How to Mint an NFT [The Ultimate Guide 2023]

A non-fungible token (NFT) is a digital asset that can cryptographically assign and prove ownership to unique physical or digital items, such as works of art, real estate, music, or videos.

NFTs are securely recorded on a blockchain which ensures the asset is one-of-a-kind and makes it difficult to alter or counterfeit NFTs.

Although they’ve been around since 2014, nowadays, people spend millions of dollars on NFT collectibles, from art and music to sports trading cards, digital houses, in-game items, sneakers, and toilet paper. Have you heard about the iconic GIF of Nyan Cat sold as NFT or Grimes getting millions for NFTs?

The market for Non-fungible tokens, or NFTs, was worth $41 billion in 2021, an amount close to the total value of the entire global fine art market.

With the NFT frenzy still at its high, it’s natural if you’re eager to hop on the NFT train and learn how to create NFTs, mint your own NFT, etc., to benefit from the NFT mania.

Read on to get a detailed understanding of how to mint an NFT, the technology and tools required for the minting process, and more. Fortunately, creating an NFT is not as complicated as you may think, and anyone with the correct tool and basic computing knowledge can create an NFT.

What Is an NFT?

A non-fungible token (NFT) is a unique data unit on a blockchain that can be linked to digital and physical objects, such as works of art, real estate, music, avatars, JPEGs, postcards, sports trading cards, or videos, to provide immutable proof of ownership.

The data an NFT contains can give an NFT owner access to exclusive merchandise, tickets to live or digital events, or be linked to physical assets such as cars, yachts, etc.

NFTs allow individuals to create, buy, and sell digital assets in an easily verifiable way using blockchain technology. Once NFTs have been encoded, they cannot be altered, and their originality and legitimacy are validated through the blockchain.

How Do NFTs Work?

While the NFT development helps content creators display their skills digitally and develop innovative value exchanges, the tokens need a proper standard to define how they work.

ERC-721 is the first NFT standard developed in 2018. It’s an Ethereum NFT token standard that implements API for tokens within a smart contract to ensure the token is non-fungible or unique. Moreover, it can come from the same smart contract and yet have a different value because of its age or rarity. We can trace the creation date of an NFT, the original creator, the current owner, and other unique identifiers due to blockchain’s immutability and transparency; these data are all recorded on a public ledger and cannot be altered.

While the NFT that conveys ownership is added to the blockchain, the file size of the digital item doesn’t matter because it remains separate from the blockchain.

The immutability and non-fungibility enable NFTs to be used as proof of ownership of digital assets. As the owner of an NFT, you can quickly establish your ownership and sell it for a profit, frequently referred to as “flipping,” and you can even get royalties from the original creator. As the creator or minter of an NFT, you can simply establish your ownership, define scarcity, receive royalties for each transaction, and sell across various NFT marketplaces or peer-to-peer networks.

How Are NFTs Used?

Most NFTs are created and stored on the Ethereum network, although Flow and Tezos blockchains also support NFTs. The NFT ownership can be easily verified and traced because anyone can review the blockchain.

Many artists, celebrities, and collectors are increasingly turning to NFTs that give them direct access to the global market without the need for intermediaries. NFTs let them expedite the normally costly and resource-intensive marketing process via conventional ways by minting the NFT version of their work and selling it on a credible NFT marketplace.

Furthermore, NFTs enable the ongoing payment of commissions to the original artist anytime the product or art changes hands. While minting the token, creators can build in a royalty clause so that further sales of their art or digital item generate passive income.

Different types of digital goods can be “tokenized,” such as artwork, in-game items, and videos from a live broadcast. Selling NFTs has been a lucrative business in the art world, including the following examples:

- NBA Top Shots.

- Virtual real estate in Decentraland.

- Digital artist Beeple sold “Everydays — the First 5000 Days” for $69.3 million through a Christie’s auction.

- Digital sneakers from Nike.

