Hyperliquid Unstakes $316M in HYPE Days Before Major Unlock

0

0

This article was first published on The Bit Journal. The team behind Hyperliquid has reportedly unstaked $316 million worth of HYPE just days before a major HYPE unlock scheduled for November 29, raising fresh debate about market impact and investor sentiment.

Pseudonymous market researcher Avseenko notes that the bulk of the market participants were in the business of either farming HYPE via the Hyperliquid DeFi ecosystem or short-selling the token. Although the spot market was busy, he observed that there was no stiff demand in the spot market before the next HYPE unlock, which added to doubts about price activity over the weekend.

📉 $HYPE is showing serious fade. Almost 10M tokens are queued for unstake (~$316M at current prices), and a quarter of those belong to HyperLabs. Are they really just stocking up for holiday gifts? 🎁

In my circle, people are split into two camps:

1️⃣ Those farming $HYPE in… pic.twitter.com/PLiNwFjYXd— 0xAvseenko (@0xAvseenko) November 23, 2025

10 Million Tokens Set for HYPE Unlock

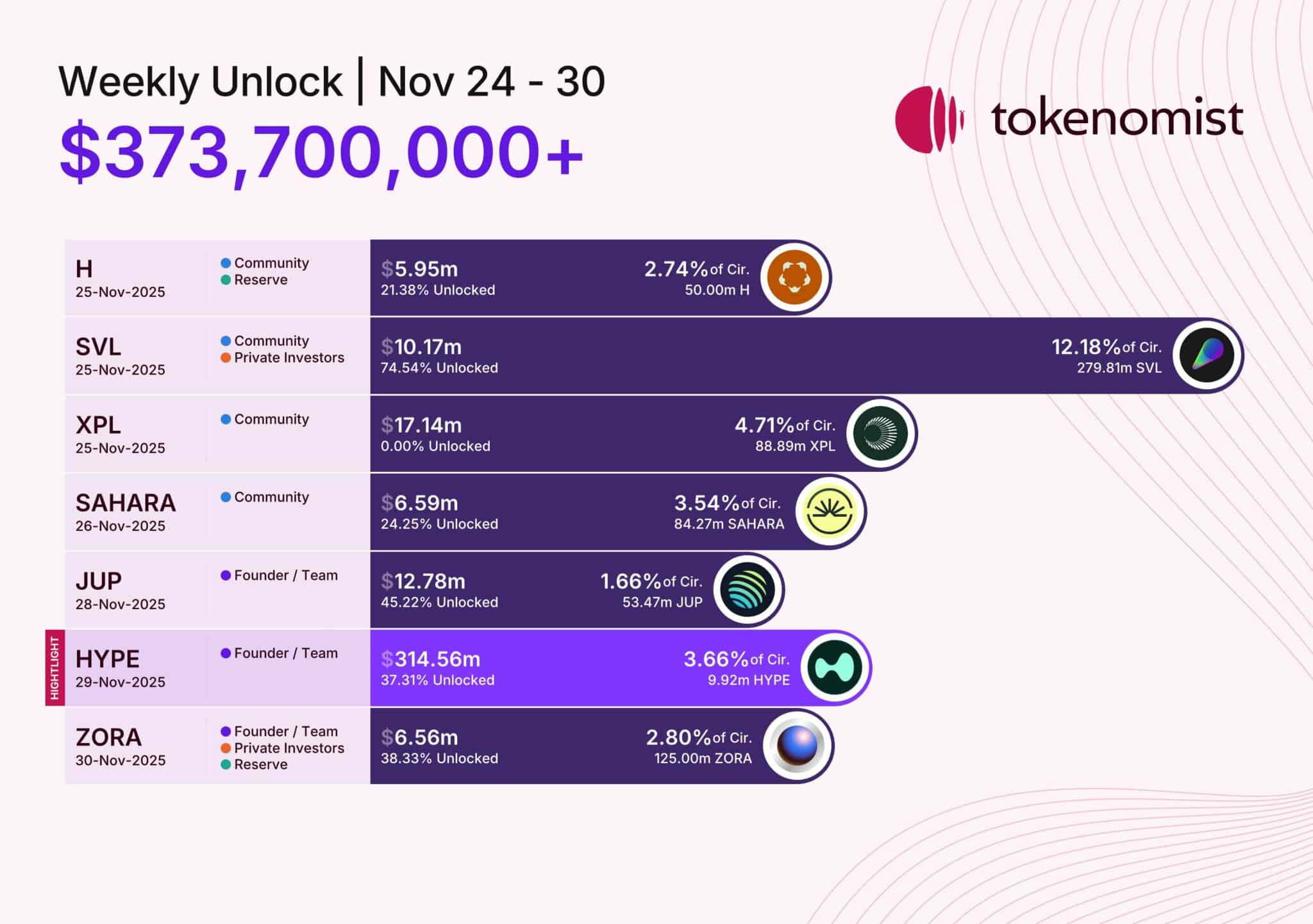

According to the tokenomics, 10 million HYPE or 3.6% of the circulating supply will be unlocked as the HYPE unlock, which will be used to reward the team and founders. The unlock is one of the most observed this week because the project is rapidly growing and has a history of causing waves of FUD in the early levels.

