Europe’s Largest Bank Buys BlackRock Bitcoin ETF Before US Wealth, Pension Funds

0

0

BNP Paribas, Europe’s second-largest bank, has recently acquired significant exposure to BTC through BlackRock’s iShares Bitcoin Trust ETF (IBIT).

This strategic purchase positions BNP Paribas ahead of many US wealth and pension funds in adopting Bitcoin-based investment products.

Institutions Buy BlackRock Bitcoin ETF

BNP Paribas, boasting over $600 billion in assets under management, made a comparatively modest investment of approximately $40,000 in BlackRock’s Bitcoin ETF. Despite the small scale of the investment in terms of the bank’s vast asset pool, the move is significant.

It marks one of the first instances where a major European bank has ventured into BTC exposure via an ETF. This reflects the escalating acceptance of crypto among conventional financial entities.

The BlackRock iShares Bitcoin Trust ETF has experienced substantial success since its introduction earlier this year. To date, it has accumulated over $200 billion in traded volume. This has set a benchmark for the product, illustrating robust market confidence and a strong appetite among investors.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

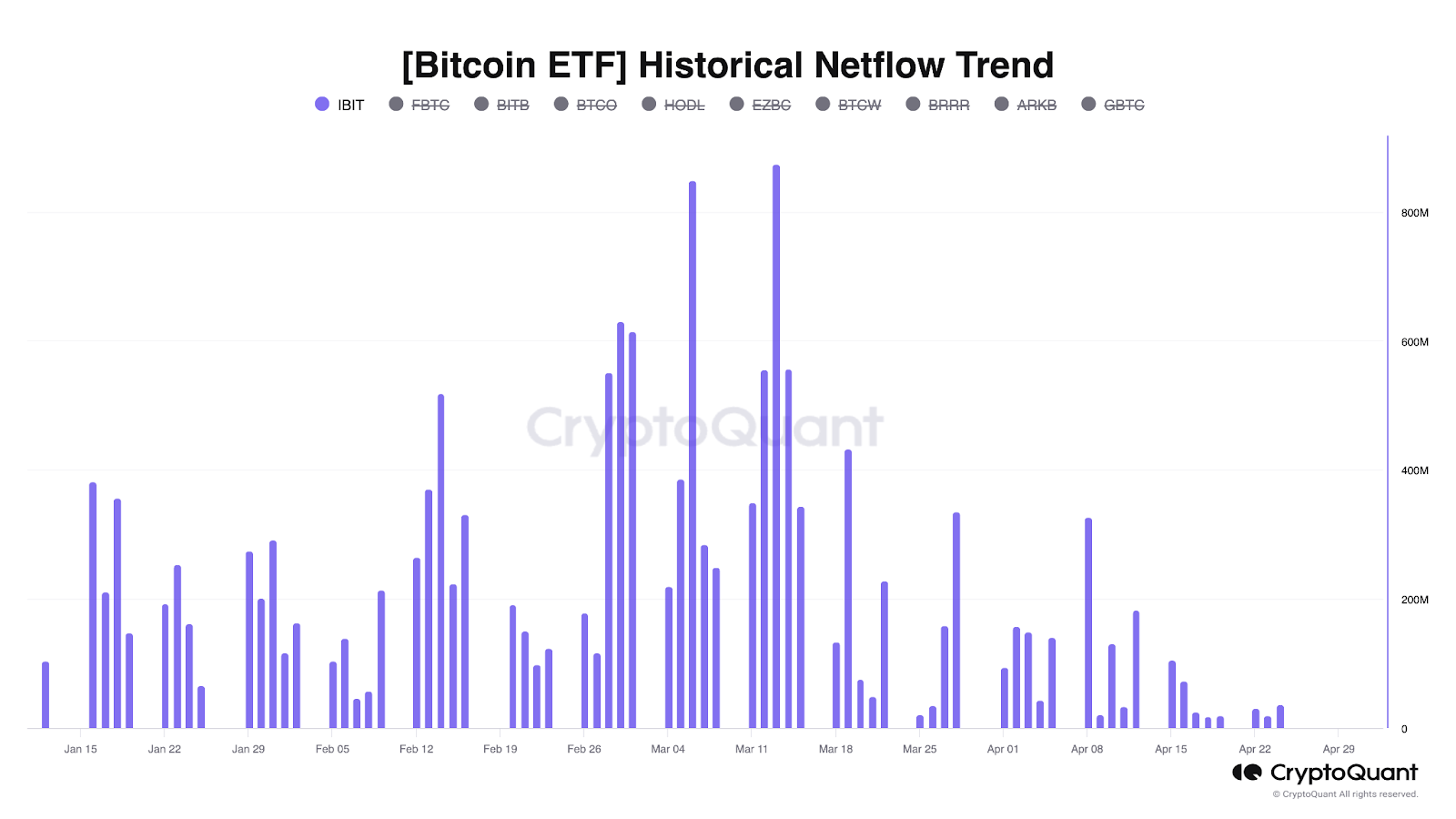

BlackRock Bitcoin ETF Netflows. Source: CryptoQuant

BlackRock Bitcoin ETF Netflows. Source: CryptoQuant

Further insights from BlackRock suggest that investments for ETFs are set to expand, with potential upcoming allocations by sovereign wealth funds, pensions, and endowments.

Robert Mitchnick, BlackRock’s head of digital assets, highlighted the ongoing discussions. Recent educational efforts at these institutions indicate a sustained interest and a proactive approach toward embracing Bitcoin.

“Many of these interested firms – whether we’re talking about pensions, endowments, sovereign wealth funds, insurers, other asset managers, family offices – are having ongoing diligence and research conversations, and we’re playing a role from an education perspective,” Mitchnick said.

With BNP Paribas setting a precedent, the stage is set for more institutions to follow. These investments could lead to a new wave of adoption in Bitcoin.

0

0