Chainlink is a decentralized oracle network aiming to integrate on-blockchain smart contracts with real-world data stored off-blockchain. Each oracle provides real-time data feeds that may be linked to any decentralized application (DApp), while oracles in a network ensure that data feeds stay decentralized, eliminating any concerns about dependability.

Chainlink is often used in DeFi lending and borrowing marketplaces like Aave and synthetic exchanges like Synthetix. Although largely utilized in DeFi, this data bridge has other uses, including retrieving aircraft flight data and delivering it to insurance firms to enable automated insurance claims.

The oracle network launched Chainlink Staking v0.1 in December 2022, introducing another layer of crypto-economic security on Chainlink. Staking enables ecosystem participants to earn rewards while ensuring the security and credibility of oracle services.

LINK is Chainlink’s native cryptocurrency for compensating node operators, incentivizing good actions, and as a reputation indicator for data providers.

This post will explore the types of staking in the Chainlink ecosystem, its benefits and risks, and provide a guide on where and how to stake Chainlink tokens to begin earning interest on your staked LINK tokens.

One Place For All Your

Crypto, DeFi & NFTs

What Is Chainlink Staking?

Chainlink is a decentralized oracle network that provides reliable, tamper-proof inputs and outputs for complex smart contracts on any blockchain. The network uses “secure aggregated price feeds” to ensure the data provided by its oracles is accurate and reliable. It enables multiple oracles to provide price data for the same contract, which is then aggregated and validated by a decentralized network of nodes. This mechanism ensures the data is accurate and tamper-proof, as any attempt to manipulate the data would require control over a significant portion of the network.

Staking within decentralized oracle networks aims to create reliable and tamper-resistant oracle reports that accurately reflect the state of the external world.

Chainlink staking is the process of locking up LINK tokens to participate in the consensus mechanism of the Chainlink network and receive rewards in the form of more LINK tokens in return.

Staking is an essential aspect of the Chainlink network, helping secure the network and maintain its integrity. By staking LINK tokens, Chainlink ecosystem participants essentially commit their tokens as collateral to verify any on-chain transaction on the network. This ensures the network remains decentralized and trustworthy.

Types of Chainlink Staking

Chainlink offers the opportunity of staking LINK tokens in the Chainlink staking v0.1 staking pool. The staking pool could become larger as the network grows and accommodates more community members. Chainlink plans on introducing the v0.2 staking pool in around 9 -12 months from December 2022.

Chainlink staking enables ecosystem participants, including node operators and community members, to increase the security guarantees and user assurances of oracle services by backing them with staked LINK tokens. Let’s look into the main types of Chainlink staking below.

- Node Operators Staking

A user can choose to support the broader expansion of the Chainlink infrastructure by becoming a node operator. Node operators must hold a certain amount of LINK tokens as collateral, which helps ensure that they have a financial stake in the network’s success. In exchange for their services, node operators receive a share of the transaction fees generated by the network.

Node operators gather and transfer data to smart contracts while managing the infrastructure that keeps Chainlink operational and running around the clock. The ranking of a node in the Chainlink system increases with the number of LINK tokens held by the node.

LINK token holders need extensive technical knowledge and experience to create a node in the Chainlink network.

Note: According to the Chainlink team, Node Operator Stakers would not see their committed stake slashed during Chainlink staking v0.1. However, up to three months of accrued staking rewards were slashed from node operators serving the ETH/USD Data Feed on Ethereum due to a possible valid alert. Rewards of actively staking node operators not serving the ETH/USD Ethereum Data Feed weren’t slashed during v0.1

- Community Stakers

Community stakers are LINK token holders who participate in Chainlink staking to help secure and maintain the network. Community stakers may choose to operate their own Chainlink node or delegate their tokens to an existing node operator. As a reward for their contribution, they receive a share of the transaction fees generated by the network.

Community stakers play a crucial role in the success of the Chainlink network, helping ensure the network is decentralized and secure. By holding and staking their LINK tokens, they help to incentivize the proper functioning of the network and maintain the integrity of the data being transferred through it.

