What Is Lido Finance [Deep Dive Into the World’s Second-Biggest DeFi Protocol]

Numerous decentralized finance (DeFi) protocols were born to remove financial borders and create more opportunities for retail users like you and me.

One such protocol is Lido finance, which aims to remove the considerable financial entry barriers for Ethereum staking (as becoming a validator requires 32 ETH) and makes it less technically challenging to run a validator node.

But more importantly, what is Lido Finance and how can it help you generate passive income? And how did one single DeFi protocol get to account for over 30% of all staked ETH on the Beacon Chain? Find out in our deep dive on Lido Finance.

What Is Lido Finance?

In a nutshell, Lido Finance is a liquid staking protocol, which enables users to stake proof-of-stake-based cryptocurrencies like Ethereum and Solana, without having to lock them up. This means that tokens (or rather the Lido-issued version of them) can be freely traded while being staked to the protocol.

One of Lido’s biggest advantages is that it lowers the entry barriers for ETH staking, as running a validator node on Ethereum requires a minimum stake of 32 ETH, worth just over $54,000 at current price levels. With Lido, users can stake a fraction of an Ether token, without the technical difficulties of setting up their own validator node.

The equivalent of the staked cryptocurrencies can still be freely traded on the open market, hence the term liquid staking. But how exactly does this work?

Users who stake their ETH with Lido will receive an equal amount of Lido Staked Ether (stETH), which reflects the price of ETH (more on this below). These can be freely traded and transferred among DeFi protocols, increasing capital efficiency for stakeholders.

Lido Finance currently supports Ethereum’s Beacon Chain (also known as Ethereum 2.0), Solana, Polkadot, Kusama, and Polygon.

Staking rewards depend on the cryptocurrency, starting from a 3.8% annual percentage rate (APR) for liquid Ethereum staking, up to 16.5% APR for liquid Polkadot staking.

How Does Lido Finance Work?

When a user stakes ETH on Lido, a set of smart contract algorithms distributes the tokens among 22 validators on Ethereum’s Beacon Chain. All Beacon Chain validators are previously vetted by the Lido DAO. In exchange for sharing their node capacity, validators earn 5% of the staking reward from all ETH delegated to them by Lido.

Another 5% of the staking rewards go to the Lido DAO’s treasury, which will be used for research & development, protocol insurance, and the Lido Ecosystem Grants Organization (LEGO). The remaining 90% of rewards go to stETH holders who staked their tokens with the protocol.

As previously mentioned, Lido offers a tradable token, similar to a receipt, for your staked tokens. For instance, if users stake 1 ETH to the protocol, they will receive 1 stETH token in return — which is pegged to the price of ETH and is freely tradeable.

But how does stETH maintain its price peg? In essence, there are three price stabilization mechanisms:

- Arbitrage

This refers to crypto traders buying stETH when it drops below its price peg, to sell it for ETH tokens while making a profit off the price difference. This acts as an organic financial incentive that day traders will take advantage of.

- Liquidity Mining

Liquidity mining is the second price-stabilizing mechanism for tokens like stETH. As the Lido DAO and Curve Finance offer rewards for providing liquidity for the ETH-stETH trading pairs, investors are incentivized to deposit both assets into the liquidity pool.

- Organic Demand

Organic demand is the third major mechanism that helps stETH maintain its peg. As stETH can be freely traded while earning staking rewards, it makes the token a great fit for lending protocols like Aave — enabling them to earn staking rewards and interest from borrowers simultaneously.

How to Stake on Lido Finance via CoinStats Earn?

Staking with Lido is fairly user-friendly and only takes a few steps via CoinStats Earn. Here’s how it works, using Ether as an example:

- Visit the CoinStats homepage and open the Earn page, by clicking on the nine dots on the top menu.

