How to Buy Elrond (EGLD) | Where, How, and Why

The Elrond blockchain is a fast, secure, and highly decentralized platform for the new internet economy, decentralized applications, and enterprise use. Elrond was created to address the problem of traffic congestion on networks like Ethereum or Bitcoin by offering solutions for scalability. The blockchain platform uses an adaptive state sharding system to deliver faster, robust, and scalable transactions with significant throughput. The network can reportedly handle 15,000 transactions per second, making it one of the quickest blockchain networks in the cryptocurrency market.

Read on to learn everything you need to know about the Elrond blockchain, its seamless transactions, user-friendly experience, and the EGLD coin. Discover if Elrond is a good investment for the future and how to buy Elrond (EGLD) in a few simple steps.

Let’s jump right in!

What Is Elrond

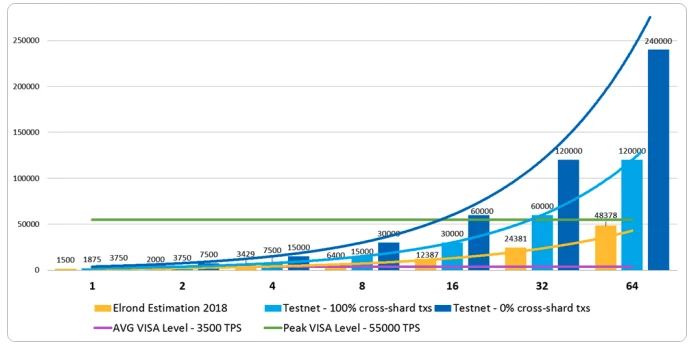

The development team describes the Elrond blockchain network as an “internet-scale blockchain” aimed at creating and developing decentralized applications (DApps), cryptocurrencies, and enterprise use cases. Elrond’s founders, Lucian Todea, Beniamin, and Lucian Mincu, established the network in 2017. Beniamin and Lucian Mincu also co-founded MetaChain Capital, a technology platform investment company, and ICO Market Data, an aggregator of data about initial coin offerings.Compared to the Bitcoin network, which can handle an average of 7 transactions per second (TPS), the Elrond network claims to achieve up to 15,000 TPS. To scale the environment for developers, Elrond uses a robust technology model based on “Adaptive State Sharding” along with a unique “Secure Proof-of-Stake (SPoS)” consensus mechanism. Elrond caters to cross-chain interoperability and maximum operational efficiency by providing developers with the most common programming languages and flexible tools. It aims to speed up transactions on the network, minimize network traffic congestion, and increase the number of TPS. Elrond rewards network participants whose computational power supports the system of smart contracts.

How Does the Elrond Network Work

Elrond achieves scalability and robust security due to the combination of the following three mechanisms:

1. Sharding Mechanism

Elrond uses Adaptive State Sharding, a function that splits the network’s infrastructure to support the increasing number of applications and transactions on the ledger. The Elrond network combines three standardized sharding methods: network sharding, transaction sharding, and state sharding to create a well-balanced, high-performance system.

Network Sharding: It dictates the way network nodes are allocated and mapped in specific shards to optimize communication and message propagation inside a shard.

Transaction sharding: It determines how transactions are assigned to shards where they will ultimately be processed. For instance, a transaction could be assigned to a specific shard based on the sender’s address.

State sharding: It’s one of the most complex methods to implement where every shard maintains only a portion of the state. If the accounts involved in a transaction reside in different shards, executing that transaction will require the state to be updated in both shards and involve the exchange of messages between the nodes of the two shards. For better resistance to malicious attacks, the nodes in the shards are programmed to be reshuffled from time to time. State sharding increases the transaction throughput due to parallel transaction processing while also lowering the transaction fees to $0.001 per transaction with a six-second latency rate.

