OpenOcean Pros

- DeFi aggregation services are provided at no cost

- It supports 4 distinct blockchains, with more on the way

- Provides an API that lets advanced traders implement trading strategies

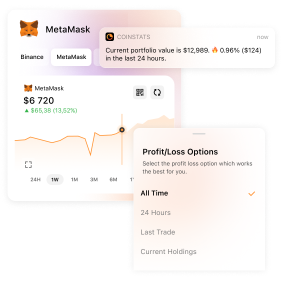

- Users can connect with 13 different wallets

- Functional and visually appealing user interface

OpenOcean Cons

- Currently, only one supported centralized exchange

- A limited number of trading pairs are available in the Pro interface

The cryptocurrency market has evolved to the point that users can now select from hundreds of different decentralized and centralized exchanges. With the rise of decentralized finance (DeFi), new DEXs and automated market makers regularly join the market, offering even more possibilities. While having a variety of options will always help the end customer, deciding which platform to choose among a staggering number of crypto exchanges out there can be challenging.

This is why cryptocurrency market aggregators are in high demand. Aggregators such as OpenOcean reference multiple platforms, allowing users to access several exchanges’ liquidity and prices at once to ensure users find the best rates and lowest fees for their trades. OpenOcean is a multi-chain exchange that acts as an aggregator of centralized finance and decentralized finance.

Our OpenOcean Review will reveal everything you need to know about the OpenOcean exchange, its features, trading fees, customer support, etc., to help you decide if it’s a suitable exchange for you.

What Is OpenOcean Exchange?

OpenOcean Exchange is a multi-chain exchange that operates as a centralized and decentralized aggregator. OpenOcean aggregates liquidity from several centralized and decentralized exchanges allowing users to benefit from competitive transaction prices and decreased slippage points. It’s the first DEX aggregator on the Binance Smart Chain (BSC) and aggregates several DEX protocols such as Ethereum, BSC, TRON, Ontology, and all leading AMM’s like PancakeSwap, Bakeryswap, StreetSwap, and BurgerSwap.

General Information on DEXs

Have you ever wondered why DEXs are becoming so popular? We believe it’s mostly because of the following factors:

- DEXs aren’t governed by any central authority; instead, they use smart contracts to allow you to trade in crypto assets without the need for a regulatory authority. They deploy an automated market maker to remove any intermediaries and give complete control over the funds to users.

- Most DEXs don’t require you to provide any personal information. You can open an account and begin trading right away.

- DEXs’ servers are distributed worldwide, reducing the possibility of a server outage.

- DEXs are essentially immune to hacker attacks.

Execution

OpenOcean has a few essential features that enable it to service its users efficiently. OpenOcean uses its optimizing algorithm based on Dijkstra and D-star to discover the optimum initial route for users, ensuring the best fills and gas fees. The algorithm then uses machine learning to constantly optimize routes based on data. This mechanism enables accurate and efficient aggregation without charging users excessive fees.

Token Economic Subsidies is a method established by OpenOcean that decreases users’ impermanent loss through “slippage subsidies.” This safeguards users in situations when their exchange value is higher or lower than the transaction’s expected value. If the user’s exchange value is higher than the expected value, the user will be fully refunded the exchange value. And when a transaction is completed with a lower than expected value, users are subsidized with the platform token, OOE.

In addition, the OpenOcean team has launched its asset evaluation system, OpenOcean Defi Evaluation System (ODES). The system uses a vast amount of ecological data to assess tokens in terms of risk exposure to protect users. Tokens must comply with “low risk” criteria to be provided for exchange. This acts as a preliminary screening mechanism, providing OpenOcean users with an extra layer of security.

Finally, the OpenOcean team strives to serve all traders; the team’s mission is to become a one-stop trading hub for all assets. This implies that users will be able to utilize the OpenOcean Wallet to trade on centralized platforms such as Binance, Coinbase, and Bitfinex. OpenOcean is also trying to include derivatives platforms through the use of a portfolio margin pool. To make it easier for users to access their front-end, OpenOcean provides them with APIs and custom-fit UIs. OpeanOcean is already building a completely new UI/UX to provide the best tools to their traders. Overall, the team intends to expand further, as they only offer aggregation to spot and DEX traders presently.

