The Ultimate Huobi Review [For 2023]

Huobi

Huobi Pros

- User Protection Fund

- OTC (Over-the-counter) and dark pool trading

- Fiat currency

- Mobile app available for iOS and Android

- Over 300+ cryptocurrencies

- Competitive trading fees

- 24/7 Customer Service

- Staking, margin trading, futures trading option

Huobi Cons

- Hard for beginners

- Not available for U.S. residents

- Low withdrawal limits

- No MetaTrader platforms

- Not regulated

Huobi Quick Overview

Huobi is a global crypto exchange with a rich suite of trading options and tools for crypto trading, including Spot trading, Margin trading, Contract trading, P2P exchange, and Staking.

Huobi Global, a global crypto exchange, is its most extensive offering. Huobi Global is a cryptocurrency trading platform that supports an impressive array of trading pairs and more than 200 cryptocurrencies. The exchange has 15+ fiat currencies available, alongside its own invention – HUSD, a USD-backed stablecoin. Huobi also has a token – Huobi Token, or H.T., which comes under the top 100 currencies by market caps.

The main Huobi Pro exchange supports over 100 cryptocurrencies and tokens, and it can be expected that the alternative HADAX exchange will soon support the trade of hundreds of small altcoins and tokens.

The Huobi Pro exchange platform is among the best trading platforms of traditional financial markets. Price feeds, a market chart, market depth data, and profiles describing individual cryptocurrencies are all displayed on the trading interface of the Huobi Pro exchange.

The Huobi website is user-friendly and allows beginners to easily navigate the network with its clean and friendly user interface.

This Huobi review is designed to teach you everything you need to know about this digital asset exchange and help you decide if it’s right for you.

Let’s dive in!

History

Huobi started as a global cryptocurrency exchange in Beijing and moved its headquarter to Singapore following a full-fledged ban on crypto trading platforms in the Chinese market. It has offices in multiple countries, including Hong Kong, the U.S., South Korea, Japan, Russia, etc., and caters to more than 3 million active users in over 130 countries.

Huobi was founded in China by Leon Li, a former Oracle engineer. In 2013, he bought the Huobi domain, aiming to capitalize on the steam gained around the emerging Bitcoin market before taking BTC trading live later that same year.

The exchange generated more than $4 billion in turnover in just three months after its debut. By 2014, Huobi had quadrupled its turnover, becoming Asia’s largest digital asset exchange.

According to Huobi’s filings, the exchange reported a turnover of $247 billion in 2016, almost half the share of the global cryptocurrency exchange market.

Huobi is one of the largest cryptocurrency exchange platforms with an impressive $2.3 trillion trading volume. Huobi Global is one of the top crypto exchanges as per the ranking made by Coinmarketcap.

Huobi Features

- P2P market

- Institutional trading accounts

- Margin trading

- Derivatives Trading

- 24/7 customer support

Now let’s look into Huobi’s key features in detail:

