How to Buy Radix [The Ultimate Guide 2023]

The global cryptocurrency market cap soared to an all-time high, reaching a market cap of $3 trillion. Everyone seems interested in cryptocurrency, from financial institutions to individual investors these days. In recent years, the number of tokens available for trading to new investors has skyrocketed. Not just Bitcoin, the market demand has grown for Ethereum (ETH) and thousands of other cryptocurrency tokens, including the recently launched and fast-growing cryptocurrency token Radix, with ticker XRD.

Read on for our deep-dive on Radix(XRD) and learn how to buy Radix (XRD) in a few simple steps.

Let’s get right to it!

What Is Radix (XRD)

Radix (XRD) is a Layer 1 (L1) protocol with the goal of building an open, interconnected platform. It lets developers build various decentralized finance applications and smart money apps such as stablecoin platforms, yield farming protocols, games, NFTs, lending and borrowing platforms, etc. In Radix, developers receive rewards for each improvement made to the protocol using the native XRD token.

Radix is the first crypto layer 1 blockchain protocol that introduces a scalable, secure-by-design, composable platform with a DeFi-specific build environment to make it easy to build and launch scalable DeFi. To deliver the kind of performance needed to make DeFi a global phenomenon, Radix uses the newly developed consensus mechanism Cereberus. It also deploys the Radix Engine, its own version of Ethereum Virtual Machine (EVM).

The Radix platform describes itself as the only decentralized network that allows developers to build quickly without worrying about security risks, such as hacking incidents or other cyberattacks.

Radix was developed by Dan Hughes in 2017. Hughes is a distributed ledger expert and currently serves as the CTO of Radix. The CEO of Radix is Piers Ridyard, who is skilled in Management, Business Development, Finance, Venture Capital, and Private Equity.

How Is Radix Different

Building decentralized finance applications on most protocols that aren’t specifically built to serve DeFi leads to congestion, hacks, and developer frustration. Radix changes the game by introducing a scalable, secure-by-design, composable platform with a DeFi-specific build environment and a new programming language, Scrypto, to make it easy to launch and develop scalable DeFi.

Radix relies on 2 leading technologies: Radix Engine and Cerberus consensus algorithm. The network also uses Scrypto programming language to develop smart contracts, which are called “Components” on Radix.

Radix Engine uses Component Catalog, a registry of inactive templates that allows any developer to choose among already developed functionalities. Smart contracts can apply to an unlimited number of transactions, and developers can add new blueprints or build smart contracts from scratch.

The Radix Engine Version 1 (V1) was released in July 2021, and the launch of Version 2 (V2) is scheduled for 2022.

The Cerberus consensus algorithm is used to validate transactions, ensure security, and achieve high scalability on the network. Cerberus introduces two significant changes from other scalable consensus protocols that give it practically unlimited scalability without compromising free atomic composability. All Radix transactions are composed atomically across multiple shards. The protocol provides linear scalability through unlimited parallelism, scaling thousands of nodes and millions of users seamlessly.

Cerberus is based on a Delegated Proof of Stake (DPoS) mechanism. XRD token holders can choose validator nodes to stake their tokens in the network through a process called delegation. Validator nodes carry out transactions reaching consensus and securing the network. Stakers and node runners are economically incentivized and get rewards for participating in the consensus on transactions.

Radix also has lower on-ledger/blockchain running costs than other scaling solutions.

Radix has founded GoodFi, a not-for-profit organization with the mission of getting 100 million people into DeFi by 2025. DeFi industry leaders such as Chainlink, Aave, Sushiswap, Avalanche, etc., have also joined GoodFi.

Radix (XRD) Tokenomics and Price

Radix token was first launched on the Ethereum blockchain as an ERC-20 e-Radix token (eXRD). The circulating supply of e-Radix tokens was 42 million, with a maximum circulating supply of 4.41 billion. 642 million e-Radix tokens (14.6% of the initial supply) were sold in the token sale.

The Radix mainnet Olympia was launched on July 28, 2021, and the XRD token went live on the native network. The initial ERC-20-based XRD (e-XRD) tokens remained on Ethereum as a wrapped version of XRD. XRD, e-Radix price is volatile and depends on various factors, such as supply and demand, general crypto market trends, protocol upgrades, etc.

The eXRD (e-Radix) price reached its all-time high of $0.6538 on November 14, 2021 (data as of February 27, 2022). The fully diluted market cap of XRD is $3,530,520,674.

Some cryptocurrencies, like e-Radix, can only be purchased with another cryptocurrency on decentralized exchanges. To buy e-Radix, you’ll need first to purchase Ethereum (ETH) and then use ETH to buy e-Radix.

