How to Buy Curve DAO Token (CRV)

8

4

Curve Finance is an Automated Market Maker (AMM)-based decentralized exchange (DEX) that connects users interested in swapping stablecoins. The platform’s AMM enables users to trade stablecoins from a liquidity pool without needing to find buyers and sellers. The protocol ensures low fees and minimal slippage by identifying the ideal routes for exchange.

CRV is the Curve DeFi protocol's native utility token and governance token.

This review will look into Curve DAO features and provide potential investors with a tutorial on how to buy CRV.

Let's get started with an easy step-by-step guide on buying CRV!

Key Takeaways

- Curve Finance is an Automated Market Maker (AMM)-based decentralized exchange (DEX) that enables users to trade stablecoins from a liquidity pool without needing to find buyers and sellers.

- The system enables minimal slippage and low fees by finding the best routes for users’ swap requests.

- You can buy Curve DAO tokens on centralized and decentralized cryptocurrency exchanges by registering an account and depositing funds.

- Curve liquidity pools incentivize users to become liquidity providers by depositing their tokens into the pools to keep the price satisfactory and get rewards.

- Curve charges low trading fees while also providing efficient fiat savings accounts for liquidity providers.

- Curve ensures investors avoid volatile crypto assets while still earning high-interest rates from lending protocols by focusing on stablecoins.

Step#1: Choose a Crypto Exchange

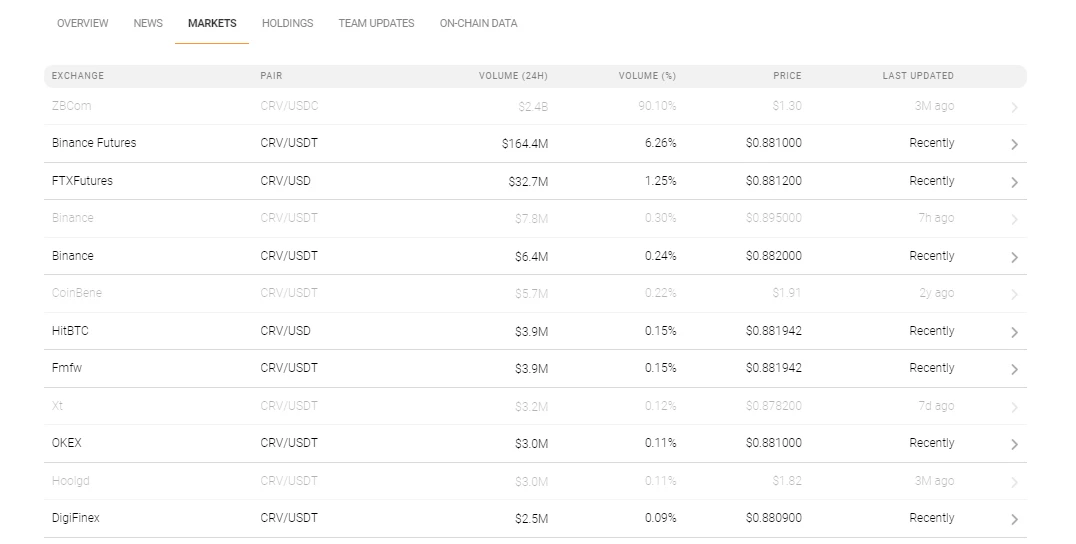

Curve DAO token is available on several cryptocurrency exchanges. Visit the market page on CoinStats to view the exchange platforms supporting CRV. Compare the exchanges’ security, user experience, fee structure, supported crypto assets, etc., to choose the one with the characteristics you need, such as affordable transaction fees, an intuitive platform, round-the-clock customer service, etc. Also, consider whether the cryptocurrency exchange is regulated by the Financial Industry Regulatory Authority (FINRA) and allows you to buy crypto using your preferred payment method.

In the crypto world, any trader is confronted with the initial choice between centralized and decentralized crypto exchanges, so let's look into the details of each type below.

