How to Stake Cardano (ADA) [The Ultimate Guide 2023]

Cardano was founded in 2015 by Ethereum co-founder Charles Hoskinson, an American computer programmer who aimed to build a blockchain-based on high-level intellectual concepts.

The Cardano blockchain was created to facilitate the deployment of decentralized applications (DApps). In comparison to its direct competitors like Ethereum, its Proof-of-Stake consensus mechanism and internal design allow for fast processing speeds and greater throughput. Cardano is also the first blockchain to be thoroughly peer-reviewed by the academic and scientific Cardano community.

ADA is Cardano’s native token, named after Augusta Ada King, Countess of Lovelace (1815-1852), the first computer programmer. ADA serves diverse functions on the Cardano blockchain, the most important of which is to validate and protect the blockchain network through staking using the Proof-of-Stake consensus mechanism.

Cryptocurrency staking involves locking up your funds in your personal cryptocurrency wallet for a specific period to contribute to the performance and safety of the blockchain network and earn rewards in the form of additional coins or tokens. However, every investor should be aware of the risks associated with staking any crypto asset.

In this article, we’ll explain what Cardano staking is, how to stake Cardano and the risk associated with staking.

So let’s get right to it!

What Is Cardano (ADA) Staking

Staking is the process of locking up cryptocurrencies in a Proof-of-Stake (PoS) blockchain and earning rewards in exchange for their assistance in securing and validating the network.

Cardano uses a delegated Proof-of-Stake consensus protocol called Ouroboros to make staking easy through delegation. The protocol comprises two main parties: Stake Pool Operators (SPOs) and Delegators.

SPOs are network nodes that validate transactions and assist the system’s operation. SPOs are selected to validate transactions depending on the quantity of ADA staked in a pool. Staking ADA tokens as an SPO requires long-term investment, extensive technical expertise, and familiarity with the Cardano network, typical for advanced cryptocurrency users. However, ADA can still be staked using the more accessible delegation approach.

Instead of running a node, delegators can stake ADA tokens in a specific SPO staking pool. Delegating ADA tokens increases the chance of the chosen SPO being selected to validate transactions. The SPO and supporting delegators share the benefits if a node is selected. Delegator staking can be realized directly using a cryptocurrency wallet or indirectly through a cryptocurrency exchange. Cardano stakeholders get rewards every 5 days; a time frame referred to as an “epoch” in the Cardano staking jargon.

In addition to staking ADA on the Cardano blockchain, ADA can be lent through decentralized finance (DeFi) and centralized finance (CeFi) service providers. Lending ADA to other traders through a lending and borrowing service can yield more significant yearly percentage returns; however, the trade-off is that it’s riskier and more complicated than staking through a wallet or exchange.

How to Stake Cardano (ADA)

Cardano can be staked in three ways:

- Staking through a wallet or exchange

- Lending through a DeFi platform

- Lending through a CeFi platform.

For beginners, the easiest option is to stake Cardano directly using a cryptocurrency wallet.

Users must first have ADA tokens in their cryptocurrency wallet to begin staking ADA tokens. You can buy ADA directly on a crypto exchange or transfer any tokens you already own into your exchange wallet. Investors can use popular multi-currency digital wallets such as Exodus or a hardware wallet, like Ledger, to provide an extra degree of protection.

Staking Cardano (ADA) On-Chain Through a Wallet

Cardano recommends two software (online) wallets for staking ADA tokens. The first is the Daedalus wallet, a desktop wallet for Windows, macOS, and Linux developed by Cardano’s development arm, IOHK. The second is Yoroi, a simpler browser-extension wallet that works with Google Chrome, Microsoft Edge, and Firefox and is also compatible with Android and iOS smartphones.

Daedalus is a full node wallet designed for people who want to set up a node and become a staking pool operator on the network. The wallet downloads a copy of the entire Cardano blockchain, which is subsequently validated and updated. Daedalus wallet is more feasible for advanced and technical users.

Yoroi is a beginner-friendly staking wallet designed for people who want to stake ADA tokens as a delegator.

Note: There are many fraudulent cryptocurrency wallets, so it’s best to download the wallets straight from the Daedalus or Yoroi websites to ensure you’re using the official ones.

