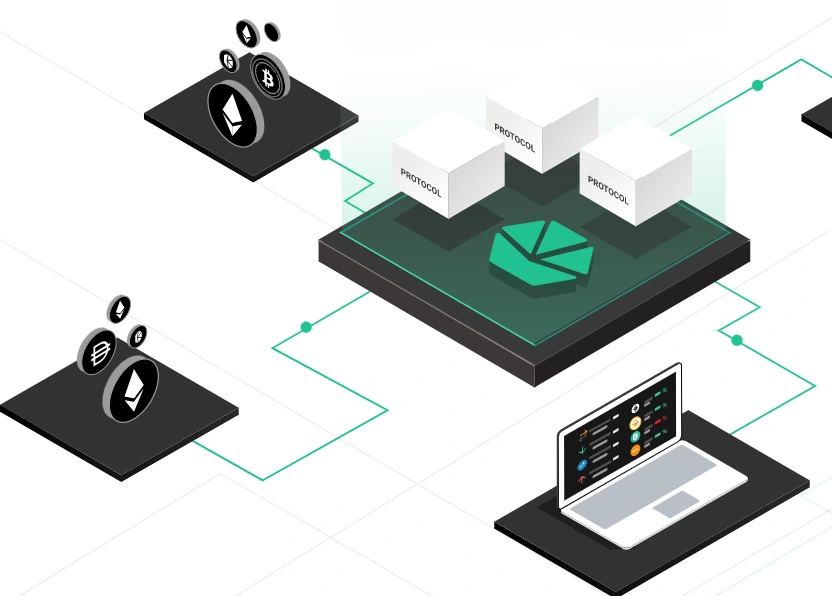

Kyber Network is a multi-chain crypto trading and liquidity hub that connects liquidity from different sources to enable trades at the best rates. As a decentralized protocol, Kyber Network facilitates cryptocurrency exchanges without KYC or a middleman and enables on-chain transactions that are entirely transparent and verifiable.

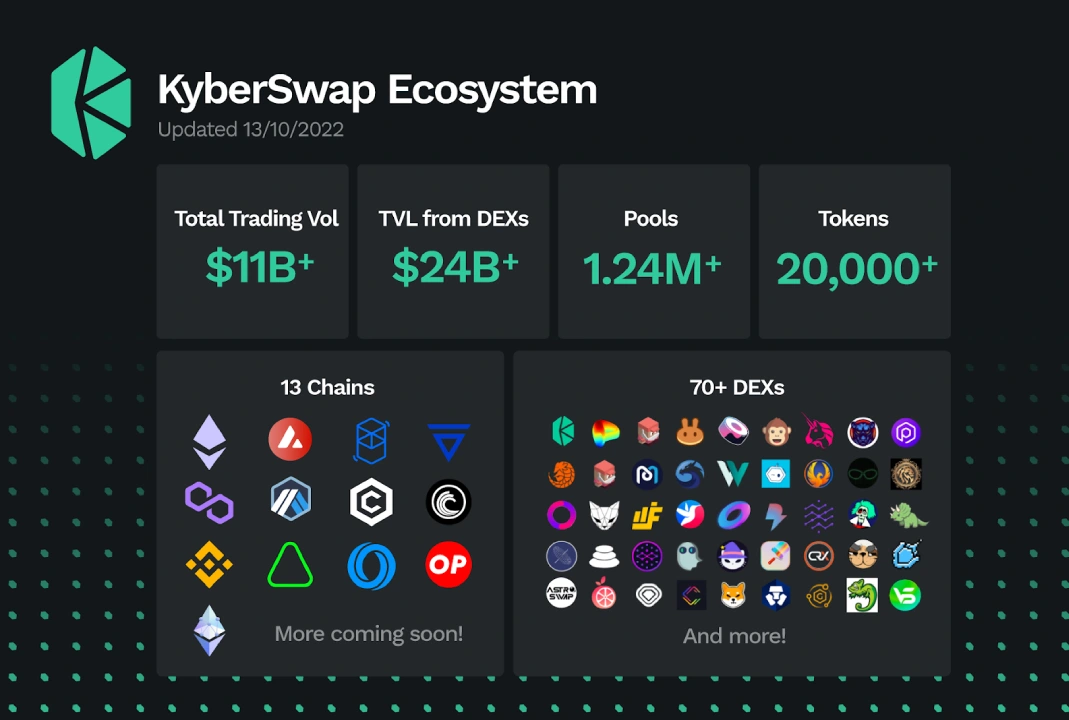

KyberSwap, the network’s flagship product, is a next-gen DEX aggregator that enables users to swap, earn, and seamlessly participate in DeFi on each of the 13 supported chains. As a DEX aggregator, KyberSwap sources liquidity not only from its own pools but also from over 70 DEXs across its supported networks and is equipped with yield optimization protocols to ensure the best rates and returns.

