The crypto markets are showing signs of entering a bullish phase, marking a significant turnaround after enduring nearly two challenging years characterized by a bearish market, project failures, and exchange collapses. Since the beginning of 2023, the crypto industry has been on a path to recovery. However, the recent victory of Ripple in the SEC case in the USA appears to be the most influential catalyst for the upcoming bull cycle. A federal judge ruled that XRP, the Ripple protocol’s native token, didn’t qualify as a security when sold to the general public on exchanges, thereby bringing about regulation clarity for XRP and numerous other crypto assets. As a result, the cryptocurrency markets are expected to reach new all-time highs in the forthcoming years.

This paradigm shift presents numerous opportunities for individuals to capitalize on the potential for financial gain through trading digital assets and other avenues such as crypto staking, crypto lending, etc. These methods enable individuals to earn passive income by leveraging their holdings. With Ripple’s role in bringing about clarity regarding digital currency, it’s worth exploring the process of staking XRP and discovering how one can earn extra money from their XRP holdings.

One Place For All Your

Crypto, DeFi & NFTs

What Is Crypto Staking?

Cryptocurrencies are digital assets created and operated using a blockchain network. These networks can be used to facilitate or validate transactions, verify new blocks, etc.

The consensus mechanism employed by a blockchain network determines how these tasks are accomplished, with the two primary mechanisms being Proof-of-Work (PoW) and Proof-of-Stake (PoS).

In a PoW blockchain, the process to verify transactions is called mining, and the participants in the network, referred to as miners, earn the blockchain’s native token as rewards. Bitcoin mining is a prominent example of PoW, where miners compete to solve complex mathematical problems to validate transactions and secure the network.

In contrast, a PoS blockchain verifies transactions and creates new blocks through a process called staking. Notably, Ethereum recently transitioned from a PoW to a PoS consensus mechanism, making the network faster and energy efficient. In a PoS system, users stake their digital assets by locking them up in a wallet or smart contract on the blockchain network. In so doing, they contribute to the network’s security and consensus algorithm and earn rewards in the form of the blockchain’s native tokens or other coins supported on the network.

In other words, staking is similar to a savings account, where you earn passive income by locking fiat currency in your account. However, in staking, the crypto assets are utilized to validate transactions and maintain the network’s integrity.

How Does Crypto Staking Work?

- First, you must choose a digital asset and a blockchain network from the network list supporting staking.

- You can either stake your crypto assets directly on the network or use third-party platforms such as DeFi protocols, centralized exchanges, or liquidity pools.

- You’re all set to stake your crypto holdings to passively earn rewards.

Here are some steps to consider to mitigate risks and ensure a safe staking experience:

- Before choosing a staking platform or service, conduct thorough research about its reputation, security measures, and user feedback. Look for reviews, check the platform’s background, and assess its credibility. Verify the platform’s legitimacy by checking if they are licensed or regulated in relevant jurisdictions.

- Ensure that the staking platform has robust security measures in place. Look for features like two-factor authentication (2FA), encryption, cold storage for funds, and regular security audits. A platform with robust security protocols reduces the risk of unauthorized access and potential hacks.

- Read and understand the terms and conditions of the staking platform. Pay attention to details such as low transaction fees, lock-up periods, withdrawal policies, and potential penalties. Ensure you are comfortable with the platform’s terms before staking your funds.

How to Stake XRP?

Before staking XRP, it’s essential to understand how Ripple (XRP) works. Ripple is a digital payment network used by financial institutions as a global payment system. Built on blockchain technology, Ripple is powered by its native XRP token. The XRP Ledger is used in such domains as payments, tokenization, decentralized finance (DeFi), central bank digital currencies (CBDCs), and stablecoins.

Unlike traditional PoW or PoS mechanisms, Ripple employs its unique consensus algorithm, the Ripple Protocol Consensus Algorithm. The algorithm validates transactions through a network of servers owned by banks.