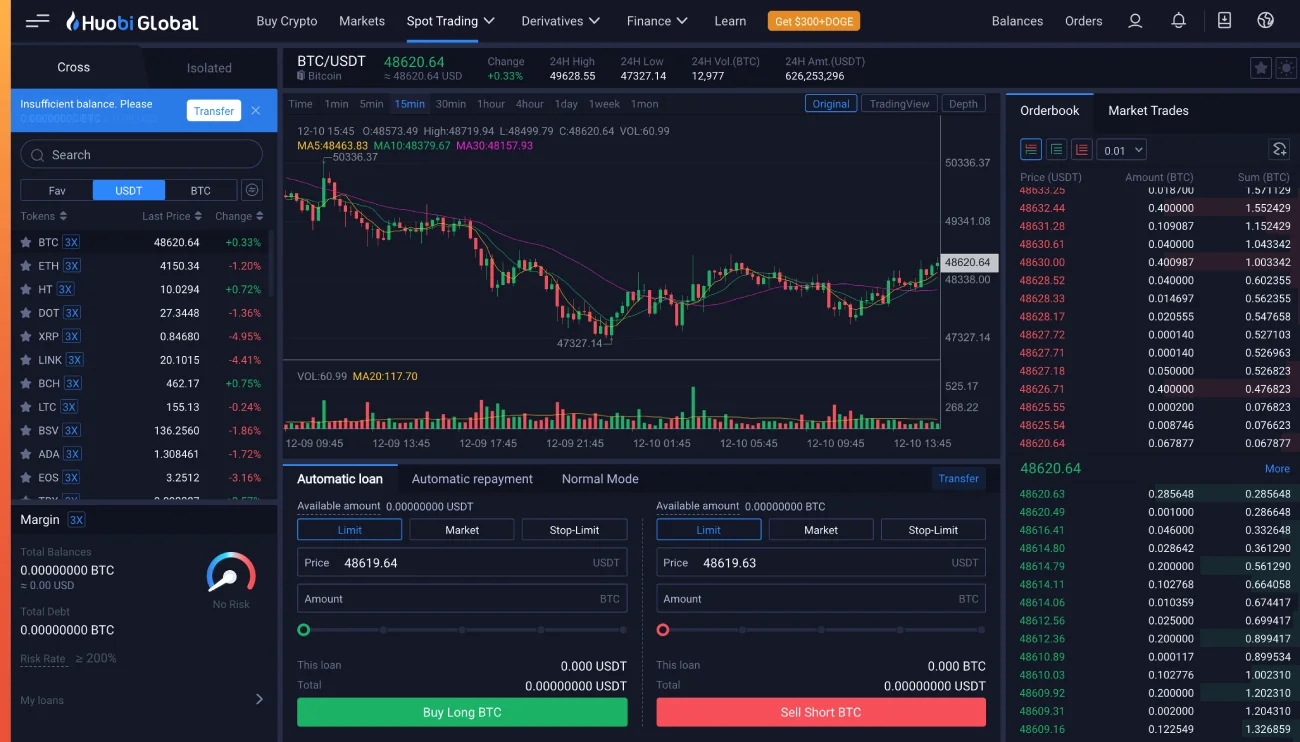

Simple User Interface

Huobi Global offers one of the friendliest user interfaces allowing new users to navigate its website easily. The trading interface includes market and pricing data sources, charting and analytical tools, etc. The HADAX alternative crypto market, which supports smaller tokens and altcoins, also benefits from Huobi’s professional interface and functionalities.

In addition, the website provides a Tradingview function where users can plot or use their favorite indicators. The platform supports over ten languages.

Multiple Order Types:

The exchange offers the following types of orders:

- Limited order

- Market order

- Stop Limit Order

The platform also enables Bitcoin and Litecoin margin trading with 5x leverage and a 0.1% fee for 24 hours.

Flash Trade

The Flash Trade enables users to test real-time trading volumes, especially during times of high volatility. This is one of the most exciting features of Huobi that integrates orders, charts, indexes, and markets for an order book.

Compatibility

The Huobi platform is compatible with multiple platforms such as Mac, Windows, iOS, and Android.

Security

The efforts made by the Huobi team to ensure the security, information, and funds of Huobi clients inspire quite an amount of confidence in Huobi. At a glance, the platform provides multiple security protocols to protect user accounts, such as 2-factor authentication and one-time password layers to keep hackers at a distance.

It also provides Singapore users’ regulatory protection in the event they lose their funds.

Customer support

Huobi provides customer support in English and Mandarin. Traders can report to the customer service agents via telephone, email, or online chat. They can also raise tickets against their issues, which will be resolved by a support member of the Huobi team within a few hours. Huobi also has several social media networks and a dedicated messaging app community.

Services

Trading Pairs

Huobi offers a wide selection of digital currencies to trade. However, Huobi’s selection of available cryptocurrency pairs focuses more on bringing in projects from Asia.