Grow Your Crypto With CoinStats Premium

Explore CoinStats without limitations and you’ll never want to go back.

Why OpenOcean?

Until now, the crypto industry lacked a single point of entry for free-flow crypto trading between DEXs and CEXs, supported by price comparison on a single website. Some users prefer DEXs wishing to keep control over their funds; therefore, they trade with smart contracts. Other users may choose to trade on CEXs since they have higher liquidity and can conduct transactions in fiat currency. However, customers without considerable programming skills will be unable to obtain the best pricing quickly due to price volatility and currency differences.

OpenOcean enables consumers to compare the best DEX and CEX prices and trade at the best price on the DEXs or CEXs of their choice using their wallets. Users with an OpenOcean account can trade on a CEX without having to open a new CEX account.

The OOE Token

The majority of projects in the DeFi space release their own tokens, and OpenOcean followed suit. The project released its native token OOE with a total supply of 1 billion tokens on March 8, 2021. The OOE token serves several purposes within the OpenOcean ecosystem. It’s used as a governance token, allowing holders to vote on different OpenOcean-related issues. OOE holders also benefit from cheaper transactions due to gas fee reductions and slippage subsidies during special campaigns arranged by OpenOcean. The coin can also be used in OpenOcean platform liquidity mining operations. Users who own a significant amount of OOE will enjoy various benefits when using OpenOcean’s centralized exchange aggregation features.

OpenOcean released 10 million OOE tokens (1% of total supply) to users who had completed at least four legal OpenOcean transactions or executed a transaction worth more than 40 USDT between the platform’s inception and March 8, 2021. Those who missed out on the first airdrop might still have a chance for a possible second round. This opportunity gives an additional incentive to people who haven’t traded on OpenOcean yet to try it out.

Here’s a more extensive analysis of the OOE supply distribution:

- Airdrops to existing users: 2%

- Team and advisors: 18%

- Protocol development: 29%

- Liquidity Mining programs over a 5-year period: 34%

- Strategic Investors: 10%

- Ecosystem Foundation: 7%

The Team Behind OpenOcean

OpenOcean was co-founded by Michael “Monty” Widenius, the “spiritual father” of MariaDB, and one of the original developers of MySQL and Tom Henriksson, who invested in MySQL and MariaDB. Both of OpenOcean’s co-founders have extensive experience in investment and trading systems development.

OpenOcean’s development team consists of 16 full-time employees with broad expertise in blockchain development. The development team’s core members are seasoned engineers and financial veterans from prominent industry exchanges and international IT businesses, including IBM, Intel, and HP.

The project has also partnered with key organizations to enhance the capabilities of trading features and provide crypto fans with a wide range of investment options.

According to a recent release, OpenOcean has completed a funding round that included Binance as a strategic investor, as well as other well-known names, including CMS, Multicoin Capital, Altonomy, Kenetic, and LD Capital.

OpenOcean Features

OpenOcean enables swaps at the best market price and with the lowest slippage. Additionally, it offers arbitrage between DEXs and CEXs, cross-chain swap transactions, and more. OpenOcean aggregates a collection of popular DEXs on various public chains and develops spot and derivative trading on DEXs and CEXs alike.

Trading Options

- When trading on DEXs and CEXs, traders can customize the user interface to ensure they don’t miss any critical information.

- Limit orders and candlestick chart tools, profit and loss setting, timely monitoring and reminders, and custom APIs with customizable user interfaces are all available tools that support trading strategies.

- Individual investors have access to a user-friendly interface that allows them to execute spot and derivative trades at the best possible price with the least amount of slippage.

Improved Liquidity

OpenOcean integrates liquidity from major DEXs and CEXs to provide transaction depth and a faster response time. Mainstream wallets are supported. You may execute one-stop transactions on any CEX with the OpenOcean portfolio margin pool and wallet. They offer the best prices and the lowest slippage gas fees through intelligent routing and machine learning. They employ an optimized variant of the Dijkstra Algorithm (D-star) for routing across protocols.

