PancakeSwap Pros and Cons

Pros

- Lower trading fees compared to other exchanges

- PancakeSwap users can earn a variety of Non-Fungible Tokens (NFTs)

- Yields range from 23.52% to 378%, which is higher than the yields on other exchanges

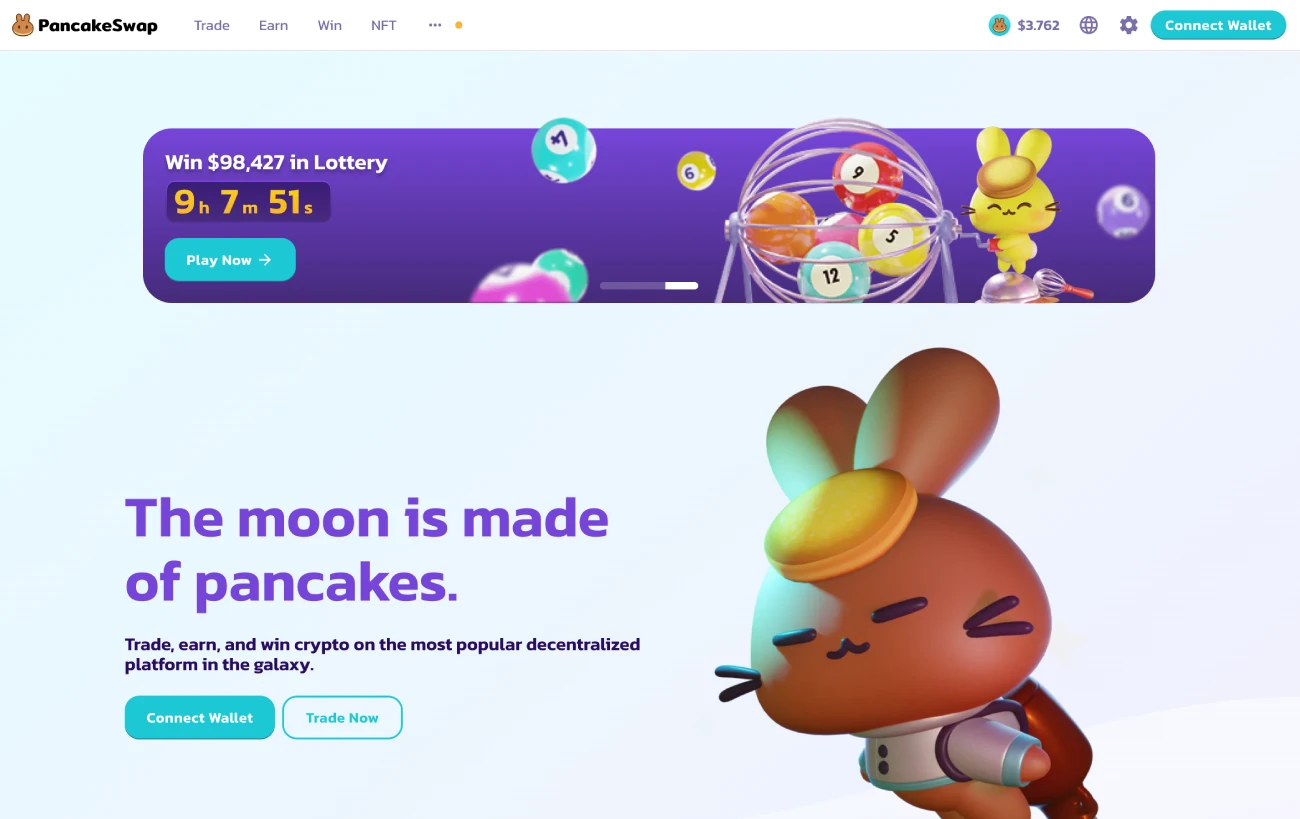

- PancakeSwap provides lottery entry, with the prize of 50% of the lottery pool

- Users are highly rewarded for contributing to the exchange's liquidity

- Several BEP20 tokens can be exchanged on PancakeSwap

- The ability to develop your own projects in the BSC community

Cons

- Not suitable for beginners

- No native wallet and complicated BSC process

- Complicated staking process

PancakeSwap is a decentralized exchange that operates on the Binance Smart Chain, providing users with a fast, low-cost, and user-friendly platform for trading cryptocurrencies. In this article, we’ll be diving into some of the key aspects of PancakeSwap, including its safety measures, transaction fees, and investment potential.

Whether you’re a seasoned trader or new to the world of cryptocurrency, this article will provide valuable insights into what PancakeSwap is all about and whether it’s a platform worth considering. So let’s get started and explore what PancakeSwap has to offer.

What Is PancakeSwap?

PancakeSwap is a decentralized exchange that allows users to trade cryptocurrencies on the Binance Smart Chain. It works by utilizing liquidity pools, which are essentially collections of tokens that are locked into smart contracts. Users can trade tokens by swapping them in and out of these pools, with the value of the tokens being determined by a mathematical algorithm.