User Protection Fund

Huobi Global is in possession of a 20,000 BTC security reserve, which serves the purpose of coping with extreme security accidents. For this to happen, the platform will use 20% of the net revenue they generate to buy back Huobi Tokens, which will be placed in the Huobi User Protection Fund.

Huobi Peer-To-Peer Trading Platform

Huobi offers an easy and secure P2P (peer-to-peer) exchange that allows trading crypto directly on their own terms with 0 fees.

Spot Trading

With Huobi Spot Trading, users can purchase or sell digital assets immediately at the current market rate. Users can implement the grid trading strategy by creating a “buy low and sell high” bot to avoid erroneous trading decisions caused by human factors. Grid trading bots will then assist users in strictly implementing the “buy low and sell high” transactions strategy.

Crypto traders choose the price range and the number of grids within the price range, which will affect the profit per grid. When the price drops and hits the buy order, the bot will place a sell order one grid up from that grid. When the price rises and hits the sell order, the bot will place a buy order one grid down from that grid.

Huobi charges 0.2% in spot trading fees for both takers and makers (flat trading fee), below the average of 0.25%.

Maker refers to orders initiated to create an order book, pending matching fills.

Taker refers to orders with a matching order price in the order book and can be immediately filled.

Margin Trading

Huobi Spot Trading also has an option for margin trading, which means you can take out a loan to buy assets and repay the loan later.

Huobi offers many features in the margin trading window, such as trigger order, stop-limit, and risk rate indicator.

Alongside higher profits, margin trading comes with more significant risks. In the event of sharp fluctuations in markets, when the risk rate is ≤110%, your account will be forced into liquidation to repay the loaned coins and interest.

Huobi cross margin trading allows using the available account balance as margin. If one of your positions is losing and the other is gaining, then the one in profit can cover the losses, and you can avoid being liquidated.

Huobi isolated margin trading increases your chances of liquidation, but it reduces the chances of any further losses from your main account. It does so by handling separate margin accounts reserved for one position only, in isolation from other positions.

Huobi also has a Quick Margin function which offers automatic loan and automatic repayment trading modes.

With automatic loan mode, you can directly enter the amount that exceeds the account’s margin to place the order, and the excess part will automatically loan and accrue interest. After the trade is completed, the system will automatically use the trade’s earnings to proceed with the repayment.

Huobi Futures

Huobi derivatives offer futures and perpetual swap instruments leveraged up to 20x on the futures and 125x on the swap.

Futures trading lets users buy or sell any specific digital currency in the future on the chosen delivery date. Users can profit from the rising/falling of the prices of digital currencies by going long or selling short based on their own decision.

The Huobi Futures adopts spread delivery. All open positions will be closed at the index-based last-hour arithmetic average price when the futures trading expires.

There are four contract types available:

- Weekly: futures will be delivered on imminent Friday

- Bi-weekly: futures will be delivered next Friday

- Quarterly: futures will be delivered on the last Friday of the imminent quarter

- Bi-quarterly: futures will be delivered on the last Friday of the next quarter.

Choices of leverage: 1x, 5x, 20x, and higher leverages.

If users choose BTC weekly futures with 10x leverage, users can take 1 BTC as the margin to open long/short 10 BTC positions.

Before opening a position, users need to select the leverage. Once the leverage is set, the weekly, bi-weekly, quarterly, and bi-quarterly futures should all use the same leverage. Users cannot change the leverage unless they hold no position and have no pending orders.

Fee rates of Huobi coin-margined futures are 0.02% for makers, 0.04% for takers. Delivery fee rates for BTC are 0.015% and for other Futures – 0.05%.

Institutional Trading Accounts

Huobi provides institutional traders with one-stop professional services, including:

- Exclusive channels for institutions to ensure safe, compliant, and rapid deposit & withdrawal of high-value assets

- Trading with multiple positions and strategies capped at 1,000 sub-accounts

- Customized withdrawal and loan limits

- Exclusive and personalized on-call customer support

- Regular industry data analysis and reports on the secondary market’s investment strategy by Huobi Research and Huobi Quant Academy

- Dialogues with industry influencers on blockchain topics and digital currency development, exclusive networking with deposit-withdrawal dealers, seminars on media resources, etc.

