Deep Dive Into 1inch Network [Offering the Most Profitable Asset Swaps in DeFi]

With over 280 centralized and decentralized exchanges in the crypto space, it’s increasingly difficult and time-consuming for users to find the best option for their digital asset swaps.

But what if there was a network built to help you find the best option for your cryptocurrency swaps, including the cheapest transaction fees?

Enter 1inch Network, a decentralized exchange aggregator and liquidity provider that displays the prices and liquidity available on multiple exchanges helping you find the best rates and lowest fees for your trades.

Join us in our deep dive into 1inch DEX aggregator, an extensive breakdown of its technology, history, advantages, etc., and proceed with a quick tutorial to help you get started.

What Is 1inch Network?

1inch Network is a decentralized exchange (DEX) aggregator and automated market maker (AMM) that aims to find the most efficient swapping routes across leading decentralized exchanges. It saves users’ money by finding the fastest and cheapest route stored on the Ethereum blockchain and facilitated without an intermediary.

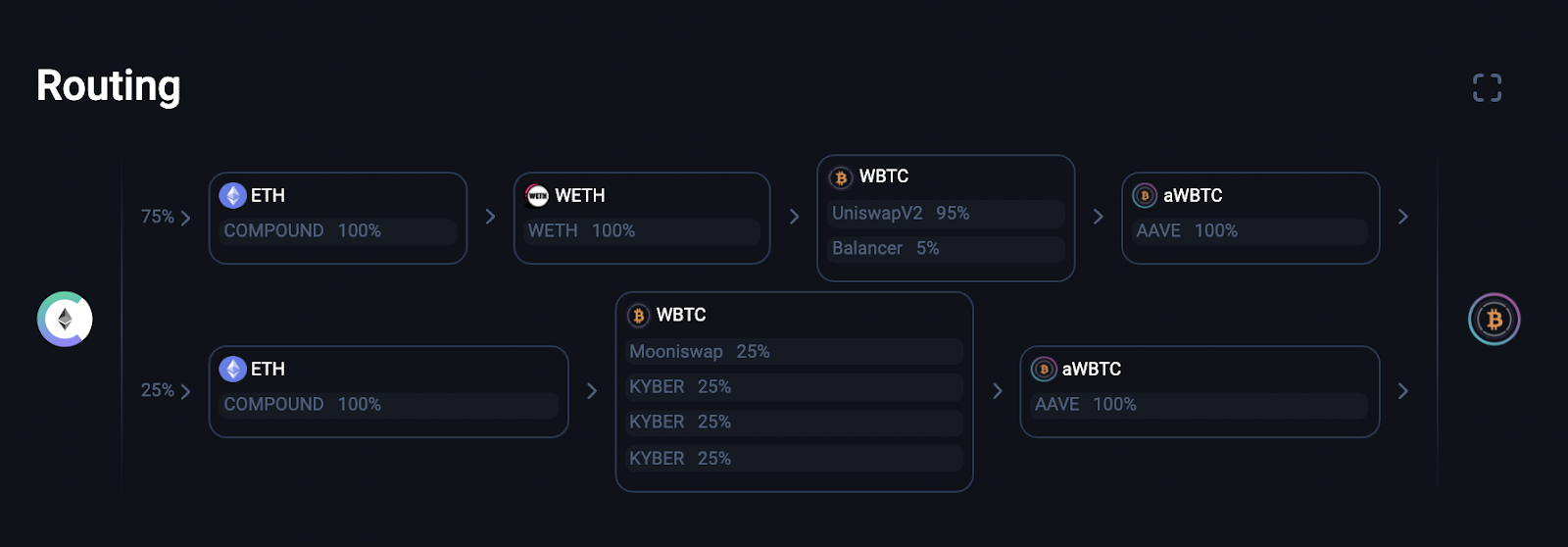

The platform divides the exchange amongst multiple exchange sources and checks for their market depths to ensure a user gets the best swap fee across many platforms. It displays the price and liquidity available on multiple exchanges to verify whether you’re getting the best rate.

Currently, 1inch exchange sources liquidity over three blockchains: Ethereum, Binance Smart Chain networks, and Polygon.

1inch network is developed by 1inch Labs, a decentralized team of software developers, and is governed by the 1inch DAO. Another key contributor is the 1inch Foundation, a non-profit organization that has issued the 1INCH token and is responsible for the network’s community initiatives.

Key Takeaways

- 1inch Network is a decentralized exchange (DEX) aggregator and automated market maker (AMM) that displays the prices and liquidity available on multiple exchanges helping you find the best rates and lowest fees for your trades.