Chainlink has an active community of stakers dedicated to the network’s long-term success. The community includes individual users and larger institutional investors supported by a range of staking platforms and resources provided by the Chainlink team.

Chainlink Staking Platforms

Several Chainlink staking platforms and resources are available to users wanting to participate in staking LINK tokens. Some examples include:

- Official Chainlink Staking Platform: This is the official staking platform provided by the Chainlink team. It allows users to stake their LINK tokens and become node operators on the network, earning rewards for validating data requests and maintaining the network’s security.

- DeFi Staking: Several DeFi platforms allow users to stake their LINK tokens in exchange for rewards. For example, the Aave protocol will enable users to stake LINK and earn interest on their holdings, while the Synthetix protocol allows users to stake LINK as collateral and earn rewards in the form of SNX tokens.

- CeFi Staking: Centralized exchanges (CeFi) is another way to stake LINK and earn rewards. These platforms, such as BlockFi or Nexo, earn interest on the deposited LINK and provide a more user-friendly and accessible staking experience than DeFi platforms. However, the number of exchanges supporting LINK staking is limited.

Some of the most popular Chainlink staking platforms are listed in the video below:

Chainlink Staking Benefits

Staking Chainlink includes several benefits listed below:

- Passive income: Staking LINK tokens allow users to earn passive income. They are rewarded in the form of additional LINK tokens for validating transactions on the Chainlink network.

- Increased security: Staking helps to increase the security and reliability of the Chainlink network by incentivizing users to act in the network’s best interest. Validators are required to stake a certain amount of LINK tokens, which they risk losing if they act maliciously. This encourages validators to act honestly and helps prevent network attacks.

- Decentralization: Staking promotes decentralization on the Chainlink network by allowing anyone with LINK tokens to participate in the validation process. This helps prevent a few large entities’ centralizations of power and control.

- Reputation: Staking LINK tokens also help to build a reputation within the Chainlink network. Validators who consistently validate transactions accurately and honestly are rewarded with a good reputation, increasing their chances of being chosen as validators.

- Liquidity: Staking LINK tokens also provide liquidity to the Chainlink network. By locking up LINK tokens, users reduce the number of LINK tokens available for trading, which can help stabilize the LINK token price and reduce market volatility.

Chainlink Staking Risks

- Your tokens are used as collateral when staking Chainlink. If the node you selected provides incorrect information or violates the service agreement, you may lose a portion of your staked tokens. Additionally, since this is a new technology, staking may have unforeseen risks.

- Before staking, ensuring cryptocurrency is legal in your country is essential. Plus, you must consider the tax implications of staking rewards, as they may be taxable in some jurisdictions as rental or interest income.

While Chainlink hasn’t suffered any public bugs or issues, it’s subject to any bugs or issues that may arise on Ethereum. However, Chainlink has implemented a bug bounty program to help identify and address any potential issues.

How to Stake LINK?

Staking LINK is a relatively simple process. Here’s a step-by-step guide on how to stake LINK:

- Obtain LINK Tokens: The first step is to acquire LINK tokens. You can buy LINK on various cryptocurrency exchanges, such as Binance, Coinbase, or Kraken.

- Set Up a Wallet: Next, you must set up a wallet that supports staking LINK. You can choose from several wallets, including MetaMask, Ledger, and Trezor. Smart contract wallets are also supported. Ensure your wallet is Ethereeum-based and compatible with the staking platform you plan to use.

- Choose a Staking Platform: Select a staking platform that supports LINK staking, including Binance, Kraken, Celsius, etc. Check the platform’s staking requirements, rewards, and fees to choose a platform that meets your needs and preferences.

- Deposit LINK: Once you’ve chosen a staking platform, deposit your LINK tokens into the platform’s staking wallet. Follow the deposit instructions carefully.