- Participation in various high-quality investment projects for qualified institutional clients.

Huobi serves four kinds of institutional investors:

- Crypto Mining Businesses

- Digital Asset Trading Businesses

- Digital Asset Investors

- Blockchain Projects.

Huobi Coin-Margined Swaps

Coin-margined Swaps is another kind of digital currency derivative. Users can profit from the rising/falling of prices of digital currencies by going long or selling short based on their own decision.

Huobi Coin-Margined Swaps has no delivery date or trading time limits.

USDT-Margined Swaps

USDT-margined Swaps is quoted in USDT. The contract face value of USDT-Margined Swaps corresponds to its underlying asset.

USDT-Margined Swaps of all tokens use USDT as margin. Users could trade various swaps only with USDT. USDT is also used to calculate PnL.

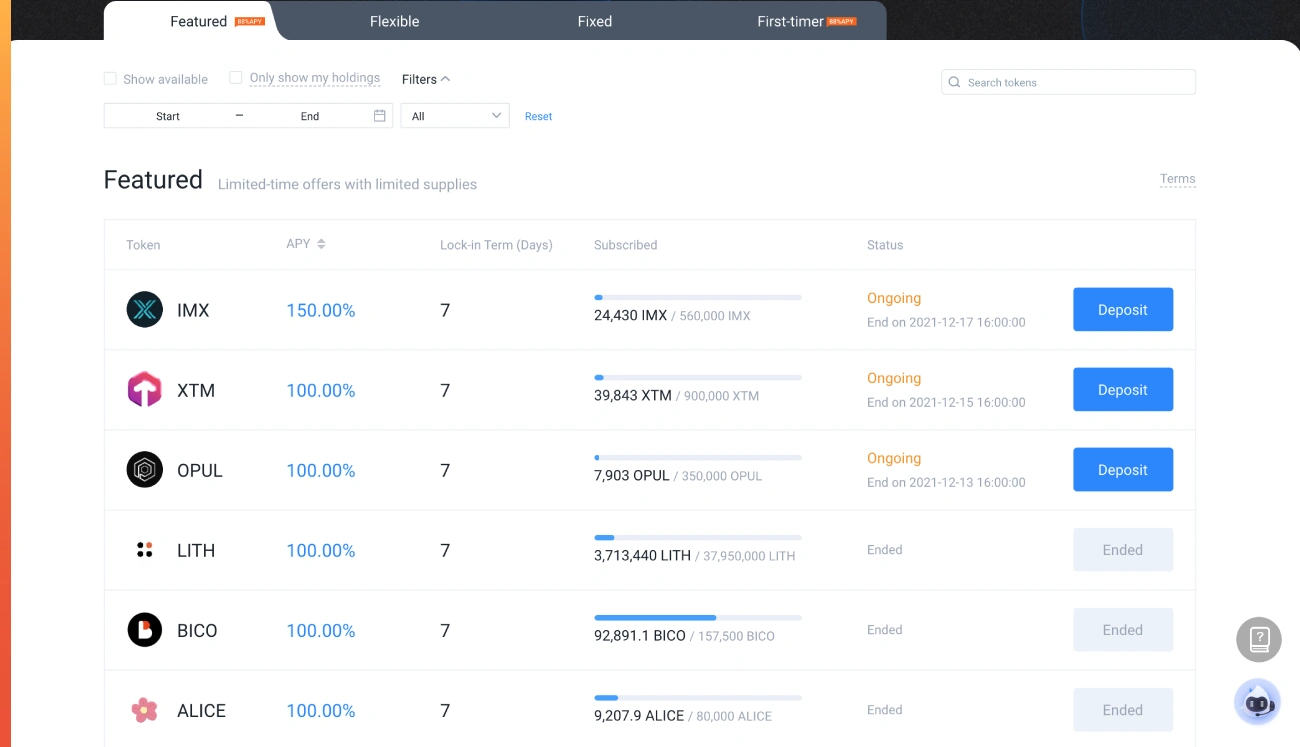

Huobi Staking

Many crypto investors love getting passive income with Staking.