2. Elrond’s Proof-of-Stake (PoS) Algorithm

The Elrond network has its own Proof-of-Stake (PoS) consensus algorithm called “Secure Proof of Stake (SPoS).” It uses three specific nodes (nodes can be servers/smartphones/computers) to relay and process data on the network using the Elrond node client software. The three nodes are:

Validators: Functioning as the primary nodes on Elrond, Validators process transactions on the network in exchange for EGLD. They add new blocks to the Elrond blockchain, put up collateral (or stake) Elrond EGLD tokens to process transactions, and participate in the consensus mechanism. Validators are rewarded for their service by the protocol.

Observers: Observers are passive network members that read and relay network information. They don’t need to stake EGLD coins to participate in the network and are not compensated for their services on the network. Observers can either maintain the whole blockchain history or keep only two epochs of blockchain history.

Fishermen: Fishermen nodes verify block data and challenge invalid data once it has been processed by validator nodes. They are awarded for detecting malicious actors on the network. Observers or validators who are not part of the current consensus round can fulfill the role of Fishermen nodes.

The Elrond Network’s SPoS mechanism achieves high transaction throughput by choosing instantaneous randomized validators, enabled by blockchain sharding. Validator nodes are then randomly assigned to individual shards so that each validator only has to confirm the data held on its particular shard and not all of the data held on the blockchain.

3. Smart Contracts on Elrond

The Elrond Virtual Machine (VM), or Arwen WASM Virtual Machine, was designed to build smart contracts on the Elrond platform. It supports familiar programming languages like Rust, C/C++, C#, Go, Typescript that can compile Web Assembly smart contracts. The Elrond VM’s smart contract engine is fully compliant with the Ethereum Virtual Machine (EVM). Ethereum smart contracts can seamlessly run on the Arwen WASM VM, which is also designed to achieve full interoperability between external blockchain systems, helping enable the exchange of value and data between multiple blockchain protocols. Developers who use the Elrond network to build a smart contract can earn 30% of the smart contract fees as royalties.

In a nutshell, here’s how the Elrond blockchain network works – nodes are split into subsets to process transactions, then, the shards broadcast these transactions to the “Metachain,” Elrond’s central blockchain running on a special shard. The Metachain is responsible for finalizing the transactions and performing actions like notarizing and finalizing the shard block headers, facilitating communication between different shards, maintaining a registry of validators, triggering new epochs, processing challenges forwarded by Fishermen nodes, and rewarding participants on the Elrond blockchain. Every 24 hours, one-third of the validator nodes in each shard are reshuffled to a new shard to prevent collusion among validators in each shard.

What Is the Elrond Coin: EGold

EGLD is Elrond’s native coin with multiple uses on the blockchain network. EGLD has a limited supply like many cryptocurrencies, and there will only ever be 20 million EGLD available.

EGLD Can Be Used:

- As part of the platform’s governance mechanism, giving token holders voting rights and letting them vote on network enhancements