- A CryptoPunk NFT sold for $1.8 million at Sotheby’s first curated NFT sale.

- Twitter CEO Jack Dorsey auctions an NFT of his first tweet, which sells for $2.9 million.

- The original “Nyan Cat” meme.

How Do NFTs Benefit Digital Collectors?

An NFT is a tamper-proof ledger that authenticates and defines original digital works. Since NFTs are fundamentally unique and live on a trustless blockchain, they constitute proof of ownership and help the digital collector or investor to avoid counterfeits and keep the ownership of digital goods. Some people claim that it’s easy to make replicas of an item purchased as an NFT; however, unlicensed copies of an NFT painting don’t reduce its worth in the same way that excessive counterfeiting of a Louis Vuitton bag doesn’t diminish the value of the original goods.

How to Make NFT Art?

Digital artists who have long created art and content for social media platforms typically generate traffic and ad revenue for these platforms while receiving modest pay. NFTs have the potential to transform the entire creative economy by giving artists complete control over the digital art they create. Artists are now rewarded for their works based on how the art world perceives them.

NFTs also create scarcity that encourages collectors to seek genuine and unique digital artworks. NFT owners will also receive royalties every time the item is sold in the future.

Some of the most prominent NFT art platforms include OpenSea, Rarible, Nifty Gateway, SuperRare, Foundation, and Async Art. However, well-known auction houses such as Sotheby’s and Christie’s also sell NFTs.

You can create a digital art token by carefully following the steps below:

- Select an NFT Marketplace.

- Set Up a Digital Wallet.

- Create Your Collection: On the interface of your OpenSea account, click on My Collections. Now, customize your collection by entering a name for it, writing out the description, and uploading a display image.

- Create Your Digital Arts Token: Click on Add New Item, and upload a digital file, such as visual (JPG, PNG, GIF, etc.), audio (MP3, etc.), and 3D files (GLB, etc.), and give your token a name. You can choose to mint an unlimited number of tokens, but you do it one at a time. It’s also important to note how many editions of the same token you want to create.

- Stand-alone Token: This means you can only create one copy of that digital art token, making it even more valuable.

- The Edition Tokens: Here, you create as many copies of the same token as you want by adding the edition number.

- You can also add the creation date, properties, levels, and stats. Once you’ve added all the details, such as social links, updated image, description, and name, click “Create” to add your NFT to the blockchain. You’ll need ETH to pay the gas fees. It’s essential to be aware of the transaction fees for the blockchain you use, as these fees can make or break your budget goals.

You can also choose the payment tokens you’d accept for your digital art and the percentage of royalty to receive on the secondary sales of your artwork. - List Your Artwork For Sale: Now, you can list your NFT tokens for sale. You can either choose a fixed-price listing or auction and set your price. If it is your first time creating and selling an NFT, you’ll have to pay a gas fee before listing your artwork.

- Promote Your Work on Social Media: Share your direct link to potential buyers and promote your artwork to fans on social media to help them discover it.

How Long Does It Take to Mint an NFT?

Minting your NFT can take only several minutes if you follow our guidelines. You just need an account on an NFT marketplace and an active cryptocurrency wallet with ETH in it to start minting NFTs. Consider the transaction fees that involve the creation of the NFT.

Factors to Consider Before Minting an NFT

Although minting NFT might be pretty straightforward, there are a few things to consider before starting:

1. Blockchains

You can mint an NFT on several blockchains, among them:

- Ethereum

- Binance Smart Chain

- Cosmos

- WAX

- Tron

- Polkadot

- Tezos

- EOS

- Flow by Dapper Labs

2. The Environmental Debate

Critics argue that creating NFTs may negatively impact our environment due to hefty carbon emissions. They even think that the process of NFT creation is so toxic for the environment that it should be avoided altogether.