Crypto staking involves “locking up” a portion of your cryptocurrency for some time as a way of contributing to a blockchain network. In exchange, stakers can earn rewards, typically in the form of additional coins or tokens. It’s like depositing money in a bank.

Huobi also has a staking feature that allows users to earn rewards for holding digital currencies within a Huobi wallet.

For example, XPRT can be staked on Huobi Global to earn an estimated reward of 30.00% APY. 100XPRT estimated earnings would be 0.0821XPRT.

Staking is suitable for crypto holders comfortable with locking in their coins for a set amount of time to accrue the staking benefits. Once the coins are staked, the Huobi wallet balance will be deducted, and the coins will be staked automatically in the pool to earn rewards.

Smart-Chain Analysis

Smart-Chain Analysis provides information to users on various blockchain assets and over 50 different trading indicators.

Huobi API

Huobi Global allows users to encrypt their trading bots via the Huobi API key or the REST API. To start operating with the Huobi API, users must first generate their API key that they should not share with anyone.

Huobi Global has developed a set of related products, including:

- Huobi Pool

- Huobi Token

- Huobi Global App

- Huobi Wallet

- Huobi DeFiLabs

Huobi Pool

Huobi pool is a universal and multi-currency mining platform, which consists of a dozen service platforms.

Launched in April 2018, with Bitcoin becoming the first cryptocurrency supported by the platform, it’s currently the world’s eighth-largest mining pool by hash rate, according to data from BTC.com.

The main feature of Huobi Pool is PoW mining and DPoS voting for the world’s largest and most professional EOS. Also, the pool has become the largest EOS voting platform in the world.

Huobi POW mining advantages:

- Exclusive hedging services used to obtain income in advance

- Low mining commissions

- Direct access to the currency trading platform

- Various types of value currencies, including BTC, ETH, DCR, ETC, and others

- Own token, the HPT

- High-quality support.

Huobi Earn

Huobi Earn is an investment product for users to manage their digital assets. Instead of just holding your assets, you may subscribe and transfer portions of your holdings into Flexible Earnings and Fixed Earnings, which will generate an APY on assets. Special “Featured Earnings” promotions are also offered periodically, subject to availability.

There is also a new user exclusive offer such as 50% APY on selected deposits.

Users are required to complete registration and I.D. verification for their Huobi account prior to usage. In addition, users’ available balances should meet the minimum subscription requirements for their subscriptions to be processed successfully.

Crypto Loans From Huobi

Huobi Loans is a service in which you can collateralize your crypto, borrow other crypto assets to meet your needs instantly, get low-interest rates and charge by the hour, get high loan limits with high LTV, receive instant approval, etc.

Your account should be KYC-verified for you to borrow loans from Huobi.

The interest is calculated based on the hourly service rate; the fees are calculated based on how long the user holds the loan.

Huobi Wallet

Huobi Wallet is a professional Multi-chain light wallet. Based on the combined security expertise and technology development of the Huobi Group in blockchain, Huobi Wallet guarantees the security of users’ assets and provides simple, convenient, and secure Digital Asset Management (DAM) services.

Key Features of Huobi Wallet:

- Multichain

- Comprehensive user interface

- Guaranteed assets

- Crypto pinning

- 1000+ tokens support

Huobi DeFiLabs

Huobi DeFiLabs is the platform for DeFi research and investment/incubation, including but not limited to loans, trading, and derivatives. It’s committed to promoting the growth of startups and the development of the DeFi ecosystem with the leading power of Huobi Group.

