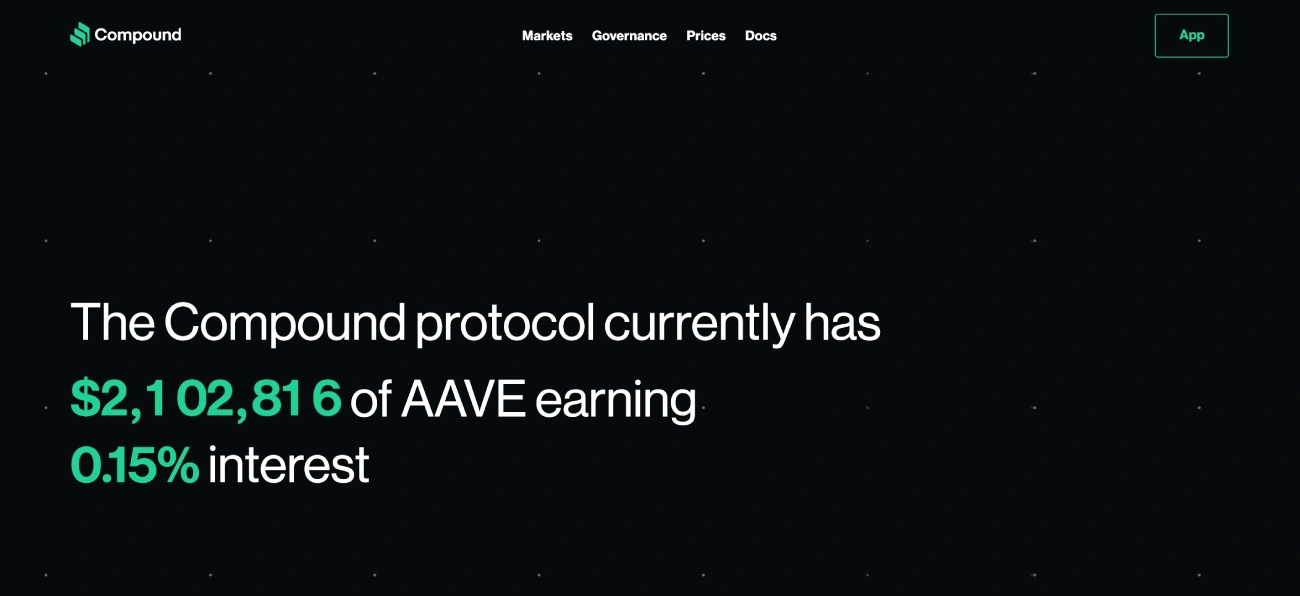

Compound

Compound is a decentralized lending and borrowing platform that allows users to earn interest on their cryptocurrency holdings or borrow cryptocurrency against their existing holdings. The platform is known for its high interest rates, wide range of supported cryptocurrencies, and user-friendly interface. However, the platform’s fees can be high, and there is a risk of loss in the event of a smart contract failure.

Pros

- Higher interest rates compared to traditional financial institutions.

- You don’t need AML, KYC, or Credit Score to use the platform.

- The Compound (COMP) tokens are used to reward customers.

- There are no restrictions on using the asset pool several times.

- It’s a Decentralized Autonomous Organization that is governed by Community.

Cons

- A limited number of cryptocurrencies to borrow or lend.

- A highly volatile algorithm-based smart contract system leads to technical errors in the DeFi system.

- Yield Farming can be risky as the users can trade crypto much larger than the actual value they have put down.

General Information:

· Robert Leshner is the founder of the Compound protocol.

· Compound was launched in 2018.

· The DApp provides a stablecoin and a platform for lending/borrowing digital assets.

· The number of followers in Compound’s Twitter community is more than 213,000.

Key Features:

· The Compound smart contract allocates 10% of interest payments as reserves, with the remaining funds going to providers.

· cTokens are representations of the financial commodity that generate interest and act as security for supplied asset amounts.

· Based on the asset class value, customers can borrow between 50% and 75% of the price of their cTokens.

Why We Recommend: Compound has been a vital actor in modernizing the old finance system through smart contract technology, one of the most user-friendly, secure, and open DeFi technologies available. The number of supported crypto-assets may grow over time.

MakerDAO

MakerDAO is a decentralized stablecoin platform that allows users to create and trade stablecoins backed by cryptocurrency collateral. The platform is known for its stability and reliability, and its stablecoin, DAI, is widely used in the DeFi ecosystem. However, the platform can be complex to use, and there is a risk of liquidation in the event of a price crash.

General Information:

· Rune Christensen is the founder of Maker.

· The development of MakerDAO started in 2015, but it was available for use in 2018.

· Maker is built on the Ethereum blockchain.

· Maker DApp provides lending/borrowing services and stability in trading.

Key Features:

· MakerDAO offers two cryptocurrencies: DAI and MKR.

· The stablecoin known as DAI is pegged to the Dollar, while the MKR token is used to pay interest to users.

· Maker is mainly used for lending of the stablecoin, DAI. Users deposit supported ETH into the Maker Vault, generating a loan represented in DAI, which can subsequently accrue interest.