This Kyber Network review will look into the Kyber Network, its services, products, trading fees, etc., and assess the KNC tokens’ long-term adoption potential and use cases.

What Is Kyber Network?

Kyber Network’s goal is to make Decentralized Finance accessible, cheap, fast, and secure for all users.

A pioneer in the DeFi space, Kyber Network launched in 2017 under Vitalik Buterin’s mentorship with a successful ICO raising $52 million. Kyber Network has evolved to a project committed to making DeFi easy and accessible for all – including KyberSwap, the most advanced DEX & Aggregator in DeFi, KyberDAO, the governance community at the forefront of DeFi, and Kyber Ventures, Kyber’s investment arm supporting Web3 founders to build the future of decentralized technologies.

Over the past 5 years, Kyber Network has been driven by innovation and dedication to become one of the top DEXs in the DeFi space. Their core product, KyberSwap, is a next-gen DEX aggregator providing the best rates for traders and maximizing returns for liquidity providers in DeFi.

As a decentralized exchange, KyberSwap connects traders to liquidity pools rather than an order book. The protocol’s smart contracts provide liquidity and enable users to complete transactions without intermediaries.

Currently deployed on 13 chains, including Ethereum, Polygon, BNB, Avalanche, Fantom, Cronos, Arbitrum, BitTorrent, Velas, Aurora, Oasis, and Optimism, KyberSwap aggregates liquidity from over 70 DEXs to give users the best rates possible for their swaps.

For liquidity providers, KyberSwap has a suite of capital-efficient protocols designed to optimize rewards. KyberSwap Classic’s Dynamic Market Maker protocol (DMM) is DeFi’s first market maker protocol that dynamically adjusts LP fees based on market conditions, while KyberSwap Elastic is a tick-based AMM with industry-leading liquidity protocols and concentrated liquidity, customizable fee tiers, reinvestment curve and other advanced features specially designed to give LPs the flexibility and tools to take earning strategies to the next level without compromising on security. Liquidity providers can add liquidity to KyberSwap pools and earn fees and incentive rewards.

To date, KyberSwap powers 100+ integrated projects and has facilitated over US $11 billion in transactions for thousands of users since its inception.

Despite its similarities with other exchanges, Kyber provides a unique platform to users enabling them to easily trade one token for another through a liquidity pool by combining several cryptocurrencies.

What Makes KyberSwap Unique?

The introduction of decentralized exchanges bridged shortcomings in centralized systems’ operations, such as increased expenses and taxes, sluggish transaction rates, indiscriminate wallet locking, increased exposure to insecurity, etc.

However, decentralized exchanges also have vulnerabilities, including significant expenses for trade modifications in order books and lack of liquidity, a key component in the DeFi ecosystem. Kyber Network Crystal introduces the KNC and develops liquidity pools by collecting liquidity from various digital tokens.

The Network makes the liquidity pools always available to investors. As a result, investors who don’t have booking orders can trade directly from their wallets. However, traders will maintain custody of their tokens throughout the process.

KyberSwap facilitates swapping cryptocurrencies at the lowest possible cost for each protocol transaction.

Kyber Network is also compatible with other protocols and is called a developer-friendly project by the crypto community. The protocol that wishes to connect with KNC must operate on a blockchain-powered by smart contracts.

Several companies, DApps, and wallets have already integrated the Kyber platform into their projects or businesses, such as InstaDApp, MetaMask, SetProtocol, bZx, AAVE, Coinbase, etc. According to the Kyber Network website, the project has already received over 100 integrations.

Kyber Network Features

The Kyber Network is not just a decentralized cryptocurrency exchange but also a digital asset transfer platform. It facilitates the exchange process by allowing users to transmit tokens and receive any token they choose. Let’s have a closer look at its features.