One of the key benefits of PancakeSwap is its user-friendly interface, which makes it easy for both novice and experienced traders to use. Additionally, transaction fees on PancakeSwap are generally lower than on other decentralized exchanges, thanks in part to the Binance Smart Chain’s fast and low-cost infrastructure.

In addition to trading, PancakeSwap also offers liquidity providers the ability to earn rewards through yield farming. Yield farming involves depositing tokens into liquidity pools and earning rewards in the form of additional tokens or transaction fees. This can be a lucrative way to earn passive income in the world of cryptocurrency, although it does come with some risks that investors should be aware of.

Overall, PancakeSwap offers a simple, low-cost, and user-friendly way to trade cryptocurrencies on the Binance Smart Chain, with the added potential for yield farming rewards.

PancakeSwap Fees

While PancakeSwap is known for its low transaction fees, there are still some costs associated with using the platform. When making a trade on PancakeSwap, users will be charged a trading fee of 0.25% of the transaction amount. Additionally, there are gas fees that must be paid in order to execute transactions on the Binance Smart Chain.

Compared to other decentralized exchanges, PancakeSwap’s fees are generally lower, especially when compared to Ethereum-based platforms. This is because the Binance Smart Chain has been designed to provide fast and low-cost transactions, making it an attractive option for traders who want to minimize fees.

To minimize fees when using PancakeSwap, there are several tips that traders can follow. One is to use limit orders instead of market orders, as this can help reduce the likelihood of slippage and minimize trading fees. Another tip is to avoid trading during times of high network congestion, as this can cause gas fees to spike.

Overall, while there are still fees associated with using PancakeSwap, they are generally lower than those of other decentralized exchanges, making it an attractive option for cost-conscious traders. By following some basic tips and strategies, traders can further minimize their fees when using the platform.

Is PancakeSwap a Safe Platform?

When it comes to trading cryptocurrencies, safety and security are of paramount importance. Fortunately, PancakeSwap has taken several measures to ensure that its platform is as safe and secure as possible. One of the key steps it has taken is to undergo regular audits by third-party security firms, which help to identify and address any vulnerabilities or potential security issues.

In addition to audits, PancakeSwap also operates a bug bounty program, which rewards users who identify and report any security vulnerabilities on the platform. This incentivizes users to help improve the platform’s security by identifying any weaknesses that could be exploited by malicious actors.

While PancakeSwap has generally been a safe platform, there have been some notable security incidents and vulnerabilities in the past. For example, in June 2021, PancakeSwap was the victim of a phishing attack that affected some users. However, the platform was quick to respond and take measures to mitigate the impact of the attack.

To stay safe when using PancakeSwap, there are several tips that traders can follow. These include using strong passwords and two-factor authentication, being cautious of phishing scams, and avoiding sharing personal information or private keys with others.

Overall, while no platform can guarantee 100% security, PancakeSwap has taken several measures to ensure that its platform is as safe and secure as possible. By following some basic security practices, users can help to minimize their risk and trade cryptocurrencies with confidence.

Grow your crypto with CoinStats Premium

Explore CoinStats without limitations and you’ll never want to go back.

Is PancakeSwap a Good Investment?

As with any investment, there are both potential benefits and risks associated with investing in PancakeSwap. One of the key benefits of investing in PancakeSwap is the potential for high returns. As a decentralized exchange, PancakeSwap allows users to earn rewards by providing liquidity to its various liquidity pools. Additionally, PancakeSwap’s native token, CAKE, has seen significant price increases in the past, which has led to substantial profits for early investors.

However, there are also risks associated with investing in PancakeSwap. One of the biggest risks is the volatility of cryptocurrency prices. Cryptocurrencies, including CAKE, are known for their high volatility, which can lead to significant price fluctuations and potential losses for investors. Additionally, there is always the risk of technical issues or security vulnerabilities that could impact the value of CAKE or the overall performance of the platform.

Despite these risks, many investors see PancakeSwap as a promising long-term investment. CAKE has shown strong growth potential in the past, and the platform’s popularity continues to grow as more users become interested in decentralized finance. Additionally, PancakeSwap has outperformed many other decentralized exchanges in terms of trading volume and liquidity, which suggests that it has a strong market position.

Overall, while investing in PancakeSwap does come with some risks, many investors see it as a promising long-term investment. By carefully considering the potential risks and benefits and staying up-to-date on market trends and performance, investors can make informed decisions about whether or not to invest in PancakeSwap.

PancakeSwap Key Features

PancakeSwap offers the following key features to its users:

- CAKE, PancakeSwap’s native token, is a BEP20 token built on BSC.

- Faster transactions and lower fees than other Ethereum-based Decentralised Finance (DeFi) platforms.

- It’s an Automated Market Maker, similar to ERC20-based platforms such as SushiSwap and Uniswap.

- It enables users to trade digital assets against a variety of liquidity pools while also collecting yields.

- It allows users to lend their digital assets to liquidity pools in exchange for liquidity tokens, which they can stake to gain even more digital assets.

