How to Stake Solana (SOL)

Solana is a permissionless and open-source blockchain that provides a wide range of innovative decentralized finance (DeFi) solutions. It solves scalability issues via Solana’s low fees and quick transactions. SOL is the native token for the Solana network. Since the platform uses a Proof-of-Stake (PoS) network, participants can stake their SOL coins to become validators within the network and earn passive rewards for their efforts. SOL is one of the best staking coins because of the speed of transactions and the low cost of completing them.

Read on to learn everything you need to know about staking and how to stake Solana (SOL) to make the most of your crypto holdings.

Key Takeaways

- Solana is a permissionless blockchain that provides a wide range of innovative decentralized finance (DeFi) solutions and solves scalability issues.

- SOL is one of the best staking coins because of the speed of transactions and the low cost of completing them.

- Participants can stake their SOL coins to become validators within the network and earn passive rewards for their efforts.

- You can also stake SOL by delegating it to an existing network validator.

- You can earn between 6 to 8 percent annually from staking SOL.

How to Stake Solana (SOL)?

Now let’s get to our step-by-step guide on how to stake Solana (SOL). To stake tokens on Solana, you must first transfer some SOL into a wallet that supports staking, then create a stake account and delegate your stake.

Get a Solana Wallet

To stake SOL tokens, you must create a Solana wallet to connect your tokens to the Solana network. Some of the best wallets for staking Solana are:

Solflare Wallet

Solflare is one of the best and most widely used wallets for staking Solana. It’s web-based and can be integrated with Ledger hardware wallets, enabling you to benefit from its safety and security while staking SOL.

Phantom wallet

The Phantom wallet is a trendy alternative to the Solflare wallet, and it shares similar functionalities with the Solflare wallet and is also compatible with Ledger. The Phantom wallet can be used as an extension for your web browser or an app for iOS. You can download it and start staking tokens with just a few clicks while enjoying the safety of a non-custodial wallet. You can also connect your Phantom wallet to CoinStats and track your entire portfolio using its crypto portfolio trackers.

Atomic wallet

The Atomic wallet is another viable option for staking SOL. You can stake SOL easily using the Atomic wallet from any operating system of your choice, such as Android, macOS, Windows, Linux, etc.

You can go with any of the above wallets or choose any other Solana wallet available in the market to start staking Solana (SOL).

Deposit Solana (SOL)

The next step is to deposit Solana (SOL) into your Solana wallet. You can buy Solana tokens on Binance, Huobi Global, Coinbase, etc. You’re welcome to visit our detailed guide on “How to Buy Solana.” While there is no particular minimum requirement of how many Solana tokens you must have for SOL staking, we recommend having some extra tokens to pay network fees, etc. You must now deposit SOL into your wallet and follow the instructions provided by the wallet to create a stake account and delegate your stake.

Choose a Validator

Once you have the required amount of Solana tokens in your wallet, the next step is to choose a validator. As mentioned earlier, finding a trustworthy validator is essential to maximize your SOL rewards and minimize any losses. To select the right validator, follow our recommendations given below:

Choose a Small or Medium-Sized Validator

While you might be tempted to choose the top validators for Solana staking, note that validators are sorted by the total amount of SOL staked. However, there is a downside to delegating to top validators as they are saturated with many delegators. So, the better option would be to delegate to a small or medium-sized validator, not to lower your rewards due to saturation, and help keep the network decentralized.

Check the Validator’s Performance

The next step is to check the validator’s past performance on Solana Beach or with the Validators.app.

Check Validator Fees

Most validators charge commissions ranging from 0 to 10% taken from your staking rewards. After you’ve chosen a validator, go to your wallet for staking Solana (SOL). Your Solana SOL rewards will be automatically credited to your stake balance, and you’re not required to claim them manually.