3. NFT Marketplace

Once you’ve decided on a blockchain for your NFT minting, another essential element is choosing a marketplace among many NFT marketplaces to offer your NFT to your consumer. Marketplace availability is based on the blockchain where you minted your NFT. Developers using the Ethereum blockchain may come across various NFT platforms, among them OpenSea, Rarible, and Mintable. Binance Smart Chain marketplaces include Treasureland, Juggerworld, and BakerySwap.

How to Mint NFTs?

OpenSea is the most popular marketplace for non-fungible tokens. Users can buy and sell NFTs on the secondary market, as well as create and sell NFT collections on the primary marketplace.

The steps involved in minting NFTs on OpenSea are outlined below:

1. Buy Ethereum (ETH)

Ethereum is the second most popular cryptocurrency after Bitcoin, supported by most NFT marketplaces. To buy Ethereum, you must first create an account on one of your preferred trading platforms.

You can purchase it from cryptocurrency exchanges such as Coinbase, Gemini, crypto.com, etc.

2. Create Your Own Crypto Wallet

After purchasing some ETH, you’ll need to create an Ethereum wallet compatible with the Ethereum network to buy and sell NFTs on OpenSea. The MetaMask wallet is the most popular crypto wallet on OpenSea. It’s also one of the most user-friendly wallets available that lets you securely store your tokens.

3. Link Your Crypto Wallet to OpenSea

You can now connect your crypto wallet to OpenSea in a few simple steps:

- Open the MetaMask plugin in your browser and type your password to unlock it.

- Go to OpenSea and click “Profile.”

- Accept the terms and conditions.

- To authenticate your account, enter your email address and username.

- A confirmation email will be sent to your email. Please click on the link to verify and complete the process.

4. Create Your First NFT Collection

After setting up your wallet and connecting it to OpenSea, it’s time to create your first NFT collection. This stage is also known as pre-mint NFTs. Follow these steps to create a collection:

- Select “My Collections” from your OpenSea profile.

- To create a new collection, click on “Create.”

- Consider this to be your digital art portfolio. You can use artwork, memes, or even cute cat pictures.

You’ll find different properties to fill in, starting with the URL of your collection on OpenSea, the description, category, and links to your website and social networks. You’ll need to insert your payout wallet address. Go to the wallet icon and click on your address; it will automatically copy it, then paste it into the required field. Next, choose the royalties and the payment tokens to buy and sell your items. After you’re done, click “Create.”

