How to Buy Saitama Inu [The Ultimate Guide 2023]

The success of dog-themed meme coins like Dogecoin and Shiba Inu coin eventually spawned the massive litter of many pet coins. Saitama Inu (SAITAMA) is a recently launched meme coin inspired by a myth about “ghost dogs,” guardians against misfortune in the Saitama mountains, Japan.

Saitama Inu (SAITAMA) is also a decentralized platform to educate Generation Z about crypto investment opportunities and drive crypto adoption by making cryptocurrencies safe and accessible.

Read on to learn all the relevant information about Saitama Inu, including its pros and cons, and explore its unique features to make an informed investment decision. Scroll down for our step-by-step guide on where and how to buy Saitama Inu (SAITAMA) tokens.

Let’s get right to it!

What Is Saitama Inu

Saitama Inu was founded in May 2021, but the founder had to renounce ownership of the project due to personal reasons. However, a group of people who found the goal valuable took over the project and continued developing it. The project is now headed by Steve@RocketCrypto, a crypto YouTuber with over 56,000 subscribers.

According to its whitepaper, “Saitama is a Web3.0 technology company primarily focused on developing a decentralized finance ecosystem for everyday life” and helping newcomers understand the basic concepts and skills needed for blockchain and cryptocurrencies.

Saitama advertises itself as a “community-driven platform.” Moreover, the team targets Gen Z traders and commits to helping young crypto investors reach financial well-being. The Network focuses on Gen Z investors because, according to the whitepaper, 93% of new crypto investors feel frustrated or confused. In addition, buying crypto can be challenging, especially considering the endless lines of new digital assets popping up monthly.

As the traditional finance rules don’t always apply to the crypto sphere, many Gen Z traders are left to make decisions on their own and have very little guidance. Saitama claims it can provide “wealth education” and teach traders to work smart instead of waiting for the “freedom of retirement.”

SAITAMA is the native token of Saitama Network, used within the ecosystem to conduct transactions and for staking. SAITAMA is an ERC-20 token built on the Ethereum blockchain. It’s a dog-themed meme coin aiming to educate as much as entertain.

The Saitama network has set several goals for the upcoming months. It plans to build a reliable ecosystem, a smart wallet, a multi-channel content platform, a marketplace, and an NFT-based launchpad.

What Makes Saitama Unique

Meme coins haven’t exactly established themselves as a reliable investment. However, Saitama Inu claims to change traders’ minds by providing several attractive features (some of them coming soon) to investors, including:

- The Saitama Edutainment platform

- The SaitaMask wallet

- The SaitaMaker NFT-based “launchpad platform”

- The SaitaMarket Marketplace

- Saitama Studios.