Huobi DeFiLabs provides:

- Huobi propaganda resources

- Professional startup tutorial

- Investment recommendation

- Ecological project cooperation

Huobi Exchange Registration

It’s quite easy to open an account on the Huobi exchange platform. Depending on your location, you need to choose between hbus.com, Huobi.com, Huobipro, or hbg.com.

Huobi US or HBUS is the right platform for U.S. users. To register, follow these steps:

Register: After choosing your platform, click on the “Register” tab on the upper right corner of its homepage. The link would redirect you to the registration page. You will then need to fill in the form.

Huobi will send an automatically generated activation email to your registered email address to activate your account. It’s recommended to add 2FA (two-factor authentication) to add layers of security for your funds and data.

Verify: After successful account creation and email address verification, Huobi will require you to verify your name and nationality. You need to upload government-issued I.D.s such as passports, driver’s licenses, social security numbers, military certificates, etc. Once the documents are uploaded, you’ll need to upload a selfie with any government-issued document and submit the snapshot of the last three deposit transactions.

Your Huobi username should be the same name used on your bank accounts to link it to your Huobi account.

Start trading: After successful verification, Huobi will direct you to a page where you can find a summary of the supported cryptocurrencies, the total supply of each currency, etc. You can now choose your preferred trading pair.

Huobi Fee Limits

Huobi fees are generally divided into: “General Tiered Fee Structure” and “Professional Trader Tiered Fee Program.”

The users whose 30-day trading volume is less than 1000 BTC fall under the first category. The basic Huobi transaction fee rate is 0.2000%. However, the amount will reduce, and the level of the user will increase with their HTC holdings. Therefore, the more HTC, the higher will be the discount on Huobi fees.

Advanced and professional traders with more than 1000 BTC as their 30-day trading volume fall under the second category. Generally, the professionals’ maker and a taker fee start with 0.0700% and 0.0850%, respectively.

Further discounts are given based on their HTC holdings and 30-day trading volume.

Huobi Withdrawal Fees and Deposits

The Huobi exchange withdrawal fee is below the industry average. This exchange charges a withdrawal fee amounting to 0.0001 BTC when you withdraw BTC. Huobi does not charge any fee for depositing funds into your account. The withdrawal fee for the seven major currencies is as follows:

- Bitcoin – 0.001 to 0.001

- Bitcoin Cash – 0.0001

- EOS – 0.5

- Ethereum – 0.01

- XRP – 0.1

- Litecoin – 0.001

- Tether – 20

Users creating an account on the platform without any KYC compliance get restrictions on the amount they can take out within a given period.

In detail, unverified Huobi account holders can withdraw up to a maximum of 0.1 BTC per day. Meanwhile, for Ethereum (ETH), the maximum withdrawal limit is up to 2.5 per day. Similarly, for Bitcoin Cash (BCH), it’s 0.6; and for Ripple (XRP) and Litecoin (LTC), it’s 2500 and 5 per day, respectively.

Payment Methods

Huobi’s exchange platform accepts two fiat currencies: the U.S. dollar (USD) and the Chinese yuan (CNY). It also accepts the two leading digital currencies: Bitcoin (BTC) and Litecoin (LTC).

Huobi Token (H.T.)

H.T. (Huobi Token) is the only token officially launched by Huobi. Huobi tokens have diverse use cases and value support but also risks of intense price fluctuations.

Huobi token was initially launched as a loyalty-building token for the Huobi exchange. Since China’s ban on cryptocurrency in 2017, the markets have experienced shallow user activity, with the future of cryptocurrency being questioned. To combat this issue, Huobi launched the token to gain user attention and give new life to the crypto exchange. The token rewards its users with low transaction fees and serves as an investment tool by being tradable with other cryptocurrencies.

The H.T. token is based on the Ethereum network and has a total limited supply of about 500 million, created by the Huobi group.

Huobi Token’s live market cap is $1.2B. It has a circulating supply volume of 161,078,564 HT coins and a max. supply volume of 500,000,000 HT alongside $1.2B 24h trading volume.

In addition, there are VIP memberships available to users who can book to reduce the same rates up to a maximum of 65%.

