How to Buy DeFi Pulse Index on CoinStats [The Ultimate Guide 2023]

The DeFi Pulse Index (DPI) is a blockchain financial product designed to track the performance of decentralized finance (DeFi) tokens. The protocol lowers the barrier to entry for new users and enables experienced users to gain exposure to DeFi through a single asset.

The DeFi Pulse Index chooses its tokens according to a DeFi project’s market cap and re-weights its index on the first day of every month. The index includes blue-chip DeFi governance tokens, covering the major decentralized exchanges, lending protocols, etc.

Read on to learn everything you need to know about DeFi Pulse Index (DPI) and how to buy DeFi Pulse Index on CoinStats in a few simple steps.

Let’s get started!

What Is DeFi Index

Trading in the cryptocurrency industry is incredibly complicated. Traders need to learn about particular cryptocurrencies and study the entire crypto market trends.

This is why DeFi indexes have emerged as an easy way to get passive, diversified exposure to the market.

What Is DeFi Pulse Index

The DeFi Pulse Index (DPI) was the first non-derivative and non-synthetic index in the DeFi market. DPI is an ERC-20 token that enables users to gain exposure to a basket of DeFi protocols via a single transaction. The DeFi Pulse Index began with 10 of the most popular Ethereum-based DeFi tokens and is weighted depending on each token’s capitalization.

The DeFi Pulse Index considers the following factors when evaluating tokens for inclusion in the index:

- Tokens must have a connection to a DeFi protocol or DApp listed on DeFi Pulse.

- Tokens cannot be synthetic or wrapped.

- The protocol or product must have been launched at least 180 days before being able to qualify to be included in the index.

- Tokens must be considered bearer instruments.

- Tokens must not reflect tangible assets, options, or futures contracts in the real world.

- Tokens must be listed on the Ethereum blockchain.

- Over the next five years, the token’s overall supply must be reasonably predictable.

- At least 7.5% of the token’s five-year supply must be currently circulating.

- Tokens must not reflect claims to other tokens on blockchains other than the Ethereum blockchain.

Underlying Tokens in the Dpi Index as of April 2022 Rebalance:

Maker (MKR), Compound (COMP), Synthetix (SNX), Yearn Finance (YFI), Aave (AAVE), Kyber Network Crystal (KNC), REN (REN), Loopring (LRC), Balancer (BAL), Uniswap (UNI), Sushi (SUSHI), Farm (FARM), Badger DAO (BADGER), Tribe (TRIBE).

Where Can You Buy DeFi Pulse Index (DPI)

The DeFi Pulse Index can be purchased on major cryptocurrency exchanges such as eToro and Crypto.com, as well as decentralized markets such as Uniswap.

It’s also compatible with Pillar, Zapper, and Dharma, among other DeFi systems and protocols.

DeFi Pulse Index has joined forces with the Set Protocol, which enables the creation, maintenance, and trading of “Sets,” baskets of ERC-20 tokens representing a portfolio of underlying assets.

How to Buy DeFi Pulse Index On CoinStats

Some cryptocurrencies, such as the DeFi Pulse Index, can only be acquired on decentralized exchanges with another coin. To buy DeFi Pulse Index, you must first buy Ethereum (ETH) and then use ETH to buy DeFi Pulse Index (DPI).

You can buy ETH on popular cryptocurrency exchanges such as Coinbase, Binance, Bitfinex, Gemini, Bitstamp, Kraken, KuCoin, etc., with credit/debit cards or bank transfers.