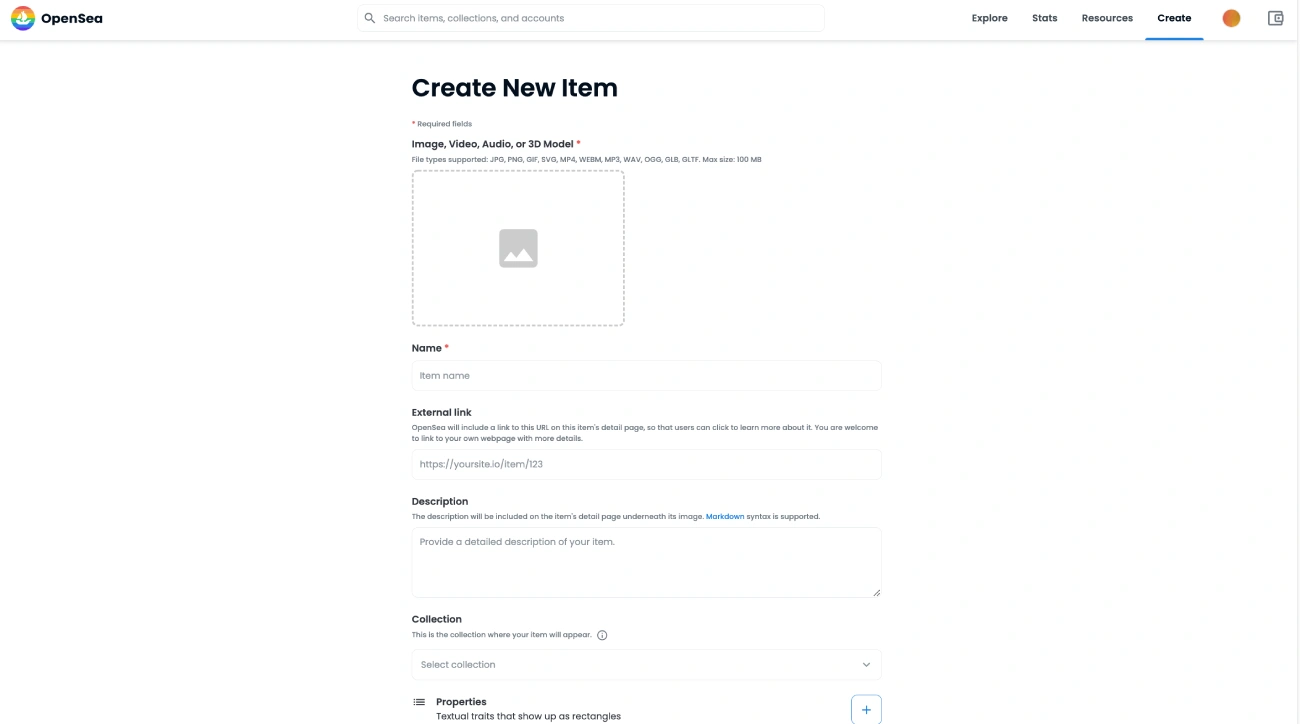

5. Mint an NFT on OpenSea

Once your initial NFT collection is complete, it’s simple to add NFTs. Simply follow the steps described below:

- Open the collection you’ve made.

- Select ‘Add New Item’ from the drop-down menu.

- Give the NFT a name and upload it.

- Fill in the properties, levels, stats, and other information about the item.

- Choose the supply, which is the number of copies that can be minted, and the issuing blockchain.

- Click on “Create,” and your new item will appear as a new NFT in your collection. You are free to offer it for sale at a set price or to the highest bidder.

OpenSea NFT Minting Fees

Before making their first transaction, all first-time vendors must pay two fees to OpenSea. You’ll have to pay gas fees for transactions on the Ethereum blockchain, and the cost may be more or lower depending on the current gas price.

The first charge to set up your account and begin selling is between $70 to $300. The second transaction costs between $10 and $30 and gives OpenSea access to your NFTs.

OpenSea collects fees in Ethereum (ETH). The price is determined by the current value of the used cryptocurrency.

Additionally, the platform takes 2.5% of every transaction on it.

After the initial sale, OpenSea doesn’t impose fees for minting NFTs.

However, Lazy Minting was launched at the end of 2020 and was quickly adopted by OpenSea. Lazy minting lets a creator or artist mint their artwork for FREE! They’ll only pay the gas fees once their artwork is purchased, and the fees will be deducted from that amount.