A longer release cycle also starts with this unlock. In the next 24 months Hyperliquid is going to run monthly HYPE unlocks, which some analysts fear will bring about persistent supply strain.

Arthur Hayes Warns of Supply Overhang

Cryptocurrency market investor Arthur Hayes had warned that despite buybacks being active at Hyperliquid, the market would still be over 400 million of supply overhang as a result of the HYPE unlock cycle, which might pressure overall valuation.

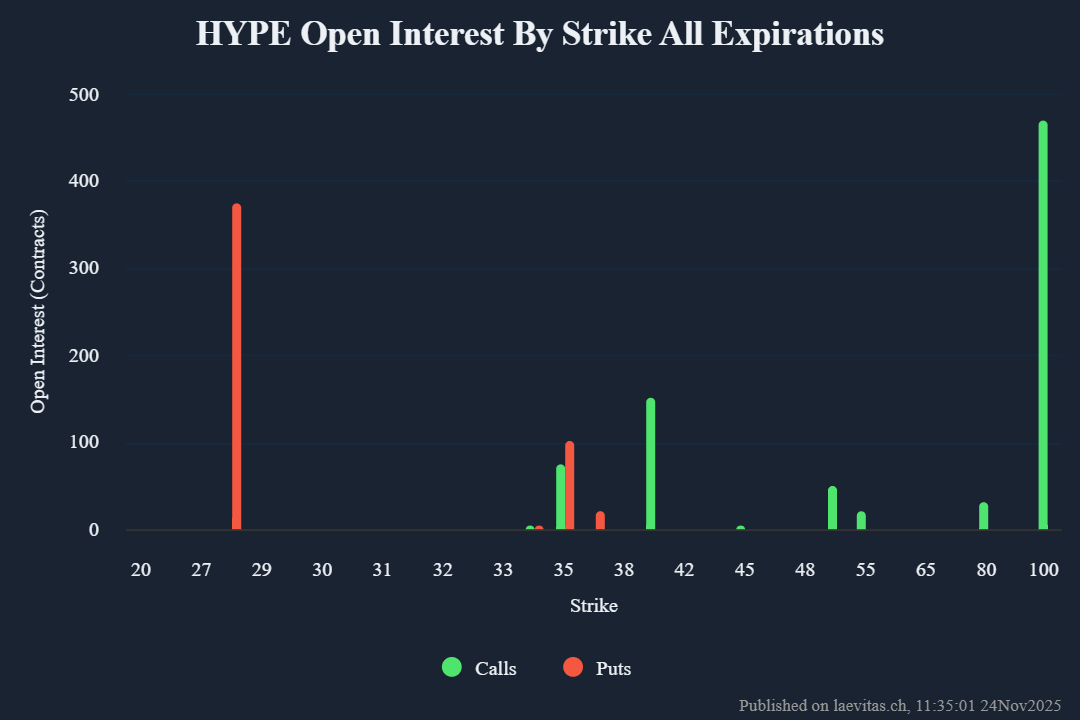

By the time of writing, HYPE was trading at $31.94, which is 47% lower than the all-time high at 59.4. It has been priced in derivatives dealing with a 10% downside on the HYPE unlock, and the traders focus on the level of 28 as major interest.

The options data indicates that there has been unusually heavy put interest at $28, indicating that traders are hedging against a decline, whilst at the same time anticipating that the token would still be above the level after the HYPE token unlock.

Technical Levels and Market Positioning

On the price graph, the support zone of $28 was a significant breakout zone in the rise of HYPE this year. This level has now become predicted by many analysts to stabilize short-term volatility with the HYPE token unlock, which may assist in the recovery of the token.