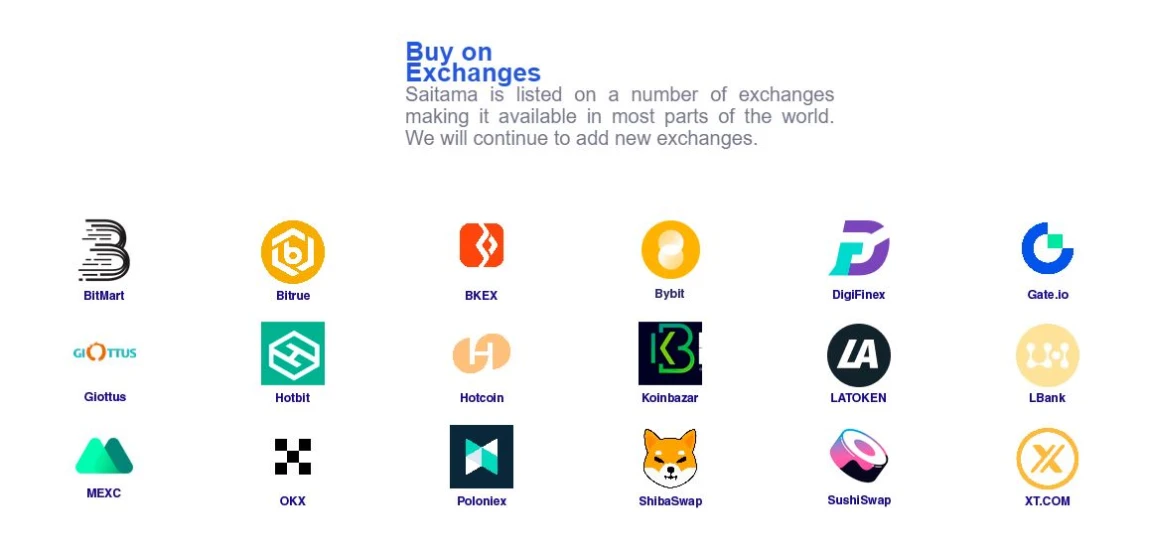

SAITAMA Inu has been listed on several crypto exchanges; however, unlike other leading cryptocurrencies, it can’t be directly purchased with fiat money. You can buy the SAITAMA coin by first buying Ethereum or another major coin from any fiat-to-crypto exchanges and then transfer to the exchange that supports Saitama Inu. The most popular cryptocurrency exchanges to trade SAITAMA are OKX, gate.io, Uniswap (V2), LBank, etc.

How to Buy Saitama Inu

There are several ways to buy Saitama, depending on whether you have crypto holdings in your cryptocurrency wallet or plan to make the transaction through fiat money.

How to Buy Saitama Inu With SaitaSwap

The platform advertises the SaitaSwap decentralized crypto exchange as the best place to buy Saitama Inu.

To purchase Saitama directly with SaitaSwap, follow the steps highlighted below:

Step 1: Download SaitaPro Wallet App

You must first install the free SaitaPro app, available for both Android and iOS. However, if you already have a wallet, like a Metamask wallet, you can simply connect your existing wallet to SaitaSwap and start trading.

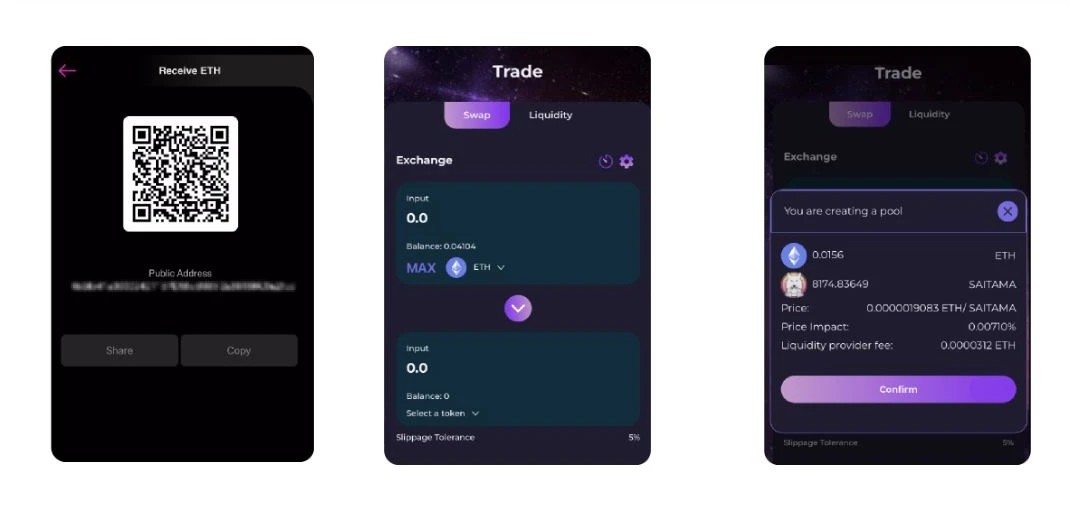

Step 2: Purchase Ethereum (ETH)

Due to the limited trading pairs available for SAITAMA, the easiest way is to purchase ETH and then exchange it for SAITAMA. However, trading ETH comes with the downside of notoriously high gas fees and possibly long transaction times. Remember to have enough ETH to cover the gas fees.

Note that fiat currency deposits aren’t supported on the platform.

