What Is dYdX: Deep Dive Into the Decentralized Perpetual Trading Platform

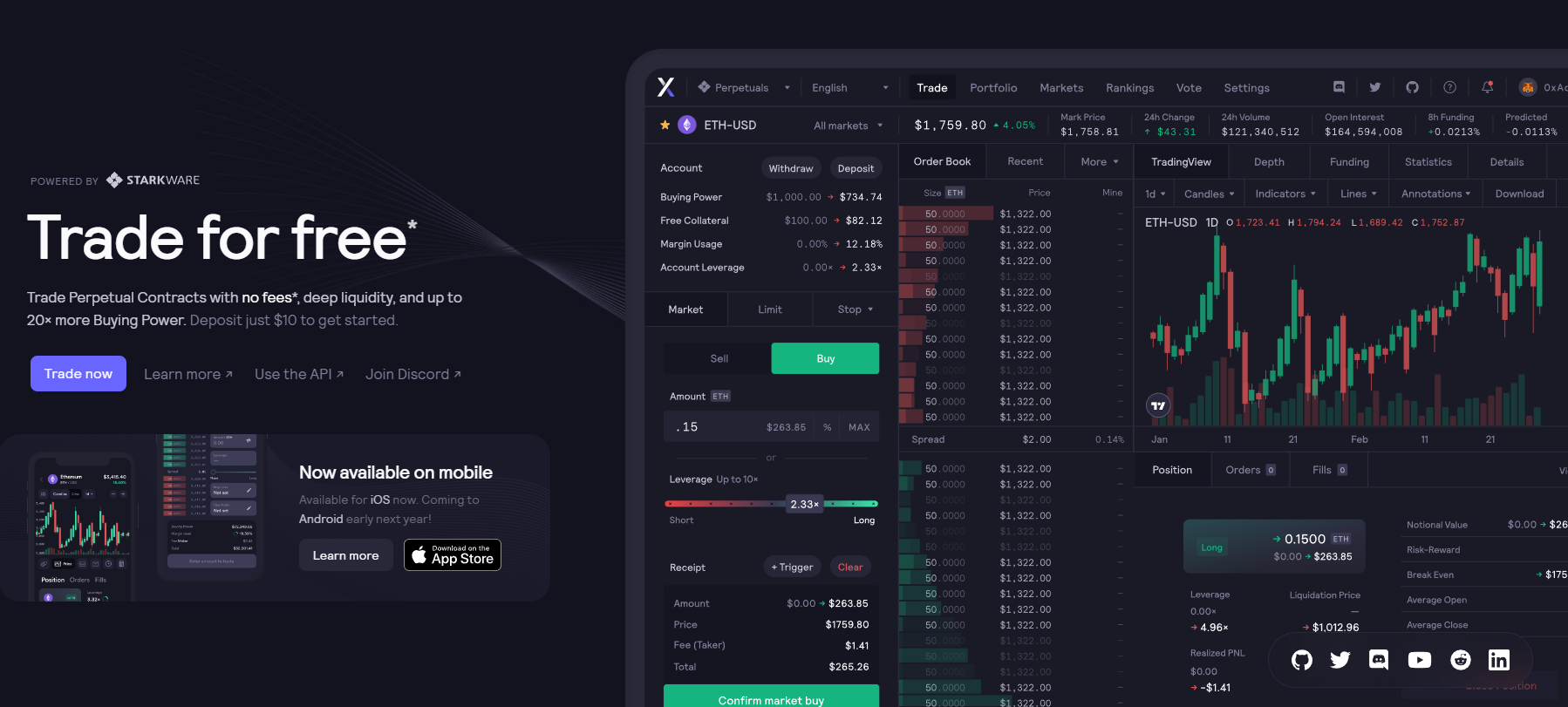

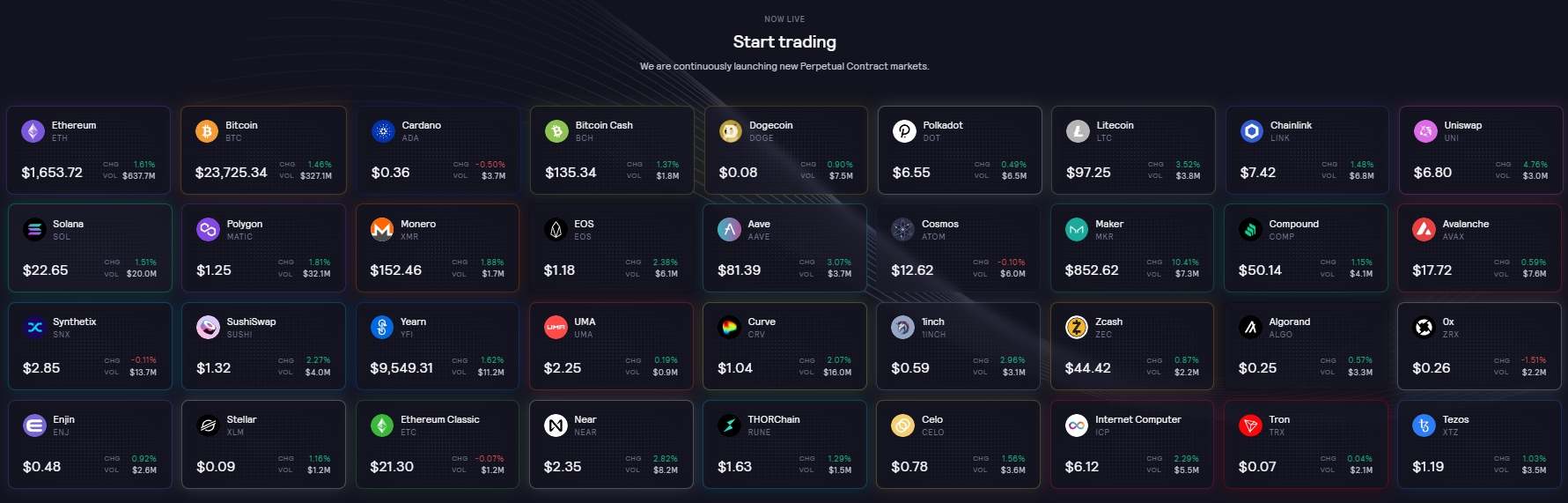

dYdX is a crypto derivatives decentralized (DEX) exchange offering users a wide range of financial instruments such as perpetuals, margin, spot trading, lending, borrowing, and making bets on the future prices of popular cryptocurrencies. It enables users to trade over 35 different cryptocurrencies. The dYdX protocol was developed on Ethereum smart contracts and Stark rollups powered by Starkware. It’s designed to bring the standard trading features of a centralized exchange to the blockchain world. In so doing, it combines the security and transparency of a decentralized exchange with the speed and usability of a centralized exchange.

The protocol has its native governance token, DYDX, which enables network participants to control future developments, gain mining rewards, and receive trading discounts on the exchange.

dYdX was launched in July 2017, initially offering crypto margin trading, lending, and borrowing services across Ethereum Layer 1.

In August 2021, the dYdX exchange launched Layer 2 cross-margin perpetual trading enabling users to repurpose their available platform balance to offer liquidity to existing trades to prevent liquidations during periods of extreme volatility.

The project was designed to be the fastest, cheapest, and most powerful decentralized exchange. The dYdX platform is one of the world’s largest decentralized exchanges in terms of trading volume and market share, with over 60,000 users. It’s worth about $11 billion in perpetuals and profits and over $25 billion in flash transactions via dYdX Liquidity Pools.

Executive Summary

- dYdX is an Ethereum-based decentralized exchange with a wide range of financial instruments such as perpetuals, margin, spot trading, lending, borrowing, and making bets on the future prices of popular cryptocurrencies.

- dYdX Layer 2 improves network scalability by employing zkSTARKS, a type of zero-knowledge Rollup technology. It provides cryptocurrency perpetual contract trading for a broad range of digital assets.