KyberSwap

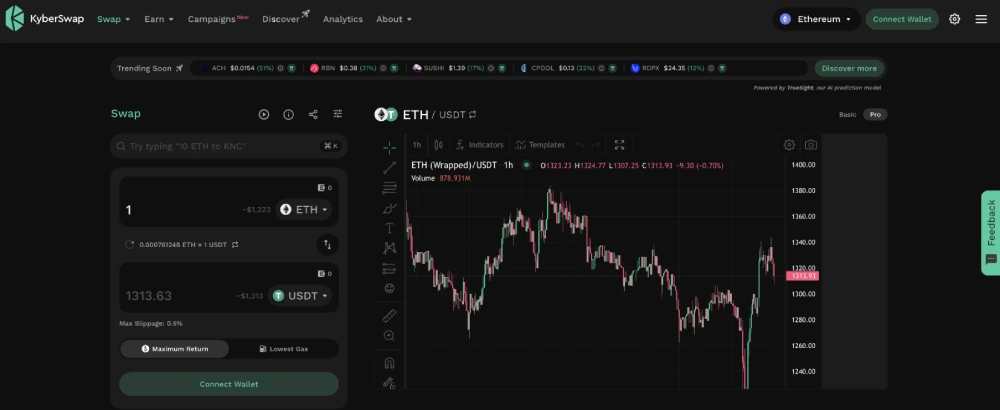

The KyberSwap mechanism enables the instant swapping of cryptocurrencies without using order books, deposits, or wrapping. The exchange constantly routes queries via numerous centralized exchanges and liquidity pools to get the best price. Clients can optimize their swaps for either the lowest gas prices or the highest returns. Variable slippage tolerance and critical pre-trade information such as minimum returns and predicted USD value are also available.

Kyber Developer

This developer-friendly mechanism provides developers with the tools and documentation to integrate new apps, wallets, exchanges, and platform enhancements into the DeFi ecosystem.

Kyber Network Fees

KyberSwap Fees

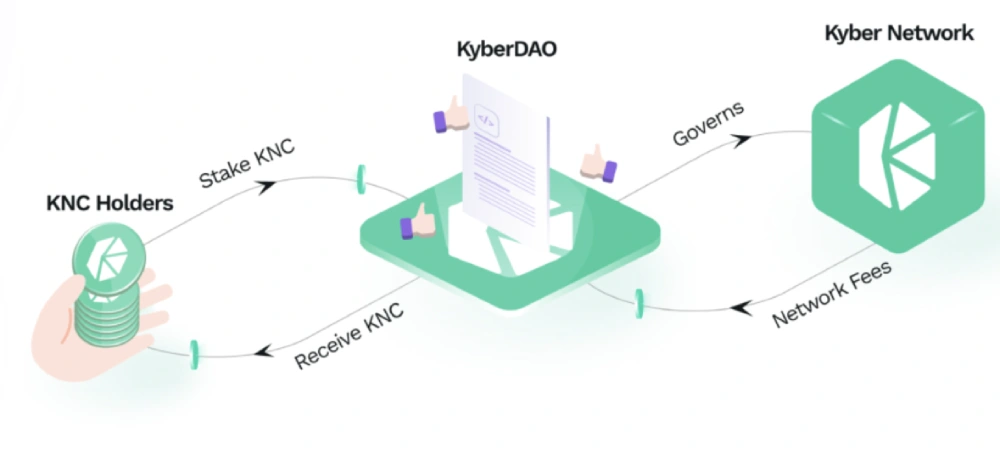

Unlike some DEXs, KyberSwap does not charge any aggregator, management, or platform fees. Liquidity providers earn 90% of their fees, while the remaining 10% goes to the KyberDAO for governance rewards. These rewards are paid out in KNC and are distributed to KNC holders who stake and vote on governance proposals based on the proportion of their stake.

Kyber Network doesn’t charge any withdrawal fees, which makes it a highly competitive offering. However, it should be noted that there are also exchanges that pay the network fees for the traders’ advantage, i.e., their withdrawal fees are 0. On the other hand, the network fees are rather insubstantial; therefore, charging the network fees solely is also a trader-friendly fee arrangement.

Buying & Storing KNC

You can buy KNC tokens through various cryptocurrency exchanges, such as Coinbase, Binance, etc. The former is headquartered in the United States, while the latter is an offshore exchange. There’s a spread in the trading volume of the digital asset at these exchanges, which indicates that KNC’s liquidity has no dependence and concentration on a single exchange. Moreover, every exchange book gives you high liquidity. For example, the Binance BTC/KNC books are diverse and have a high turnover resulting in faster order execution.