- It lets users trade other BEP20 tokens in addition to using cryptocurrencies to add liquidity to exchange pools, enabling them to earn extra tokens.

- With CAKE, users can earn more tokens or other tokens based on the BSC, like DODO, UST, or LUNA, by using the native token in SYRUP liquidity pools.

- “Know Your Client” (KYC) and/or Anti-Money Laundering (AML) aren’t required.

- CertiK has audited and verified PancakeSwap to ensure its legitimacy and security.

- It features a 40 CAKE reward per block; however, 15 CAKE is burnt, making the effective value substantially lower.

Binance Bridge

To trade ERC-20 tokens on PancakeSwap, you must first wrap them on the Binance Bridge and convert them into BEP-20 assets. On the Binance Bridge, connect your digital wallet. The transaction must then be verified on the Ethereum network for some Ether known as gas fees.

While the high Ethereum gas fees may make this expensive, once you’ve wrapped and bridged your crypto assets to BSC, PancakeSwap’s low fees will save you a lot of trading expenses. After you’ve finished your transactions on PancakeSwap, just use Binance Bridge to transfer your BEP-20 assets back to ERC-20. As a result, you can use BSC to buy tokens like ApeCoin using this bridge.

PancakeSwap Exchange: Products and Services

PancakeSwap has been holding on to the status of “largest DEX on the BSC chain” for so long because of its capacity to offer a wide range of financial products and services through a single interface. Most of this is feasible due to the hard work of its development team behind the scenes. PancakeSwap has extended its services from basic token swaps to an on-chain derivatives market in less than two years.

The following is a list of its current services:

- Spot Trading

- Perpetual Futures Trading

- Yield Farming

- IFO – Initial Farm Offering

- Prediction Market

- Lottery

- Syrup Pools (Staking)

- NFTs

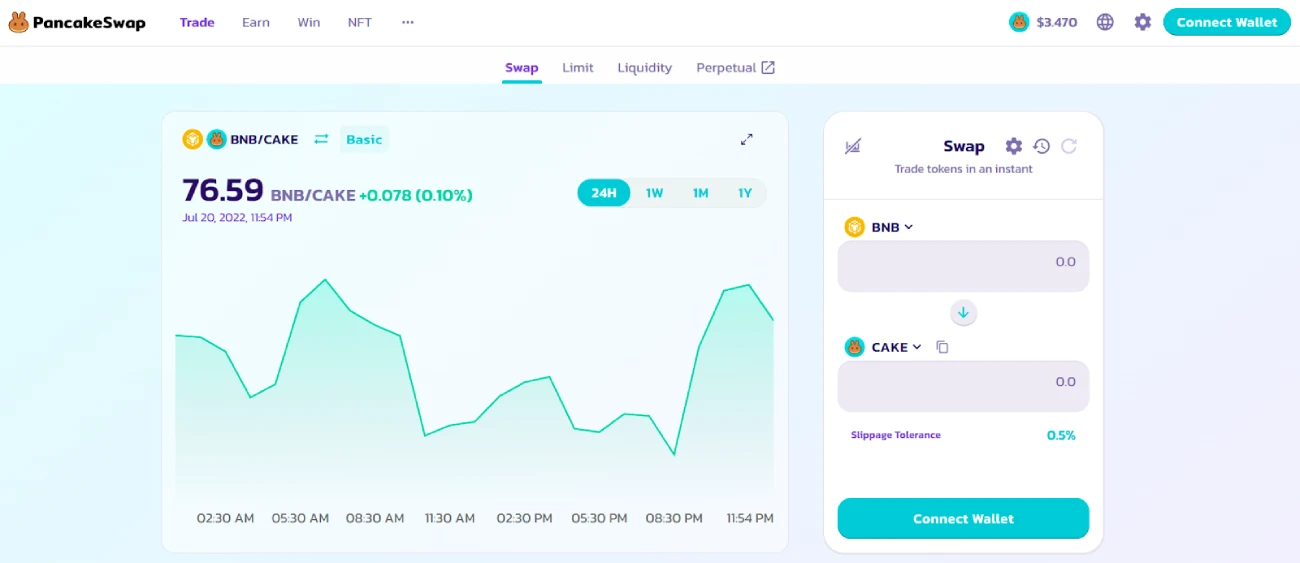

PancakeSwap Spot Trading

Spot trading on PancakeSwap is carried out by swapping assets in a liquidity pool via an automated market maker (AMM). AMM swaps are often done live, with the price defined by the ratio of assets in the pool; users have no decisive influence over the price at which they buy or sell assets.

PancakeSwap offers a solution to this problem by allowing users to pre-set orders using the limit order function on its interface. Unlike centralized exchanges, this does not imply matching one order against another. Instead, once the pre-set price objective is met, the AMM executes a swap on its liquidity pool.

However, remember that PancakeSwap doesn’t accept limit orders for tokens with a fee/tax on the ‘transfer’ of tokens. Open limit orders will stay open forever unless they are executed or canceled by users. Soon, a customizable expiration date functionality is planned.