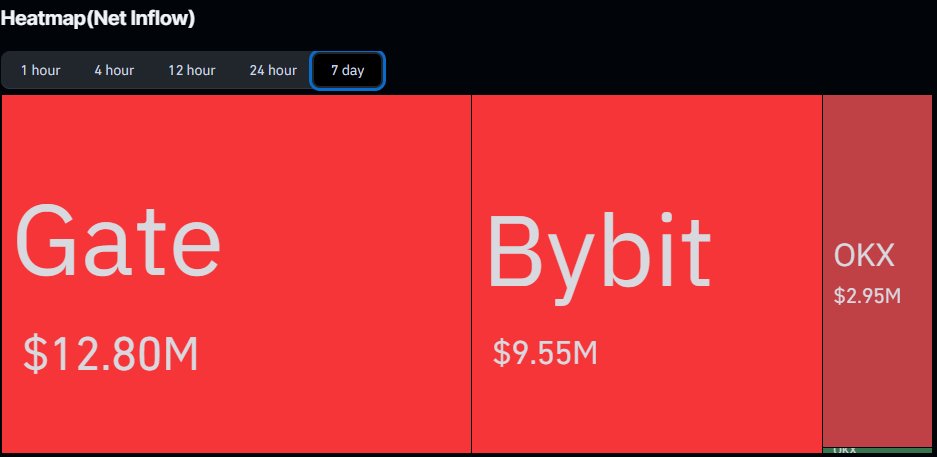

With mixed sentiment, HYPE has been accumulated very well this week. According to CoinGlass data, net outflows of exchanges have been on a bullish trend of more HYPE being transferred to self-custody, which could suggest that some investors are gearing up in advance of the Hype unlock.

Options Positioning Shows Mixed Investor Sentiment

According to market data, there is no apparent agreement regarding the way the HYPE unlock will impact price direction. Although there is fear of short term pressure, the accumulation trends and those of positioning options indicates that the market is not entirely bearish.

Analyst Teng Yang had an average view, as he said:

“IMO the team will sell tokens, but impact probably not as steep as people fear (e.g. OTC, slow drip). More diamond-handled compared to if this were a VC unlock.”

HYPE is a token I watch closely, so some quick thoughts.

the question I ask is: how much of the unlock selling has been frontrun these past 3 days?2 variables:

A. $$ that team will actually be selling (~$300M of unlocks on 29 Nov, then monthly)B. $$ from people who sold but… https://t.co/UXJbmbsrGE

— Teng Yan · Chain of Thought AI (@tengyanAI) November 22, 2025

With the November 29 HYPE unlock within sight, everybody is wondering whether the level of 28 will hold and whether the confidence of investors can absorb the inflow of supply without an additional correction being triggered.

Conclusion

As the HYPE unlock approaches, market sentiment remains cautious yet resilient. Mixed accumulation trends, positioning under strategic options, and inflows under self-custody indicate that the effect on prices could be limited. Analysts see a controlled release, and the level of $28 will serve as support, and the investors are watching, but cautiously optimistic of stabilizing the situation in the near future.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

Summary

- Hyperliquid unstaked $316M in HYPE ahead of a 10M-token unlock on November 29.

- Analysts flag weak spot demand and a potential $400M supply overhang.

- Options data signals strong support near $28 despite expected volatility.

- Exchange outflows show accumulation, suggesting the unlock impact may be limited.

Glossary of Key Terms

Unstaking: Removing tokens from staking so they can be sold.

Circulating Supply: Amount of tokens currently available on the market.

DeFi Farming: Earning rewards by interacting with DeFi protocols.

Short Selling: Betting that a token’s price will fall.

Tokenomics: A project’s supply, distribution, and economic design.

FUD: Fear, uncertainty, and doubt affecting market sentiment.

Buybacks: When a project repurchases its own tokens.

Options Data: Market information showing trader expectations.

Put Options: Contracts used to hedge against price drops.

OTC (Over-the-Counter): Large trades executed off exchanges.

Frequently Asked Questions about HYPE Unlock

1. Why did Hyperliquid unstake $316M in HYPE?

To prepare for the upcoming token unlock and potential liquidity needs.

2. How many tokens will be unlocked?

10 million HYPE, about 3.6% of the circulating supply.

3. Will the unlock hurt HYPE’s price?

Analysts are split, but options data and accumulation suggest limited downside.

4. Why is the $28 level important?

It’s a key support zone and previous breakout level traders expect to hold.

References

Read More: Hyperliquid Unstakes $316M in HYPE Days Before Major Unlock">Hyperliquid Unstakes $316M in HYPE Days Before Major Unlock

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.