- Users can use dYdX to borrow, lend, and speculate on the future prices of major cryptocurrencies.

- DYDX token holders can stake their tokens in the dYdX safety staking and liquidity pools to earn rewards for securing the protocol.

- The protocol’s native governance token, DYDX, enables network participants to control future developments, gain mining rewards, and receive trading discounts on the exchange.

- The dYdX exchange’s original goal is becoming completely decentralized, with no centralized components.

How Does dYdX Work?

dYdX is based on the Ethereum blockchain. The exchange combines Ethereum’s security with fast and low-cost transactions via its Layer 2 network.

The L2 protocol uses the scalability solution StarkEx and Perpetual smart contracts of dYdX. Perpetuals are essentially crypto derivative swapping contracts based on speculation on the future price of cryptocurrencies without expiration dates. dYdX allows up to 25X leverage.

Instead of individual borrowers and lenders making and accepting loan offers, there is one global lending pool per supported asset on dYdX. The lending pool is managed by smart contracts, so withdrawing, borrowing, and lending can happen anytime without waiting for matches or sufficient capital. The supply and demand for each asset determine the interest rates of each asset. The technology ensures lender security by requiring borrowers to deposit sufficient account collateral.

The protocol achieves decentralized governance through its native ERC 20 token DYDX.

dYdX introduces retroactive mining bonuses to past users in addition to trading and liquidity provider awards, incentivizing them to trade on the Layer 2 protocol. DYDX token holders can stake their tokens in the dYdX safety staking and liquidity pools to earn rewards for securing the protocol. While the safety pool serves as the platform’s safety net in a shortfall event, the liquidity pool attracts high-quality market makers.

Layer 1 dYdX (Ethereum)

The Layer 1 version of dYdX is a highly liquid decentralized exchange for cryptocurrency margin and spot trading with 5x leverage on assets like BTC and ETH paired with stablecoins (USDC & DAI).

Borrowing to fund your positions is simple and quick, with funds sent directly to your wallet as long as you collateralize properly. Currently, the collateralization minimum is 125%, meaning you must deposit significantly more than you wish to borrow. Over-collateralization safeguards lenders in the event of a default.

Layer 2 dYdX (Starkware)

The Layer 2 version of dYdX improves network scalability by employing zkSTARKS, a type of zero-knowledge Rollup technology. zkSTARKSe uses an off-chain virtual machine to process batches of transactions and post a validity proof on-chain to confirm. It removes expensive computations from the mainnet while still preserving decentralization.

Layer 2 dYdX provides cryptocurrency perpetual contract trading for a broad range of digital assets, including USD-paired cryptocurrencies like BTC, ETH, SOL, DOT, AAVE, LINK, UNI, SUSHI, MATIC, and LTC. In terms of leverage, you can use up to 25x, a significant improvement over dYdX on Layer 1.

Layer 2 dYdX offers the following benefits:

- Low/ no gas fees

- Mobile friendly

- Cross-margining

- Secure and private transactions

- Fast transactions.

dYdX Founders

Antonio Juliano is dYdX founder and CEO – an experienced programmer with expertise in blockchain technology. He became involved in crypto as a software developer at the Coinbase cryptocurrency exchange platform in 2015. Juliano is a Princeton University graduate with a computer science degree. He launched dYdX in early 2017.

dYdX started with the launch of the Layer 1 product (Solo), which supported lending, borrowing, and margin trading on Ethereum.

In 2021, dYdX launched a closed alpha for its new Layer 2 cross-margined Perpetuals product built on StarkWare’s StarkEx scalability engine.

In August 2021, dYdX Trading Inc. announced the creation of the dYdX Foundation. The dYdX Foundation deploys smart contracts and issues the DYDX governance token. It supports community research and education and also manages the dYdX community treasury.

The exchange launched in 2019 after receiving over $10 million in seed venture capital funding in 2017. The dYdX token ICO was held on September 9th, 2021.

