BlockFi Review [The Ultimate Guide 2023]

BlockFI Pros and Cons

BlockFi Pros

- Price Transparency

- Excellent Customer Service

- BlockFi Credit Card

- Margin Lending Account

- Accredited Investors can choose between three managed funds.

BlockFi Cons

- A limited number of cryptocurrencies are available, many of which are stablecoins

- New clients cannot open an interest-bearing account

- No joint or custodial accounts

- Fluctuating APY & Loan rate

BlockFi is a privately held New Jersey-based lending platform founded in 2017. It seeks to “bridge the worlds of traditional finance and blockchain technology to bring financial empowerment to clients on a global scale.”

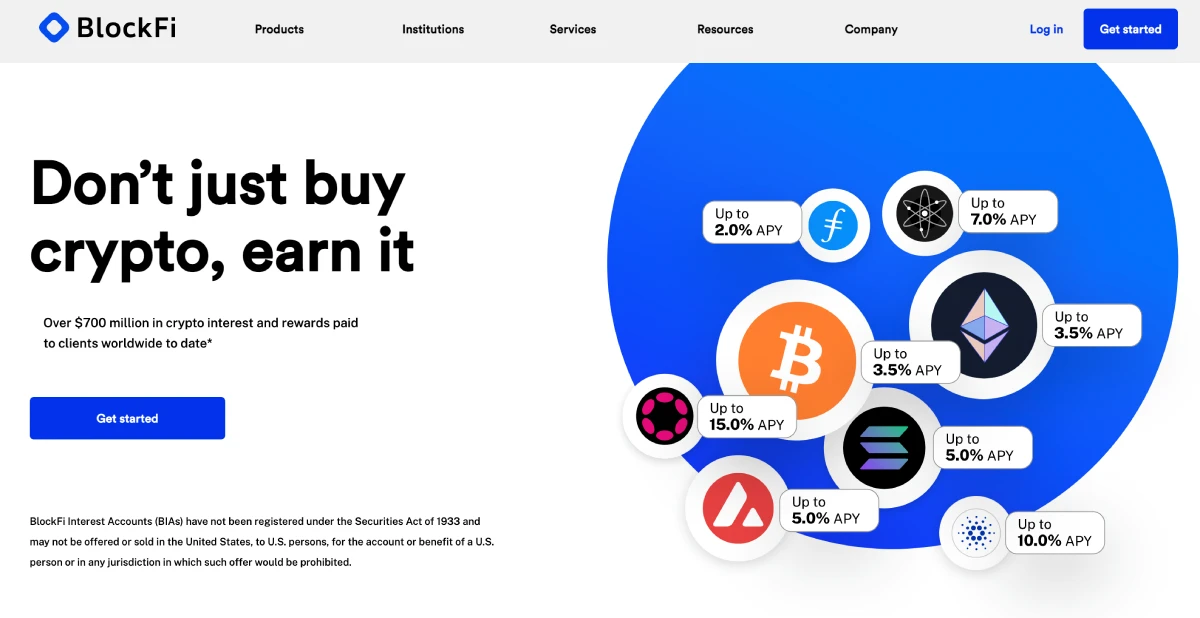

BlockFi offers a cryptocurrency exchange, interest-bearing accounts, and low-interest-rate loans worldwide. BlockFi charges zero transaction fees on trades, and there are no hidden fees or minimum balances. The BlockFi Interest Account (BIA) is among the leading cryptocurrency interest accounts popular among investors interested in generating passive income. It allows users to earn between 3% and 8.6% compounding interest on cryptocurrencies such as BTC, ETH, LTC, USDC, USDT, GUSD, and PAXG.

The company recently settled with the SEC after it was charged with failing to register its retail crypto lending product, among other issues. The settlement included a $100 million fine and required BlockFi to stop offering BlockFi Interest Accounts to U.S.-based users.

Read our BlockFi review for an overview of the platform’s features and services.

Let’s get right to it!

What Is BlockFi

BlockFi is a New Jersey-based crypto assets custodian founded in August 2017 by Flori Marquez and Zac Prince.

BlockFi is an excellent choice for investors looking to trade crypto without hidden fees and a minimum deposit. The platform provides a rich suite of features and services such as a crypto rewards credit card, a BlockFi wallet, or cryptocurrency-backed loans with a 50% LTV ratio.