KNC is an ERC20 token that can be stored in any Ethereum-compatible wallet, including MyEtherWallet, MetaMask, and CoinStats Wallet.

KyberSwap Team

The team has an experienced and skilled advisory board comprising Vitalik Buterin, the Ethereum founder.

The protocol’s testnet became operational in August 2017. The Network’s initial coin offering (ICO) raised $60 million, the equivalent of 200,000 ETH, in September 2017.

The mainnet was launched in February 2018 and was only accessible to whitelisted users. In March 2018, the KyberSwap platform launched the mainnet as a public beta. The network volume increased by over 500% by the end of the second quarter of 2019.

Kyber Network (KNC) Token

KNC is the Kyber Network’s native token, released in 2017. The KNC price during the Initial Coin Offering (ICO) was $1 per token. Only 61% of the 226 million KNC raised for the ICO were sold, and the remaining share was split 50/50 between the founders/advisors and the company. The lockup term for this control is one year, while the vesting period is two years.

At the time of writing, the total supply of KNC was 223 million, with over 102 million tokens in circulation and a market capitalization of $116.5 million, as per the data available on CoinStats.

The token effectively supports the Network by connecting liquidity seekers and liquidity providers.

KNC is also the Kyber Networkecosystem’s governance token. Token holders can stake KNC tokens on KyberDAO to vote on platform updates, boost their value, and improve adoption rates. This will also increase the project’s functionality and value. The tokens are staked in cycles called “epochs,” which are measured in Ethereum block timings and have a time span of two weeks. Holders are entitled to a portion of the fees generated by the protocol’s liquidity pools.

KNC is also a deflationary token, i.e., a percentage of the token generated by fees is burned to decrease the cryptocurrency’s total supply. Deflation has a beneficial effect on the asset’s economic flow.

Note: Currently, the KNC supply is fixed until the KyberDAO votes to burn or mint more.

The protocol burned its first 1 million KNCs in May 2019 and the second 1 million KNCs in August 2019. While the first burning occurred 15 months after the launch, the second one was only after three months following the first, demonstrating the protocol’s rapid growth and acceptance.

Frequently Asked Questions

What Is the Kyber Network Crystal Token?

KNC has several applications as the blockchain’s native token, such as staking for passive income rewards, platform governance, etc.

Is the Kyber Network Safe?

As Kyber Network is a non-custodial, decentralized exchange, users need to link their wallets to begin trading while preserving anonymity and complete control of their crypto assets.

Kyber Network’s codebase has been audited by top audit firms Chainanalysis and Hacken and is available for public record.

Conclusion

Kyber Network aims to become a leader in the DeFi community for facilitating reserve liquidity through its functionality and operations. It offers liquidity by aggregating liquidity from several sources and is powered purely by code, a distributed network of software users, and the Ethereum blockchain.

To reach its goal, the Kyber Network provides a protocol for decentralized exchange, an application programming interface (API) for token swaps, and the KNC cryptocurrency. The Network’s growth trajectory is strong, notably through quick token trades.

The protocol will increase trading volume, and KNC token demand as the Network’s utility in DeFi grows.

We hope our Kyber Network review has been helpful for your crypto trading!

You’re also welcome to visit our CoinStats blog to discover a broader perspective on decentralized finance and how it seeks to empower people.

Investment Advice Disclaimer: The information contained on this website is provided to you solely for informational purposes and does not constitute a recommendation by CoinStats to buy, sell, or hold any securities, financial product, or instrument mentioned in the content, nor does it constitute investment advice, financial advice, trading advice, or any other type of advice.

-

Rahul Mantri is an author, investor, and public speaker with over 7 years of experience writing about emerging technologies under his belt. He has produced a number of widely acknowledged articles and has contributed to a lot of tech journals. He has a background in finance as well as technology and holds IBM Blockchain Essential & Developer Certification.

He is a voracious reader and his energetic talent of engrossing new words is his entrancing trait. Understanding the complexities of technology and writing prodigious technology blogs serves as a perfect example of his ability. After discovering cryptocurrency & blockchain technology for several years and drawing on his skills in finance and technology, he made his aim to enlighten people all around the world about digital currency.