The project investors are Andreessen Horowitz, Paradigm, Polychain capital, and Coinbase CEO Brian Armstrong.

dYdX Trading Options

dYdX provides perpetual markets (buying or selling orders at a fixed price indefinitely, i.e., with no expiry date), including spot and margin trading on the Ethereum Layer 1 blockchain and Layer 2 cross-margined perpetuals. Let’s look into the details of each below:

Perpetual Trading on the dYdX Exchange

Perpetual trading is dYdX’s primary product, enabling users to trade open markets with non-expirable contracts. As a result, investors can hold their buy or sell positions indefinitely until the predefined transaction conditions are met. For example, if a user places an order to sell one Bitcoin for $100,000, the order will be active until Bitcoin reaches $100,000 and the trade is completed. On the other hand, an investor can terminate the contract by pre-closing the buy or sell order.

The dYdX perpetual is a non-custodial, decentralized margin product that provides a synthetic exposure to a wide range of cryptocurrency assets. Perpetual contracts are created on top of an underlying asset, in this case, Ethereum-based ERC-20 tokens. As a result, dYdX enables the creation of totally new asset classes, the values of which are derived from the underpinning blockchain-based assets.

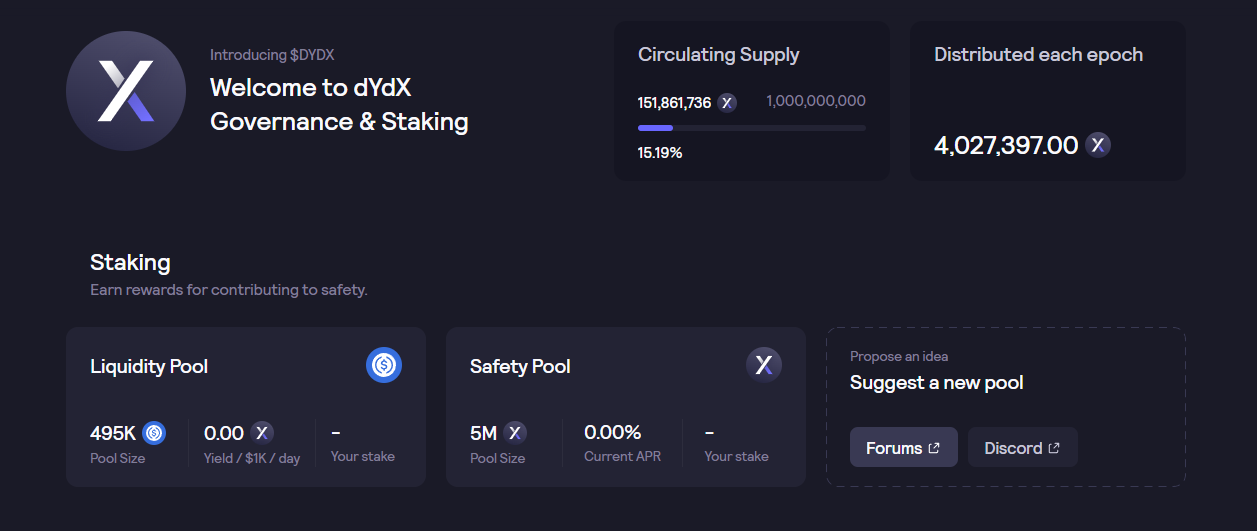

dYdX Governance & Staking

The governance token for the dYdX protocol, DYDX, was issued a year after the dYdX platform launch. The DYDX token can be used for community voting and governance projects on the platform. Users can vote with their DYDX reserves on community proposals related to module enhancements, restorations, and grants. Furthermore, users can earn DYDX by trading on the DEX, with all costs and interest paid.

The dYdX exchange’s community arm enables users to stake their existing crypto holdings to earn yield in its in-house governance token DYDX. The exchange provides two pools to stake USD Coin (USDC) to earn rewards for contributing to dYdX exchange liquidity.

To help the community, you can purchase DYDX tokens on prominent cryptocurrency exchanges like Kraken and Coinbase.