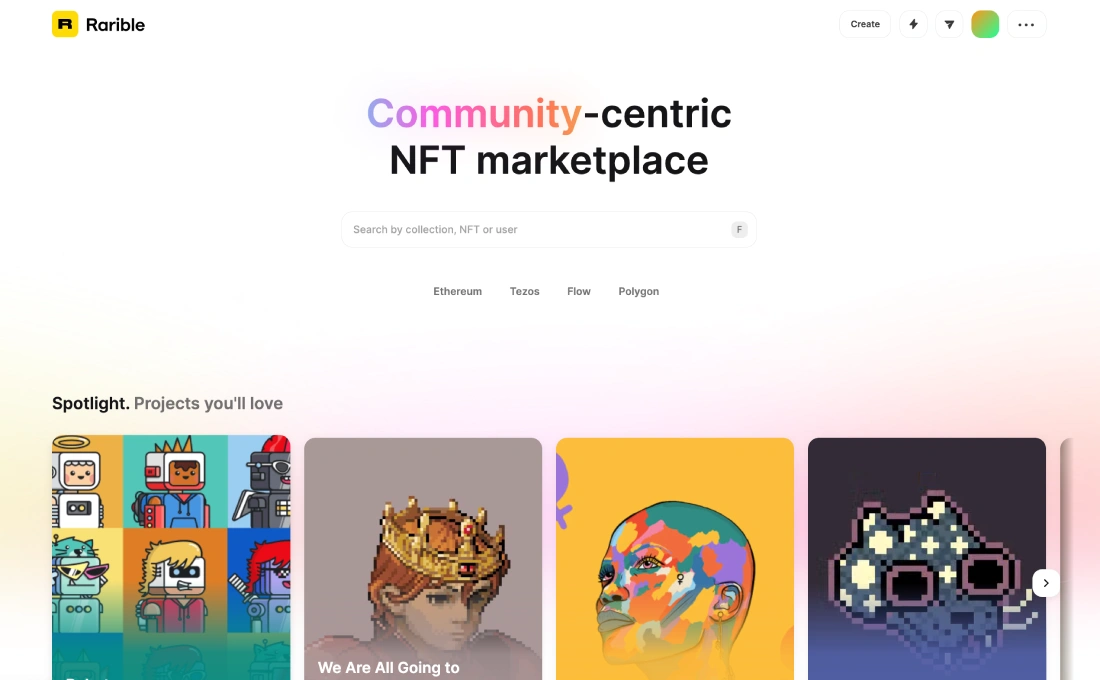

How to Mint an NFT on Rarible?

Rarible is a popular NFT marketplace with a convenient protocol that supports Lazy Minting. Here’s how to get started:

- Link your crypto wallet to Rarible.com.

- Click “Create” and enter all the details for the NFT you want to create.

- From the drop-down option, select “Free minting.”

- Click “create item” and use your wallet to sign the free authorization.

- Voilà! You can now mint for free and with ease.

After completing the buy transaction, the NFT will be minted in your wallet and instantly transferred to the new owner.

Rarible Minting Fee

Rarible charges a service fee of 2.5% per sale on both ends of the transaction, which acts as a listing fee. However, the seller can choose to take on the fee, which will cost 5% of the final sale price.

The good news is that Rarible has also adopted the “lazy minting” mechanism that lets artists, crafters, and amateurs freely mint NFTs. This is a fantastic solution for a simple alternative to mint NFT.

Other Marketplaces to Mint NFTs

SuperRare

SuperRare is a non-traditional digital art marketplace that allows users to purchase and sell one-of-a-kind digital artworks. All transactions (mining, buying, and selling) are conducted using Ether (ETH) cryptocurrency.

BakerySwap

BakerySwap is a cryptocurrency-based digital art and online gaming marketplace powered by Binance Smart Chain. BAKE tokens are the platform’s principal payment tokens. The process of minting and selling NFT is straightforward.

KnownOrigin

KnownOrigin is a digital artwork marketplace powered by Ethereum. Here, you can post digital art in GIF or JPG files that are stored on IPFS (Interplanetary File System).

What Happens After an NFT Is Minted?

When you create a new NFT, you ensure that the ownership of the artwork is recorded on the Ethereum blockchain. Each NFT has its own set of information, which is accessible in real-time on the distributed ledger by individuals worldwide.

When your NFTs are minted, you can program the royalties you wish to get in commission when your work is sold, swiftly publicize your product on social media pages or even your blog, or do a ‘drop,’ in which you set up a timed auction and wait for bids on your NFT.

If someone wants to buy your NFT after posting it for sale, they can bid on it. The records will be made public if you accept the offer. The NFT token is then transferred to the new owner, with the owner’s identity and the trade’s history and details being recorded on Ethereum’s blockchain.

How to Buy/Sell NFTs?