XRD has a max supply of 24 billion tokens. 10% (2.4 bln) of the supply was allocated for future development, 10% was locked for the stablecoin reserve, around 10% (2.7 bln) went to Radix Foundation, 50% of the supply was kept for staking rewards (300 M tokens into circulation each year), and around 15% (4.41 billion) was initially allocated as eXRD tokens.

Now, let’s look into where, how, and when to buy Radix (XRD).

Where to Buy Radix(XRD)

Currently, Radix (XRD) is available on the Bitfinex crypto exchange. As for e-Radix, the token can be traded on a few popular crypto exchanges with decent daily trading volumes, such as Gate.io, Uniswap, Kucoin, Mexc, Hoolgd, BitMax, MXC, etc.

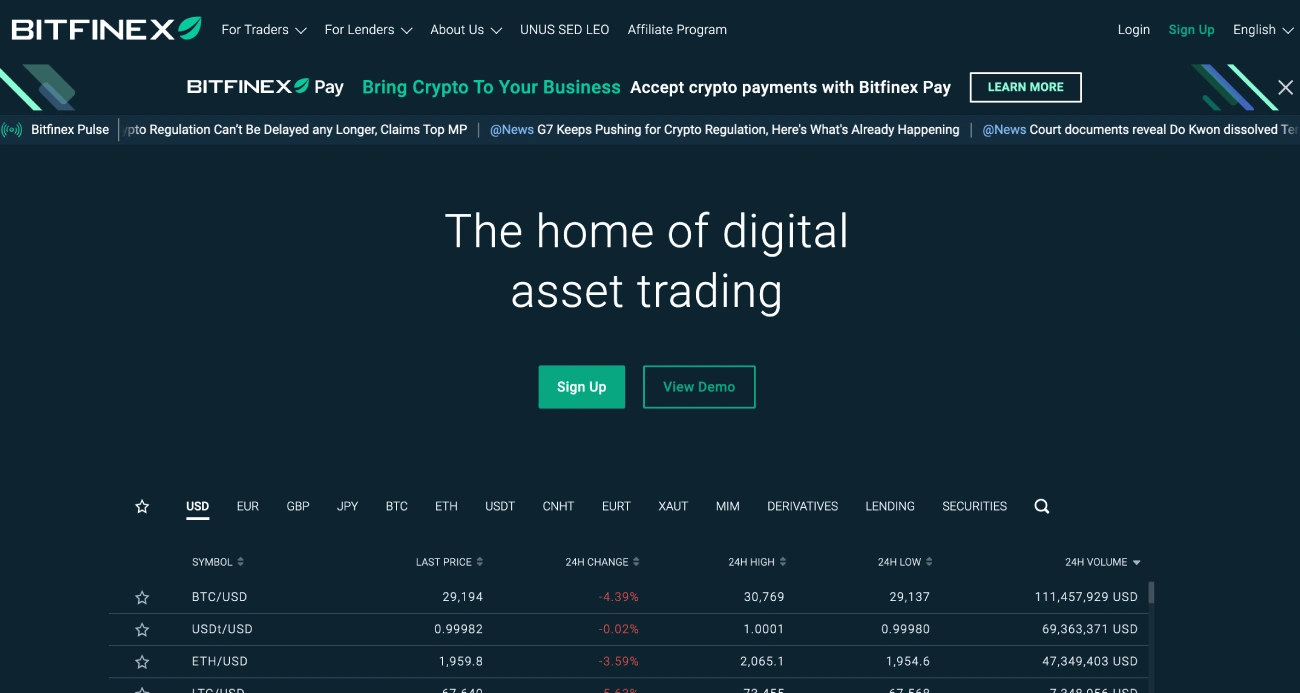

You can purchase (XRD) on Bitfinex with USD/eXRD and BTC/eXRD trading pairs. Bitfinex is a centralized exchange, consistently reaching over $1Bn in 24hr trading volume, with a wide range of markets and pairs. It has recently launched the first L2 bridge with the layer-2 decentralized trading platform DeversiFi to facilitate ERC-20 token transactions between centralized and decentralized exchanges.

Another crypto exchange to purchase Radix (XRD) is DigiFinex. Visit the CoinStats page on XRD markets for more information on exchanges where you can buy XRD.

Let’s look into how to buy Radix (XRD) on Bitfinex.

What Is Bitfinex

Bitfinex is one of the oldest cryptocurrency exchanges that has been in operation since 2012. The Bitfinex headquarters is based in Hong Kong and managed by iFinex Inc.

The Bitfinex exchange is one of the largest cryptocurrency platforms in terms of trading volume, with a 24-hour volume of over $2 billion. Bitfinex is known for its high liquidity in terms of BTC/USD daily trading volume.

