The Top Three DeFi Tokens of 2020 So Far

11

3

The cryptocurrency market is experiencing a deja vu, thanks to DeFi, a backronym for decentralized finance.

The performance of every token listed under the said brand name is looking insanely bullish in 2020. It is very similar to how native tokens of a long string of initial coin offering (ICO) projects appeared in 2017. People saw potential in ICOs and bought their cryptos to realize that more than 90 percent of them were backing worthless vaporware projects.

But DeFi appears different. The industry has raised funds after delivering a working product, unlike the ICOs that were attracting billions of dollars worth of investment at the ideation stage. That serves as one reason why traders are still adamant about rising the crazy DeFi rally – they see real potential.

CoinStats has compiled a list of top decentralized finance tokens based on their market performance between January 1, 2020, until August 31, 2020.

#1 Aave

Aave is an open-source, non-custodial protocol that enables users to earn interest on deposits. The project also allows people to borrow assets based on a variable or stable interest rate.

It further enables people to obtain ultra-short duration flash loans without requiring collateral.

Aave had a different name at the time of its launch. As ETHLend, it was a product of the ICO craze but became one of the few projects that lived up to its promise to deliver a working product.

Its team raised $16.2 million via crowd sales to create a decentralized lending platform. Later, the protocol became part of Aave, a company that backed multiple crypto products, including Aave Lending, Aave Pocket, Aave Custody, Aave Clearing, and Aave gaming.

Aave has now about $1.8 billion worth of cryptocurrencies locked inside its liquidity pool. That shows that the protocol can handle more requests for lending and borrowing.

Meanwhile, Aave’s governance token, LEND, has surged by almost 4,115 percent in value in 2020, its upside following a greater demand among traders to participate in proposing, voting, and deciding on new additions, features, assets on the Aave protocol.

The LEND/USD exchange rate was $0.749 at the time of this writing.

#2 Melon Protocol

Melon Protocol aims to reconstruct traditional investment vehicles by removing hurdles that add unnecessary costs to the operations. It enables asset managers to develop their own tokenized investment vehicles and define the key parameters, including fee structure, trading exchanges, risk management, compliance costs, etc.

Asset managers to get to write these rules into a self-executable computer code, known as smart contracts, while each outcome out of these contracts is stored on a blockchain. The process removes the need or writing contracts in a fund prospectus. It leads to cost, time, and operational savings.

Each process involved in the Melon Protocol relies on its native token MLN. Asset managers need to burn the cryptocurrency to set up a fund, seek investments from investors, approving an investment request by a third-party.

That means that each MLN holder receives compensation for holding the token against the rising number of funds’ creation. The Melon Protocol has assisted in creating 375 funds already, which has brought about $23,000 into the system.

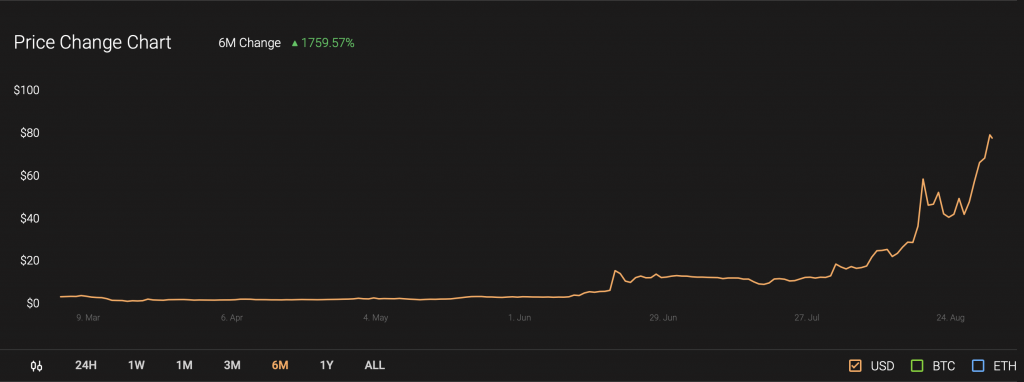

Meanwhile, MLN/USD exchange rate has surged by 2,521 percent in 2020, becoming the second-most profitable token on a year-to-date timeframe. The pair was trading at $79.21 at the time of this writing.

#3 Ren

Ren backs a decentralized dark pool known as RenEx. The project is using its technology to create, deploy, and run privacy-centric applications using zkSNARK on its secure multiparty computation protocol (sMPC).

Meanwhile, Ren’s main product is RenVM, a decentralized custodian that brings interoperability to DeFi. It does so by holding users’ assets as they move between different blockchains using zero-knowledge proofs over an sMPC-based protocol.

The entire process remains hidden from everyone, including the Darknodes that power it.

The REN token, meanwhile, is used as a bond to run the Darknode. Each node operator deposits 100,000 REN to register and run the said obfuscation tool.

The REN/USD exchange rate has surged 1,475 percent so far in 2020.

Other Top DeFi Performers include…

…Airswap (1,005%), Loopring (890%), Kyber Network (876%), Bancor (666%), and others.

The post The Top Three DeFi Tokens of 2020 So Far appeared first on CoinStats Blog.

11

3

![Aave [OLD]](https://static.coinstats.app/coins/ETHLendbeN3n.png)