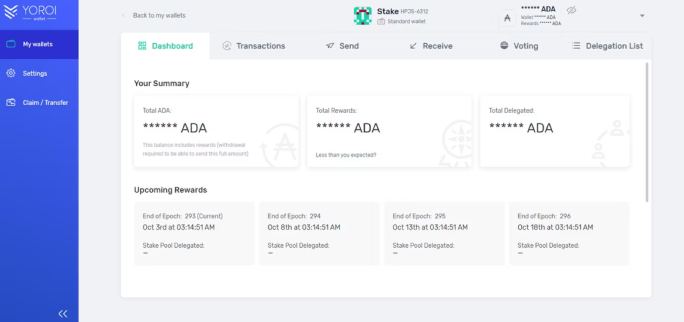

How to Stake Cardano (ADA) Through Yoroi

1. Download the Yoroi browser extension and accept the terms of usage to stake ADA as a delegator.

2. You’ll get two configuration options: Simple or Advanced. If you’re a beginner, select the Simple option. You can build Payment URLs to make it easier to pay individuals.

3. You’re now ready to start staking. Connect a hardware wallet containing ADA tokens or buy ADA from a cryptocurrency exchange such as Coinbase, Kraken, Binance, or Huobi. Transfer the ADA tokens to the Yoroi wallet.

4. The following step is to assign your ADA to a staking pool. Each staking pool charges delegator fees for node operation. These fees differ between staking pools, so it is worthwhile to look into your alternatives. Pool fees can change anytime and without notice, so be aware of this before you begin. Investors sometimes divide their ADA holdings by staking in various pools to diversify the risk.

Once you’ve assigned ADA to a staking pool, you’ll start earning rewards. When depositing coins for the first time, users must wait 20 days for the Cardano network to approve them. So, your reward for each 5-day cycle will be calculated for your ADA balance 25 days ago from the current cycle. This authentication delay protects spammers from overwhelming the network.

After a 20-day wait, stakers will start receiving rewards every 5 days. The first ADA staking payout will be made on the 25th day after beginning to stake, and the next will be made every 5 days.

NOTE: Stakers must pay a network fee when claiming rewards. It’s between 0.1 and 0.2 ADA but can change quite frequently. Many stakers wait to claim their rewards all at once, so their gains are not eaten up by fees.

Additionally, when stakers claim rewards, they need to pay the network fees, which fluctuate regularly and are between 0.1 and 0.2 ADA currently. Many investors wait to receive their rewards all at once to avoid having their profits eaten away by fees.

Staking Cardano (ADA) Through an Exchange

As cryptocurrency exchanges have grown in popularity, they have evolved to provide services beyond just buying and selling cryptocurrencies. One of these features includes enabling users to stake cryptocurrency tokens directly through the exchange.

In the case of Cardano, the exchange serves as the staking pool operator, handling all technical elements of ADA staking across the network. The trade then accumulates ADA rewards.

While Cardano is accessible for buying and selling on most major exchanges, not all of those support Cardano staking. Binance, Kraken, Bittrex, and KuCoin are the 4 major exchanges supporting ADA staking.

How to Stake ADA Through Binance

To stake ADA on Binance, follow the steps highlighted below:

- Check your Binance Spot wallet for ADA.

- Navigate to Binance’s Locked Staking page.

- Select a lock term, 30/60/90/120 days, for your ADA.

- Click “Stake Now,” and you’ve successfully staked ADA.

The rewards will be deposited into your Spot wallet on a regular basis.

Note: If you withdraw your ADA during the locked time, you’ll lose your rewards.

Earn Interest Lending ADA

CeFi Lending

Nexo is the only major CeFi lending service letting customers earn interest on ADA holdings.

DeFi Lending

DeFi lending is the practice of lending cryptocurrency through decentralized finance (DeFi) platforms. DeFi applications, such as decentralized exchanges (DEXs) or lending protocols, frequently rely on user-supplied liquidity to function properly. Users are compensated with a portion of transaction fees in exchange for providing liquidity.

The interest rate offered for DeFi lending is directly proportional to the demand for the cryptocurrency, and payouts are often better than staking ADA on the Cardano network. Interest rates will rise if demand for ADA rises, but supply remains limited, and rates will decline if demand for ADA falls and supply remains high.