- The platform divides the exchange amongst multiple exchange sources and checks for their market depths to ensure you get the best swap fee across many platforms.

- Executing a digital asset swap on the 1inch App is easy, especially using the simple mode.

- 1inch Earn enables 1INCH token holders to earn passive income on their holdings through providing liquidity and staking.

How Does 1inch Work?

So how does 1inch facilitate an asset swap? After submitting an order, 1inch will search across all compatible sources and DEXs to enable cost-efficient and secure swap transactions across multiple liquidity sources.

The protocol uses the Pathfinder algorithm to find the best trading path across different markets with over 50+ liquidity sources on Ethereum, 20+ liquidity sources on Binance Smart Chain, and 7+ on Polygon.

To achieve this, the protocol relies on multiple protocols, which all work together to ensure a smooth and efficient DeFi space. The three underlying protocols are:

Aggregation Protocol

The 1inch Aggregation Protocol’s key role is to source liquidity from various decentralized exchanges and liquidity protocols and split a single trade across multiple exchanges to offer the best rates. This is achieved by 1inch’s V3 smart contract algorithm, which cross-references over 100 liquidity protocols to find the most advantageous digital asset swap based on parameters like price, liquidity, and slippage. The aggregation protocol uses the Pathfinder discovery and routing algorithm to find the best paths across multiple markets in less than a second. It enables the protocol to split a digital asset swap into numerous transactions to offer users the fastest swap with the lowest fees. This is a relatively new feature, released as part of the 1inch v2 upgrade.

Liquidity Protocol

Liquidity Protocol is an Automated Market Maker (AMM) that allows users to trade their assets using liquidity pools automatically. The liquidity protocol provides liquidity to the pools and enables users to participate in liquidity mining programs to earn rewards.

The protocol works like other popular automated market makers, i.e., Uniswap and Sushiswap, automatically facilitating buy and sell orders on decentralized exchanges without needing an order book or central intermediary. Yet, 1inch’s additional features help it stands out from other AMMs.

The protocol’s smart contract algorithms are responsible for sourcing liquidity from different DEXs and pools. The AMM protocol has access to the deepest liquidity sources from the most popular networks, including Ethereum, BNB Chain, Avalanche, Polygon, Optimistic Ethereum (oΞ), Gnosis Chain, Fantom, Arbitrum, Aurora, and Klaytn.

Limit Order Protocol

1inch Network’s limit order protocol enables users to place limit orders on their asset swaps via smart contracts. The protocol facilitates flexible limit order functionality and features no fees. The protocol offers dynamic pricing based on demand and supply, conditional execution of orders, multichain support, and fulfills requests for quotations. Furthermore, the protocol implements stop-loss orders, trailing stop orders, and auctions.

Fast Fact

1inch Network is fully non-custodial, meaning that no central entity or third party ever controls user assets. This is a great selling point for investors as it nullifies the risk of asset freezing or censorship.

1INCH Token

1INCH is the protocol’s governance and utility token. It’s an ERC-20 token and is available as a BEP-20 token on the BNB chain.

1INCH has a total supply of 1.5 billion tokens, with a current circulating supply of over 584 million coins. At the time of writing, 1INCH is the 128th largest cryptocurrency, with a market capitalization of $359.2 million, according to data from CoinStats.

The 1INCH token was launched on December 25, 2020. As a Christmas present, the token was airdropped to community members and users, who previously executed at least one trade before September 15, 2020, made at least four trades in total or traded a total minimum volume of $20. The token was also airdropped to 1inch liquidity providers.