Traders can effortlessly earn an interest rate of 8.6% by depositing crypto assets into their BlockFi account and trading cryptocurrencies. However, the BlockFi Interest Account (BIA), which allowed users to earn compound interest on crypto holdings, is no longer offered to new clients residing in the United States. Existing clients that are US residents will be unable to transfer new assets to their BIAs.

The company has raised a total of $508.7M, of which $158.7 million in Series C funding.

How Does BlockFi Work

BlockFi is a cryptocurrency exchange platform and a crypto wallet enabling individual traders and enterprises to fund their savings accounts using cryptocurrency, stablecoins, and USD.

Its former Interest Account was a spread business that made money by borrowing capital at a specific rate (the interest rates it paid to users) and lending it a higher rate (the interest rates it offered for BTC/ETH/GUSD loans).

Currently, BlockFi still makes money on the spread of assets exchanged on its platform, interest paid on its loans, and with its credit card account.

The BlockFi Team

BlockFi’s executive team has decades of experience in traditional financial services and banking. To position itself favorably for long-term development and expansion, the firm commits to taking a prudent regulatory approach.

Founder & CEO Zac Prince has held executive positions at several high-performing software firms. Before founding BlockFi, he worked as head of business development teams at Orchard Platform, an online lending broker-dealer and RIA, and Zibby, an online consumer lender.

Flori Marquez, co-founder & VP of Operations, has prior expertise in managing alternative financing products. As Head of Portfolio Management for Bond Street (bought by Goldman Sachs), she assisted in the development and scaling of a $125M portfolio. She was in charge of all operations, including origination, default, and litigation.

BlockFi Products and Services

The platform provides its users with the following BlockFi products and services:

BlockFi Interest Account (BIA)