Furthermore, as PancakeSwap is based on the BSC network, transaction speeds are substantially faster and less expensive than on Ethereum. When completing swaps on PancakeSwap, ensure to use the V2 swap, as the previous version (V1) is more prone to slippage, which results in financial loss.

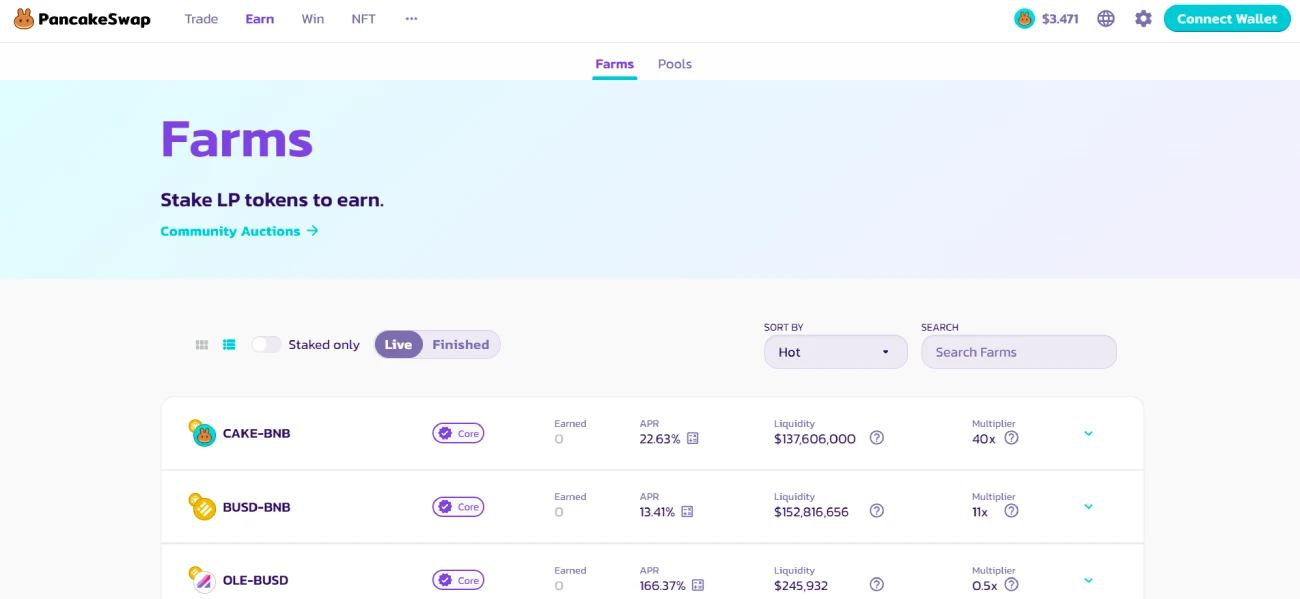

PancakeSwap Yield Farming

Users can farm rewards in the form of CAKE tokens by supplying liquidity to PancakeSwap’s Liquidity Pools. PancakeSwap features several yield farms, which require you to stake two tokens to obtain the LP tokens associated with the specific farm. Each farm on PancakeSwap has its own yield rate and multiplier, so before supplying liquidity, ensure to know which farm you want to profit from. For example, the CAKE-BNB farm has a 40x multiplier, which means it earns 40 CAKE for every block produced.