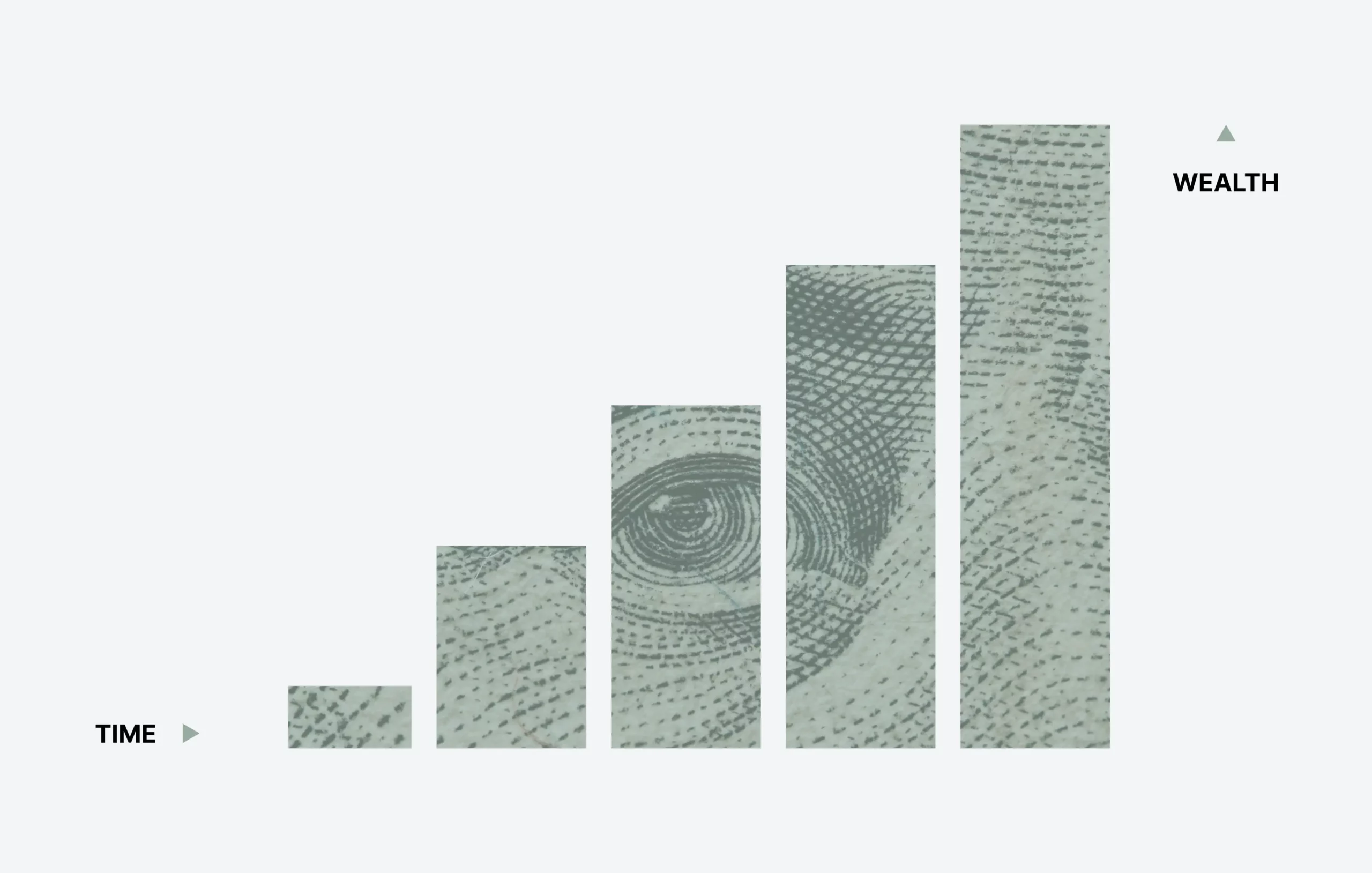

How Much Can I Earn From Staking Solana?

The amount you earn from staking SOL varies between 6 to 8 percent annually and depending on factors such as:

- Your validator

- The Solana network state

- The amount of staked SOL, etc.

While you can get high staking rewards when you stake Solana (SOL), you should also be aware of several risks, such as a potential adverse price movement in the asset you are staking. If, for example, you’re earning 15% APY for staking SOL, but it drops 50% in value throughout the year, you’ll make a loss.

Now that you know how to stake Solana and how much you can earn let’s discuss the downsides or risks associated with staking.

Pro-Tip

While you can get high staking rewards when you stake Solana (SOL), you should also be aware of several risks, such as a potential adverse price movement in the asset you are staking.

Staking Risks

As with staking any cryptocurrency, the risks associated with staking Solana are as follows:

Market Risks

Market risks associated with a potential adverse price movement in the asset you’re staking are the most common ones. Suppose you stake SOL and earn 8 % APY, but if the SOL price drops by more than 70 % in value, you’ll still make a loss. You can check the live price of Solana (SOL), price charts, etc., here at Solana price.

Validator Risk

Choosing a reliable validator is crucial because if the validator you delegate to is slashed by the network for malpractices, you’ll end up losing a portion of your staked tokens.

As you can see, not many risks are associated with staking Solana if you consider the volatile nature of crypto markets and choose a reliable validator. Apart from staking, the Solana Network is working with some of the notable names in DeFi to bring DeFi staking, liquid staking, etc., to the network. You can learn more about DeFi and how to make the most of DeFi staking on “What Is DeFi.”

What Is Staking?

Before learning how to stake Solana (SOL), it’s essential to understand what staking is and how you can earn staking rewards on your crypto holdings.

Staking is the crypto world’s equivalent of earning interest or dividends while holding onto your underlying assets. It’s a popular way to generate extra income with your cryptocurrencies if you plan to hold them for a specific period. Staking involves locking up your digital assets in your cryptocurrency wallet for a specific period to contribute to the performance and safety of the blockchain network and earn rewards in the form of additional coins or tokens.

Most major DeFi protocols provide platforms for staking cryptocurrency, allowing you to earn passive income for holding cryptocurrency on the exchange.

Staking only applies to blockchains that utilize the Proof-of-Stake (PoS) consensus mechanism, in which staking is used to validate transactions.