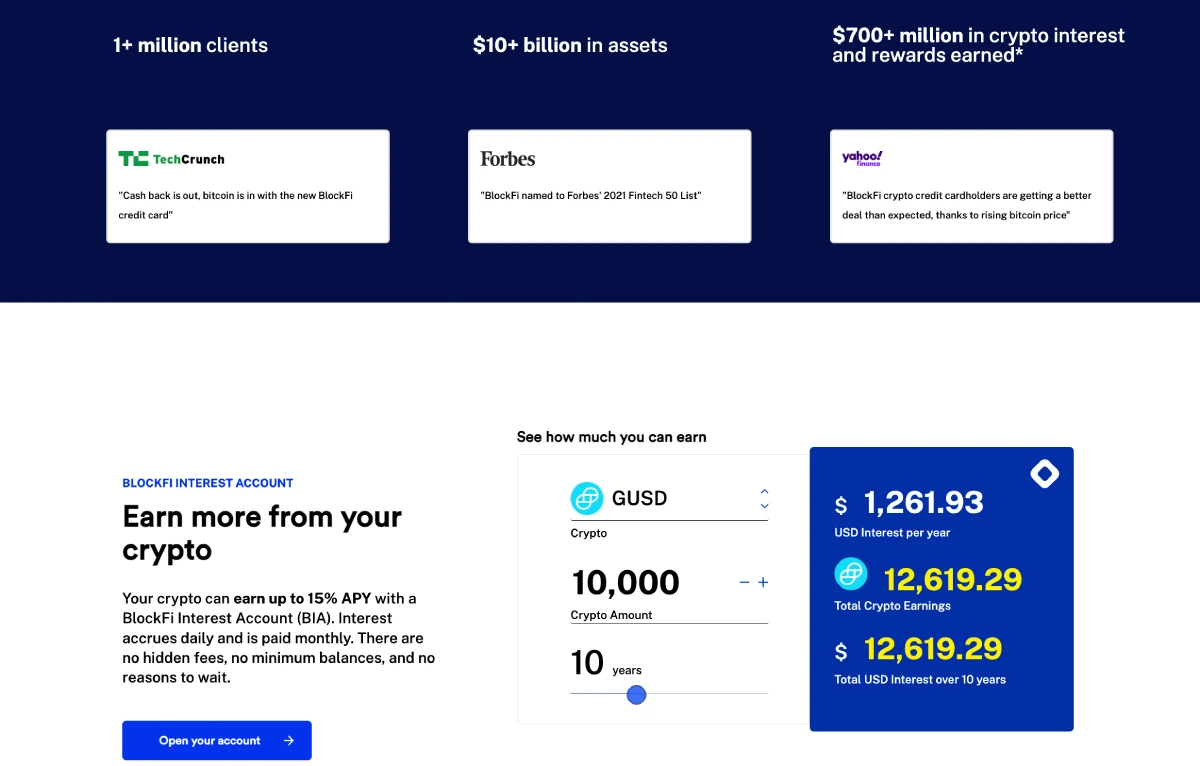

This account is only available to non-US persons and is offered through BlockFi’s subsidiary, BlockFi International (Bermuda). When BlockFi was first launched, this was its most noteworthy feature. The BlockFi interest accounts work similar to traditional savings or investment plans, allowing users to earn interest on their savings or investments. You can fund your BlockFi Interest account with crypto or fiat currencies and receive interest on crypto deposits.

As of July 2022, BlockFi offers a 6% Annual Percentage Yield (APY) on Bitcoin, an 8.6% APY on GUSD and USDT, and a 4.5% APY on Ethereum deposits.

Interest accrues daily on your account balance and is paid out monthly. This account is also free of hidden fees and minimum balance requirements.

While the interest-bearing account is not currently available to US-based users, BlockFi is in the process of registering a similar product, called BlockFi Yield, with the SEC. If the SEC approves this new product, a version of it will be available to US-based customers.

BlockFi keeps reserves with the New York trust corporation Gemini to facilitate customer withdrawals.

Borrow Against Crypto Collateral

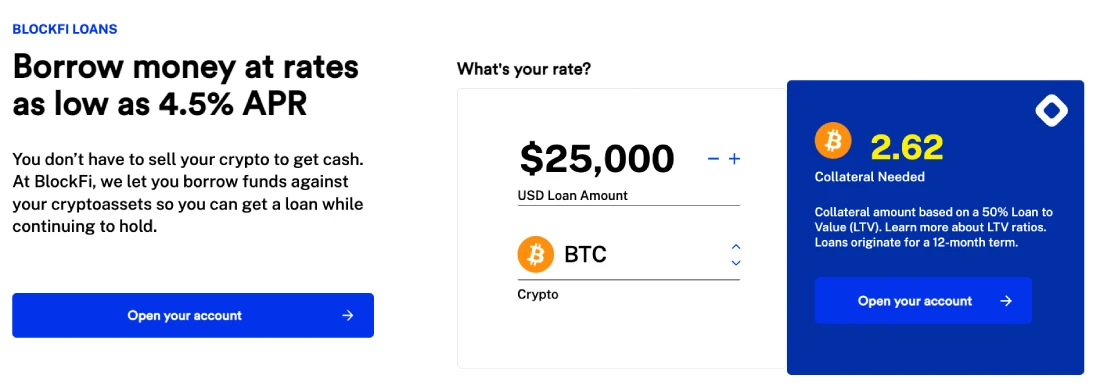

BlockFi allows its registered users to borrow in USD against their crypto assets with interest rates as low as 4.5%. You can get a loan for up to 50% of the value of your BTC, ETH, or LTC if you use your crypto as collateral.

BlockFi requires traders to maintain a 50% LTV (loan to value) ratio while borrowing USD. The LTV ratio should not go below 50%, so if BTC prices drop unexpectedly, traders must deposit extra BTC as collateral to back their BlockFi loans.

Traders can get a loan from BlockFi on the same business day they submit their collateral. As long as the collateral is with the exchange, the traders can enjoy access to their consumer loans. Furthermore, the platform allows borrowers to repay their cryptocurrency loans in whatever way they like, such as paying off a fraction of the outstanding balance of the complete amount at their convenience.

Cryptocurrency Trading

BlockFi enables efficient trading of stablecoins (USDC, USDT, GUSD, and PAX) and digital assets (BTC, LTC, ETH, PAXG, etc.) at competitive prices. Traders will receive interest as soon as they complete a transaction (buy or sell) and have cryptocurrency in their accounts. BlockFi strongly emphasizes fast trade at competitive prices with quick interest accrual.

BlockFi also provides tax-loss harvesting, an investing method that uses losses to offset taxable profits.

BlockFi Rewards Credit Card

Consumers rely heavily on reward credit cards. The BlockFi Rewards Visa Credit Card gives crypto traders up to 3.5% back in cryptocurrency on all purchases up to $100 for the first 90 days. After 90 days, users will receive 1.5% crypto rewards, but if the yearly spending surpasses $50,000, the rate of crypto rewards rises to 2%.