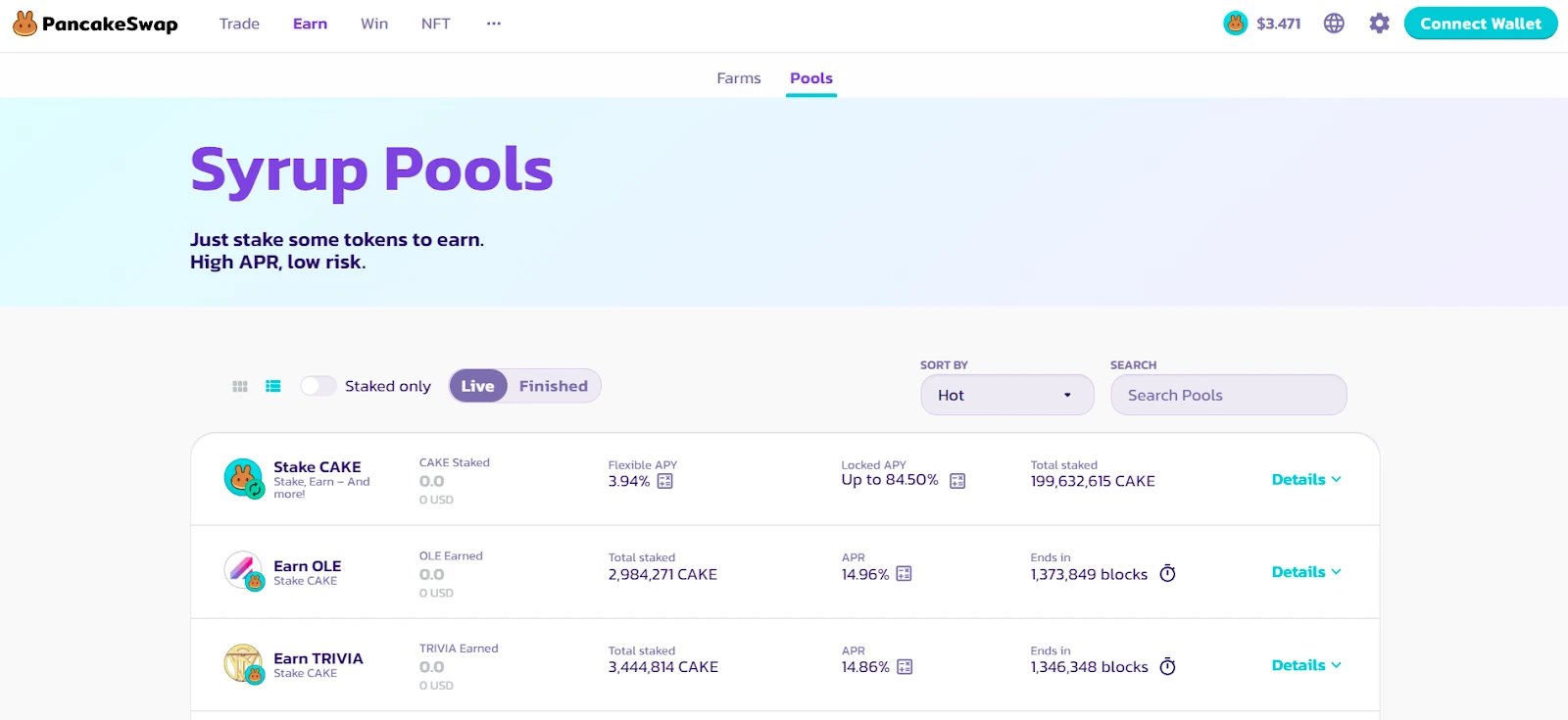

PancakeSwap Syrup Pools (Staking)

Syrup Pools let users stake CAKE and gain rewards in the form of CAKE or other tokens. The CAKE Syrup Pool, for instance, allows users to choose between flexible and locked staking. The locked staking option offers a high APY but requires users to lock their tokens for a predetermined period. The flexible staking option provides a lower APY but lets users withdraw their tokens anytime.

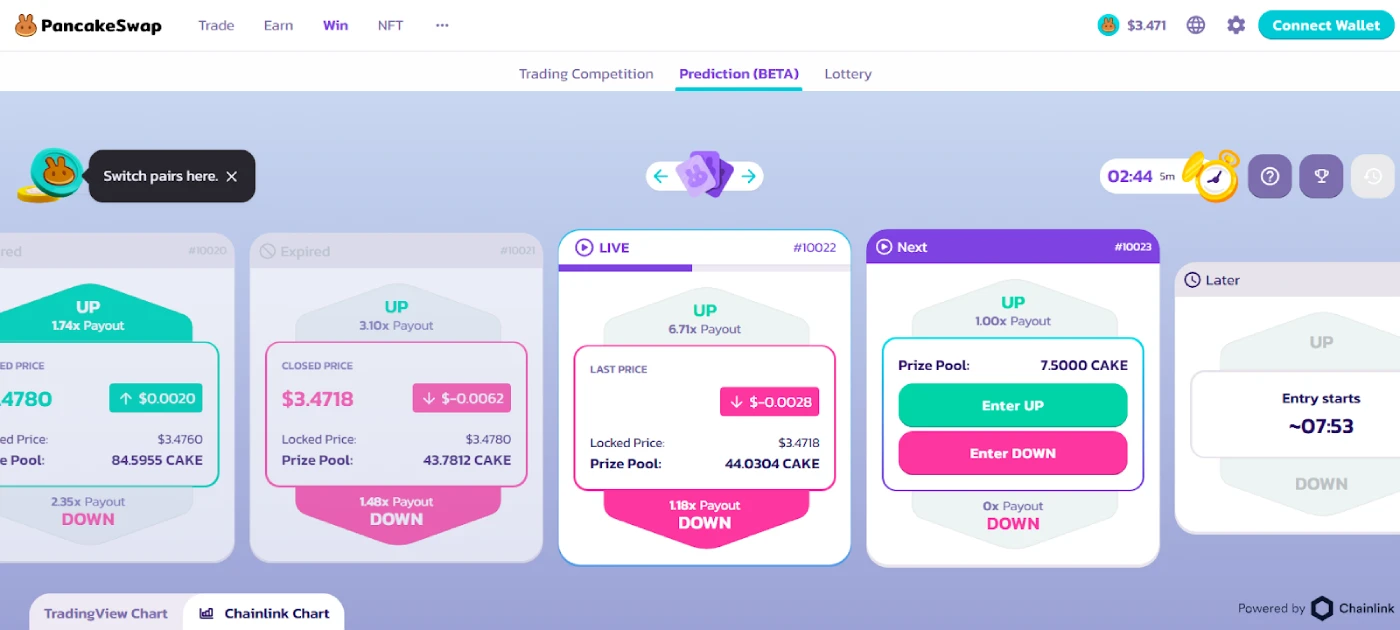

PancakeSwap Prediction Market

PancakeSwap’s prediction market lets users earn tokens by correctly predicting the price movement of BNB-USD or CAKE-USD pairs. Users can bet on whether the price of BNB or CAKE will rise or fall in the next five minutes.