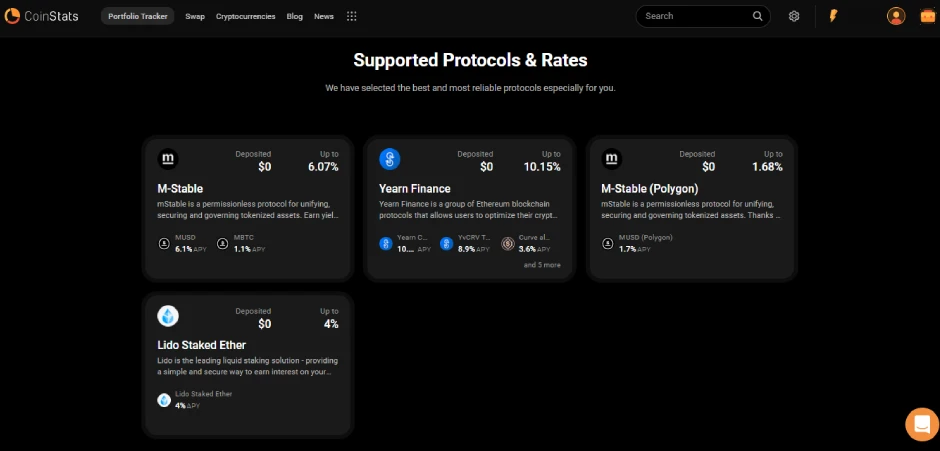

- Once you’re on the Earn page, click on the orange “Start Earning” button.

- Click on Lido Staked Ether to start staking with Lido Finance.

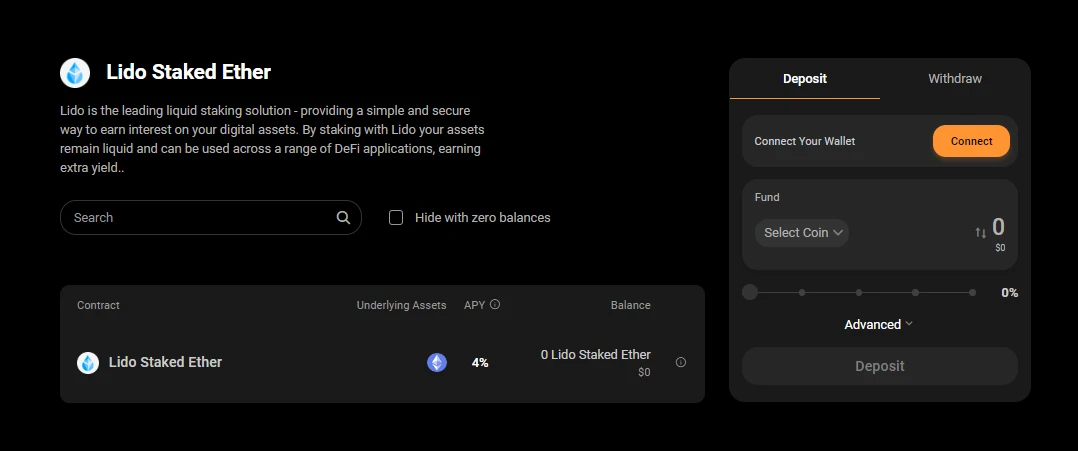

- Once you’ve opened up the Lido Staked Ether dashboard, you’ll be prompted to connect your wallet. Click on the orange Connect button to do so.

- After connecting your crypto wallet, select the coin you wish to stake under the “Deposit” tab and adjust the number of tokens you wish to stake.

- After reviewing your settings, click on the “Deposit” button below.

- This will prompt a transaction in your wallet, which you’ll have to approve to finalize the staking.

- Once the transaction is completed, you’ll receive the equivalent of your staked ETH in stETH, directly in your crypto wallet.

Is Staking with Lido Finance Safe?

While staking with Lido is considered relatively safe, all DeFi protocols come with their own set of risks. These are the main risks involved with using Lido:

- Smart contract exploits

Smart contracts are a fairly new technology, having only been introduced in 2015. Despite Lido being audited by ChainSecurity and MixBytes, there is a risk of smart contract exploits via bugs in the code or other vulnerabilities.