Arbitrage

OpenOcean assists you in identifying pricing differences between CEXs and DEXs and identifying arbitrage opportunities. On OpenOcean, you can also find a comprehensive guide on arbitrage.

OpenOcean Classic

It’s a simple platform used for swapping in DEXs. In comparison to OpenOcean Pro, they support more token pairings.

OpenOcean Pro

OpenOcean Pro is an advanced arbitrage and swapping platform that supports charts. They also intend to introduce derivatives, lending, and insurance products.

OpenOcean Supported Wallets

ETH

- MetaMask, Trustwallet, ONTO, Mathwallet, SafePal, BitKeep, TokenPocket, ImToken

TRON

- TronLink

ONT

- ONTO, Cyano

BSC

- BSC Wallet, MetaMask, Trustwallet, ONTO, Mathwallet, SafePal, BitKeep, TokenPocket

OpenOcean API

OpenOcean provides (APIs) and custom user interfaces to traders and institutions to help them with their investment strategies. They can conduct their custom investment strategies by connecting via API.

Supported Blockchains and Exchanges

OpenOcean supports decentralized exchanges based on the Ethereum, Binance Smart Chain, Ontology, and TRON blockchains. It supports 19 DEXs in total. Listed below are a few examples:

- Uniswap (Ethereum)

- Pancake Swap (Binance Smart Chain)

- Curve (Ethereum)

- Kyber Network (Ethereum)

- JustSwap (TRON)

The OpenOcean team is striving to increase the number of supported blockchains, with plans to include Solana, Polkadot, NEO, and additional public blockchains in the future.

To trade on DEXs using OpenOcean, users simply need to link their wallets. Users who wish to access liquidity on centralized exchanges using OpenOcean must first open an account with OpenOcean. To extend their withdrawal limits to more than 2 BTC on a centralized exchange, users need to undergo an identity verification process. Binance is the first centralized exchange integrated into OpenOcean.

OpenOcean Fees

OpenOcean doesn’t charge any transfer fees or withdrawal fees other than the network fees. Fees are charged in the four circumstances listed below:

- Combined Margin products.

- Intelligent wealth management service.

- Institutional investors pay for having an investment strategy on their custom-built UI.

- Primary Membership Edition (PME) is an automated SaaS that enables capturing arbitrage opportunities between CEXs and DEXs.

Customer Support

OpenOcean offers live chat on their website. You can also follow them on the following social media platforms:

Security

OpenOcean takes a security-first approach to protect users from security vulnerabilities and other incidents. Besides their own internal security auditing, the team frequently works with external partners to make sure they pass the most updated and leading industry standards. The OpenOcean security level is high, and there is no chance of your private key being hacked. They also have the Twenty-Four Hours Active Support Group.

How to Use OpenOcean: Trading on OpenOcean

To trade on OpenOcean, you’ll need a cryptocurrency wallet that allows you to access and utilize decentralized apps.

Step #1: Connect Your Wallet to OpenOcean

OpenOcean supports MetaMask, Ledger, Portis, and several other Ethereum blockchain wallets. To access the Binance Smart Chain, TRON, and Ontology platforms, you can use wallets like MetaMask, BSC Wallet, Cyano Wallet, TronLink, and ONTO Wallet.

To link your wallet to the platform, first go to OpenOcean and select the trading interface (Classic or Pro). Select the blockchain on which you wish to trade on the trading page, and then click “connect wallet” to link your wallet to the platform.

Step #2: Make a Swap on OpenOcean

After selecting the blockchain and linking your wallet to OpenOcean, choose the cryptocurrency you want to swap in the “from” box and enter the amount. Then, in the “to” section, select the cryptocurrency you wish to swap to. The protocol will compare prices on multiple DEXs and provide you with the best available price. If you click on the “Exchanges” tab, you will see the decentralized exchange that will be utilized for your order and less favorable prices on other exchanges. Click on the “swap now” then the “confirm” button to complete the swap.

OpenOcean Slippage and Gas Price

You can change the price tolerance and gas price before conducting a swap on OpenOcean. You may also specify which decentralized exchanges should not be utilized for your order. To alter the default settings, go to the switch interface and select the settings button. For price tolerance, you can choose a figure of 0.5%, 1%, or 3%, or input a custom number. To perform a quicker transaction, select “fast” or “immediate” instead of “standard” in the gas price column or input a custom / cheaper gas price.