Results will be calculated, and rewards will be distributed based on the closing price at the end of the round.

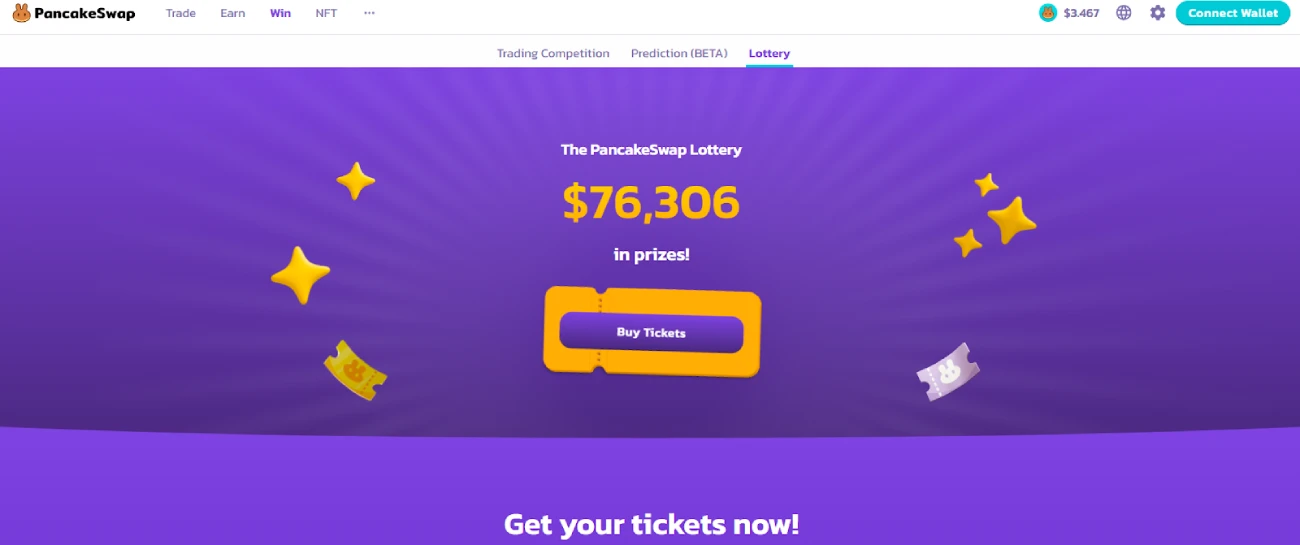

PancakeSwap Lottery

Users can purchase lottery tickets for the PancakeSwap Lottery, and each ticket has a unique 6-digit combination. A random six-digit combination is generated at the end of each lottery session, which lasts between 12 – 36 hours.

Users must have tickets that match the winning combination from left to right to win. The closer your number is to the winning combination, the higher your payout.