- DAO risks and key management

Validator withdrawals on Lido are controlled by 11 multi-signature (multi-sig) wallets. If the private keys to 6 of those wallets were misplaced or corrupted, hackers could theoretically approve withdrawals on behalf of the Lido DAO. This could also occur in case of the wallet keys being mismanaged, as we’ve seen in the unfortunate event of the $625 million Ronin hack.

- Validator risks

Ethereum validators risk being penalized if their nodes go offline, which can cost them up to 100% of their staked ETH. This is commonly referred to as “slashing” — which is also a risk if you stake with Lido.

It’s worth noting that slashing is a minimal risk, as Lido spreads your tokens among multiple reputable validator nodes and mitigates losses incurred through slashing with a dedicated insurance fund.

- stETH price de-pegging

Despite having three price-mirroring mechanisms in place, stETH can theoretically lose its peg due to limited withdrawals on Lido. At the time of this writing, stETH is trading 0.2% lower than ETH. Yet, the Lido DAO is actively taking measures to maintain the price peg.

- Risks of an ETH-stETH “death spiral”

A “death spiral” refers to the events that led to Terra/Luna losing its peg as the price stabilization algorithms failed due to extreme sell pressure. While stETH is not an algorithmic stablecoin, its value is entirely based on ETH and the staking reward on the network. If staking rewards or Ether prices started crashing, the significant sell pressure could lead to extreme price inconsistencies for stETH.

On the bright side, stETH can’t completely lose its value, as it is backed 1:1 by actual ETH held in staking pools.

The Lido DAO Token (LDO)

The Lido DAO token (LDO) launched in January 2021, one month after the Ethereum Beacon Chain launched at the end of 2020. LDO functions as a governance token in the Lido DAO, enabling holders to create proposals and cast their votes on existing ones.

In technical terms, LDO is an Ethereum-native ERC-20 token. It has a circulating supply of 620 million and a maximum supply of 1 billion tokens, all of which were minted in the Genesis block. According to the introductory blog post, the LDO token’s initial allocation was the following:

- DAO treasury – 36.32%

- Investors – 22.18%

- Validators and signature holders – 6.5%

- Initial Lido developers – 20%

- Founders and future employees – 15%

There is no set release schedule or issuance rate for tokens locked in the Lido DAO’s treasury. All treasury emissions have to be voted on and accepted by the majority of LDO token holders.

LDO is currently the 30th largest cryptocurrency by market capitalization, trading at $2.02, with a market cap of $1.7 billion, according to data from CoinStats.

The Team and Funding Behind Lido Finance

Lido Finance was founded in 2020 by Konstantin Lomashuk (who also founded P2P Validator), Vasiliy Shapovalov, and Jordan Fish (also known as Cobie on Crypto Twitter), who since left Lido in 2021.

In May 2021, Lido raised $73 million in a funding round led by crypto venture capital firm Paradigm, which bought $51 million worth of LDO tokens from the Lido DAO’s treasury. The other $22 million was jointly raised by notable industry participants like Coinbase Ventures, Three Arrows Capital, Jump Trading, Alameda Research, and others.

In March 2022, venture capital firm Andreessen Horowitz (a16z) invested $70 million in Lido Finance, also taping the protocol to stake an undisclosed amount of their ETH holdings to the Beacon Chain.

The Lido DAO

The Lido DAO is a Decentralized Autonomous Organization that manages Lido’s liquid staking protocol. They are responsible for setting fees, assigning node operators, and deciding on other key parameters through the voting power of LDO governance token holders.

According to Lido’s technical docs, the DAO is also responsible for accumulating service fees and investing them in research & development, liquidity mining incentives, protocol upgrades, bug bounty incentives, and the general operation of the protocol.