Consensus Mechanism

In a centralized system, like a DMV database, a central authority controls all the possible data and updates and is in charge of maintaining genuine records. Conversely, decentralized systems, for example, blockchain networks, work without any single authority. Public blockchains operate as self-regulating systems by involving contributions from millions of participants globally who verify and authenticate transactions occurring on the blockchain. To ensure that all the network transactions are genuine and that all participants agree on a consensus on the status of the Ledger, these publicly shared ledgers need an efficient, fair, real-time, functional, reliable, and secure mechanism.

The mechanism that performs this important task is the consensus mechanism, which refers to a set of rules used to achieve agreement, trust, and security across a decentralized computer network.

Two of the most prevalent consensus mechanism algorithms are Proof-of-Work (PoW) and Proof-of-Stake (PoS).

Proof-Of-Work Consensus Mechanism

Proof-of-Work (PoW) is a common consensus algorithm that requires miners to compete to solve complex mathematical problems to verify and process transactions and add them as a new block in the blockchain. As a result, miners are rewarded with mining rewards in the form of the blockchain’s native cryptocurrencies. The Bitcoin blockchain is a prime example of a PoW blockchain, where miners earn BTC as a reward for their mining efforts. While PoW blockchains are pioneers in the blockchain industry, and the PoW mechanism of verifying transactions on the blockchain is robust and secure, it also requires high energy consumption and a longer processing time. This hinders the number of transactions that can be processed by a blockchain simultaneously and therefore causes a scalability issue.

Proof-Of-Stake Consensus Mechanism

In a PoS consensus, a participant node is allocated the responsibility of maintaining the public Ledger in proportion to the number of virtual currency tokens it holds. On a Proof-of-Stake blockchain, the right to verify transactions is assigned to users randomly based on the number of tokens they have staked. So, holders of a required number of coins can earn staking rewards and participate in validation, i.e., verify transactions as needed.

Users staking assets in a PoS blockchain for an agreed-upon ‘staking period’ to provide value to the network and earn rewards in return are called validators. PoS validators give value to the network and are selected based on the higher number of staked coins. Anyone holding a required number of coins can participate in validation, i.e., verify transactions and earn staking rewards.

A Proof-of-Stake blockchain is less power-consuming and, therefore, solves scalability issues faced by a Proof-of-Work blockchain.

Now that you know what staking is and how you can earn staking rewards let’s look into what Solana staking is.

What Is Solana Staking?

Before we learn how to stake Solana (SOL), it’s crucial to understand what Solana staking is. Staking SOL is a great way to earn staking rewards on your crypto holdings. The process of staking Solana includes locking up an amount of SOL for an agreed-upon period to support the Solana network and earn SOL as a reward.

By staking your tokens, you become a delegator who designates his SOL tokens to a validator.

Validators and Delegators

Solana staking involves two parties, delegators, and validators. Delegators (stakers) delegate their tokens to validators, thereby amplifying their weight in processing and securing the network. Anyone with SOL tokens and a device that can connect to the Solana network can become a delegator.

Validators run a full validator node that actively participates in the verification and consensus of the Solana network, maintaining its speed, security, decentralization, etc. To become a validator, you need computer hardware with high specifications.

Solana network is secured from attacks and subversion by the collective validator voting worldwide. The delegated stakes or the number of SOL tokens serve as proof of trustworthiness when a validator votes on a network consensus. The more SOL is delegated to a validator, the more transactions it gets to validate and the more powerful it becomes. By delegating your tokens to the validator, you basically “vote” for and signal your trust in it. The more transactions a validator validates, the more money it earns.

When staking Solana or other cryptocurrencies, it’s essential to choose your validator diligently and conduct prior research because if you delegate your tokens to a bad validator, you might end up at a loss.

Fast Fact

When staking Solana or other cryptocurrencies, it’s essential to choose your validator diligently and conduct prior research because if you delegate your tokens to a bad validator, you might end up at a loss.

How Does SOL Staking Work?

Solana staking involves users locking up their tokens for a fixed period at a pre-approved interest rate. Staking yields typically range between 5% and 10%. You can unstake your tokens before the staking period expires, but you might lose any interest you’ve earned or even be charged a fee.

The network uses a PoS consensus model that leverages the so-called proof-of-history (PoH) for staking Solana. This adds time as a variable to the process helping to create a chronology of events independent of local timestamps.

As a delegator, you can select a validator from the list of providers for staking SOL. Remember to perform due diligence before going with a particular validator service.

The Solana validator you pick will allow you to deposit your SOL tokens to earn staking rewards. The more transactions a particular validator validates, the more money it earns. It also distributes a portion of these rewards to all delegators who delegated their SOL to it.

Conclusion

Solana is one of the most significant protocols, with its native token, the SOL coin, ranked among the top 10 cryptocurrencies worldwide. Even though it looks like the crypto winter will last forever, and the prices won’t rise again, we must go back to what happened when the last bear market ended, and the bull market began. In the meantime, staking Solana could be a great way to earn passive income.

Disclaimer: Nothing in this article is a piece of financial advice, and you should perform your own research before investing in risky and unregulated assets like cryptocurrencies.