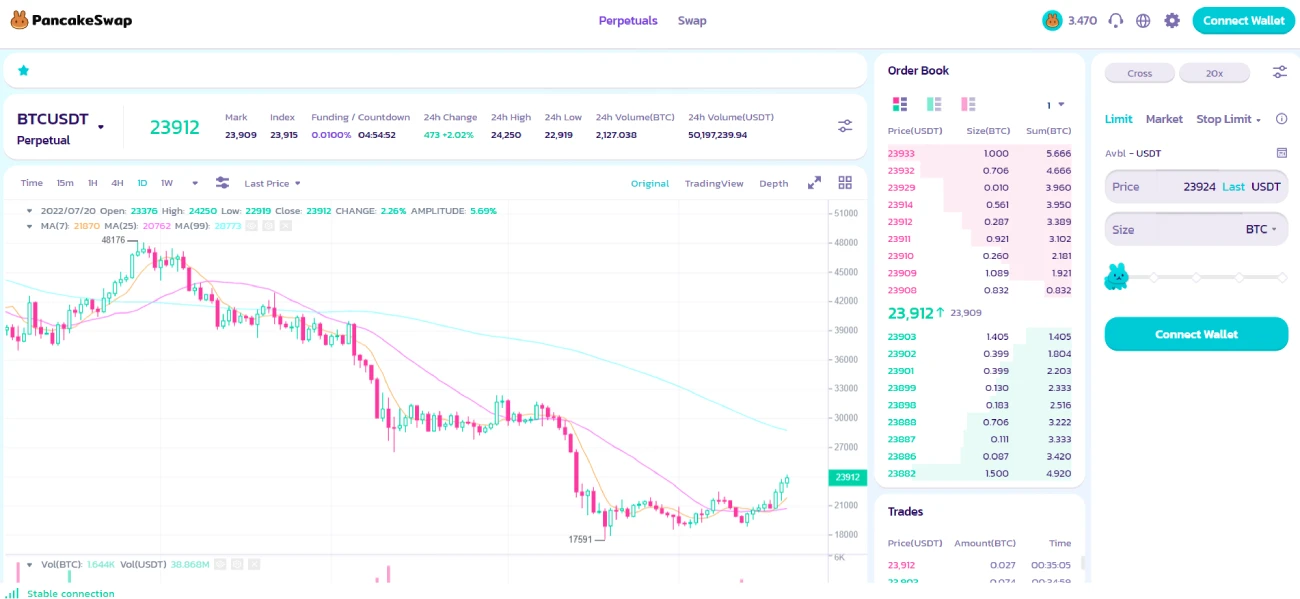

PancakeSwap’s Perpetual Futures Trading

PancakeSwap has collaborated with ApolloX Finance to allow customers to trade perpetual futures contracts using its interface. The trading infrastructure is built with off-chain order-book matching and on-chain settlement, allowing for critical trading features such as different order types (such as limit orders, stop orders, and post-only orders) while preserving privacy and security of a DEX. I.e., it doesn’t require KYC or use intermediaries when engaging with smart contracts.

PancakeSwap Initial Farm Offerings (IFO)

Initial Farm Offering, or IFO, is a novel Initial Coin Offering (ICO) concept introduced by PancakeSwap. Users must create a “profile” on PancakeSwap to participate in an IFO. Users can then commit CAKE tokens to the IFO pool to buy the token. The number of iCAKE a user owns determines the amount of CAKE a user can commit. iCAKE is a numerical metric used to calculate the quantity of CAKE staked in the fixed-term CAKE staking pool as well as the overall staking duration of your current fixed-term staking position.

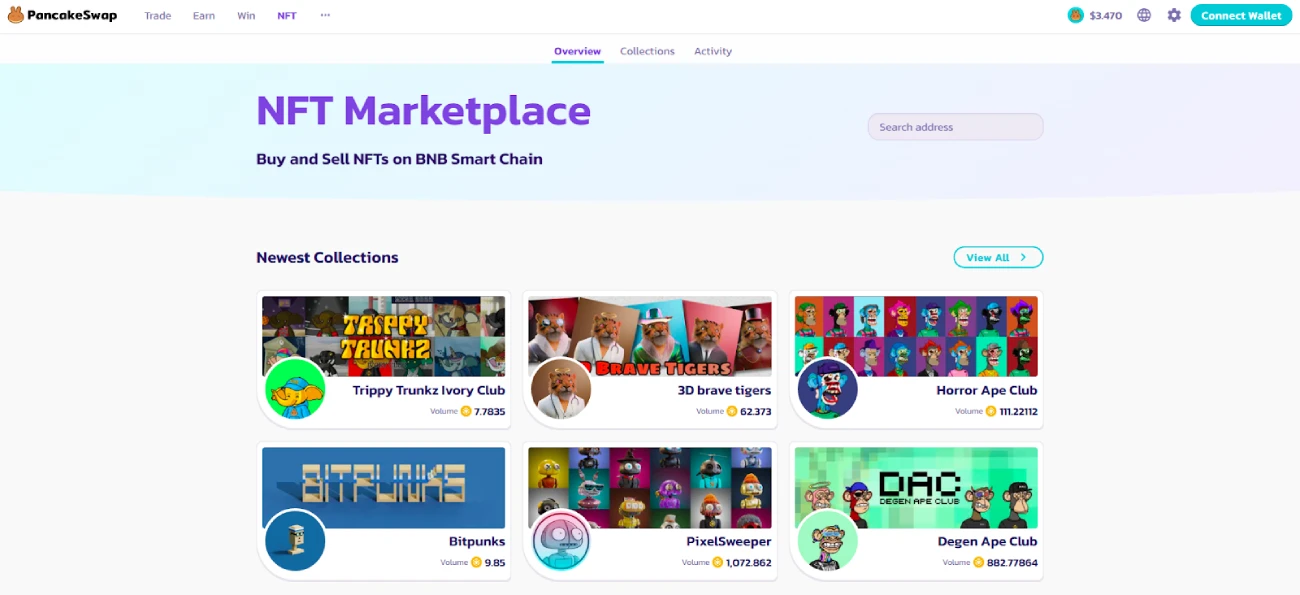

PancakeSwap’s NFTs and NFT Marketplace

PancakeSwap is staying ahead of the competition by launching its own NFT collections and allowing users to create personalized profiles on the exchange by linking them to an NFT. PancakeSwap also has its own NFT marketplace for trading white-listed NFT collections.

NFTs can be won through team trading games, where traders compete to see who has the greatest trading volume in a period, or via PancakeSwap airdrop events.