Let’s learn how to buy DeFi Pulse Index on CoinStats:

Step #1: Connect Your Wallet

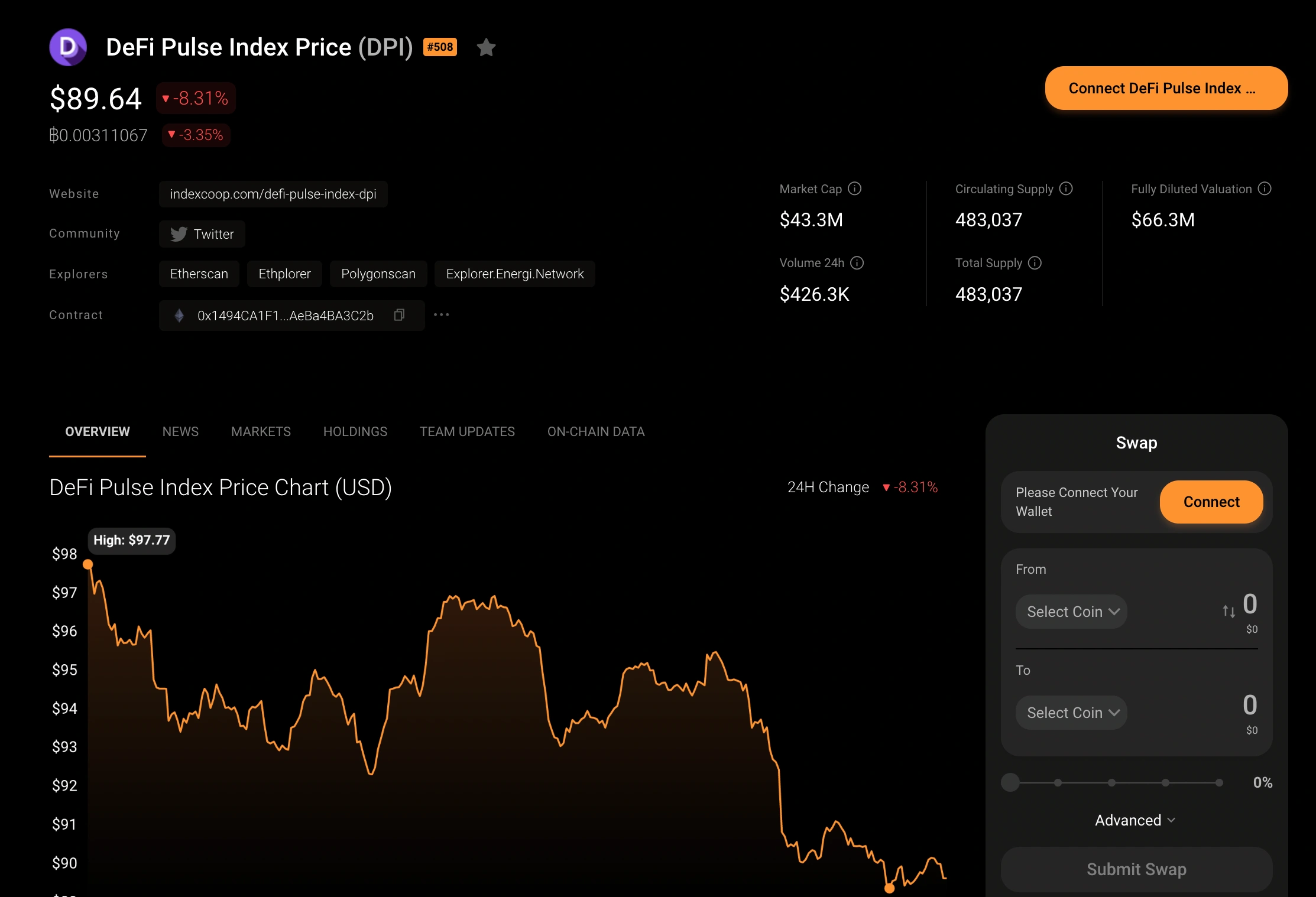

Go to the coinstats.app and search for the DeFi Pulse Index (DPI) Price in the search bar. Scroll down to the “swap” features and connect the wallet where you store the ETH token.