As a centralized cryptocurrency exchange, Bitfinex offers its users a plethora of features and services to make their trading experience smooth and seamless. Bitfinex supports trading in more than 500 tokens, including Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Cardano (ADA), and popular altcoins like Dogecoin (DOGE), Shiba Inu (SHIB), etc. It serves most countries worldwide and supports both fiat-to-crypto and crypto-to-crypto trades. The Bitfinex exchange offers a tiered fee structure and a wide range of advanced trading options with easy-to-navigate dashboards and menus.

Yet despite the robust security measures, Bitfinex was hacked in 2015 and 2016. Nonetheless, Bitfinex’s recovery management after the hacks was legendary, and since then, it has significantly improved its security and compensated lost funds to every user.

How to Buy Radix (XRD) on Bitfinex

To purchase Radix (XRD) on Bitfinex, follow the steps below. The process is similar to buying cryptocurrencies on other platforms, but novices might find our step-by-step guide helpful.

Create an Account

To buy, sell, trade, and exchange crypto fast, you’ll need to open an account with your preferred cryptocurrency exchange, i.e., in this case, it’s Bitfinex. To signup for Bitfinex, you’ll need to provide personal information such as your name, contact number, email address, home address, social security number, etc. Once you’ve entered all this information, the exchange will ask you to set up two-factor authentication with the Google Authenticator. A verification email will be sent to your email, and after getting verified, you can start trading.

Verification

Bitfinex complies with the Anti-money-laundering, Know Your Customer, and Counter-Terrorism Financing laws and regulations. There are four levels of verification available on Bitfinex:

- Basic: The basic level is for new users who create a Bitfinex account and verify their email. At this level of verification, users can deposit, trade, and withdraw various cryptocurrencies, but the advanced features aren’t available to them.

- Basic Plus: For the Basic Plus level, you’d need to upload an Official Photo ID, Biometric photo (selfie), and Phone number. At this level, you can unlock features such as Multipliers in Bitfinex Affiliate Programs, etc.

- Intermediate: To become an Intermediate level user, you’d need to be a Basic Plus user and then upload a Second Official ID, Proof of Address, Financial Questionnaire, and KYC declaration. An intermediate user has access to many features such as margin trading, derivatives trade, and a host of other Bitfinex services.

- Full: To be a Bitfinex Full verified user, you need to be an Intermediate level user and then upload your bank statement. This would unlock all the features available on Bitfinex.

Buy Radix

Once you’ve successfully verified your account, the next step is to purchase Radix (XRD). You’ll need to deposit funds onto your account. You can deposit either cryptocurrencies or fiat currency, but only Full users can make a bank transfer. The bank transfer can be made in USD, EUR, GBP, JPY, and CNH. You can choose an XRD/USD or XRD/BTC trading pair to buy Radix (XRD) for USD or in exchange for BTC. After choosing your trading pair, simply place a market order to buy Radix at the best market price available.

Store Your Radix(XRD) Tokens

Once you’ve completed your Radix (XRD) purchase, the next step is to select a crypto wallet to store your coins securely. Your coins can be stored in your exchange wallet; however, in this case, they’ll be exposed to hacking. We highly recommend creating a private wallet with your own set of keys. Depending on your investing preferences, you might choose between software and hardware wallets, the latter being a more secure choice.

- Software (Hot) Wallet: Software wallets, also known as Hot wallets, are connected to the internet at all times. They store your keys online and are therefore less secure. Software wallets are free to use, and their ease of use makes them an ideal choice for newbies with a few tokens. One of the most popular and widely used software wallets are the Coinbase wallet, MetaMask, and the CoinStats Wallet, available for free download on Google PlayStore and App store. The CoinStats Wallet is the best wallet for storing your DeFi tokens and lets you earn a very high APY on them.

- Hardware (Cold) Wallet: A hardware wallet is a device that stores the private keys you need to receive or send crypto. Hardware wallets are usually considered the safest way to store your cryptocurrencies as they offer offline storage, thereby significantly reducing the risks of a hack. They are secured by a pin and will erase all information after many failed attempts, preventing physical theft. Hardware wallets also let you sign and confirm transactions on the blockchain, giving you an extra layer of protection against cyber attacks. Ledger and Nano hardware wallets are arguably the most secure hardware wallets letting you securely manage your Radix tokens.

Final Word

Radix is the first layer-one protocol specifically built to serve DeFi. If successful, it will bring about the continued growth and mass adoption of the DeFi ecosystem. If you’re considering investing in Radix as a part of your portfolio, make sure to do your own research, consider your own circumstances, take the time to explore all your options, and only invest what you can afford to lose.