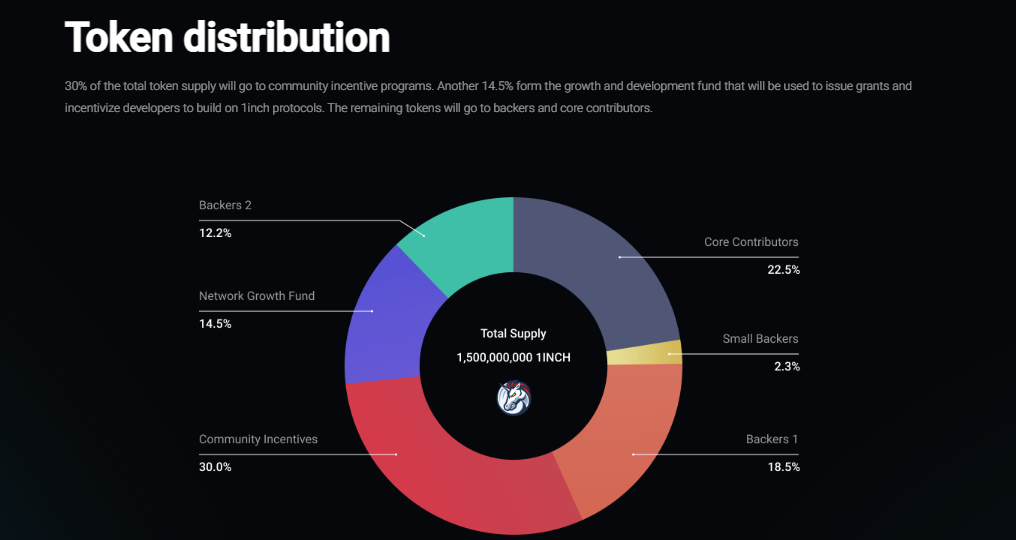

As per the official token release announcement, the 1INCH token’s initial distribution was as follows:

- 56% of the total token supply was allocated to core backers, contributors, and early investors

- 30% was allocated to community incentives

- 14.5% – to the protocol growth and development fund (with a 4-year unlock period)

- 0.5% – to liquidity providers.

1inch Network Team and History

1inch was launched in May 2019 by Sergej Kunz, a former software engineer at Porsche, and Anton Bukov, a former smart contract developer at the Near protocol. The protocol was launched during the famous ETHGlobal New York hackathon.

1inch network was initially launched without venture capital firms or investors’ funding.

However, in August 2020, 1inch successfully closed its first investment round led by Binance Labs, raising $2.8 million from institutional investors like Galaxy Digital, Greenfield One, Libertus Capital, Dragonfly Capital, FTX, etc.

In December 2020, 1inch completed its second funding round led by Pantera Capital, raising $12 million from prominent institutional investors like ParaFi Capital, LAUNCHub Ventures, and Nima Capital.

In December 2021, 1inch closed an astonishing $175 million Series B funding round led by Amber Group, with participation from the likes of Jane Street, VanEck, Fenbushi Capital, Alameda Research, Celsius, Nexo, etc. This brought the protocol’s total valuation to $2.25 billion.

How to Use 1inch Network?

Executing a digital asset swap on the 1inch App is easy, especially using the simple mode. Here’s how it works:

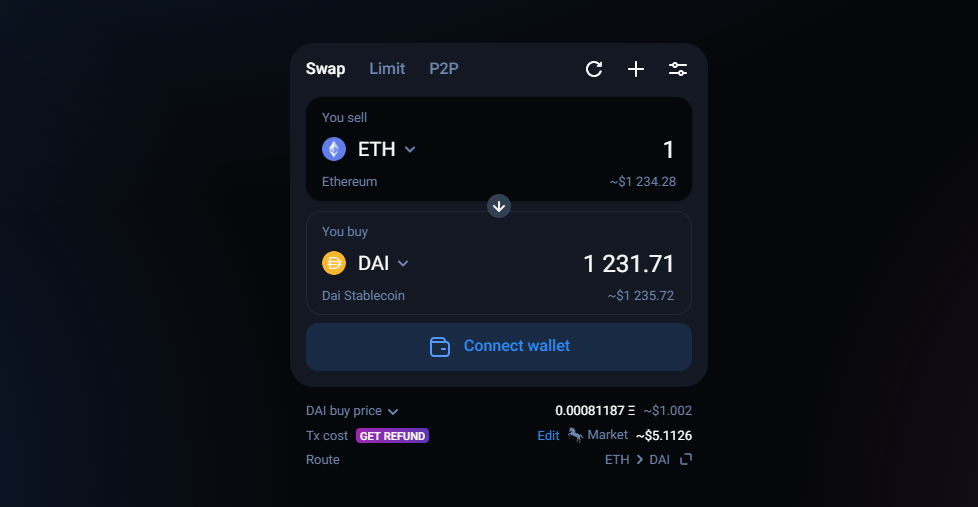

- Open the 1inch App. The app will automatically open the simple mode, which is more user-friendly and offers fewer features.