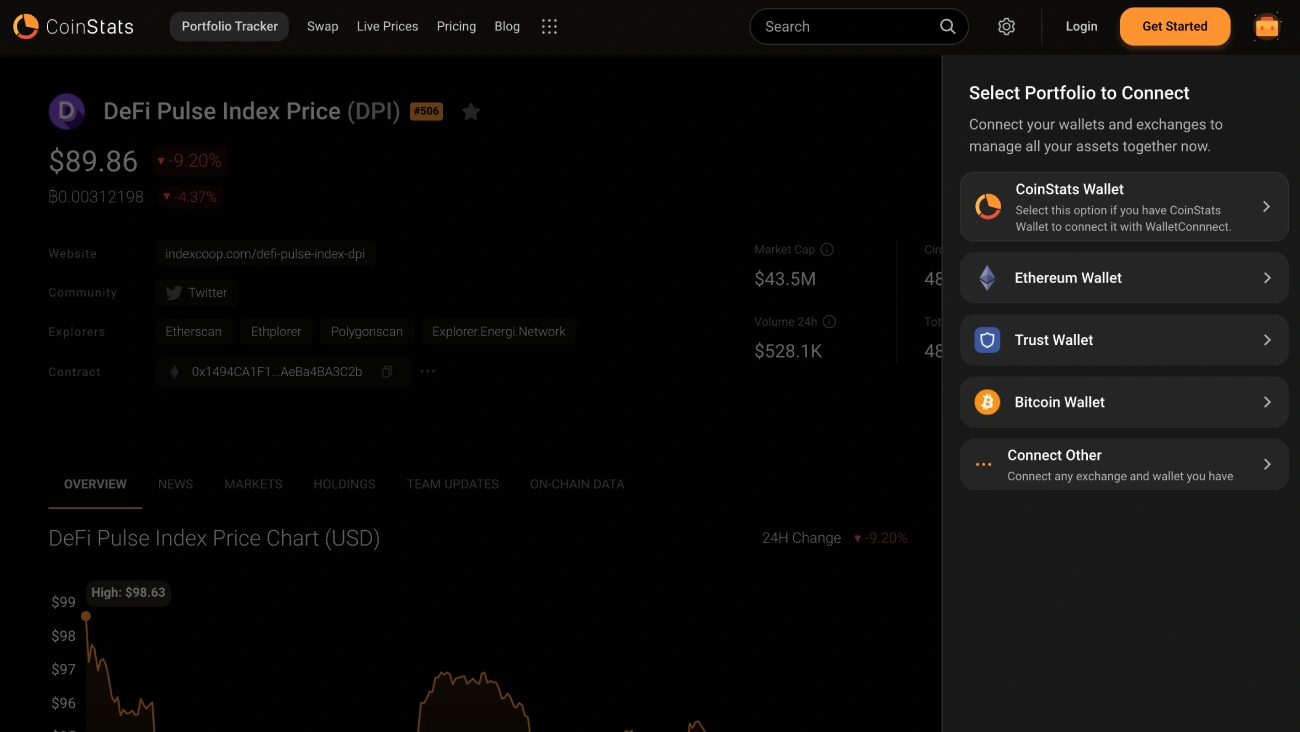

By clicking on the “Connect” button, you’ll see the various wallet options supported by CoinStats. Search for your wallet and connect it.