PancakeSwap Farming and Staking

PancakeSwap Liquidity pools are funded with users’ deposits, and in exchange for their contributions, users get Liquidity Provider (LP) tokens, also known as FLIP tokens. These LP tokens can be used to reclaim their share and a percentage of the trading fees.

PancakeSwap also allows users to farm CAKE and SYRUP tokens. Users can deposit their LP tokens on the farm to get rewarded with CAKE. CAKE tokens can then be staked to get SYRUP, which has extra utility as a governance token and can be used as tickets in different lotteries.

CAKE holders are given a fixed quantity of CAKE for each built block, and users can stake them to earn incentives. CAKE is distributed as BEP20 tokens to those offering liquidity to the network, and users may earn 170 percent APY by staking CAKE in the pool. Users need a Metamask wallet or a Binance Chain Wallet with both CAKE and (Binance Coin or BNB) to pay for gas on the exchange to stake CAKE.

Users can begin staking by following these steps:

- Go to the PancakeSwap website under “Finance” and click the “Connect” button in the upper righthand corner of the homepage.

- Users can choose “Connect” or “Binance Chain Wallet,” which will open the wallet.

- The user can choose “Pools” from the left-hand menu to see a list of active pools ready to accept a stake, such as the CAKE Pool.

- After identifying the pool, the user can click “Approve CAKE,” which will access the user’s wallet.

- The user can then click “Confirm” and wait for the transaction to be confirmed on the blockchain, which takes around 3 seconds.

- The pool’s format has changed, and the user can now select the “+” option on the CAKE Pool. Users may now input the amount they want to stake and click “Confirm.”

- The user’s wallet will appear, allowing them to verify the transaction details before clicking “Confirm,” which will take a few seconds to approve on the blockchain.

- Once completed, the user’s stake and CAKE balance will be updated. From here, the user may “Harvest” to claim their CAKE rewards or “Compound” to reinvest them by choosing the corresponding option offered.

PancakeSwap Deposits and Withdrawals

PancakeSwap platform exclusively accepts deposits and withdrawals from users who want to utilize PancakeSwap’s perpetual futures trading product. By depositing funds, you are granting the protocol permission to use your funds as collateral for any margin transactions you do. This collateral will be liquidated if you do not repay or close positions before certain critical price levels.

Currently, deposits are only accepted in USDT, BUSD, APX, or CAKE. To withdraw deposited funds, close any open trades and click the withdraw option under the assets tab.

PancakeSwap Supported Wallets

Users of PancakeSwap have a variety of wallet options to select from, including MetaMask, MathWallet, WalletConnect, TokenPocket, and Trust Wallet. MetaMask is an ERC-20 wallet that can also be configured to hold BEP-20 assets.

You can also choose from several other wallets in the crypto market that you can connect to PancakeSwap.

PancakeSwap Security

PancakeSwap is an open-source project that has undergone many security assessments by Certik, Peckshield, and SlowMist. The official documentation lists a total of 9 security audits.

PancakeSwap also follows standard practices in security by employing multi-signature for all contracts and setting a time-lock option for them. Furthermore, for maximum transparency, the majority of PancakeSwap’s code is publicly available, and all of their contracts are checked on BscScan.

Conclusion

In summary, PancakeSwap is a decentralized exchange running on the Binance Smart Chain. It offers a user-friendly interface, low transaction fees, and a variety of liquidity pools for users to earn rewards through yield farming. While there are risks associated with investing in PancakeSwap, including cryptocurrency price volatility and potential technical issues, many investors see it as a promising long-term investment due to the strong growth potential of its native token, CAKE, and the platform’s market position.

When it comes to safety, PancakeSwap has taken measures such as audits and bug bounties to ensure the platform’s security. By following best practices for staying safe when using PancakeSwap and minimizing fees, users can make the most of this decentralized exchange.

Overall, we encourage readers to try PancakeSwap for themselves and to stay informed about developments in the decentralized exchange space. With its user-friendly interface, low fees, and potential for high returns, PancakeSwap is a promising platform for anyone interested in decentralized finance.

Disclaimer: All information provided in or through the CoinStats Website is for informational and educational purposes only. It does not constitute a recommendation to enter into a particular transaction or investment strategy and should not be relied upon in making an investment decision. Any investment decision made by you is entirely at your own risk. In no event shall CoinStats be liable for any incurred losses. See our Disclaimer and Editorial Guidelines to learn more.

-

Rahul Mantri is an author, investor, and public speaker with over 7 years of experience writing about emerging technologies under his belt. He has produced a number of widely acknowledged articles and has contributed to a lot of tech journals. He has a background in finance as well as technology and holds IBM Blockchain Essential & Developer Certification.

He is a voracious reader and his energetic talent of engrossing new words is his entrancing trait. Understanding the complexities of technology and writing prodigious technology blogs serves as a perfect example of his ability. After discovering cryptocurrency & blockchain technology for several years and drawing on his skills in finance and technology, he made his aim to enlighten people all around the world about digital currency.