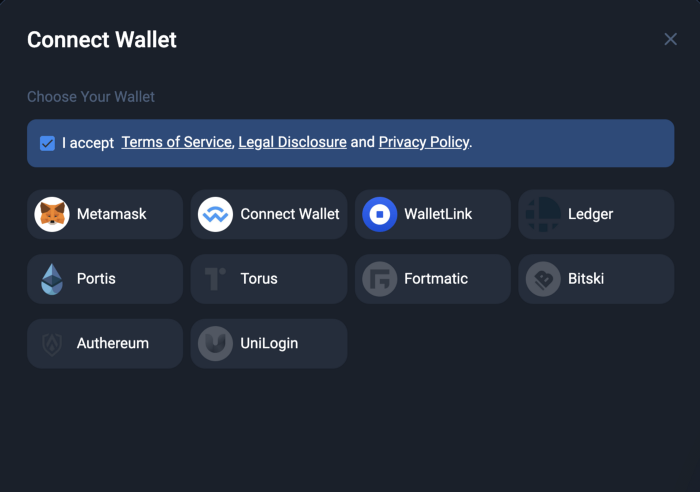

- On the “Swap” window, click “Connect wallet.”

- This will prompt a window with all the available wallets. Select the one you’d like to use for the asset swap and accept the terms of service.

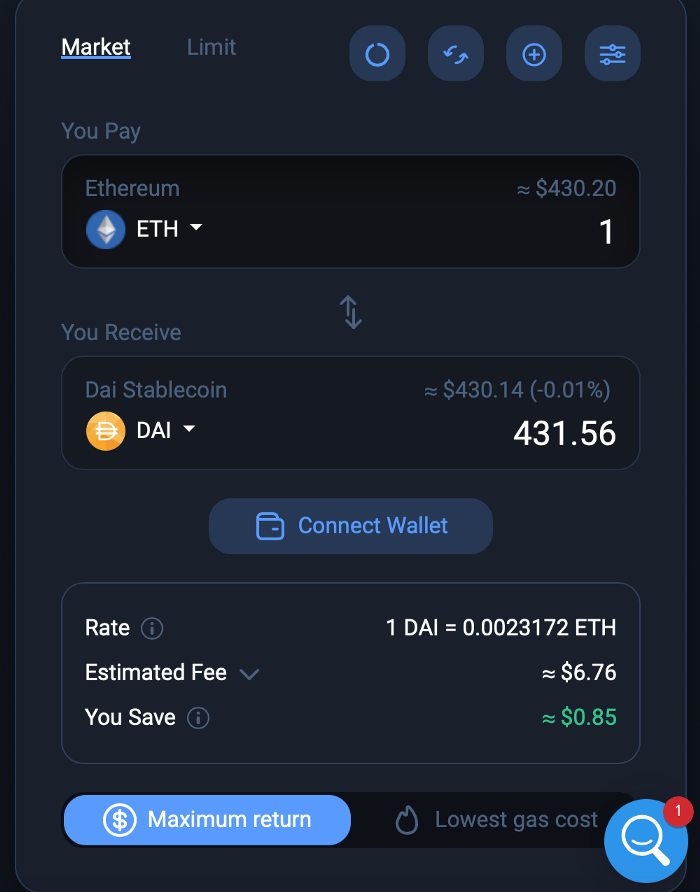

- Once you’ve connected your crypto wallet, select the cryptocurrency you want to sell and enter the amount in the “You sell” tab. Then choose the cryptocurrency you want to buy in exchange by clicking on the “You buy” tab.

- You can also choose between “Maximum return,” i.e., the best swap rates, or “Lowest gas cost,” for the lowest transaction fees.

1inch DAO

The 1inch Network is governed by the 1inch DAO — a decentralized autonomous organization that enables 1INCH stakers to participate in the protocol’s governance by voting for key protocol parameters.

1inch Network DAO Treasury is a pool of funds under the ownership of the community, controlled by 12 multi-signature (multi-sig) wallets, of which 7 are needed to sign transactions.

All protocol funds (like the swap surplus created by Pathfinder) are directed toward the treasury, and none of the revenue funds go to the 1inch Foundation. The funds are used for grants and other network-oriented initiatives.

Pro-Tip

The app provides a simple trading mode for beginners and a classic trading mode with advanced features for seasoned DeFi veterans. The network charges no trading fees for asset swaps, and the protocol’s top stakers get up to 95% refund for gas fees charged using the network.

Governance

The 1inch Network’s governance structure differs from most DeFi protocols with its instant governance feature, enabling the community to vote for protocol settings under the 1inch DAO in a transparent, user-friendly, and efficient way.

Instant governance has no entry barriers for users, making this governance structure more decentralized and community-oriented.

1inch allows anyone holding the governance token to create proposals or vote on existing ones. A user’s voting weight is directly proportional to the number of tokens held in the staking contract. Users can also choose to delegate their voting power to other addresses, known as “Delegatees.”