Lido DAO members include Semantic VC, ParaFi Capital, Libertus Capital, Bitscale Capital, StakeFish, StakingFacilities, Chorus, P2P Capital, and KR1.

Governance

All Lido DAO governance and network decisions are governed by the LDO token and its holders — to ensure the stability and decentralized governance structure of Lido Finance.

Protocol proposals are created and voted on in the Lido governance forum. The voting weight of a user is proportional to the amount of LDO stake held in the voting contract. Meaning that the more LDO a user locks in the voting contract, the greater the user’s decision-making power.

Treasury

As per Lido’s official blog post, the purpose of the Lido DAO treasury fund includes the following:

- Insurance fund

- Development grants / Gitcoin grants

- Salaries and compensation

- Legal requests

- Research inquiries with other protocols

- Social/marketing campaigns

- Protocol fees

- Liquidity mining events

Any treasury fund allocations need to be voted on and accepted by the majority of LDO holders. At press time, the Lido DAO treasury wallet holds just over 139 million LDO tokens, worth approximately $281 million, at the current price.

Roadmap

One of the main missions of Lido Finance is making liquid ETH staking fully trustless, as described in their blog post from July 2021. This requires no central custodians or other entities to be involved with depositing, staking, or unstaking ETH tokens.

Accordingly, Lido has a dedicated roadmap for decentralization, which aims to make the protocol fully trustless. Currently, Lido’s validator node selection process is centralized, as nodes have to apply and be vetted by the Lido DAO.

To achieve a permissionless validation process, Lido is gradually adopting Distributed Validator Technology (DVT), which will allow the protocol to onboard untrusted node operators, by pairing them with a majority of trusted nodes — hence enabling new nodes to decentralize the node setup, without the risks of slashing, as they would propose and attest blocks together with the trusted nodes.

The implementation of Distributed Validator Technology (DVT) is the main focus of the Lido roadmap.

The second major milestone is to create a Node Operator Score (NOS) based on node performance and other metrics, using it to adjust stake allocation accordingly. This would allow anyone to become a node in a trustless manner and build up their reputation over time. This would also replace the current binary system of trusted/untrusted node operators.

Last but not least, Lido Finance is aiming to make the Ethereum network more decentralized. The protocol is accomplishing this by making it easier for anyone to run a validator node, onboarding increasingly more ETH validators, and making staking more financially rewarding for validator nodes.

Concerns around Lido

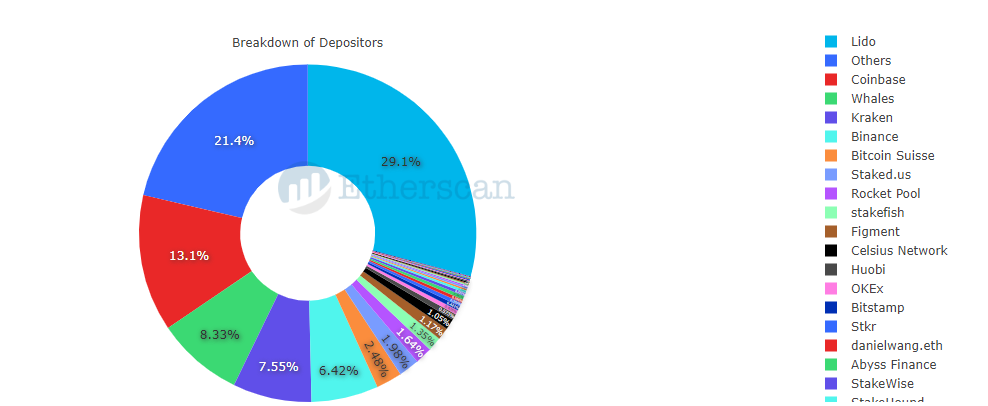

The primary concern around Lido Finance is the protocol’s large ETH stake, as Lido currently makes up 29.1% of the total Ether staked on the Beacon Chain.