Users can apply for the ‘Bitcoin Rewards Credit Card account by signing up for a ‘BlockFi Interest Account,’ completing the registration process, funding their BlockFi accounts, and joining the BlockFi waitlist.

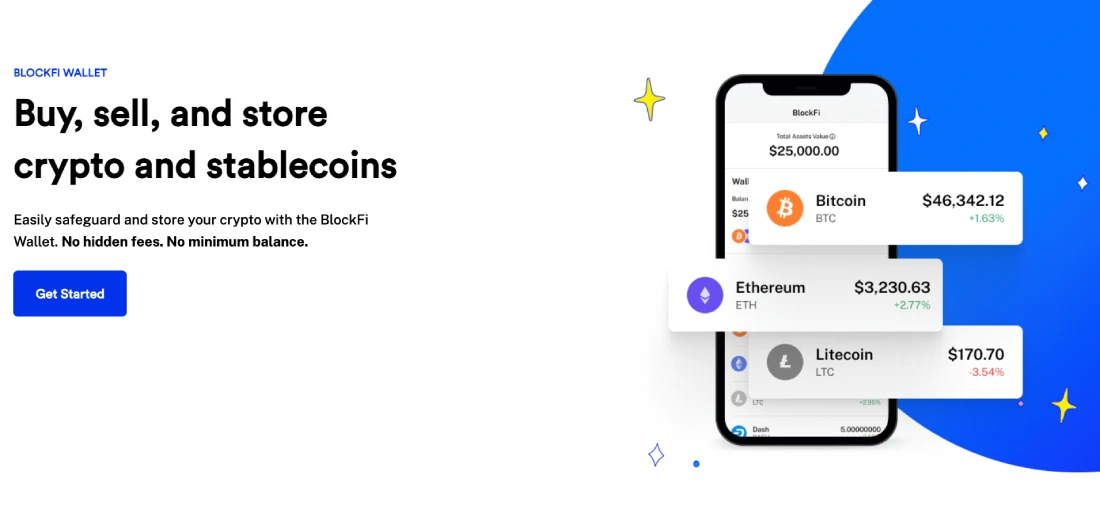

BlockFi Wallet

The BlockFi Wallet is the default cryptocurrency storage solution on the platform. It’s a non-interest-bearing account, enabling you to buy, sell, store, and safeguard your crypto and stablecoin assets. BlockFi protects your assets and never lends them out.

In most cases, external cryptocurrency can be moved into the BlockFi Wallet, and assets stored within the wallet can be transferred out. However, this function has some limitations for US clients for specific cryptocurrencies, such as Dogecoin (DOGE), Bitcoin Cash (BCH), and Algorand (ALGO). These cryptocurrencies cannot be withdrawn or funded from a personal wallet.

BlockFi Personalized Yield

Any current or potential client with a minimum of $3 million in U.S.-equivalent crypto assets on the platform is eligible for the BlockFi Personalized Yield premium services. BlockFi’s Personalized Yield product is tailored to each client’s specific needs. Prospective clients are provided with high-level onboarding and a dedicated client relationship manager.

BlockFi Personalized Yield clients enjoy benefits such as discounted trading expenses, negotiated crypto interest rates on margin borrowing, and the ability to lend their crypto to BlockFi to earn additional returns.

BlockFi Trusts

Accredited investors and institutional investors can invest in any of the three BlockFi Trusts: Bitcoin, Ethereum, or Litecoin.

Owners of trusts get access to crypto storage and the chance to have their crypto assets passively managed. The minimum investment requirement is $50,000, and the yearly management charge is 1.75%.

The value of these cryptocurrency trusts may differ from the underlying value of the digital assets, making them a risky investment.

BlockFi Loan

A BlockFi Loan, like other margin loans, uses your cryptocurrency holdings as security while you receive US dollars deposited into your bank account. It’s a convenient method to get cash without having to sell your cryptocurrencies, and it doesn’t require a credit check. The collateral cryptocurrency is returned to you when your loan is repaid.

BlockFi crypto-backed loans “need no credit information” and are accepted as long as you have enough collateral.