You’ll need a cryptocurrency wallet (Coinbase Wallet, MetaMask, or Trust Wallet), similar to the TokenMaker, and enough Ether (ETH) to buy NFTs.

WePlay Collectibles makes it simple to buy one-of-a-kind digital art through the Binance NFT marketplace. If you already have a wallet, you can use it to purchase and sell digital art on the Binance market. If not, you need to sign up for Binance and create your digital wallet.

You must have ETH, BNB, or BUSD in your Binance wallet to purchase NFTs. After crediting these cryptocurrencies to your wallet, you can bid on non-fungible tokens accessible on the Binance NFT Marketplace.

Cheaper Ways to Mint NFTs

Learning when and where fuel costs are lower than usual is crucial for saving money and spending as little as possible while minting NFTs. Fortunately, you can use tools like Gas Tracker to keep track of gas fees at all times and find the best time to mint NFT at a lower price.

NFT Alerts For Finding New Collections

Let’s have a look at some of the best tools for tracking and benefiting from the hottest and trending NFTs.

1. Dappraddar

Dappradar is a feature-rich analysis tool suitable for both expert and novice NFT investors. It offers a ranked list of all existing Decentralized Applications (Dapps) that are free to use, as well as a sectioned display that shows major features like Hot Topics, NFTs, DeFi, Exchanges, Games, and so on.

The Portfolio Tracker allows users to effortlessly assess, track, and find new projects in the NFT market, as well as manage their purchased assets. The website ranks projects based on liquidity, capitalization, and pricing using various metrics. Users are guided to the market’s real-time trading volume and price adjustments by segments for NFT top sales, top collections, marketplaces, and new projects.

2. Icy.Tools

Icy.Tools is a simple tool for tracking NFTs. Beginners love it because of its simple & transparent interface, which is ideal for doing a rapid market survey.

Users can use any wallet address to access features such as transaction history and balance searches. However, additional functions are available in the premium edition. Users who want extensive analysis, unrestricted wallet monitoring, in-depth market charts, and bespoke notifications must pay 0.03 ETH per month for the premium edition.

3. Nansen

Nansen is an analytics tool that integrates on-chain data with a massive and ever-expanding database of millions of wallet labels. Nansen’s user-friendly dashboards include features such as wallet profilers, smart alerts, top holders, token distribution information, etc.

Although rather expensive (as many similar service providers are), Nansen goes beyond tracking collectors and transactions by offering users downloadable data, additional insights and analysis, live DEX trading updates, and more. Nansen, a platform that has been operational for over a year, looks to be one of the most popular alternatives among NFT analytics providers.

Closing Thoughts

The online creator economy was an early adopter of NFTs. Converting your digital work into a blockchain-based asset is a game-changer for artists, musicians, content producers, video game developers, etc., and changes the way creators are rewarded. If you’re an artist or digital entrepreneur, the world of NFTs is worth exploring. NFTs are also perfect for hobbyist collectors who want to support a content creator or own something they’re passionate about. However, keep in mind that this trend is still in its early stages of development. Additionally, as an investment opportunity, NFTs are highly volatile, and the market is speculative – some NFTs have gained immense value over time while others have lost value.

We hope this article has helped you to understand NFTs better, how they operate in the market, the benefits and risks, and how to get started with them.

You can also visit our CoinStats blog to learn more about wallets, cryptocurrency exchanges, portfolio trackers, tokens, etc., and explore our in-depth guides on various topics such as What Are Blockchain Layers and How Do They Work, What Is DeFi, How to Buy Cryptocurrency, etc.

Investment Advice Disclaimer: All information provided in or through the CoinStats Website is for informational and educational purposes only. It does not constitute a recommendation to enter into a particular transaction or investment strategy and should not be relied upon in making an investment decision. Any investment decision made by you is entirely at your own risk. In no event shall CoinStats be liable for any incurred losses. See our Disclaimer and Editorial Guidelines to learn more.