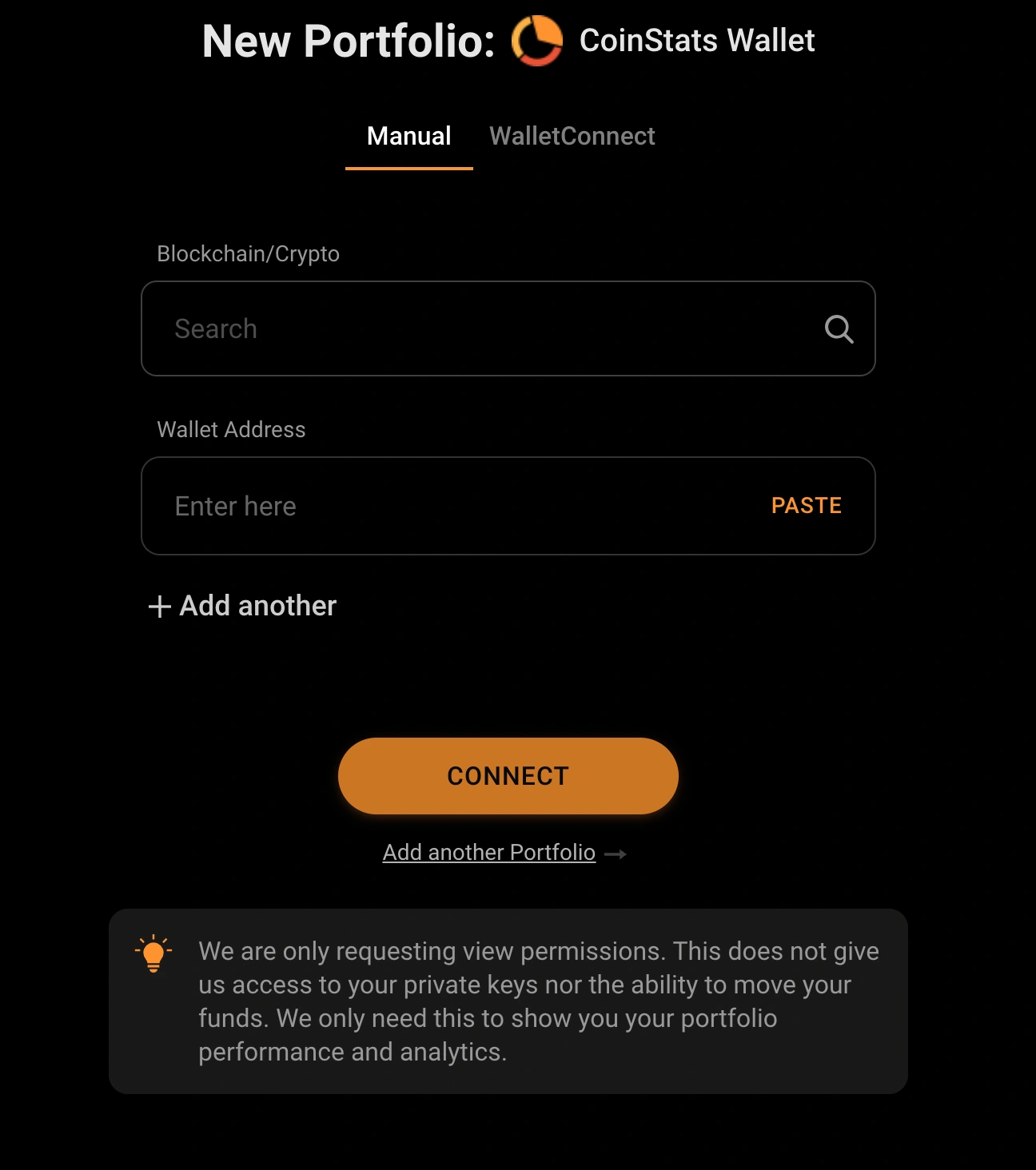

You can connect it by scanning the QR Code via WalletConnect or manually adding the Blockchain/Crypto and Wallet address in your web or mobile application.