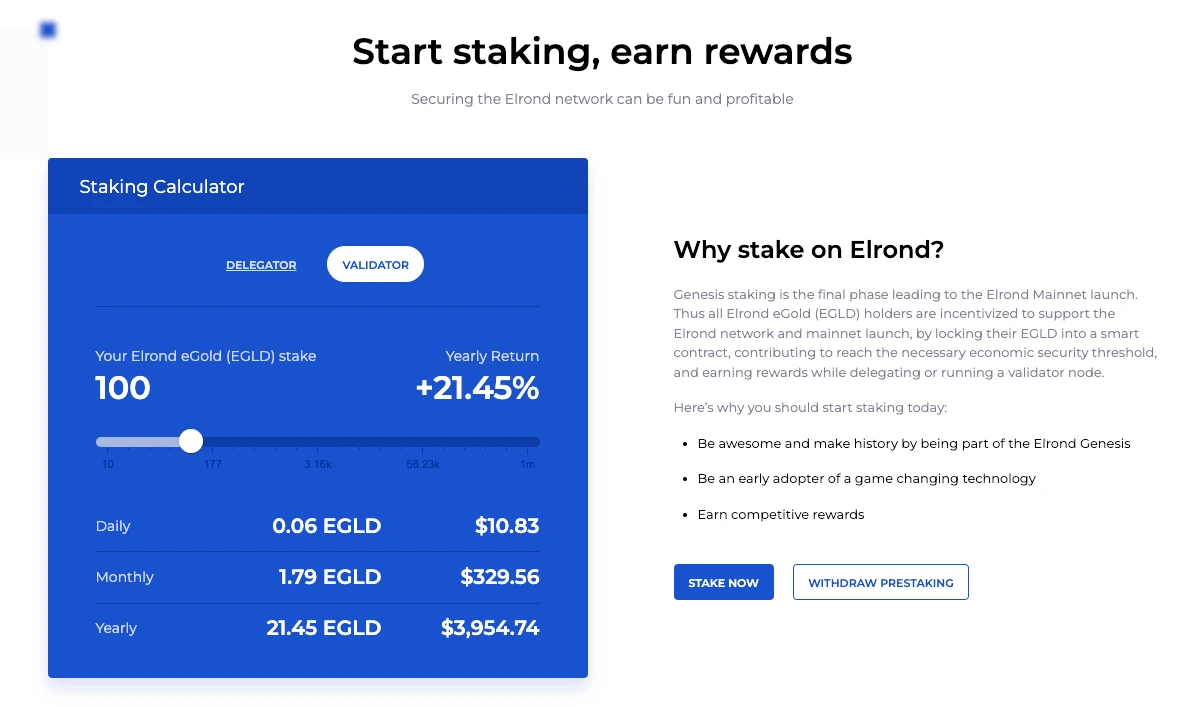

- For staking, validator, and active participation rewards

- As payment for transactions and smart contracts.

Platform users and developers pay to use the Elrond Network with the EGLD coin. The EGLD coin was designed for use with Elrond’s proprietary wallet that enables users to send transactions over the Elrond Network.

Elrond Tokenomics

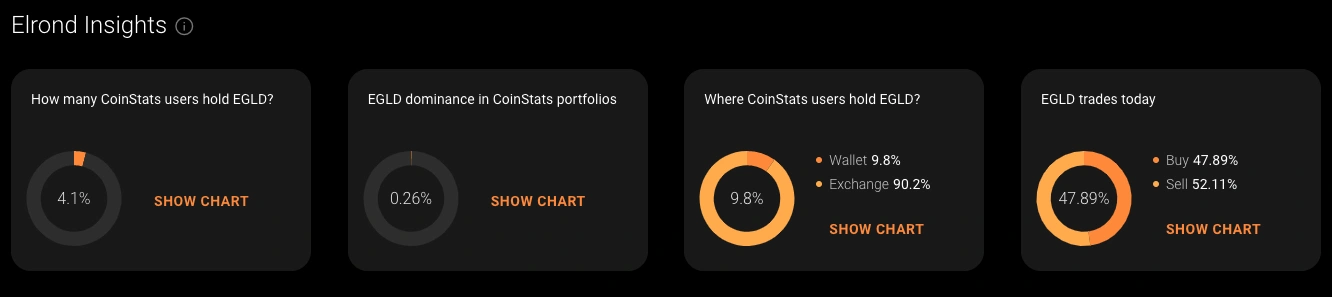

Check the real-time Elrond price, live market cap, circulating supply, maximum supply, trading volume, historical statistics, etc., along with in-depth information on several of the biggest and fastest-growing cryptocurrencies on CoinStats, one of the best crypto platforms around. You can buy, sell and trade EGLD on exchanges like Binance, ByBit, KuCoin, CoinEx.

Is Elrond a Good Investment

Elrond aims to create a new digital economy where decentralization and scalability are integral characteristics of its blockchain infrastructure. It allows users and developers to create new crypto assets and decentralized applications and conduct transactions at a low cost. The project enables scalable, robust, and secure transactions that have piqued the interest of traders globally.