Centralized Exchange

A centralized crypto exchange or CEX, such as Coinbase, eToro, Binance, etc., is governed by a centralized system and charges specific fees for using their services. Most crypto trading takes place on centralized exchanges, allowing users to convert their fiat currencies directly into crypto easily. Centralized exchanges require their users to follow KYC (know your customer) and AML (anti-money laundering) rules by providing some information and personal identification documents. However, a CEX holds your digital assets on its platform while trades go through - raising the risk of hackers stealing the assets.

Decentralized Exchange

On the other hand, a decentralized exchange (DEX), like Uniswap, SushiSwap, Shibaswap, etc., is not governed by any central authority; instead, it operates over blockchain and charges no fee except for the gas fee applicable on a particular blockchain, i.e., on the Ethereum blockchain. Decentralized exchanges use smart contracts to let people trade crypto assets without needing regulatory authority. They deploy an automated market maker to remove any intermediaries and give complete control over the funds to users. Decentralized exchanges are less user-friendly from an interface standpoint and in terms of currency conversion. For instance, they don't always allow users to deposit fiat money in exchange for crypto; users have to either already own crypto or use a centralized exchange to get crypto. It also takes longer to find someone looking to trade with you as DEX engages in peer-to-peer trade, and if liquidity is low, you may have to accept concessions on price and quickly sell or buy low-volume crypto.