Users have to stake their 1INCH tokens to be eligible to vote on the proposal and receive additional tokens as staking rewards. The amount of staking rewards is directly proportional to the fees generated on 1inch — more protocol fees equal greater staking returns for voters.

In an effort towards transparency, 1inch displays the top addresses by voting power.

1inch Earn

1inch Earn enables 1INCH token holders to earn passive income on their holdings through the following methods:

- Providing Liquidity

Providing liquidity is the main way to generate passive income on the network. This involves locking a cryptocurrency trading pair in 1inch’s liquidity pools in exchange for an annual percentage yield (APY) ranging from 1 to 205%, depending on the asset pair and trading pools.

Liquidity providers must stake both cryptocurrencies of the trading pair in a 1:1 ratio, like LDO – stETH tokens.

- Staking

Staking is another popular yield farming product on 1inch, which requires 1inch token holders to lock up their tokens for a set period in the network’s staking contract.

Staking APY differs depending on the pool balance. At the time of writing, stakers earn a fixed 6.35% APR from the Turbo 1INCH staking pool.

How to Stake on 1inch?

- Visit the 1inch App homepage, click the “DAO” section to open the drop-down menu, and click “Staking.”

- On the Staking dashboard, click “Connect Wallet” in the upper right corner and add the crypto wallet with your 1INCH tokens.

- Enter the number of tokens you wish to stake in the “amount” field, or conveniently select the percentage of the total holding you wish to commit.

- Once you’ve reviewed your selection, click on “Submit.”

- After carefully reviewing the transaction displayed in your crypto wallet, click “give permission to stake 1INCH.”

- Approve the transaction and click “Stake Token” on the Staking Dashboard. Once the transaction is executed, your tokens will be staked on the 1inch smart contract.

Get Inspired

1inch allows anyone holding the governance token to create proposals or vote on existing ones. You can also choose to delegate your voting power to other addresses, known as “Delegatees.” You must stake your 1inch tokens to be eligible to vote on the proposal and receive additional tokens as staking rewards.

1inch Network Benefits

The benefit of using 1inch is that the aggregation protocol offers the best swap rates across all DeFi protocols by choosing the most efficient swap route from hundreds of liquidity sources.

The network also offers a user-friendly front-end interface attracting crypto beginners and bolstering blockchain mass adoption. The app provides a simple trading mode for beginners and a classic trading mode with advanced features for seasoned DeFi veterans.

Another major benefit of 1inch is that the network charges no trading fees for asset swaps. Moreover, the protocol’s top stakers get up to 95% refund for gas fees charged using the network.

Security is another feature that makes the network stand out among DeFi protocols. 1inch has a 91/100 Skynet Trust Score, according to blockchain security firm CertiK. 1inch underwent numerous security audits from other industry-leading firms like SlowMist, OpenZeppelin, and Consensys Diligence, to name a few. For each code vulnerability, 1inch performs an average of 16 audits, while other DeFi protocols request 3 to 4 audits for the same issues.

Last but not least, 1inch Network is fully non-custodial, meaning that no central entity or third party ever controls user assets. This is a great selling point for investors as it nullifies the risk of asset freezing or censorship.

1inch Network Criticism

While 1inch Network doesn’t raise many concerns, some people have questions concerning the 1INCH token. The reason for concern is that 56% of the total token supply was initially distributed to investors and core contributors, which is an unusually large percentage.

This raises concerns about the token distribution’s centralization and potential price manipulation, as the group of stakeholders could create a significant amount of sell pressure, leaving retail investors holding the bag. It also might be the likely reason why 1INCH is barely hanging in the top 130 tokens by market cap, despite the immense benefits of using the network.

Bottom line

1inch offers liquidity mining programs and compares exchange rates between multiple platforms to provide its users with the best possible options. Moreover, the exchange has an intuitive user interface and provides an array of opportunities, such as staking, supplying liquidity, earning governance rewards, etc.

Currently, 1inch Network has a total value locked (TVL) of $2.3 million, down from its all-time high of $1.64 billion in March 2021. Yet, it’s worth noting that this downtrend is correlated with the drastic TVL drop in DeFi, which saw the industry fall from its peak of $216 billion in TVL in December 2021, all the way down to $59 billion in TVL to its lowest in June 2022.

On the bright side, 1inch Network will likely grow and recapture the lost TVL due to its support of the most popular blockchains and offering the most profitable asset swaps in the industry. Additionally, 1inch Network is supported by some of the most prominent venture capital firms, helping it to maintain its growth by investing more funding into the network to support its development.