If you default on your loan, BlockFi will sell some of the cryptocurrency you staked as collateral to repay the loan. If you don’t repay your loan altogether, you’ll be liable for capital gains taxes on the cryptocurrency sold by BlockFi.

BlockFi Loan Fees

The origination fee for margin loans is 2%. Borrowers can borrow up to 50% of the value of their account, with margin rates depending on the loan-to-value (LTV) ratio ranging from 4.5% to 9.75%.

For example, a 20% LTV rate would incur 4.75% interest on the loan, but a 50% LTV rate would incur 9.75% interest.

BlockFi Mobile App

BlockFi offers a top-notch mobile app compatible with both iOS and Android smartphones. This allows tech-savvy mobile customers to manage their BlockFi accounts on the go. With a single click, users can view account balances (to remain on top of their cryptocurrency management), carry out cryptocurrency trades, borrow money, begin investing, and even generate a passive income (earn interest).

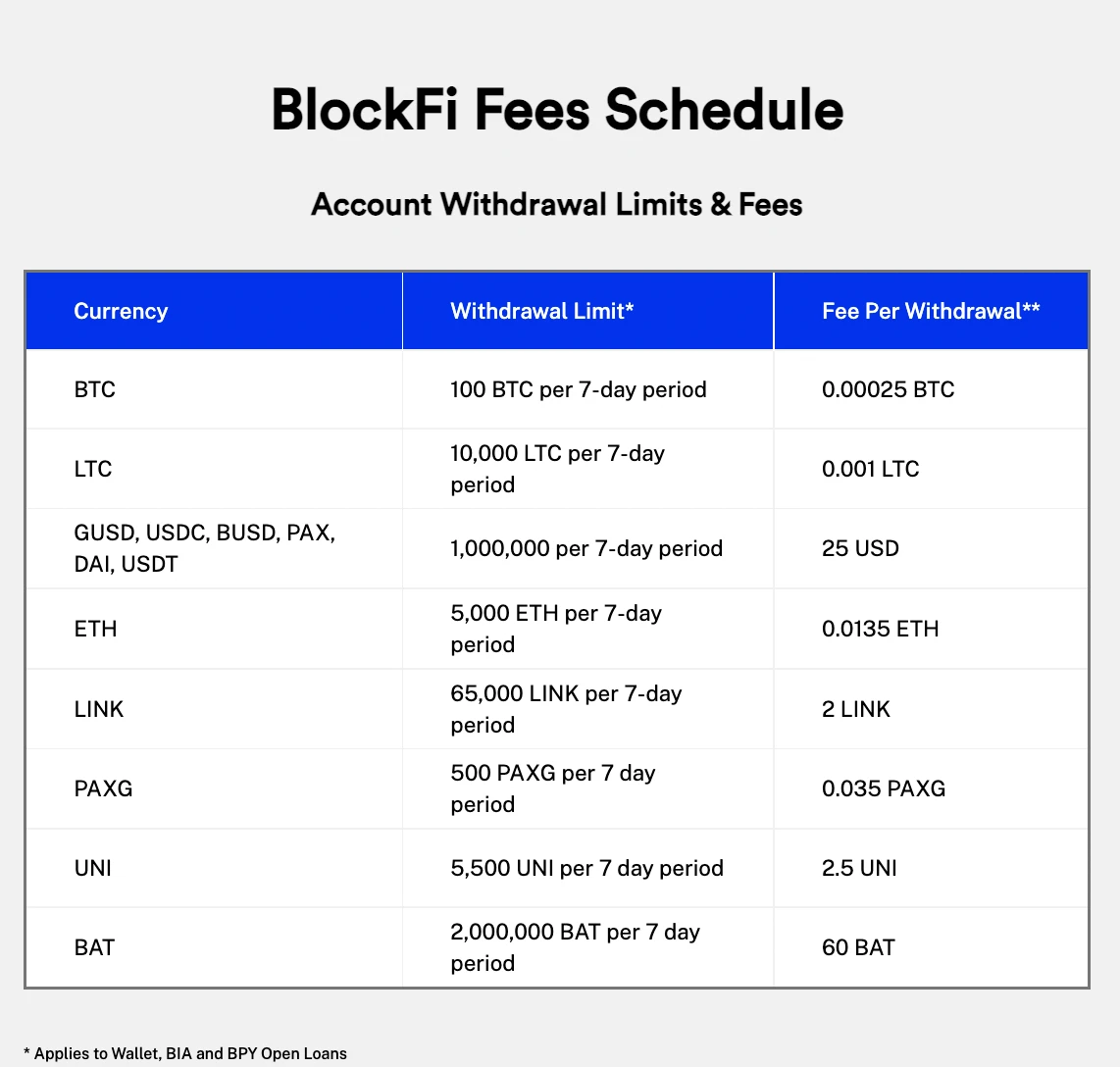

BlockFi Fees

BlockFi acts as the market maker for all transactions, unlike other cryptocurrency exchanges. As a result, BlockFi doesn’t charge trading fees for buying or selling cryptocurrency on the platform.

However, the platform does levy withdrawal fees. Users receive one free withdrawal of Bitcoin, Litecoin, and some stablecoins supported by BlockFi each month. Subsequent withdrawals of these cryptocurrencies are subject to a fee, detailed in the table below. Furthermore, certain supported currencies don’t qualify for free withdrawals.

The buy (ask) and selling (bid) prices on the exchange differ slightly. The spread usually is 1%; however, it can vary depending on the coin’s liquidity.

Available Cryptocurrencies

Unlike many of its competitors, BlockFi offers a curated selection of cryptocurrencies that will suit most investors, with the exception of the most ardent cryptocurrency traders. The following cryptocurrencies are available for trading on BlockFi:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Binance USD (BUSD)

- ChainLink (LINK)

- Basic Attention Token (BAT)

- PAX Gold (PAXG)

- Dogecoin (DOGE)

- USD Coin (USDC)

- Ethereum (ETH)

- Dai (DAI)

- Litecoin (LTC)

- Gemini dollar (GUSD)

- Uniswap (UNI)

- Algorand (ALGO)