Step 3: Swap ETH for SAITAMA

Once you’ve purchased ETH tokens, you can swap them for SAITAMA by selecting the digital asset in the “swap” section and setting the slippage tolerance to 5%.

Voilà! Now you’re a proud owner of Saitama Inu coins.

Now, let’s learn how to buy Saitama Inu on cryptocurrency exchanges that support the coin. While leading crypto exchanges like Binance and Coinbase don’t offer any SAITAMA pairs, the platform lists all crypto exchanges where you can buy Saitama Inu.

How to Buy Saitama Inu on a Cryptocurrency Exchange

Step 1: Choose an Exchange

You’ll have to compare cryptocurrency exchanges to choose the one with the features you want, such as low transaction fees, an easy-to-use platform, and 24-hour customer support. When you buy through your funded crypto brokerage account, you’ll pay nothing in commissions, which is a significant benefit compared to others. Also, consider if the crypto exchange allows buying crypto assets with your preferred payment methods, such as a credit or debit card, a bank transfer, etc.

Step 2: Register on a crypto exchange

After choosing the best exchange for you, it’s time to register an account. We’ll take the Binance exchange as an example. Like most crypto exchanges, Binance requires a valid email address to create an account. A link will be sent to your email, and you must click it to verify your email. Once the account is activated, you must create an elaborate password, and you are good to go. Notably, trading is available immediately, even if you prefer not to go through the KYC (know your customer) identification process. However, doing so will unlock several additional privileges on the platform.

Note: Crypto investors, who already have an available crypto wallet with some digital assets, can connect their wallets to one of the platforms from the list above and purchase SAITAMA by providing their wallet address.

Step 3: Acquire ETH or USDT

After registering on Binance or any other platform, you must choose a deposit method to fund your account to buy a major coin. The Binance cryptocurrency exchange supports several payment methods for buying ETH or USDT. Binance offers videos to guide you through buying crypto with a credit/debit card.

You can also buy ETH through a direct wire transfer from your bank account.

NOTE: Double check the fiat amount you’d like to deposit onto the platform, as the transfer might not be reversible.

Step 4: Transfer your USDT or ETH to an Altcoin Exchange

As Binance doesn’t offer Inu Saitama pairs, you must connect your newly established cryptocurrency wallet to Gate.io or any other SAITAMA backing exchange to buy SAITAMA tokens.

Step 5: Trade Saitama

Select “ETH” in the search bar in the right column, click on it, and enter “SAITAMA.” Select the SAITAMA/ETH pair and check the price chart of SAITAMA/ETH in the middle of the page. Go to the “Buy SAITAMA” button below, choose the “Market,” enter your amount or choose what portion of your deposit you’d like to spend by clicking on the percentage buttons. Confirm and click “Buy SAITAMA.”

Note that you can trade Saitama, ETH, and all your other crypto assets – CeFi, DeFi, and NFTs – directly on CoinStats. It’s the only platform where you can track, manage, and earn on your assets from a single spot. Getting started with CoinStats is easy and free, all you have to do is connect your portfolio.

Now that you’ve learned how to buy Saitama Inu let’s look into what you can do with your newly acquired coins.

How to Use Your SAITAMA Coins

Congratulations on adding SAITAMA tokens to your crypto portfolio! You can use your Saitama Inu coins in the following ways:

- Store your Saitama Inu in a crypto wallet. While your SAITAMA tokens can be stored in your brokerage exchange wallet, experts advise storing your precious coins away from exchange wallets, as those might be susceptible to hacks and interference. We highly recommend creating a private wallet with your own set of keys. Depending on your investing preferences, you might choose between software and hardware wallets, the latter being a more secure choice. The strength of software wallets lies in their flexibility and ease of use. A software wallet is the most easy-to-set-up crypto wallet and lets you easily interact with several decentralized finance (DeFi) applications. However, these wallets are vulnerable to security leaks because they’re hosted online. So, if you want to keep your private keys in a software wallet, conduct due diligence before choosing one to avoid security issues. We recommend a platform that offers 2-factor authentication as an extra layer of security. A hardware wallet is usually considered the safest way to store your cryptocurrencies as it offers offline storage, thereby significantly reducing the risks of a hack. A hardware wallet is secured by a pin and will erase all information after many failed attempts, preventing physical theft. Hardware wallets also let you sign and confirm transactions on the blockchain, giving you an extra layer of protection against cyber attacks. Ledger hardware wallets are arguably the most secure hardware wallets letting you securely manage your digital assets. The Nano X is designed for advanced users and offers more storage space and advanced features than Ledger Nano S, designed for crypto beginners. Tip: A paper wallet is a type of free cold wallet or an offline-generated pair of public and private addresses that you must write somewhere and keep safe. However, paper wallets aren’t durable.