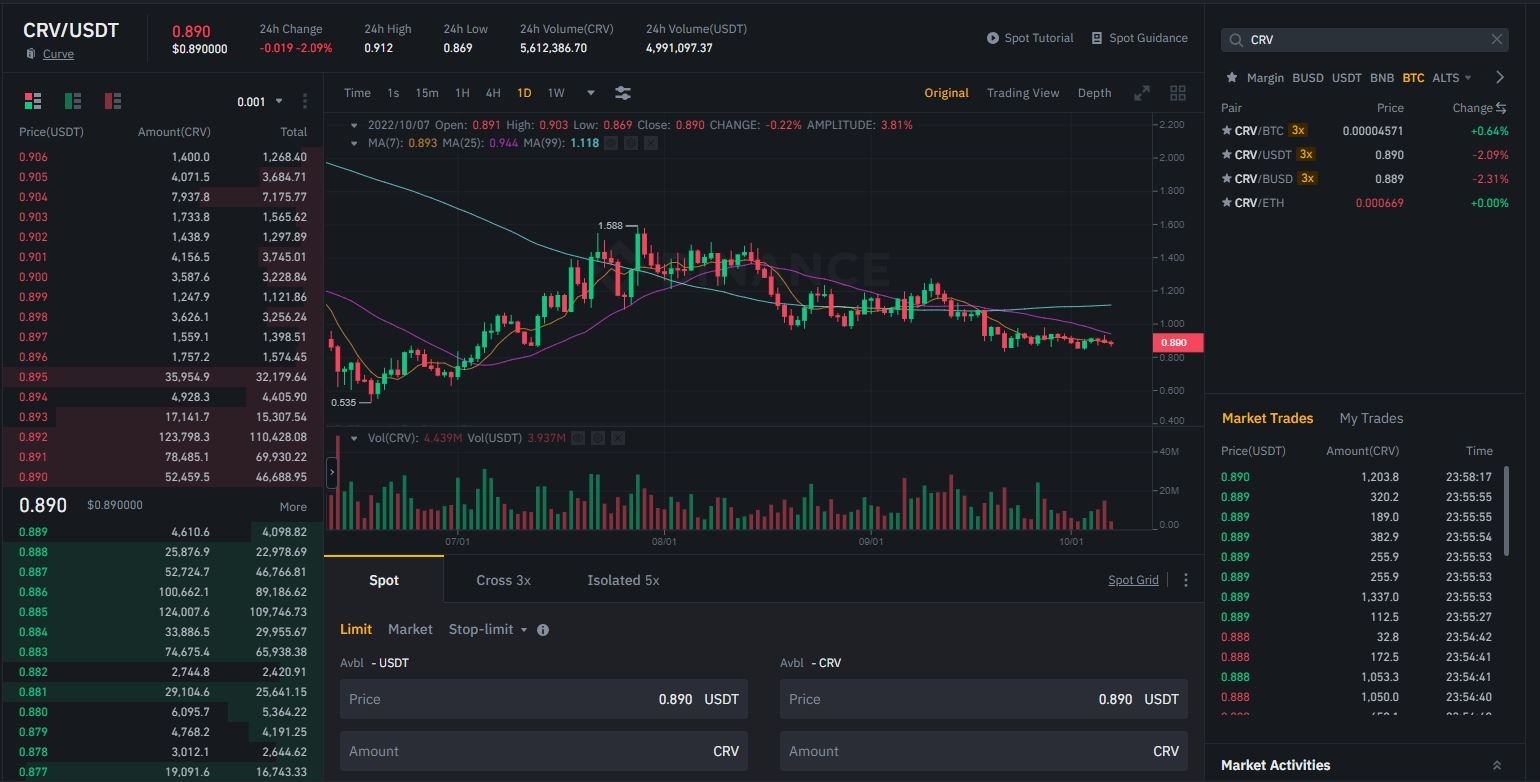

For example, we'll demonstrate the process of buying CRV on the Binance exchange below.

Step #2: Create an Account

To buy Curve DAO token CRV on Binance, you must register with the exchange through your Google account, a valid email address, an Apple account, or a valid mobile number. A link will be sent to your address, and you must click it to verify your account. Once the account is activated, you must create an elaborate password, and you’re good to go.

Binance doesn't require new users to undergo KYC (know your customer) verification straight away by providing additional documents. However, KYC verification enables you to take full advantage of the platform's services for lowers fees.

To get verified, you must provide personal information such as:

- Full name

- Residential address

- Date of Birth

- ID Document.

Sometimes, you might also need to upload a selfie or undergo video verification to finalize the process. Once your identity verification is complete, it’s recommended to activate two-factor authentication (2FA) for an extra layer of security.

Step #3: Deposit Funds

The next step is to deposit funds into your newly created Binance account to buy CRV tokens. Binance supports several deposit methods, such as a credit/debit card, a wire transfer, bank deposits from your bank account, and third-party payments, such as Simplex. The fees for buying crypto through the methods described above vary, so you should check them before making a purchase is highly recommended.

You can also link your crypto wallet to buy curve DAO token CRV with your digital assets.

Simply select your preferred deposit method, such as a bank transfer, wire transfer, credit or debit card, e-wallets, PayPal, etc., and the currency you wish to deposit. Tap on “Deposit Funds,” enter the amount you want to deposit and click “Deposit.”

Some deposit methods are extremely fast, while others require confirmation from authorities depending on the amount. Remember to evaluate the fees of different deposit methods since some have more significant fees than others.

NOTE: Binance requires users to complete KYC for fiat transactions.

Step #4: Buy Curve DAO Token CRV

Binance offers the following Curve DAO CRV trading pairs: Bitcoin (BTC), Ethereum (ETH), Tether Stablecoin (USDT), and Binance USD (BUSD).

- Go to Markets and search for CRV.

- Select a trading pair you wish to buy CRV against.

- Enter the number of CRV tokens you wish to buy and click on Buy CRV.

- The order will be filled instantly for the market price, and your newly purchased tokens will be reflected in your spot wallet. NOTE: Before buying CRV, consider that Curve DAO, or crypto assets generally, are highly volatile.

Curve DAO Token Use Cases

Congratulations! Now you're the proud owner of Curve DAO. Here's what to do with your crypto assets:

Store CRV

While your CRv tokens can be stored in your brokerage exchange wallet, experts highly recommend storing your precious coins away from exchange wallets, as those might be susceptible to hacks and interference.

We highly recommend creating a private wallet with your own set of keys. Depending on your investing preferences, you might choose between software and hardware wallets:

Software Wallets

If you’re looking to trade CRV regularly, software or hot wallets from your selected crypto exchange will suit you. The strength of software wallets lies in their flexibility and ease of use. A software wallet is the most easy-to-set-up crypto wallet and lets you easily interact with several decentralized finance (DeFi) applications.

However, these wallets are vulnerable to security leaks because they're hosted online. So, if you want to keep your private keys in a software wallet, conduct due diligence before choosing one to avoid security issues. We recommend a platform that offers 2-factor authentication as an extra layer of security.

Examples of software wallets include CoinStats Wallet, MetaMask, Coinbase Wallet, Trust Wallet, and Edge Wallet, amongst others.