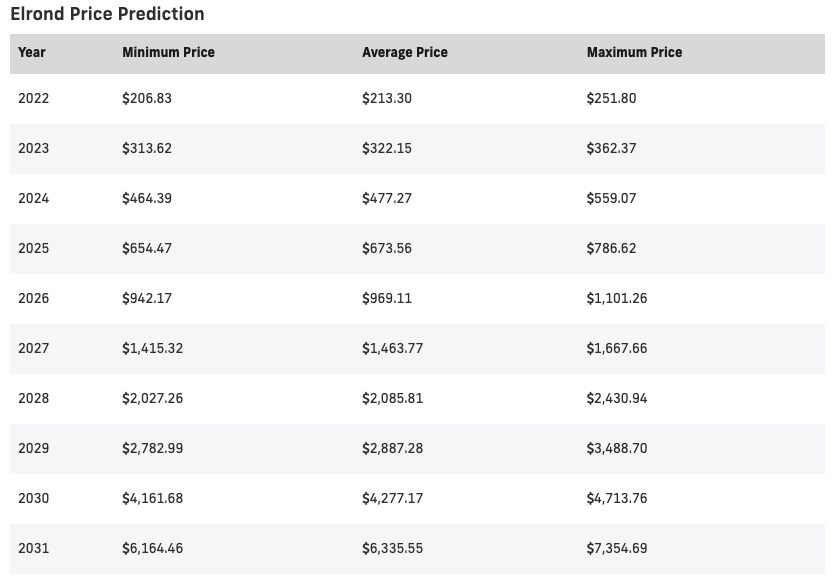

The price of Elrond is predicted to reach a maximum level of $329.21 in 2023. In 2027, the EGLD price is expected to reach a maximum of $1,515.81.

How to Buy Elrond EGLD

You can purchase Elrond EGLD from various crypto exchanges like Binance, Crypto.com, Bitfinex, etc., or through services like Moonpay and Ramp. You’ll have to compare them to choose the cryptocurrency exchange with the features you want, such as low transaction fees, an easy-to-use platform, and 24-hour customer support. Also, consider if the cryptocurrency exchange allows buying Elrond with your preferred deposit methods, such as a credit or debit card, another cryptocurrency, or a bank transfer.

Follow our step-by-step guide on how to buy Elrond EGLD below to get started:

Step #1: Create an Exchange Account

After you’ve decided on a reliable cryptocurrency exchange that supports EGLD, the next step is to open a trading account for purchasing Elrond. The requirements differ depending on the platform you pick, but most exchanges comply with KYC and ALM procedures. Personal information such as your name, contact number, email address, home address, social security number, and a copy of your driver’s license, passport, or government-issued ID will be required for most transactions. You must provide this information to be authenticated if you plan to deposit fiat currency from your bank account for purchasing Elrond.

It’s advisable to enable two-factor authentication (2FA) to keep your funds safe once you’ve verified your identity.

Step #2: Fund Your Account

You must deposit funds for buying Elrond and other cryptocurrencies. To buy Elrond, you can use a credit or debit card, bank account, or crypto from a cryptocurrency wallet. The payment method you use will be determined by your location, preferences, and platform.

Step #3: Buy Elrond

Next, look for the EGLD/USD or EGLD/BTC price chart on your cryptocurrency exchange and execute the trade. Ensure to select an order type and double-check the transaction details before confirming your Elrond purchase.

How to Store EGLD

Once you’ve completed your Elrond purchase, the next step is to select a crypto wallet to store your coins securely. Your coins can be stored in your brokerage exchange wallet; however, we highly recommend creating a private wallet with your own set of keys. Depending on your investing preferences, you might choose between software and hardware wallets, the latter being a more secure choice. Let’s look into various wallet types below:

1. Elrond Wallet

You can safely store your eGold tokens in Elrond Wallet, which comes with lower transaction fees and full custody over your funds. Maiar is another official eGold digital wallet powered by the Elrond blockchain. You can register your phone number with the wallet app to easily access your funds and activate a wallet account. You can use a passphrase to recover access in case you lose your wallet.