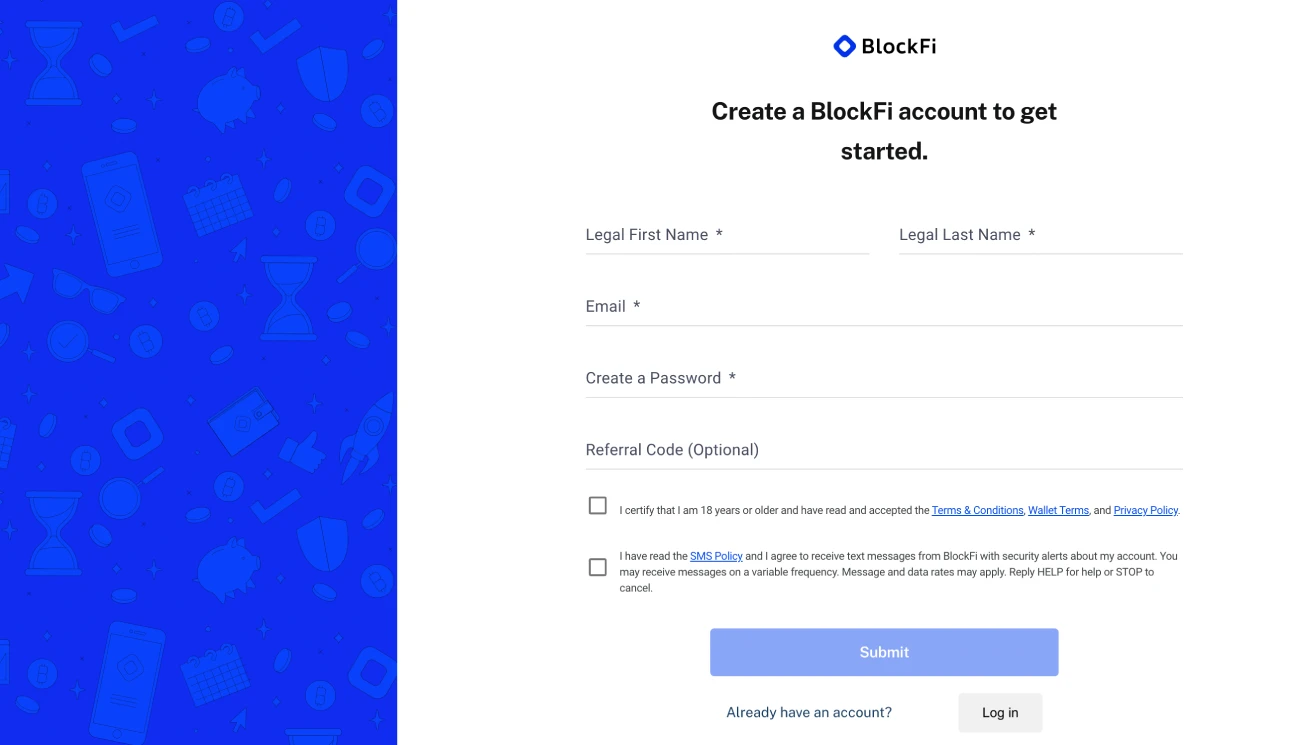

How to Create a BlockFi Account

The BlockFi account sign-up process is relatively straightforward. Users will need to open a cryptocurrency trading account on the platform and make a minimal deposit into the account to start trading on the BlockFi platform instantly.

Here is a quick step-by-step guide to assist traders in setting up an account on the BlockFi exchange:

Step #1: Create an Account

To open an account, users must visit the official website and click on the “Get Started” button in the upper right-hand corner of the screen. When you click the button, a registration form will appear for you to fill in your name, email address, and a secure password in respective fields.

Once you fill in and submit the form, the BlockFi business development team will send you a confirmation email to your provided email address. You must click on the link included in the email to confirm the email address to start trading.

Step #2: Verification

After completing the registration process by providing your personal information, you must complete the KYC verification process by uploading a government-issued ID such as a passport, driving license, or any other eligible IDs.

Step #3: Deposit Funds and Start Trading

