How to Buy Osmosis | Where, How and Why

Osmosis is a cross-chain automated market maker (AMM) protocol and a Layer-1 Proof-of-Stake (PoS) blockchain built with the Cosmos SDK. The protocol enables developers to design, build, and deploy their own customized AMMs through its on-chain governance system and many modules.

OSMO is the protocol’s native governance and utility token used to facilitate transactions, provide liquidity, stake, and vote on the platform. The protocol also has an AMM app that uses OSMO and ATOM as its base trading pairs.

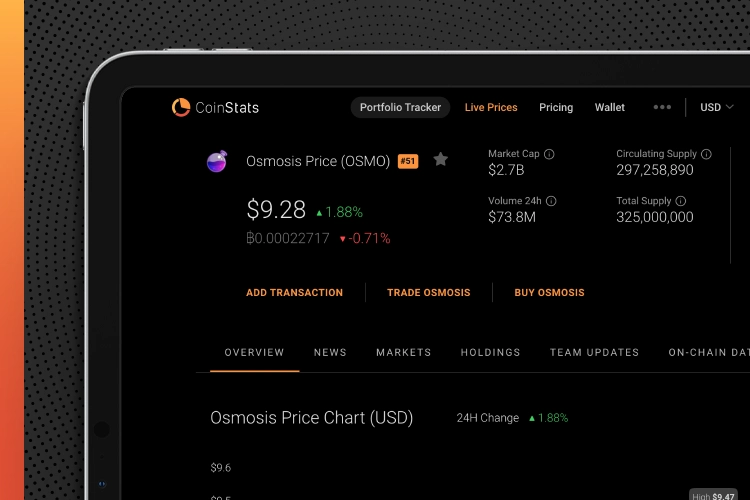

Check the current OSMO price, market cap, circulating supply, trading volume, historical statistics, price chart, etc., on CoinStats, one of the best crypto platforms around.

Read on for our ultimate post on the Osmosis blockchain and learn how to buy Osmosis in a few simple steps.

Let’s jump right in!

What Is Osmosis?

Osmosis is a cross-chain Automated Market Maker (AMM) protocol designed with the Cosmos SDK that enables developers to create, build, and deploy their own customized AMMs.

Osmosis is one of the first AMM Decentralized Exchanges (DEXs) based on Cosmos, an “Internet of Blockchains” network where developers can build interoperable DApps. It specializes in the InterchainDeFi movement (Tendermint-based blockchains) in the Cosmos ecosystem, accounting for roughly 40% of the total inter-blockchain transfers on Cosmos. Osmosis is inspired by Balancer, Uniswap, and Curve Finance, and IBC compatible blockchains (such as Cosmos, Regen, Akash, etc.) can be seamlessly swapped on Osmosis, with fees generally under $1.00.

What Is OSMO?

OSMO is the native utility and governance token for Osmosis that facilitates liquidity mining reward allocation and the base network swap fee. Superfluid Staking, the unique feature of Osmosis, makes it possible for OSMO to be used both for staking and liquidity simultaneously, letting liquidity providers or stakers earn rewards from providing liquidity and staking.

As a governance token, OSMO can be used to vote on protocol upgrades, allocate liquidity mining rewards for specific liquidity pools, and set the base network swap fee.

Why Do You Need Osmosis?

The customizability of liquidity pools, self-governing liquidity pools, and AMM as serviced infrastructure are features that make Osmosis a valuable investment.

Most major AMMs limit the adjustable parameters of liquidity pools. Uniswap, for example, only enables the creation of a pool with two tokens of equal ratio with the swap fee of 0.3%, making swapping easy for users with little or no prior knowledge in market making.

However, as the DeFi market expands, the necessity for liquidity pools that react to market conditions becomes obvious. The optimal swap fee for an AMM trade is determined by various factors, including block times, slippage, transaction fees, market volatility, etc. There is no one-size-fits-all solution, as the mix of blockchain protocol features, liquidity pool tokens, market circumstances, etc., can modify the optimal approach for the liquidity providers and market makers.

Tools provided by Osmosis enable market participants to self-identify opportunities and respond by modifying the various parameters. Rather than establishing a centrally planned “most acceptable compromise” value, an ideal balance between fee and liquidity can be obtained through autonomous experiments and iterations. This broadens the market for AMMs and bonding curves beyond simple token swaps since the constraint of liquidity pool customizability may have been a barrier for more experimental AMM use cases.

The pool self-governance feature of Osmosis allows a diverse spectrum of liquidity pools with risk tolerance and strategies to evolve. The liquidity pool shares are not only used to calculate the fractional ownership of a liquidity pool but also the right to participate in the strategic decision-making of the liquidity pool.