2. Hardware Wallets

Other options to store EGLD include hardware wallets or cold wallets like Ledger Nano S, Ledger Nano X, or Trezor. A hardware wallet is a device that stores the private keys you need to receive or send crypto. Hardware wallets are usually considered the safest way to store your cryptocurrencies as they offer offline storage, thereby significantly reducing the risks of a hack. They are secured by a pin and will erase all information after many failed attempts, preventing physical theft. Hardware wallets also let you sign and confirm transactions on the blockchain, giving you an extra layer of protection against cyber attacks. Since hardware wallets do require some technical knowledge, they’re best for

experienced traders with larger amounts of EGLD.

3. Software Wallets

Software wallets like the CoinStats Wallet are free and easy to use. They can be downloaded as smartphone or desktop apps and let you interact with several decentralized finance (DeFi) applications quite easily. Software wallets are of two types- custodial or non-custodial. In custodial wallets, the private keys are managed and backed up for you by the service provider. Non-custodial wallets make use of secure elements on a trader’s device to store the private keys. However, software wallets are vulnerable to security leaks because they’re hosted online, so if you want to keep your private keys in software wallets, conduct due diligence before choosing a wallet to avoid security issues. We recommend a platform that offers 2-factor authentication as an extra layer of security. Software wallets are best for novice users with little funds due to their ease of operation and use.

Final Thoughts

Blockchain technology is taking the world by storm. Elrond’s network strives to overcome the limitations encountered in blockchains like Ethereum and Bitcoin through its secure PoS algorithm and Adaptive State Sharding mechanism. Elrond blockchain network’s extensive scalability means that it can handle a significant number of transactions with ease. Let’s sum up the benefits of Elrond below:

- Full Decentralization – No inclusion of any third party and no single point of failure.

- Robust Security – Node shuffling to prevent significant risks from malicious attacks and conduct secure transactions.

- High Scalability – Allowing a high number of transactions to be processed per second with less energy consumption using the SPoS algorithm instead of the PoW (Proof of Work) algorithm that uses high power computational equipment.

- Low Transaction Fees – Providing reasonable trading fees or gas fees per transaction.

- Seamless Cross-chain Interoperability – Elrond’s design permits unlimited communication with external services.

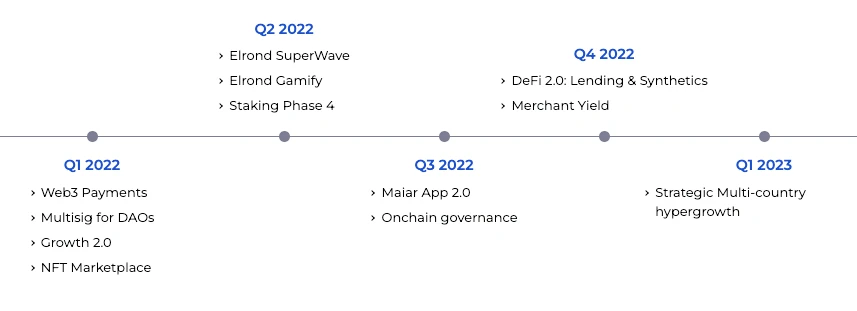

You can view Elrond’s development plan on the chart below:

Visit our CoinStats blog to learn everything you need to know about the cryptocurrency market, cryptocurrencies, best trackers on the market, blockchain technology, DeFi, etc., and explore our ultimate guides on where, why, and how to buy digital coins and tokens.

Disclaimer: The information contained on this website is provided to you solely for informational purposes and does not constitute a recommendation by CoinStats to buy, sell, or hold any securities, financial product, or instrument mentioned in the content, nor does it constitute investment advice, financial advice, trading advice, or any other type of advice.

Cryptocurrency is a highly volatile market, do your independent research and only invest what you can afford to lose. Performance is unpredictable, and the past performance of Elrond is no guarantee of its future performance. Consider your own circumstances and obtain your own advice before relying on this information. You should also carry out your own research, including the legal status and relevant regulatory requirements, and consult the relevant regulators’ websites before making any decision.

There are significant risks involved in trading CFDs, stocks, and cryptocurrencies. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider your own circumstances and take the time to explore all your options before investing in crypto trading.