Why We Recommend: MakerDAO’s tokens, DAI and MKR, function together to offer investors significant rewards and revenue. MakerDAO offers token holders the ability to collateralize a range of digital asset holdings in return for stablecoin loans paid in DAI and managed through a system called “Collateralized Debt Positions” (CDPs).

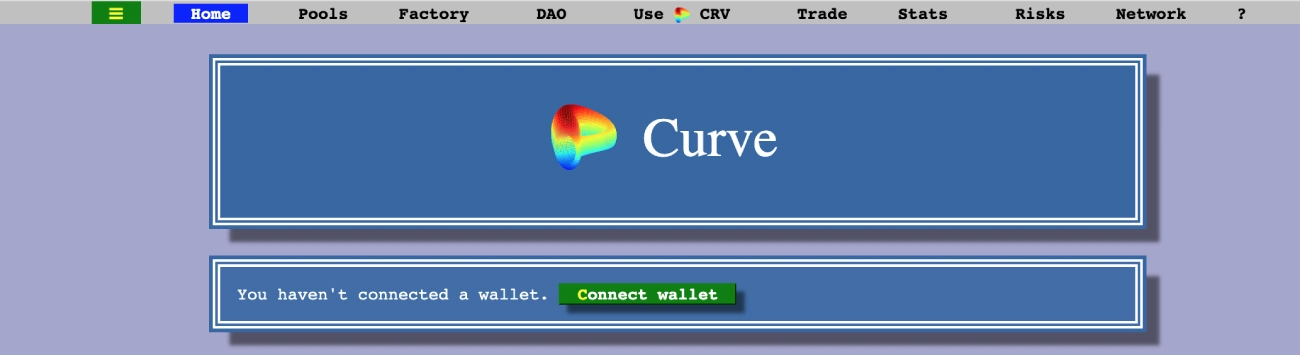

Curve Finance

Curve Finance is an Ethereum-based open-source exchange protocol on which users can swap and trade Ethereum-based assets. Curve Finance also provides liquidity to the markets using a market-making algorithm that automatically buys and sells assets while profiting from the bid and ask price spreads. Curve Finance enables high stablecoin transactions and low-risk rewards for market makers.

Pros

- Low transactional fees.

- Curve can prevent price differences in crypto pairs, which is accomplished by allowing for new types of bonding curves.

- Reduced risk of impermanent loss. Curve’s liquidity brokers offer stablecoin pairings that reduce impermanent loss to a minimum.

Cons

- Most investors avoid Curve’s token due to its sophistication.

- The risk from separate DeFi protocols. Curve Finance integrates with multiple DeFi protocols, making the system vulnerable to issues arising from a separate DeFi system.

- High fluctuation in liquidity returns. Liquidity pools returning a high annual percentage yield (APY) can often reduce to a low APY over time.

General Information:

· Michael Egorov is the founder of Curve Finance.

· The Curve Finance DAO’s ERC-20 token, CRV, is a governance token.

· Curve Finance has 251,000 followers on Twitter.

· Curve is both a Decentralized Exchange and DeFi lending platform.

Key Features:

· Vote-escrowed CRV (veCRV) is a term for CRV that has been secured into the Curve protocol for a set period.

· Owners of veCRV often earn profit from transaction fees.

· If you deposit the coin with the smallest ownership in a liquidity pool, a deposit incentive may be provided.

Why We Recommend: Curve provides a loan mechanism with low volatility compared to other DEXs. Curve Finance also rewards users that provide liquidity to the exchange. Liquidity pools don’t match a buyer with a seller to complete an exchange, resulting in a more efficient transaction.

Grow your crypto with CoinStats Premium

Explore CoinStats without limitations and you’ll never want to go back.

How to Choose a DeFi App?

When choosing a DeFi app to use, there are several factors to consider. Here are some tips on how to choose the right DeFi app for your needs:

Security

Look for a DeFi app that has strong security measures in place to protect your funds. This could include features such as multi-factor authentication, cold storage of funds, and regular security audits.

Usability

Choose a DeFi app that is easy to use and navigate. Look for apps with a user-friendly interface, clear instructions, and responsive customer support.

Fees

Consider the fees associated with using the app. Some DeFi apps may charge fees for transactions, while others may offer competitive interest rates on deposits.

Supported Cryptocurrencies

Check to see which cryptocurrencies are supported by the app. If you have a specific cryptocurrency in mind, make sure that it is supported before using the app.

Reputation

Look for DeFi apps with a good reputation in the crypto community. Read reviews and do research on the app’s development team, community support, and history of successful operations.

It’s important to remember that no DeFi app is perfect, and each comes with its own set of advantages and limitations. It’s important to do your own research and due diligence before choosing a DeFi app to use. Take the time to understand the risks involved and choose an app that aligns with your goals and risk tolerance. By following these tips, you can choose a DeFi app that meets your needs and helps you achieve your financial goals in the crypto ecosystem.

Disclaimer: All information provided in or through the CoinStats Website is for informational and educational purposes only. It does not constitute a recommendation to enter into a particular transaction or investment strategy and should not be relied upon in making an investment decision. Any investment decision made by you is entirely at your own risk. In no event shall CoinStats be liable for any incurred losses. See our Disclaimer and Editorial Guidelines to learn more.