Hardware Wallets

Hardware or cold wallets are usually considered the safest way to store your cryptocurrencies as they offer offline storage, thereby significantly reducing the risks of a hack. They are secured by a pin and will erase all information after many failed attempts, preventing physical theft. Hardware wallets also let you sign and confirm transactions on the blockchain, giving you an extra layer of protection against cyber attacks. These are more suitable for experienced users who own large amounts of tokens.

Ledger hardware wallets are arguably the most secure hardware wallets letting you securely manage your digital assets.

Examples of cold wallets are Trezor Model T, Ledger Nano X, CoolWallet Pro, KeepKey, Ellipal Titan, and SafePal S1, amongst others.

Stake Curve DAO CRV

You can also earn rewards with your Curve DAO token by staking it instead of idly storing it in a crypto wallet. Many popular cryptocurrencies offer staking options.

NOTE: As the crypto market is highly volatile, staking is a high-risk endeavor. However, it promises high rewards as well.

Staking is like owning a savings account in a bank. With crypto staking, you lock a certain amount of coins on a platform that supports CRV-staking, like Binance, to receive annual yields (APY).

Track CRV

The crypto market is volatile, and managing your portfolio could get tricky if you hold multiple assets. Utilizing a portfolio tracker will help you keep track of your Curve DAO token and all your crypto investments from one platform at all times. CoinStats offers one of the best crypto portfolio trackers in the market; you can find more information here.

You can also monitor the profit, loss, and liquidity of Curve DAO across several exchanges on CoinStats.

CoinStats supports over 250 cryptocurrency exchanges and over 7,000 cryptocurrencies. It offers charting tools, analytical data, advanced search features, and up-to-date news. Here you have the opportunity to connect an unlimited number of portfolios (wallets and exchanges), including:

- Binance

- MetaMask

- Trust Wallet

- Coinbase

- Kraken

- Kucoin

- Bitstamp and 500 others.

To connect, go to the CoinStats Portfolio Tracker page and:

- Click Add Portfolio and Connect Wallet.

- Click the wallet you want to connect to (e.g., Ethereum Wallet).

- Input the wallet address and press Submit.

Now that you have a better idea of how to buy Curve DAO and what to do with it, it's high time to present the digital asset and the platform it represents.

Pro-Tip

We highly recommend storing your precious coins away from exchange wallets in secure hardware or software wallets. You can also earn rewards with your Curve DAO token by staking it instead of idly storing it in a crypto wallet.

What Is Curve DAO?

Curve Finance is a blockchain-based decentralized exchange (DEX) built on Ethereum and based on an automated market maker (AMM) principle. It's a non-custodial financial platform that enables cryptocurrencies to be swapped using liquidity pools instead of having buyers and sellers by connecting users with exchange protocols.

The system enables minimal slippage and low fees by finding the best routes for users’ swap requests. In so doing, Curve uses liquidity pools, i.e., shared funds backed by digital tokens locked in smart contracts. Liquidity pools incentivize users to become liquidity providers by depositing their tokens into the pools to keep the price satisfactory and get rewards. Curve charges low trading fees while also providing efficient fiat savings accounts for liquidity providers. Moreover, it ensures investors avoid volatile crypto assets while still earning high-interest rates from lending protocols by focusing on stablecoins.

Curve also launched a decentralized autonomous organization (DAO) with CRV as its native token.

Curve DAO Founders

The Curve DAO platform was founded by Michael Egorov, CEO of Curve DAO, a Russian scientist and cryptocurrency expert. The CRV token was launched in 2020 and became one of the popular asset pools for swapping Bitcoin and stablecoins.

Egorov has prior experience with cryptocurrency-related companies and is also the founder of the decentralized bank and loans network LoanCoin. In 2015, he co-founded and became CTO of NuCypher, a cryptocurrency business building privacy-preserving infrastructure and protocol.

Curve’s team participates in the CRV allocation structure and receives tokens according to a two-year vesting schedule, which is a part of the initial launch plan.

In August 2020, Egorov awarded himself 71% of governance by locking a large amount of CRV; however, he later called the act an "overreaction."

What Makes Curve Unique?