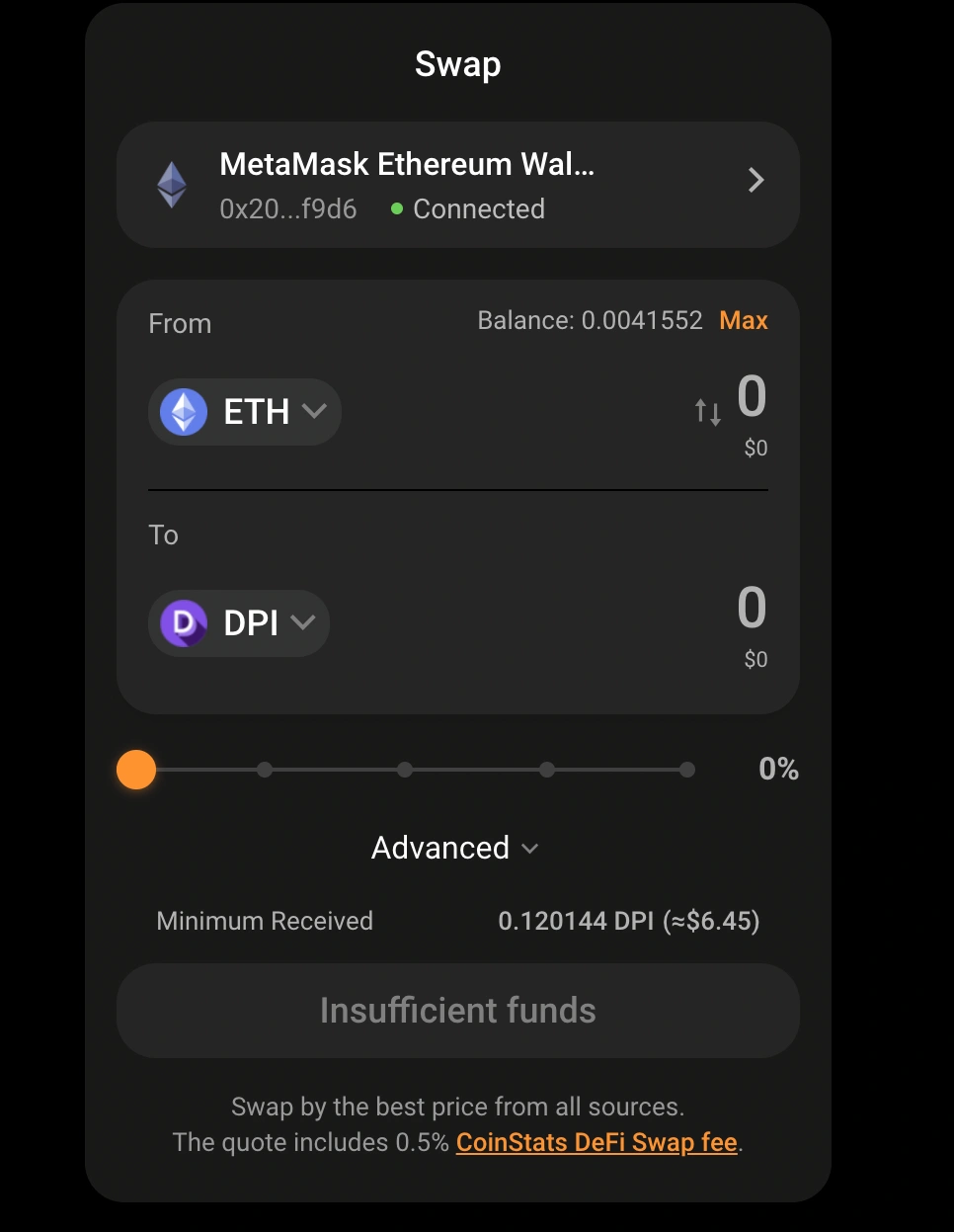

Step #2: Select Token

After successfully linking your wallet, select the token you want to swap by entering the details in either cryptocurrencies or USD/EUR.

For example, we are swapping ETH for DPI or buying DeFi Pulse Index (DPI) with ETH.

In the “From” field, select the ETH token from your wallet, and in the “To” field, select “DPI.”

Step #3: Click Swap

Click on Advanced Options to adjust the slippage and gas settings. Once done with customizing, scroll down to the bottom of your screen and click on the “Submit Swap” button.

After submitting the swap request, you’ll be asked to confirm the swap. Review the details displayed on your web or mobile app screen, and click the “Confirm” button to initiate the swap.