- Start Staking: After depositing your LINK, you can start staking. Choose the staking option that suits you best, whether it’s a fixed-term or flexible staking option. Your staking rewards will depend on the staking option you choose and the amount of LINK you stake.

- Monitor Your Staking Rewards: You can monitor your staking rewards in real-time through your chosen staking platform. Always keep track of your rewards and adjust your staking strategy as needed.

Step-by-Step Guide for Staking Chainlink With Metamask

You can stake Chainlink (LINK) tokens using Metamask, a popular Ethereum wallet that allows users to interact with decentralized applications (DApps) and perform various blockchain operations, including staking.

Metamask is a browser extension that can be added to Google Chrome, Firefox, and Brave browsers and a self-custodial wallet, meaning users have complete control over their private keys and funds.

To stake Chainlink with Metamask wallet, you must have your wallet connected to a staking platform that supports LINK staking, such as the official Chainlink staking platform or a third-party platform.

Here’s a step-by-step guide for staking LINK tokens through the Metamask wallet.

- Open your browser and visit the Chainlink Staking web page. Check the URL to ensure you are on the correct staking website.

- Click the “Connect Wallet” button in the page’s top-right corner.

- Choose Metamask as your wallet and ensure you have enough LINK tokens and ETH for transaction gas fees.

- Select the wallet account that has the LINK tokens you want to stake. Users with only one account can select the single option for connecting their wallets. On the other hand, users with multiple accounts on Metamask must click on the wallet address with the LINK tokens. Now you can click “Next” to connect it to the staking web page.

- Click “Connect” to connect your wallet address to the staking web page. You can find your connected wallet addresses in the top-right corner of the page.

- Choose the number of LINK tokens you want to stake. Ensure you have enough LINK in your wallet and don’t exceed the “Available to stake” tab amount.

- Click “Stake LINK” to start the staking process. Review the terms of service and click “Accept and continue” to proceed.

- Metamask will open up and ask for your permission to confirm the transaction. Check the ETH amount for the network transaction fee and click “Confirm” to send the staking transaction request to Ethereum.

- Wait for confirmation. The confirmation time depends on gas prices and network activity. Once you see the “Transaction complete” message, you can view your transaction on Etherscan.

Staking Chainlink on Binance

Step 1 – Create a Binance account and log in.

Step 2 – Head over to Binance Earn and select either Flexible Savings or DeFi Staking. You’ll find these options under the “Earn” tab on the top menu bar.

Step 3 – Next, click “Transfer” from the dropdown menu and fill in the necessary information.

Step 4 – Once you’ve provided all the required details, click “Lockup” to confirm your transfer.

It’s important to note that you can withdraw your funds from Flexible Savings at any time. However, staking in DeFi might require keeping your funds locked for the entire lockup period. The interest earned will be calculated and paid out daily based on your performance.

Staking LINK on Kucoin

To stake LINK on Kucoin, follow these steps:

- Create an account on Kucoin.

- Go to the “Deposit” section of the menu and choose LINK from the dropdown list.

- Copy the Deposit Address and transfer your tokens to Kucoin.

- After the transaction is complete, click “Stake Now.”

- Choose the number of LINK tokens you want to stake and click “Confirm Stake.”

- You can check your staked LINK in the “My Stakes” section of the page.

Kucoin pays out rewards daily and enables you to withdraw your tokens anytime.

Staking LINK on BlockFi

Follow the steps described below to start earning rewards by staking Chainlink on BlockFi:

- Create a BlockFi account and log in.

- Click on “Deposit” and select LINK from the list of options.

- Copy the Deposit Address and use it to transfer your tokens to BlockFi.

- Click “Stake Now” once the transaction is completed.

- Select the amount of LINK you want to stake and click “Confirm Stake.”

- Check the “My Stakes” section of the page to view your staked LINK.

BlockFi pays out rewards weekly and lets you withdraw your tokens anytime.

How to Earn Chainlink Staking Rewards?