The idea of an ‘AMM as a serviced infrastructure’ provides the ability for the creator of the pool to simply define the bonding curve value function and reuse the majority of the key AMM infrastructure. It enables to provide of a highly efficient and accessible AMM for the majority of decentralized financial instruments.

OSMOSIS Tokenomics

According to the data on CoinStats, Osmosis has a circulating supply of 297 Million OSMO coins and a total supply of 325 Million, with a market capitalization of around $2.7 billion.

An initial supply of 100 million OSMO split between Fairdrop recipients and strategic reserve. New tokens are released in events called “daily epochs” and distributed as follows:

- Staking Rewards: 25%

- Developer Vesting: 25%

- Liquidity Mining Incentives: 45%

- Community Pool: 5%

Token inflation is based on a “thirdening” model, where token issuance is cut by a third every year.

Where Can You Buy Osmosis?

To purchase Osmosis, we’ll take the Binance exchange as an example and the Keplr wallet, the most widely used wallet interoperable with all Cosmos networks, including Osmosis. First, you’ll need to purchase ATOM on Binance and then trade it for OSMO.

Follow our step-by-step guide on how to buy Osmosis below to get started:

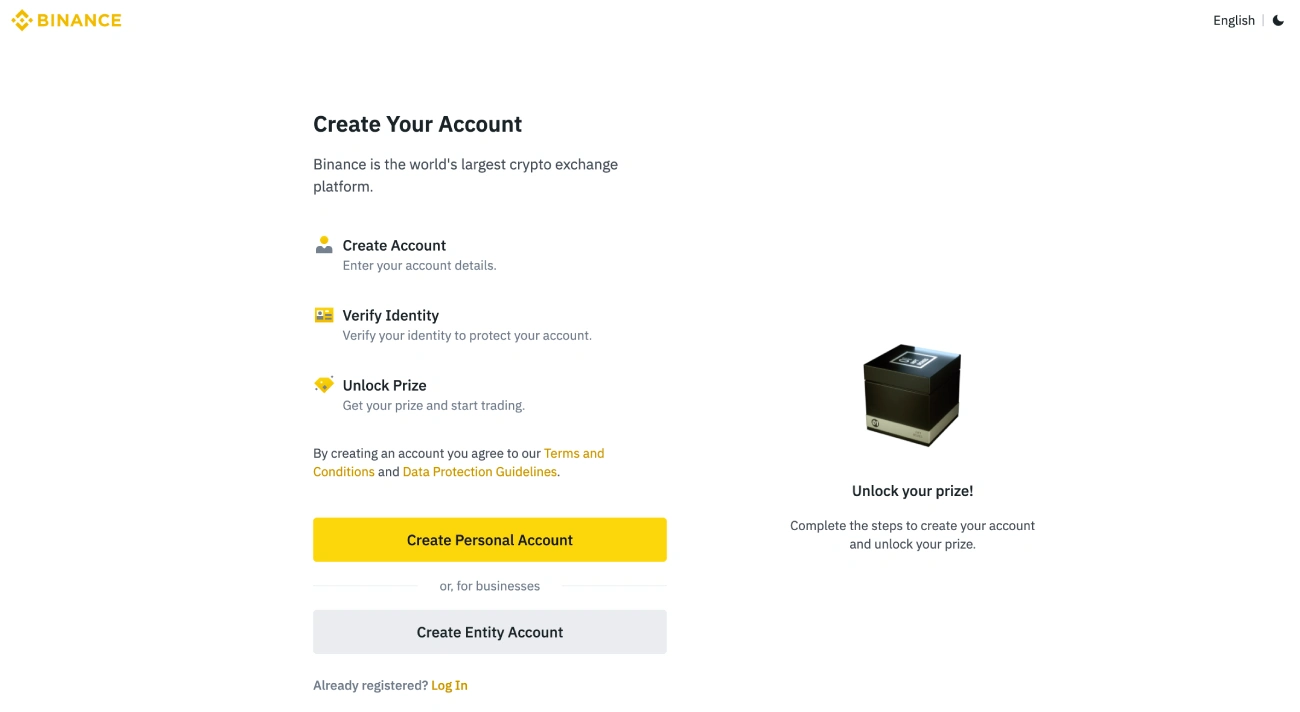

Step #1: Sign In or Create a Binance Account. To register on Binance, you need to provide an email or a phone number and come up with a secure password. KYC is not a requirement, but the lack of additional information will limit your trading opportunities on the platform. Personal information such as your name, contact number, email address, home address, social security number, and a copy of your driver’s license, passport, or government-issued ID will be required in most transactions. You must provide this information to be authenticated and start trading.

Step #2: Fund Your Account. Once your account has been verified, log in and go to the dashboard to make a deposit with your preferred payment method to purchase ATOM. You can deposit cash with your credit or debit card or a bank transfer.