Your transaction is now being processed. The speed of your transaction will vary depending on the gas settings you choose. You can trace your transaction from the loader at the bottom right corner or the wallet’s home page.

NOTE: You’ll be charged Network Transaction fees, also known as gas fees. This refers to the charge necessary to complete a transaction on the blockchain. In essence, gas fees are paid in the native currency of the network, i.e., Ethereum for the Ethereum network. CoinStats also charges a small swap fee in addition to the gas fees.

Step #4: Purchase a Wallet (Optional)

After completing your Metaverse Index Purchase, choosing a crypto wallet to store your coins safely is the next step. Your coins can be saved in your brokerage exchange wallet, but we strongly recommend creating a private wallet with your own set of keys. Depending on your investment preferences, you can pick software or hardware wallets, the latter being a more secure option.

A hardware wallet, also known as cold storage, is a physical device that stores the private keys necessary to receive and transmit cryptocurrency. Hardware wallets are often regarded as the safest option to store your cryptocurrency since they offer offline storage, which decreases the risk of hacks. They are password-protected and will erase all data after multiple failed attempts, preventing physical theft. Hardware wallets also let you sign and confirm blockchain transactions, adding an extra layer of protection against cyber threats.

Ledger wallets are undoubtedly the most secure hardware wallets available to users of all skill levels. The Ledger Nano X is ideally suited for experienced crypto traders and can store various assets, including DPI tokens.

A software wallet, on the other hand, is the most user-friendly crypto wallet, allowing you to interact with numerous decentralized finance (DeFi) applications instantly. However, software wallets are vulnerable to security breaches because they are hosted online. If you wish to use a software wallet, conduct due diligence before selecting one to avoid security breaches. As an added layer of protection, we recommend using a platform that supports 2-factor authentication.

What to Look for When Purchasing DeFi Pulse Index

Novel monetary proposition: Buyers of DPI tokens gain access to all of the DeFi Pulse Index tokens without having to own any of the assets individually.

Directly redeemable: DPI tokens can be liquidated in exchange for one or more of the index’s tokens. This implies that investors can have a stake in a basket of DeFi currencies by utilizing a single token, allowing them to spread out their total monetary risk.

Solid backing team: Concourse, an independent crypto community comprised of experienced digital currency developers, enthusiasts, and academics, oversees the administration of the DeFi Pulse Index.

Closing Thoughts

A long-term plan is essential when trading in indexes; the DeFi Pulse Index isn’t the only token of its type on the market, as other indexes are also constantly emerging. DPI’s main rivals are now the DeFi Top 5 Index (DEFI5) and the PieDAI DeFi Large Cap (DEFI+L).

However, the survival of indexes like DPI depends on DeFi and the larger crypto market, which has recently witnessed significant losses. DPI is currently worth $98.96, down 83.8% from its all-time high of $612.08 in May last year. But it’s not all bad news; the token is still up 71.6% from its low of $57.66 in November 2020.

You can also visit our CoinStats blog to learn more about wallets, cryptocurrency exchanges, portfolio trackers, tokens, etc., and explore our in-depth buying guides on buying various cryptocurrencies, such as How to Buy VeChain, What Is DeFi, How to Buy Cryptocurrency, etc.

Investment Advice Disclaimer: The information contained on this website is provided to you solely for informational purposes and does not constitute a recommendation by CoinStats to buy, sell, or hold any securities, financial product, or instrument mentioned in the content, nor does it constitute investment advice, financial advice, trading advice, or any other type of advice. Our information is based on independent research and may differ from what you see from a financial institution or service provider.

Investments are subject to market risk, including the possible loss of principal. Cryptocurrency is a highly volatile market and sensitive to secondary activity, do your independent research, obtain your own advice, and be sure never to invest more money than you can afford to lose. There are significant risks involved in trading CFDs, stocks, and cryptocurrencies. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider your circumstances and obtain your advice before making any investment. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant regulators’ websites before making any decision.