There are 5 VIP levels on Huobi:

- Partner – Minimum 500,000 EXP

- Ambassador – Minimum 150,000 EXP

- Premier – Minimum 30,000 EXP

- Insider – Minimum 7,000 EXP

- Advanced – Minimum 4,000 EXP

Huobi EXP stands for Huobi Experience points. Users accumulate experience points based on their trading volume and digital asset holdings maintained on Huobi Global.

Huobi Mobile App

Launched in November 2017, the Huobi Global app is available on iOS and Android. With over 1 million downloads, the app supports more than ten languages, including Italian and Traditional Chinese. Its 24/7 multilingual customer service is available through the mobile app, so any doubt or inquiries can be solved with just your phone.

The mobile app features the absolute best security to ensure that user assets are secure and allow clients to have complete control over their assets as the private keys of traders are not kept by the exchange.

Huobi has obtained multiple patents pertaining to data security which comprises security isolation along with data encryption. As the trading platform and exchange, the mobile app features multi-signature to allow multiple digital asset management.

Another advantage of the mobile app is that it’s user-friendly and features an innovative design.

The main features of the Huobi mobile app include:

1. Multi-currency trading: LTC/BTC, ETH/BTC, BCH/BTC, ETC/BTC, BTC/USDT, LTC/USDT, ETH/USDT, BCH/USDT, ETC/USDT, and more.

2. Real-time pricing

3. Professional, real-time charts and index analysis

4. Flexible trading methods: limit orders, market orders, stop-limit orders, etc.

5. Fast crediting of withdrawals and deposits

6. 24/7 multilingual customer service

7. Convenient asset search

8. Strategic and algorithmic grid trading systems

The page display has a clean design, allowing users to fully enjoy the features and tools provided.

The 4.0 update launched in October 2018 came with an excellent new feature that improved the app considerably. The “Discover” function added a section for breaking news and updates, helping users stay informed anywhere, anytime.

Another new feature was the application’s K-line chart, designed to help users better understand market movements. These charts can capture even the tiniest market fluctuations, providing significant insights and data to traders.

Security Huobi

Huobi has never experienced a security breach till now. According to Huobi, they have maximum security and risk controls, which the likes of Goldman Sachs have developed. Huobi has also set a decentralized exchange structure, reducing DDoS attacks on their infrastructure.

The exchange is built on an advanced distributed system architecture, and 98% of customer funds are held in multi-signature cold storage wallets, which means they are not accessible online. The digital assets stored in multi-signature cold wallets can be accessed through Huobi mobile app. Huobi’s data centers are covered by 24/7 security monitoring.

Security Huobi has invested a lot in security and even passed many third-party tests. Users can also enhance their Huobi security using features such as two-factor authentication, SMS and email notifications, and PGP encryption for emails. Huobi also follows a ‘Know Your Client,’ or KYC procedure that requires a verification process of submitting a photo of the trader’s Identity document and a snapshot of the latest three deposit transactions.

Huobi Customer Support

To reach its vast established customer base worldwide, Huobi offers customer services in two languages: English and Mandarin.

Users can contact customer service agents by phone, email, or online chat.

Huobi Review: Conclusion

To sum up our Huobi exchange review, Huobi is a successful exchange platform for many cryptocurrencies. It has a great user-friendly trading interface, strong storage, and an intervention fund for users. It also has an exchange application available for Windows, Mac, iOS, and Android devices.

When it comes to security, the Huobi team has taken all of the safety precautions – the 20,000 BTC substantial insurance fund keeps them well protected. Huobi seems to have it all for any investor, regardless of skill or experience.

Now, you are all set to start trading on the Huobi exchange. And don’t forget to connect your Huobi to CoinStats to start tracking all your crypto assets from one place.

The opinions expressed in this article do not constitute investment advice, and independent financial advice should be sought where appropriate. Cryptocurrency is a volatile market, do your independent research and only invest what you can afford to lose.