- Stake your SAITAMA tokens. The Saitama Network offers a staking option to token holders who don’t want to trade it right away. Staking entails locking part of your crypto holdings in exchange for a reward. Users staking their tokens in the Saitama Inu pool will enjoy returns sourced from transactions performed with the SAITAMA token. 2% of each transaction is deducted and used as incentives for the Saitama Inu community. Saitama ensures that as long as users remain in the pool, they’ll receive passive income with every transaction.Note that staking rewards differ depending on the platform and asset, so research well before making a final decision.

- Trade SAITAMA. You can trade your Saitama Inu tokens to speculate on cryptocurrency price movements via a CFD trading account or an exchange.

NOTE: Saitama Inu is currently a speculative coin in the crypto markets, as it hasn’t revealed most of its new features. While investing in cryptocurrency might be exciting, it also carries certain risks. Remember that this guide is not financial advice. We don’t promote Saitama as a good investment or a profitable way to create wealth opportunities.

This CoinStats guide reviews how to buy Saitama Inu with less pain and more gains. We strongly urge traders to do their own research before considering an investment.

You can also visit our other articles on meme coins, such as How to Buy Floki Inu or How to Buy Shiba Inu, etc.

Frequently Asked Questions

Is Saitama Inu a safe investment?

Cryptocurrency is a highly volatile market, and significant risks are involved in trading CFDs, stocks, and cryptocurrencies. Considering the project’s low rank, modest market cap, and low integration, Saitama Inu carries a high risk for both advanced users and beginners.

Should I buy SAITAMA on a decentralized exchange (DEX) or a centralized one (CEX)?

The decision doesn’t entirely depend on the asset itself but on the differences between the two types of exchanges in conducting transactions. A CEX stands as a middleman between the sender and the recipient, while a DEX is not governed by any central authority; instead, it operates over blockchain and uses smart contracts to let people trade in crypto assets without the need for a regulatory authority. They deploy an automated market maker to remove any intermediaries and give users complete control over the funds. While DEXs are less susceptible to hacks, they’re more prone to listing questionable coins. We recommend doing your own research before choosing an exchange.

Is Saitama Inu a scam?

Saitama appears to be a legit cryptocurrency, with an audit from CertiK security company and a detailed whitepaper. Also, the team behind the project is open to the public. While SAITAMA doesn’t look like a scam, trading it could still result in loss, as the digital asset is somewhat volatile. Start using crypto portfolio trackers to keep track of all your investments and asset prices.

What is SaitaMask?

SaitaMask is the official wallet for SAITAMA; however, it’s not available yet. The Network is currently at stage three of its 5-stage development plan, and stage four lists the completion of the SaitaMask wallet.

What is the Saitama coin price?

The Saitama coin price is volatile. You can check the SAITAMA live price, market cap, 24h trading volume, total supply, circulating supply, etc., on CoinStats.

Does Coinbase support Saitama?

No, neither Coinbase nor Binance support the coin at the moment. As of Aug. 2023, the project is too small to make it on major exchanges. However, a future listing is not off the table if the token establishes itself as a viable cryptocurrency. Patience is key for Saitama Inu supportes.

Pros and Cons of Buying Saitama Inu

Pros

- Early exposure

- High rewards in case of Saitama Network growth

- A growing ecosystem with an exchange and the SaitamaPro wallet

- A deflationary token that will appreciate with each transaction.

Cons

- High risk due to lack of longevity

- High volatility

- Limited availability

- A limited number of pairs.