Binance Smart Chain Trading on OpenOcean

You can begin trading on Binance Smart Chain by selecting the BSC network on OpenOcean and linking MetaMask or BSC Wallet to the platform. OpenOcean collects liquidity from several decentralized exchanges based on BSC and allows users to trade BEP20 tokens. Several pegged tokens are accessible on BSC, enabling you to exchange your BEP20 tokens for BUSD, USDC, USDT, and BTC. When you use OpenOcean to execute token swaps on BSC, the protocol compares prices from several BSC-based decentralized exchanges to ensure you get the best deal.

Recent Developments and Roadmap

As of March, OpenOcean has 67,000 active addresses and a trading volume of $800 million.

Binance led successful strategic funding round for the project. Shortly after that, it launched a private placement of shares with a group of investors, some of whom also invested during the funding round.

The funds were to be used to carry out OpenOcean’s extensive roadmap, which is currently on track. The roadmap is divided into four phases, the first of which has already been completed and includes aggregating liquidity from Ethereum, BSC, and Ontology. The second has also been completed and incorporates token issuance and continues with cross-chain swaps and CEX aggregation. The next phase will be integrating CeFi and DeFi derivative products into the OpenOcean protocol to offer a one-stop trading experience. A cross-exchange combined margin pool will also be implemented. In the final phase, OpenOcean aims to become a comprehensive intelligent asset management platform that offers a full spectrum of centralized and decentralized financial solutions.

Frequently Asked Questions (FAQ)

Which Blockchains Does OpenOcean Support?

The Ethereum Network, Binance Smart Chain, Tron Network, and Ontology Network are all supported by OpenOcean. It also aims to support Ethereum Layer 2, Solana, and Polkadot.

Which Centralized Exchanges Does OpenOcean Support?

OpenOcean supports Binance and plans to support Deribit in the near future.

Closing Thoughts

The OpenOcean aggregator covers an extensive section of the cryptocurrency market. The platform supports 4 distinct blockchains and 13 different wallets and is set to deliver real value to cryptocurrency users of all levels. It allows users to effortlessly and efficiently swap tokens and get the optimal fill and lowest gas fees. The aggregator protocol is free to use, and traders only pay the regular blockchain gas and exchange fees. So, keep an eye out on OpenOcean as they develop into a one-stop trading shop!

The team is also focused on combining both centralized and decentralized cryptocurrency derivatives markets (i.e., futures contracts, options, etc.). Other services being considered by the team include financing and insurance, as well as an investment management tool that would automatically distribute customers’ crypto-assets according to an investment strategy.

You can check the OpenOcean market cap and other metrics on CoinStats, one of the best crypto platforms around. Also, make sure to visit our CoinStats blog to learn more about wallets, cryptocurrency exchanges, portfolio trackers, tokens, etc., and explore our in-depth buying guides on how to buy various cryptocurrencies!

Investment Advice Disclaimer: The information contained on this website is provided to you solely for informational purposes and does not constitute a recommendation by CoinStats to buy, sell, or hold any securities, financial product, or instrument mentioned in the content, nor does it constitute investment advice, financial advice, trading advice, or any other type of advice.

Cryptocurrency is a highly volatile market and sensitive to secondary activity, do your independent research and only invest what you can afford to lose. There are significant risks involved in trading CFDs, stocks, and cryptocurrencies. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider your circumstances and obtain your advice before making any investment. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant regulators’ websites before making any decision.

-

Rahul Mantri is an author, investor, and public speaker with over 7 years of experience writing about emerging technologies under his belt. He has produced a number of widely acknowledged articles and has contributed to a lot of tech journals. He has a background in finance as well as technology and holds IBM Blockchain Essential & Developer Certification. He is a voracious reader and his energetic talent of engrossing new words is his entrancing trait. Understanding the complexities of technology and writing prodigious technology blogs serves as a perfect example of his ability. After discovering cryptocurrency & blockchain technology for several years and drawing on his skills in finance and technology, he made his aim to enlighten people all around the world about digital currency.