Step #3: Make Your Purchase. Once your funds are in your account, go to markets and choose your currency pair with regard to USDT (Tether), for example, EUR/USDT. Once you’ve decided on a pair, go to “sell” and enter the amount you wish to swap for USDT. With the USDT purchased, you need to return to the market, search for the ATOM/USDT pair, then click on it.

Here, you will find the identical “buy and sell” panel, where you need to click on “buy” to exchange your USDT for the desired number of Cosmos. After you’ve decided on the amount, click “buy,” and you’re done.

Step #4: Withdraw Your Coins From Binance. Once you have ATOM, go to your mobile device and click on the currency or, if you’re using a computer, go to your wallet. Look for Cosmos (ATOM) and select “withdraw” from the drop-down menu. You’ll now see a window where you may withdraw your coins from Binance.

Step #5: Transfer Atoms From Binance to Keplr. Go to your Keplr wallet and click on the address underneath the name to have it copied; make sure the Cosmos network is chosen in your Keplr wallet. To transfer ATOMs from Binance to Keplr, you must input this address on Binance. It’s critical to specify the Cosmos network and the amount you wish to withdraw. The fee is only a few cents. Verify that the information is valid and that the transaction was completed using the codes. The amount of ATOM you transferred should display in your wallet in a few minutes. Always ensure that you’re on the Cosmos network, as the Keplr wallet supports a variety of networks.

Step #6: Transfer Funds From Cosmos to Osmosis. Go to the Osmosis site, link your wallet by clicking on the “connect wallet” button at the bottom left, and confirm on Keplr. With the wallet linked, select assets from the list of cryptocurrencies on the menu on the left.

Look for Cosmos (ATOM) and click the deposit button. You can check how much funds you have in the Cosmos network and transfer them to the Osmosis network. Enter the desired amount, leave some for commissions, and then click deposit. Once you’ve confirmed the transaction in your wallet, you’ll see the amount of Cosmos you have in your balance and be able to exchange it.

Step #7: Purchase Osmosis. Lastly, choose how much you want to spend; you can use the buttons to select max or half. Confirm all details, including the amount and conversion rate, and then click “Swap.” Confirm the transaction in your Keplr wallet, and you’ve GOT Osmosis (OSMO) in your wallet.

Can You Buy Osmosis on Coinbase?

Some cryptocurrencies are more difficult to obtain than others, and Osmosis is one of them. Currently, no major exchanges in the US offer this coin, and it’s not supported by the Coinbase app or Coinbase Wallet.

Can You Buy Osmosis on Binance?

You can purchase ATOM through Binance and trade it for Osmosis, as demonstrated above. You’ll need to have either Bitcoin (BTC) or Ethereum (ETH) and utilize Keplr wallet to complete your purchase of OSMO.

How Do You Farm Osmosis?

The Osmosis network is extremely user-friendly, with a simple and easy-to-understand interface. Like any other DEX, it lets you easily and quickly trade/exchange your coins, select pools to join, and track your assets. You can access pools on Osmosis through several web or mobile interfaces.

Let’s look into yield farming on the Osmosis Network with ATOM, XPRT, AKT, etc.:

- Load your Keplr wallet with ATOMS

- Transfer ATOM from Cosmos to Osmosis

- Navigate to the Osmosis Assets Page

- Move ATOM from Keplr wallet to Cosmos IBC

- Find the pools to participate

- Load up the liquidity to the LP pairs

- Bond your LP token – Choose between 1, 7, or 14-day bond

- Keep track of your investment.

FAQ

Is It Possible to Have Many Pools With the Same Trade Pairs

Yes, parameters such as exchange cost, weights, and AMM model might differ between pools (e.g., Uni v3 vs. Balancer v2). Allowing users to make different pools with the same pairings fosters exploration and creativity.

Is It Necessary to Use 50-50 Token Weights in Osmosis

No, Osmosis allows pool designers to utilize more than two items and define unique weights.

Conclusion

As the most popular DEX in the Cosmos ecosystem, Osmosis has established itself as one of the first Cosmos DApps, attracting many newbies. However, it appears that the OSMO goal is much more than being a foundational pillar in Cosmos.

With the ability to integrate other token blockchains (like ERC-20s) into a network that allows for fast and low-cost transfer, Osmosis’ future appears promising.

You can also visit our CoinStats blog to learn more about wallets, cryptocurrency exchanges, portfolio trackers, tokens, including How to buy Cosmos, and get buying guides on other cryptocurrencies.

Disclaimer: No part of the information we provide should be interpreted as financial advice, investment advice, legal advice, or any other type of advice on which you should depend for any reason.