It’s crucial to note that since Ripple doesn’t operate on a Proof-of-Stake consensus mechanism, staking XRP cannot be done in the traditional sense. While you can’t stake Ripple (XRP) directly on the Ripple network, many platforms, such as crypto exchanges or lending platforms, can make staking Ripple possible. Using a crypto exchange like Binance or a lending platform like Nexo, you can stake XRP to earn interest on your XRP coins.

You can also earn passive income through crypto lending. XRP lending is facilitated by several platforms and allows you to loan out your XRP to borrowers who then pay you back at a set interest rate.

It’s crucial to exercise caution and thoroughly research any platform offering XRP staking, particularly any platform advertising unrealistically high annual percentage yield (APY). Some platforms may turn out to be scams, so it’s crucial to conduct in-depth investigations before engaging in XRP staking activities.

Staking XRP on Binance

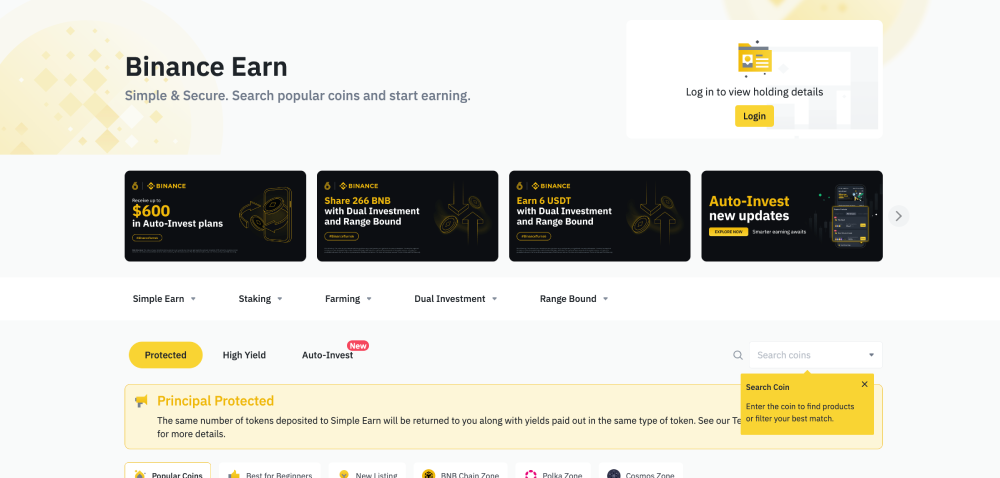

Several platforms provide interest for staking XRP. Let’s view the steps for staking XRP on Binance to earn staking rewards.

- Go to Binance and log in to your account or create one by completing KYC.

- Ensure you have enough XRP tokens in your Binance Wallet. You can buy XRP on Binance easily or transfer them from other exchanges or wallets.

- Now click on Earn and search for XRP.

- Choose your subscription type: Protected, High Yield, or Auto-Invest. Protected staking gives an APR of 1.85%, while the other two offer higher staking rewards with increased risk.

- Enter the amount of XRP you want to stake and confirm the transaction to start earning rewards.

Track Your Staking Rewards

After you stake XRP on any lending platform or a crypto exchange, you can view the performance of your tokens by logging into your account. But to avoid the hassle, you can link your crypto wallet to the CoinStats Portfolio Tracker, supporting a wide range of wallets, cryptocurrency exchanges, decentralized finance protocols, etc. Along with tracking your staking rewards, the CoinStats portfolio tracker will help you monitor the performance of all your crypto portfolios in one single place in real time.

Conclusion

Staking crypto is one of the most efficient ways of earning interest on your crypto holdings, especially during a bear market. However, it’s essential to exercise caution and follow some best practices to ensure the safety of your assets.

Disclaimer: All information provided in or through the CoinStats Website is for informational and educational purposes only. It does not constitute a recommendation to enter into a particular transaction or investment strategy and should not be relied upon in making an investment decision. Any investment decision made by you is entirely at your own risk. In no event shall CoinStats be liable for any incurred losses. See our Disclaimer and Editorial Guidelines to learn more.