Curve DAO stands out thanks to its technology and technical capacity, which makes Curve.fi a popular DeFi exchange. The AMM operating model connects users with the best routes for their exchanges and enables them to swap tokens and stablecoins at the ideal rates. Curve involves small low trading fees and minimal slippage due to its focus on stablecoins. Moreover, users can retrieve their tokens from the platform at any time.

CRV is Curve Finance’s native utility and governance token used for governance, LP rewards, boosting yields, and token burns. By locking up CRV tokens, users vote on Curve DEX protocol decisions, such as DEX operations, fee structure modification, burning schedules, creating new liquidity pools, etc., and propose protocol updates. The longer the CRV token is locked up, the more voting power token holders have.

CRV is paid to Liquidity Providers as pool rewards and incentives based on the size of their pool share. You can also buy CRV token or earn it when depositing assets into a liquidity pool.

Curve DAO Token Today

Curve DAO daily trading volumes stood around $220 million in early October 2022.

Additionally, Curve DAO provides a wide range of services, such as yield farming and liquidity mining. As discussed earlier, it takes crypto volatility out of the picture, as stablecoins are less susceptible to market fluctuations.

NOTE: While the statement above is true, stablecoins are not immune to liquidity issues, as demonstrated by the Terra implosion earlier this year. We highly recommend traders consider the risks while investing in Curve DAO token or any other crypto asset.

Curve DAO Token CRV

The total CRV supply is 3.03 billion tokens, of which 62% is distributed to liquidity providers. The remaining tokens are distributed as follows: 30% goes to shareholders, 3% - to company employees, and 5% - to a community reserve. The shareholder and employee allocations come with a two-year vesting schedule.

The team opted against CRV pre-mine, and around 750 million were in circulation a year after its launch.

Frequently Asked Questions

Is Curve DAO Token a Trustworthy Investment?

If you want to buy Curve tokens, the investment is secure enough. The platform has been around for over two years, and the developing team is available on social media. The project is instrumental for people trading or holding stablecoins.

Can I Buy Curve Tokens With Bank Transfer?

Yes, several crypto exchanges enable users to buy Curve DAO tokens with fiat money. However, not all fiat currencies might be available on a given exchange. Also, an extra swap might be required to buy Curve.

Which Cryptocurrency Exchange Should I Choose for Trading Curve DAO Token?

As mentioned earlier, the Curve DAO token is available on multiple platforms. Both, Centralized and Decentralized exchanges feature various CRV trading pairs, enabling you to choose a cryptocurrency exchange according to your convenience and preference. While our review brought Binance as an example, other exchanges like Kraken, Coinbase, Uniswap, etc., offer CRV pairs.

Is CRV Considered a Risky Investment?

Cryptocurrency investments are risky due to their volatility. The general rule of thumb is not to invest more than you can afford to lose. However, as with other popular cryptocurrencies like Bitcoin, Ethereum, or XRP, the coins have utility, which their value stems from.

Conclusion

Curve DAO has established its place in the crypto ecosystem. The platform focuses on providing investors access to stablecoin trading. The Curve DAO token is the platform's utility and governance token.

Hopefully, this review gave you a clearer understanding of what Curve is and how to buy Curve DAO token.

If you want to learn about decentralized finance and how to make the most of it, read our guide "What Is DeFi." To learn how to manage your portfolios, visit our "Crypto Portfolio Trackers."

Disclaimer: The information contained on this website is provided to you solely for informational purposes and does not constitute a recommendation by CoinStats to buy, sell, or hold any security, financial product, or instrument mentioned in the content, nor does it constitute an investment advice, financial advice, trading advice, or any other type of advice. This is not a recommendation to employ a particular investment strategy.

Cryptocurrencies are speculative, complex, and involve significant risks – they are highly volatile and sensitive to secondary activity. Performance is unpredictable, and past performance is no guarantee of future performance. Consider your own circumstances, and obtain your own advice before relying on this information. Cryptocurrency is a highly volatile market, do your independent research and verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant Regulators' websites before making any decision.

There are significant risks involved in trading CFDs, stocks, and cryptocurrencies. You should consider your own circumstances and take the time to explore all your options before making any investment.

8

4