After completing all verification steps, traders can fund their accounts with fiat currency using their bank account or cryptocurrency from their digital wallet to start trading with no limits. Additionally, individuals who own cryptocurrencies can earn interest or use them as collateral for loans.

Security BlockFi

To keep the platform safe from hackers, the BlockFi team implements the following security measures:

- For maximum security, it stores all its reserves with third-party custodians such as Gemini, Coinbase, and BitGo.

- All BlockFi investments are controlled by the US government; BlockFi exclusively purchases SEC-licensed shares and CFTC-regulated futures through a risk management and credit research mechanism.

- BlockFi requires borrowers to furnish collateral worth at least 50% of the loan amount to secure a loan.

- The self-service security option ‘Allowlisting’ allows clients to limit withdrawals or restrict them to specific addresses. This safeguard prohibits unwanted access to a user’s BlockFi account.

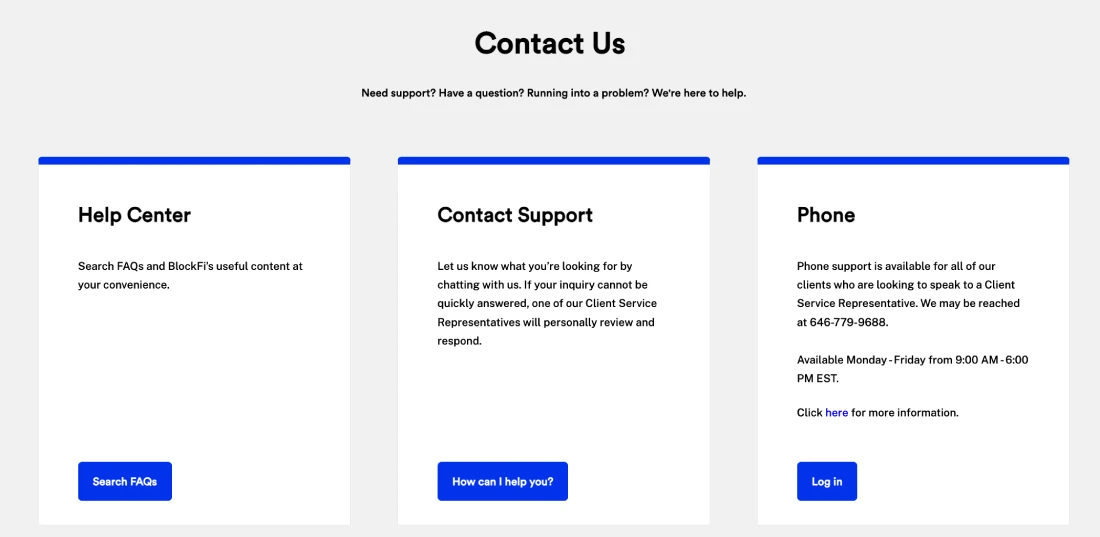

BlockFi Review: Customer Support

The BlockFi customer support team responds quickly and is available round the clock. It promptly responds to inquiries from traders (online consumer lenders) via email or phone calls at any time.