Non-Fungible Tokens on DYdX

dYdX’s most recent NFT collection is Hedgies, a collection of animated hedgehogs developed by two independent digital artists, Anna and Arek Kajda. The NFT collection went live in February 2022 and launched 4,200 NFTs minted on the Ethereum network.

Users receive Hedgies depending on their trading data and community engagement, including voting. Hedgies NFT holders are entitled to specific benefits when trading on dYdX. You can mint Hedgies through the free app that rewards users for various activities and achievements.

Spot and Margin Trading on dYdX

On November 1, 2021, dYdX discontinued its Layer 1 offering of spot and margin trading services on the Ethereum Layer 1 blockchain protocol. It shifted to offering Layer 2 perpetual products to help achieve its goal of decentralization.

The dYdX exchange leverages spot and margin trading with Ethereum smart contracts. It also provides trading options such as stop-loss and limit orders like other centralized and decentralized exchanges.

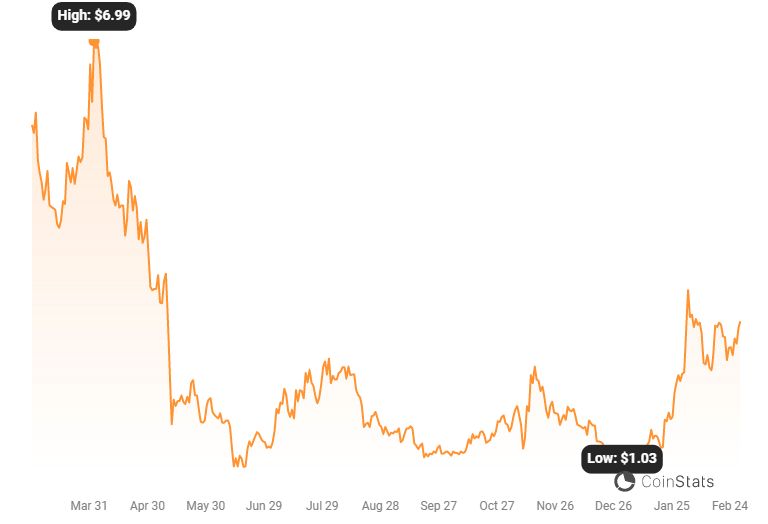

What Is DYDX Token?

DYDX is the dYdX protocol’s governance token that enables traders, liquidity providers, and partners to participate in the protocol’s community growth.

Token holders can stake their tokens to earn rewards and receive trading discounts. They can also make proposals to the dYdX’s Layer 2.

dYdX Liquidity Staking Pools

dYdX offers two types of staking pools.

The safety pool creates a safety net and ensures that the DYDX users who staked their tokens receive a portion of rewards in proportion to their staked tokens in the pool.

The liquidity pool provides liquidity network effects and incentivizes professional market makers to invest in the platform.

To encourage liquidity providers, dYdX liquidity staking pools award DYDX tokens to users depositing USDC in the pool. As part of the initiative, 25 million DYDX tokens are up for grabs, accounting for 2.5% of the entire token supply.

After depositing USDC to the protocol, users must stake it in the pool to receive stkUSDC. Then they must mark their token as active to add it to the liquidity pool to start earning DYDX tokens and a share of trading fees on their USDC deposit.

dYdX Trading Rewards

You don’t have to be a liquidity provider to earn some tokens; you can earn DYDX tokens by trading on the platform. The platform rewards traders in DYDX tokens from a 250 million DYDX token stash. That’s 25% of the total token supply, demonstrating a substantial commitment to dYdX users.

Discount on Trading Fees

Trading on dYdX entitles you to discounts in trading fees, thereby improving your profit and loss.

You must hold DYDX tokens in your wallet to receive trading fee discounts ranging from 3 to 50% for the largest dYdX investors.

How Many DYDX Tokens Are in Circulation?