How Much Can I Earn With Cardano Staking

| Platform | Type | Returns | CeFi | DeFi | Effort | Pros | |

| Staking | Yoroi | Web3 Wallet | 4-6% | ❌ | ✅ | Medium | Self-custody |

| Staking | Binance | Exchange | 4-8% | ✅ | ❌ | Easy | Convenient |

| Staking | eToro | Brokerage | 4-5% | ✅ | ❌ | Very Easy | Newbie-friendly |

| Lending | Nexo | Intech | 4-8% | ✅ | ❌ | Easy | Alternative to staking |

Staking rewards differ greatly based on the technique and platform used and will ultimately be determined by the market value of ADA. If the market value of ADA rises, so will staking rewards. However, if the value of ADA falls in the market, the deposited ADA, plus interest, may be worth less than at the beginning of the staking process.

Is Staking Cardano Safe

The lack of a lock-up period for ADA tokens is a significant benefit for Cardano stakers compared to other blockchains. Also, your tokens won’t leave the wallet when staking ADA directly through a cryptocurrency wallet. Users can stake as many ADA tokens as they want and withdraw them at any moment from staking pools. This versatile feature has earned Cardano a lot of community support.

While staking ADA directly through a wallet is straightforward, users take complete responsibility for the process. If a user forgets their recovery phrase, they might be unable to retrieve their private keys and lose access to their ADA funds. However, this applies to all cryptocurrency ownership and not just staking.

Another risk when staking ADA directly is unscrupulous validators. While they can’t take ADA tokens from a user’s wallet, they can collect all staking rewards accessible to a staking pool. They accomplish this by making abrupt modifications to margin requirements. Fortunately, this is uncommon, and the Cardano network participants are adept at identifying untrustworthy operators behaving in this manner.

Closing Thoughts

Cardano is one of the most popular cryptocurrency projects, with a sizable community following. Staking ADA as a delegator across the network is a reasonably straightforward operation that even new cryptocurrency investors can execute. Cardano wallets are available for novices, and the network is supported by all major hardware wallets, such as Ledger and Trezor.

More than 70% of the ADA circulating supply is staked in staking pools earning passive income for their holders. With an average return of 4–6% and a capital growth rate exceeding fiat currencies, many investors consider Cardano a viable solution for retirement income.

Like with every cryptocurrency, there are some risks involved that each investor should be aware of. However, developers have attempted to streamline the procedure as much as possible to attract new investors.

In general, staking is an excellent way to earn income on your cryptocurrency holdings, but remember that if the ADA price falls while coins are staked, you may receive less than you put in. Staking ADA is therefore advised for individuals interested in long-term investment in the project.

You are also welcome to visit our CoinStats blog to learn more about wallets & exchanges, portfolio trackers, tokens, etc., and explore our in-depth buying guides on how to buy various cryptocurrencies, such as How to Stake on Binance, How to Stake on Coinbase, What Is DeFi, How to Buy Cryptocurrency, etc.

Investment Advice Disclaimer: The information contained on this website is provided to you solely for informational purposes and does not constitute a recommendation by CoinStats to buy, sell, or hold any securities, financial product, or instrument mentioned in the content, nor does it constitute investment advice, financial advice, trading advice, or any other type of advice.

Cryptocurrency is a highly volatile market sensitive to secondary activity, do your independent research, obtain your own advice, and only invest what you can afford to lose. There are significant risks involved in trading CFDs, stocks, and cryptocurrencies. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider your own circumstances and obtain your own advice before making any investment. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant regulators’ websites before making any decision.

Cardano Staking Pros and Cons

Pros

- Passive Income: Users can earn passive income on their ADA holdings.

- Instant Access: There is no lock-up time for staking ADA tokens. Tokens can be withdrawn from the network at any moment.

- Non-custodial: As coins never leave a wallet during the staking process, there are fewer security risks than with other blockchains.

- Dedicated Cardano Wallet: Cardano has specialized wallets named Daedalus or Yoroi that make staking ADA tokens easier.

Cons

- Accountability: Users are responsible for all components of the staking process, including securely keeping passwords and seed phrases. Without this information, ADA holdings can be lost.

- Hacking Risk: Staking through an exchange or DApp may provide bigger payouts, but it's less secure than staking through a wallet. Cardano holders can lose access to cryptocurrency assets if a platform is hacked or if there is a vulnerability that hackers exploit.

- Lack of Access: Another issue with staking is that you cannot use the delegated ADA while it's locked up, though it can be moved at any time.