Despite aiming to make Ethereum more decentralized, Lido’s current growth rate could make it the main protocol for Ethereum validators. If Lido’s ETH stake would eventually rise to 100%, the Lido DAO could have a significant influence on the Ethereum network — especially as industry participants speculate that the protocol could soon control over 50% of staked Ether.

Lido’s growing stake is a significant worry since whoever controls the majority of the block production on a public blockchain can also re-order or censor transactions, which was also noted in Lido’s report on DAO vulnerabilities.

The second major concern around Lido is that it’s not truly trustless. Two major factors are preventing Lido from being a fully trustless protocol. Firstly, all validator withdrawals are controlled by 11 multi-signature (multi-sig) wallets. 6 of those 11 signatures are required for a transaction to be completed, according to Lido’s post on withdrawal key generation. Meaning that if 6 of those wallets were corrupted, hackers could approve withdrawals on behalf of the Lido DAO.

The second factor holding back Lido from being fully trustless is the validator onboarding process. This is because every new validator is subjected to a vetting process by the Lido DAO. While this is great for selecting the most adequate validators, it also represents a point of friction that goes against the ethos of decentralization.

Finding a major bug in Lido’s open-source code is another concern for users. There were already 2 major bugs discovered, the first of which was found in October 2021. Luckily, it was fixed before a cyber attacker could take advantage. The second major bug was discovered in March 2022. This was also addressed before an exploit could occur.

Lastly, stETH could lose its price peg to ETH, which already happened on one occasion. In March 2022, Lido warned that stETH had a 4.2% price deviation compared to ETH, due to extreme selling pressure. While this can liquidate leverage traders, it didn’t drastically affect long-term stETH holders, as the price peg eventually recovered. Yet, keep in mind that due to limited withdrawals, stETH always trades slightly below ETH prices.

Benefits of Lido

The main value proposition of Lido Finance is that it lowers the entry barriers for ETH staking, making it user-friendly and accessible for retail investors who don’t hold 32 ETH to run their own validator node.

Institutions and ETH whales also benefit from Lido, since they aren’t limited to staking 32 ETH, instead being able to stake as many tokens as they want and compound their staking rewards.

The third major benefit is the increased capital efficiency created by the stETH token — which can be freely traded while simultaneously gaining passive income from one’s ETH stake. This enables stETH holders to use their tokens as collateral for lending, yield farming, and other yield generation methods.

With regular staking, the locked ETH tokens are stuck in the staking pool until validator withdrawals will be enabled on Ethereum’s Beacon Chain in the future. Lido also awards staking rewards every 24 hours directly to user wallets.

Lido doesn’t require stakers to complete Know Your Customer (KYC) verification, further lowering the entry barriers for staking. While potential node operators still need to be vetted by the Lido DAO, the protocol is working on making the process fully trustless.

Last but not least, Lido is a non-custodial protocol, meaning that there’s no central entity holding or controlling user assets. This means that there’s no risk of censorship or user assets being frozen, as we’ve recently seen with the centralized crypto lending platform Celsius.

Bottom line

Lido Finance already plays a major role in the Ethereum network, accounting for 30.3% of staked ETH on the Beacon Chain. It’s also among the most popular DeFi protocols, with over 181,000 total stakers and $7,6 billion worth of total staked assets.

The protocol’s future adoption will largely depend on its roadmap and other proof-of-stake tokens that will be supported by Lido. Looking at Lido’s governance page, there are already proposals to add staking support for AVAX and NEAR — which would result in more protocol adoption by token holders.

As for Lido’s roadmap, decentralizing the validator selection process will also mean more validators and lower risks of penalties — as the protocol completes its decentralization roadmap.

Finally, the capital efficiency created by Lido’s stETH and other such tokens will be hard to ignore for institutional investors, as they can simultaneously earn staking rewards while deploying their stETH as collateral for other yield-generation products. This is likely the main reason why Lido already accounts for 30% of staked ETH, and is well on its way to 50% and more.