The platform’s official website provides a dedicated customer care line for any investment advice users may require (you can contact BlockFi anytime).

BlockFi support center has grouped help topics by product category, making it simple to get solutions to your problems. There is also a search function for particular searches.

Additionally, BlockFi Live, the company’s YouTube channel, offers a variety of topics, including general-interest crypto videos, interviews, and tutorials on how to use the platform.

BlockFi and SEC Fines: Latest Update

The issues with BlockFi’s Interest Account were as follows:

- The corporation failed to register BIAs as securities.

- Inadequate risk disclosure on the website and in marketing content.

- BlockFi issues securities and holds more than 40% of its total assets in investment instruments (such as crypto-backed loans to institutional borrowers).

BlockFi’s parent firm agreed to pay a $50 million penalty to the SEC, $50 million to 32 states, cease offering the unregistered BlockFi Interest Account, and try to bring its operations inside the Investment Company Act within 60 days.

BlockFi aims to register the offer and sale of a new financing product under the Securities Act of 1933. The new product has not yet been registered or announced. You can read the SEC’s full press release here.

Is BlockFi Safe

Although cryptocurrencies are inherently volatile, it’s safe to assume that BlockFi is one of the most secure organizations in the crypto industry.

BlockFi is located in the United States and uses Gemini Exchange for crypto custodial services. Gemini Exchange, created by the Winklevoss twins, is widely regarded as one of the most secure and regulated exchanges worldwide.

BlockFi is one of the few cryptocurrency exchanges in the United States that adheres to federal and state standards, making the platform safe in every way.

However, the funds in a BlockFi account aren’t FDIC or SPIC insured.

In addition to its state-regulated custodian, BlockFi is also backed by reputable organizations such as Valar Ventures, Coinbase Ventures, Morgan Creek Capital Management, etc.

FAQ

Yes, it offers the BlockFi wallet. However, clients don’t receive interest on funds stored in their wallets. To earn interest, crypto holdings must be deposited into a Bitcoin Interest Account.

Yes, it charges a spread, which varies and goes up to 1%.

BlockFi offers two types of user accounts: BlockFi Trading Account and BlockFi Interest Account.

A BlockFi Business Account is temporarily unavailable. However, it’s anticipated that the platform will soon launch business accounts.

BlockFi’s maximum withdrawal time is 1-5 business days.

Our Verdict

BlockFi pleased us with its secure BlockFi Wallet and around-the-clock customer support. The company’s thorough answers to every complaint on a major review site make it a consumer-centric platform. BlockFi’s coin selection will satisfy the needs of most beginner-to-intermediate users, while the exchange’s financing, credit card, and BlockFi Trust offerings make it a solid alternative for US consumers. The BlockFi interest rates and trading fees are quite competitive.

All the indicators in this BlockFi review confirm our judgment that the platform is secure and legitimate; therefore, there is no justification for not giving BlockFi a “Thumbs Up.”

Traders can decide whether BlockFi is a suitable platform depending on their risk tolerance and how they manage their crypto assets.

You can also visit our CoinStats blog to learn more about wallets, portfolio trackers, tokens, etc., and explore our in-depth reviews on various cryptocurrency exchanges such as BKEX, Bybit, Crypto.com, BitMEX, FinexBox, Binance, WazirX, etc.

Want to dig deeper? Discover the origin of decentralized finance, blockchain technology, and cryptocurrency with our articles What Is DeFi, How to Buy Cryptocurrency, and more.

Investment Advice Disclaimer: The information contained on this website is provided to you solely for informational purposes and does not constitute a recommendation by CoinStats to buy, sell, or hold any securities, financial product, or instrument mentioned in the content, nor does it constitute investment advice, financial advice, trading advice, or any other type of advice.

Cryptocurrency is a highly volatile market and sensitive to secondary activity, do your independent research, obtain your own advice, and only invest what you can afford to lose. There are significant risks involved in trading CFDs, stocks, and cryptocurrencies. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider your own circumstances and obtain your own advice before making any investment. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant regulators’ websites before making any decision.