A total of 1 billion DYDX tokens have been minted and will be distributed over five years starting August 3rd, 2021. 50.00% of the supply will be reserved for the community; 25.00% will be used as trading rewards; 7.50% will be set aside for retroactive mining rewards; 7.50% will be assigned for liquidity provider rewards; 5.00% will be dedicated to a community treasury; 2.50% will be allocated to users staking USDC in a liquidity staking pool, and 2.50% to users staking DYDX in a safety pool. Past investors will receive 27.73% of the proceeds, 15.27% will be distributed to the company’s team members, and 7.00% will be retained for future dYdX workers and consultants.

DYDX Tokenomics

- Max supply -1,000,000,000 dYdX

- Market cap – $1,251,357,416

- Fully diluted – $24,355,536,193

- Total value locked – $694,154,000

- Circulating supply – 1,000,000,000.

Who Is dYdX Designed For?

All of this discussion about crypto margin, spot, and perpetuals trading overlooks one crucial fact regarding their intended customer. What kind of cryptocurrency trader uses dYdX?

While Layer 1 dYdX can be used for simple crypto spot trades, that’s not its intended application. The spot trading function appears to be built in to provide an early revenue stream for the site through transaction fees and deposit collateral, but it will be removed later. Furthermore, the dYdX foundation realized that the crypto spot trading industry is rife with the rivalry between well-known brands. As a result, the team is entirely focused on crypto derivatives such as perpetual contracts.

Crypto derivatives trading is often reserved for experienced traders who have perfected their art over time and understand the risks, gains, and tactics involved. For example, trading BTC perpetual contracts requires several moving elements and cannot be done hands-off. Failure to adequately fund an account over time might result in liquidation, which is the loss of your whole stake.

However, although dYdX best suits seasoned crypto traders, anyone can learn how to trade crypto derivatives.

How to Use dYdX?

As a decentralized exchange, dYdX doesn’t require users to undergo Know Your Customer (KYC) verification on the platform. You only need a funded Ethereum crypto wallet to start trading in minutes. dYdX is non-custodial, meaning traders have complete access to their funds.

Here is a step-by-step guide on trading dXdY perpetual contracts:

- Navigate to the official dYdX website or download the dYdX trading app on iOS.

- Connect your wallet (CoinStats Wallet, MetaMask, Coinbase, etc.). After connecting to the wallet, a popup invites you to generate a Stark Key. The Stark Key is a way to assist with the user’s account’s identity, creating a secure interaction between Layer 1 and Layer 2. Click on the Generate Stark Key, which generates a Signature request. Sign the transaction, and there is no gas fee to sign.

- Agree to the terms and create an account.

- Deposit funds from Ethereum mainnet. Currently, the platform only accepts the stablecoin USD Coin (USDC) as trading collateral.

- Select your asset and a type of trade.

- Create a position with the desired leverage (if any) and limits.

- Monitor your profit and loss statement and fund your position as needed.

The Future of dYdX

The dYdX exchange’s original goal is becoming completely decentralized, with no centralized components. Currently, dYdX is in its third version, with most of the dYdX v3 platform’s components being decentralized; however, it still uses centralized systems for the order book and matching engine.

dYdX v4, the dYdX protocol’s fourth version, will be released as an open-source, decentralized, and community-controlled trading platform. Aside from complete decentralization, the dYdX v4 protocol will reintroduce trading features, including spot, margin, and other synthetic products.

The community will take control of dYdX v4 away from dYdX Trading Inc., which will no longer receive revenue on trading fees. Following community approval, the inability to earn revenue will extend to all the connected centralized systems.

Centralized exchanges such as Binance and Coinbase have been dominating the trading landscape in terms of trading volumes, despite cryptocurrency’s underlying goal of financial decentralization. One of the main reasons for this is the ease of regulating centralized enterprises. However, through decentralization, dYdX promises to give control to its investor community while still maintaining the highest level of transparency.

Bottom Line

Decentralized lending and borrowing are available in DeFi via increasingly advanced trading features. However, dYdX focuses on developing more powerful trading capabilities on the Ethereum blockchain.

The dYdX protocol, like other DeFi technologies, is open to anyone to use and expand upon, with users’ assets governed by smart contracts rather than individuals.