To earn Chainlink staking rewards, you must stake your LINK tokens with a platform that offers staking rewards.

You can also use the Chainlink Staking app, a decentralized application (DApp) with a user-friendly interface that lets users easily stake their tokens on the Chainlink network and track their rewards. To use the Chainlink Staking app, users must have a wallet that supports LINK tokens and lock up their tokens for a specified period. The app provides users.

Here are the general steps for staking:

- Choose a platform that supports Chainlink staking, such as Binance, Kucoin, or BlockFi.

- Create an account and complete any necessary verification requirements.

- Deposit your LINK tokens into the staking platform.

- Select how many LINK you want to stake.

- Confirm the staking transaction.

- Wait for the staking period, during which you will earn staking rewards.

- Withdraw your staked LINK and earned rewards anytime.

Notably, different staking platforms may have different staking requirements, rewards, and withdrawal procedures. Before staking your LINK tokens, check the minimum LINK threshold and understand the platform’s terms and conditions.

How to Stake LINK on Celsius?

Celsius is a popular crypto borrowing and lending platform enabling users to earn interest on a wide range of cryptocurrencies. With Celsius, earning interest is simple – all you need to do is store the cryptocurrency in your Celsius wallet without locking it up.

Desktop Version

- Visit the Celsius website at https://celsius.network/ to create an account.

- After setting up your account, go to your dashboard and look for Chainlink (LINK).

- If you don’t see LINK on your list of coins, click on the “Receive” tab, then click “Add New Coins,” and select Chainlink (LINK). The coin will then appear on your list, and you can click “View and Copy Address.“

- Send your LINK to the address provided by Celsius.

- Once Celsius receives your LINK, you will start earning interest immediately, with rewards distributed weekly. There is no need to lock up your cryptocurrency.

Mobile Version

- Download the Celsius app from your mobile device’s app store (available for Android and iOS).

- Open the app and create an account by clicking “Join Celsius.”

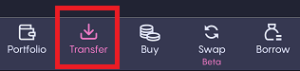

- Once your account is set up, click the “Transfer” tab to view your options.

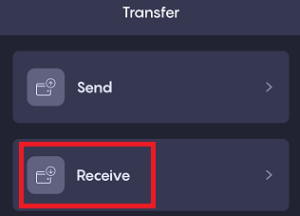

- Choose “Receive.”

- Select Chainlink (LINK) from the list to get your LINK address.

- Once you receive your LINK, you’ll start earning interest immediately, with rewards distributed on a weekly basis.

Closing Thoughts

Chainlink token holders have many possibilities to stake their idle LINK tokens to generate passive income.

Staking LINK tokens through an exchange is by far the simplest alternative, although the benefits might be modest. DeFi services are more profitable options but need more planning and information gathering. While becoming a Chainlink node operator is an option, it’s technically challenging, and many people find the approach incredibly inefficient for the incentives earned.

Chainlink staking will provide additional functionalities in the future, such as user fee rewards, a more advanced reputation system, comprehensive stake-slashing mechanics, and increased security assurances.

Disclaimer: All information provided in or through the CoinStats Website is for informational and educational purposes only. It does not constitute a recommendation to enter into a particular transaction or investment strategy and should not be relied upon in making an investment decision. Any investment decision made by you is entirely at your own risk. In no event shall CoinStats be liable for any incurred losses. See our Disclaimer and Editorial Guidelines to learn more.

-

Rahul Mantri is an author, investor, and public speaker with over 7 years of experience writing about emerging technologies under his belt. He has produced a number of widely acknowledged articles and has contributed to a lot of tech journals. He has a background in finance as well as technology and holds IBM Blockchain Essential & Developer Certification.

He is a voracious reader and his energetic talent of engrossing new words is his entrancing trait. Understanding the complexities of technology and writing prodigious technology blogs serves as a perfect example of his ability. After discovering cryptocurrency & blockchain technology for several years and drawing on his skills in finance and technology, he made his aim to enlighten people all around the world about digital currency.